2025-02-27 04:41

IndustryAI-powered forex strategy optimization using genet

#AITradingAffectsForex

The use of AI, particularly genetic algorithms, in optimizing forex trading strategies is a growing area of interest. Here's a breakdown of the key concepts:

What are Genetic Algorithms?

* Inspired by Evolution:

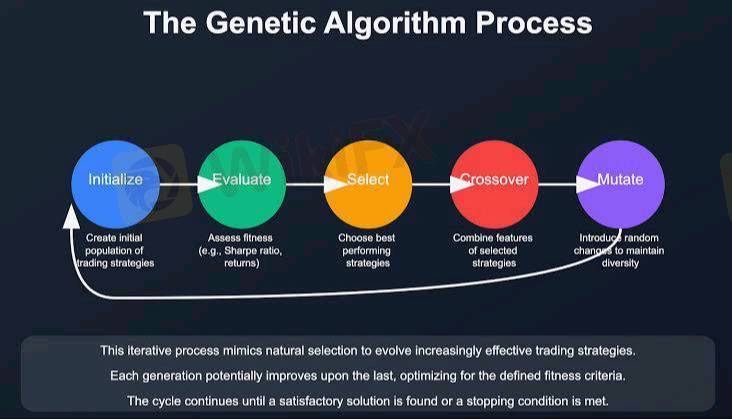

* Genetic algorithms are a type of optimization algorithm that mimics the process of natural selection.

* They work by creating a population of potential solutions (in this case, trading strategies), evaluating their performance, and then "breeding" the best solutions to create new, hopefully better, solutions.

* Key Components:

* Population: A set of potential trading strategies.

* Fitness Function: A way to evaluate how well each strategy performs (e.g., profit, risk-adjusted return).

* Selection: Choosing the best-performing strategies to "breed."

* Crossover: Combining parts of two parent strategies to create new offspring.

* Mutation: Introducing random changes to strategies to explore new possibilities.

How They're Used in Forex:

* Parameter Optimization:

* Forex trading strategies often have many parameters (e.g., moving average periods, RSI levels).

* Genetic algorithms can be used to find the optimal combination of these parameters for a given market.

* Strategy Development:

* They can help discover new and potentially profitable trading rules.

* By exploring a vast search space, they can identify patterns and relationships that humans might miss.

* Risk Management:

* They can be used to optimize risk management parameters, such as stop-loss and take-profit levels.

* They can also be used to create strategies that are more robust to changing market conditions.

Key Considerations:

* Overfitting:

* A major risk is overfitting, where a strategy performs well on historical data but poorly in live trading.

* Robust backtesting and validation are crucial.

* Market Dynamics:

* The forex market is constantly changing, so strategies need to be regularly re-optimized.

* Genetic algorithms can aid in this constant re-optimizing.

* Data Quality:

* The quality of the data used to train the algorithms is critical.

* Complexity:

* Building and implementing effective genetic algorithms for forex trading can be complex and require significant technical expertise.

In essence:

Genetic algorithms provide a powerful tool for exploring and optimizing forex trading strategies. They can help traders find better parameters, discover new rules, and improve risk management. However, it's essential to be aware of the risks and to use these tools responsibly.

Like 0

FX9372012632

Trader

Hot content

Industry

Event-A comment a day,Keep rewards worthy up to$27

Industry

Nigeria Event Giveaway-Win₦5000 Mobilephone Credit

Industry

Nigeria Event Giveaway-Win ₦2500 MobilePhoneCredit

Industry

South Africa Event-Come&Win 240ZAR Phone Credit

Industry

Nigeria Event-Discuss Forex&Win2500NGN PhoneCredit

Industry

[Nigeria Event]Discuss&win 2500 Naira Phone Credit

Forum category

Platform

Exhibition

Agent

Recruitment

EA

Industry

Market

Index

AI-powered forex strategy optimization using genet

India | 2025-02-27 04:41

India | 2025-02-27 04:41#AITradingAffectsForex

The use of AI, particularly genetic algorithms, in optimizing forex trading strategies is a growing area of interest. Here's a breakdown of the key concepts:

What are Genetic Algorithms?

* Inspired by Evolution:

* Genetic algorithms are a type of optimization algorithm that mimics the process of natural selection.

* They work by creating a population of potential solutions (in this case, trading strategies), evaluating their performance, and then "breeding" the best solutions to create new, hopefully better, solutions.

* Key Components:

* Population: A set of potential trading strategies.

* Fitness Function: A way to evaluate how well each strategy performs (e.g., profit, risk-adjusted return).

* Selection: Choosing the best-performing strategies to "breed."

* Crossover: Combining parts of two parent strategies to create new offspring.

* Mutation: Introducing random changes to strategies to explore new possibilities.

How They're Used in Forex:

* Parameter Optimization:

* Forex trading strategies often have many parameters (e.g., moving average periods, RSI levels).

* Genetic algorithms can be used to find the optimal combination of these parameters for a given market.

* Strategy Development:

* They can help discover new and potentially profitable trading rules.

* By exploring a vast search space, they can identify patterns and relationships that humans might miss.

* Risk Management:

* They can be used to optimize risk management parameters, such as stop-loss and take-profit levels.

* They can also be used to create strategies that are more robust to changing market conditions.

Key Considerations:

* Overfitting:

* A major risk is overfitting, where a strategy performs well on historical data but poorly in live trading.

* Robust backtesting and validation are crucial.

* Market Dynamics:

* The forex market is constantly changing, so strategies need to be regularly re-optimized.

* Genetic algorithms can aid in this constant re-optimizing.

* Data Quality:

* The quality of the data used to train the algorithms is critical.

* Complexity:

* Building and implementing effective genetic algorithms for forex trading can be complex and require significant technical expertise.

In essence:

Genetic algorithms provide a powerful tool for exploring and optimizing forex trading strategies. They can help traders find better parameters, discover new rules, and improve risk management. However, it's essential to be aware of the risks and to use these tools responsibly.

Like 0

I want to comment, too

Submit

0Comments

There is no comment yet. Make the first one.

Submit

There is no comment yet. Make the first one.