2025-02-27 18:16

IndustryThe reason I'm betting on a rise in the US10Y

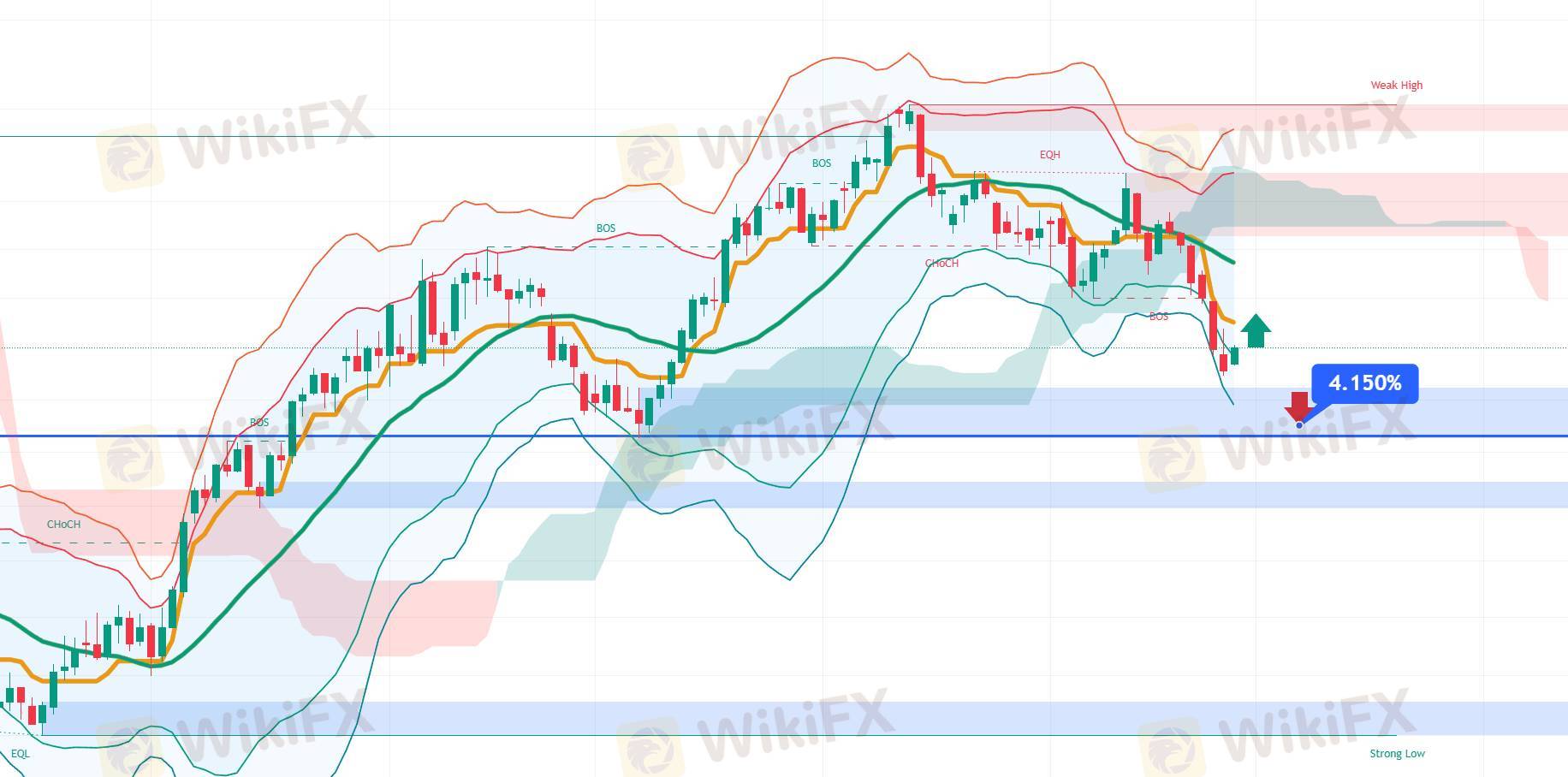

Recently, due to expectations of an interest rate cut by the Fed, a contraction in the services sector, and uncertainties surrounding the Trump administration, the U.S. 10-year Treasury yield temporarily fell to around 4.3%. Moreover, this Tuesday, a large trading bet worth $60 million was placed on the yield falling below 4.15%. While I find this an intriguing bet, I believe it reflects only short-term market expectations and overlooks the medium- to long-term impact of Trump’s policies.Trump will soon announce a 25% tariff on EU products, which I believe is likely to fuel inflation. Additionally, about 40% of U.S. fiscal spending goes toward pensions and welfare budgets, and I am skeptical that Doge Musk’s pledge to cut $1 trillion in fiscal spending can be achieved. Therefore, I think the pressures from fiscal spending and inflation will still persist.I also agree with Warren Buffett’s view that buying long-term U.S. Treasuries as an inflation hedge is not a good idea. Ultimately, I believe the U.S. 10-year Treasury yield will rebound, and my initial forecast of it rising to around 4.9%~5.2% remains unchanged.

Like 0

chunghoon oh

Trader

Hot content

Industry

Event-A comment a day,Keep rewards worthy up to$27

Industry

Nigeria Event Giveaway-Win₦5000 Mobilephone Credit

Industry

Nigeria Event Giveaway-Win ₦2500 MobilePhoneCredit

Industry

South Africa Event-Come&Win 240ZAR Phone Credit

Industry

Nigeria Event-Discuss Forex&Win2500NGN PhoneCredit

Industry

[Nigeria Event]Discuss&win 2500 Naira Phone Credit

Forum category

Platform

Exhibition

Agent

Recruitment

EA

Industry

Market

Index

The reason I'm betting on a rise in the US10Y

| 2025-02-27 18:16

| 2025-02-27 18:16Recently, due to expectations of an interest rate cut by the Fed, a contraction in the services sector, and uncertainties surrounding the Trump administration, the U.S. 10-year Treasury yield temporarily fell to around 4.3%. Moreover, this Tuesday, a large trading bet worth $60 million was placed on the yield falling below 4.15%. While I find this an intriguing bet, I believe it reflects only short-term market expectations and overlooks the medium- to long-term impact of Trump’s policies.Trump will soon announce a 25% tariff on EU products, which I believe is likely to fuel inflation. Additionally, about 40% of U.S. fiscal spending goes toward pensions and welfare budgets, and I am skeptical that Doge Musk’s pledge to cut $1 trillion in fiscal spending can be achieved. Therefore, I think the pressures from fiscal spending and inflation will still persist.I also agree with Warren Buffett’s view that buying long-term U.S. Treasuries as an inflation hedge is not a good idea. Ultimately, I believe the U.S. 10-year Treasury yield will rebound, and my initial forecast of it rising to around 4.9%~5.2% remains unchanged.

Like 0

I want to comment, too

Submit

0Comments

There is no comment yet. Make the first one.

Submit

There is no comment yet. Make the first one.