2025-02-28 18:04

Industry#AITradingAffectsForex

How AI Improves Forex Market Transparency and Compliance

AI has a significant role in enhancing transparency and compliance within the forex market by automating processes, analyzing vast amounts of data, and providing insights that help ensure market integrity and regulatory adherence. The adoption of AI technologies such as machine learning (ML), natural language processing (NLP), and anomaly detection allows financial institutions, regulators, and brokers to identify market manipulation, detect fraud, and ensure compliance with global trading regulations.

1. AI Enhances Transparency in Forex Markets

A. Real-Time Market Monitoring

• AI continuously monitors market activity in real-time, including trade volumes, price movements, and order flows. This allows market participants and regulators to access accurate, up-to-the-minute information about the state of the market.

• AI-powered dashboards provide a transparent view of liquidity, trade execution, and price discovery, making it easier for traders and regulators to track any unusual activity that might indicate manipulation or unfair practices.

B. Detecting Unusual Trading Patterns

• AI helps identify anomalous trading patterns, such as spoofing, layering, wash trading, and front-running, that could undermine market transparency.

• By analyzing order books and trade sequences, AI can flag unusual behaviors that may signal market manipulation or fraud, offering regulators and market participants early warnings and opportunities for intervention.

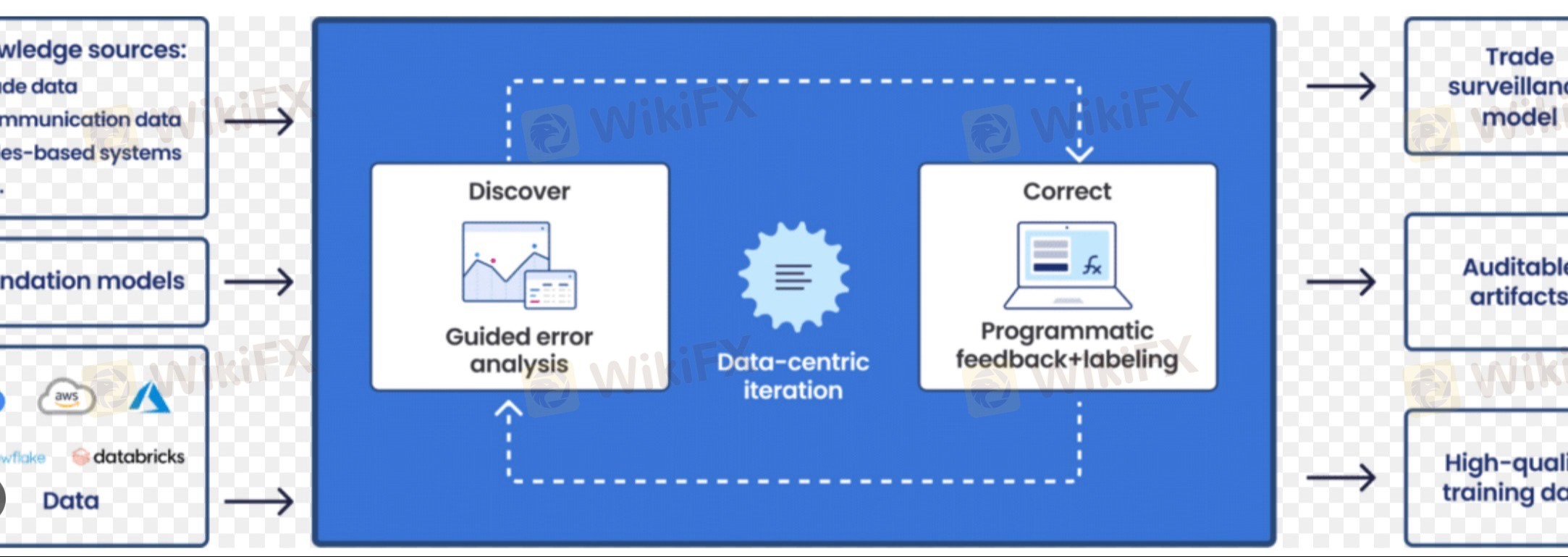

C. Enhanced Trade Surveillance

• AI-driven trade surveillance systems track all trades, ensuring that every transaction is accounted for and aligned with market regulations. AI makes it easier to audit trade activities and ensure that no illegal or unethical trading practices are being conducted.

• By tracking the entire trade lifecycle, AI helps uncover patterns that may not be immediately obvious, fostering greater transparency in the way trades are executed and cleared.

2. AI Strengthens Forex Market Compliance

A. Ensuring Adherence to Regulatory Standards

• AI tools can analyze vast amounts of transaction data to ensure that trading activities comply with local and global regulations, such as MiFID II, Dodd-Frank, or the Markets in Financial Instruments Directive (MiFID).

• AI ensures that trade execution and reporting obligations are met, helping brokers and financial institutions avoid regulatory penalties and legal risks.

B. Automating Compliance Checks

• AI-powered systems can automatically perform compliance checks against KYC (Know Your Customer) and AML (Anti-Money Laundering) regulations to detect suspicious transactions that could be indicative of money laundering, terrorist financing, or other illicit activities.

• Automated reporting and real-time alerts help ensure that institutions stay up-to-date with regulatory requirements without relying on manual processes.

C. Algorithmic Trading Compliance

• AI systems can evaluate whether algorithmic trading strategies align with established rules and best practices. For example, AI can monitor for trade execution algorithms that might create excessive market impact, ensuring that such strategies remain compliant with regulations.

• Compliance-focused AI tools ensure that algorithmic trading systems don’t lead to market distortion or manipulation, maintaining a fair and transparent trading environment.

3. AI Facilitates Enhanced Risk Management and Reporting

A. Comprehensive Risk Monitoring

• AI algorithms can detect and analyze potential risks in real-time by analyzing various risk factors such as market volatility, liquidity fluctuations, and counterparty risk. This continuous risk monitoring enables timely interventions to prevent unforeseen market disruptions.

• Risk assessment models powered by AI help identify areas where institutions might face financial exposure, enabling them to take proactive steps in managing those risks.

B. Automated Trade Reconciliation and Reporting

• AI-driven trade reconciliation tools help ensure that every trade is properly recorded, matched, and cleared according to regulatory standards. AI enhances the accuracy and speed of these processes, reducing the likelihood of errors.

• Automated regulatory reporting tools ensure that trade and transaction data are accurately reported to regulators, reducing the risk of non-compliance and ensuring timely submission of reports in accordance with jurisdictional requirements.

4. AI Improves Forex Market Integrity

A. Enhanced Fraud Detection

• AI algorithms can detect fraudulent activities, such as fake trades, market manipulation, or insider trading, by analyzing both trade data and external factors like news or public sentiment.

• Machine learning models can learn from historical fraud patterns, improving their ability to identify emerging fraudulent techniques and adapt to new threats.

B. Enhanced Data Integrity and Transparency

• AI enables better

Like 0

FX4183914356

Trader

Hot content

Industry

Event-A comment a day,Keep rewards worthy up to$27

Industry

Nigeria Event Giveaway-Win₦5000 Mobilephone Credit

Industry

Nigeria Event Giveaway-Win ₦2500 MobilePhoneCredit

Industry

South Africa Event-Come&Win 240ZAR Phone Credit

Industry

Nigeria Event-Discuss Forex&Win2500NGN PhoneCredit

Industry

[Nigeria Event]Discuss&win 2500 Naira Phone Credit

Forum category

Platform

Exhibition

Agent

Recruitment

EA

Industry

Market

Index

#AITradingAffectsForex

India | 2025-02-28 18:04

India | 2025-02-28 18:04How AI Improves Forex Market Transparency and Compliance

AI has a significant role in enhancing transparency and compliance within the forex market by automating processes, analyzing vast amounts of data, and providing insights that help ensure market integrity and regulatory adherence. The adoption of AI technologies such as machine learning (ML), natural language processing (NLP), and anomaly detection allows financial institutions, regulators, and brokers to identify market manipulation, detect fraud, and ensure compliance with global trading regulations.

1. AI Enhances Transparency in Forex Markets

A. Real-Time Market Monitoring

• AI continuously monitors market activity in real-time, including trade volumes, price movements, and order flows. This allows market participants and regulators to access accurate, up-to-the-minute information about the state of the market.

• AI-powered dashboards provide a transparent view of liquidity, trade execution, and price discovery, making it easier for traders and regulators to track any unusual activity that might indicate manipulation or unfair practices.

B. Detecting Unusual Trading Patterns

• AI helps identify anomalous trading patterns, such as spoofing, layering, wash trading, and front-running, that could undermine market transparency.

• By analyzing order books and trade sequences, AI can flag unusual behaviors that may signal market manipulation or fraud, offering regulators and market participants early warnings and opportunities for intervention.

C. Enhanced Trade Surveillance

• AI-driven trade surveillance systems track all trades, ensuring that every transaction is accounted for and aligned with market regulations. AI makes it easier to audit trade activities and ensure that no illegal or unethical trading practices are being conducted.

• By tracking the entire trade lifecycle, AI helps uncover patterns that may not be immediately obvious, fostering greater transparency in the way trades are executed and cleared.

2. AI Strengthens Forex Market Compliance

A. Ensuring Adherence to Regulatory Standards

• AI tools can analyze vast amounts of transaction data to ensure that trading activities comply with local and global regulations, such as MiFID II, Dodd-Frank, or the Markets in Financial Instruments Directive (MiFID).

• AI ensures that trade execution and reporting obligations are met, helping brokers and financial institutions avoid regulatory penalties and legal risks.

B. Automating Compliance Checks

• AI-powered systems can automatically perform compliance checks against KYC (Know Your Customer) and AML (Anti-Money Laundering) regulations to detect suspicious transactions that could be indicative of money laundering, terrorist financing, or other illicit activities.

• Automated reporting and real-time alerts help ensure that institutions stay up-to-date with regulatory requirements without relying on manual processes.

C. Algorithmic Trading Compliance

• AI systems can evaluate whether algorithmic trading strategies align with established rules and best practices. For example, AI can monitor for trade execution algorithms that might create excessive market impact, ensuring that such strategies remain compliant with regulations.

• Compliance-focused AI tools ensure that algorithmic trading systems don’t lead to market distortion or manipulation, maintaining a fair and transparent trading environment.

3. AI Facilitates Enhanced Risk Management and Reporting

A. Comprehensive Risk Monitoring

• AI algorithms can detect and analyze potential risks in real-time by analyzing various risk factors such as market volatility, liquidity fluctuations, and counterparty risk. This continuous risk monitoring enables timely interventions to prevent unforeseen market disruptions.

• Risk assessment models powered by AI help identify areas where institutions might face financial exposure, enabling them to take proactive steps in managing those risks.

B. Automated Trade Reconciliation and Reporting

• AI-driven trade reconciliation tools help ensure that every trade is properly recorded, matched, and cleared according to regulatory standards. AI enhances the accuracy and speed of these processes, reducing the likelihood of errors.

• Automated regulatory reporting tools ensure that trade and transaction data are accurately reported to regulators, reducing the risk of non-compliance and ensuring timely submission of reports in accordance with jurisdictional requirements.

4. AI Improves Forex Market Integrity

A. Enhanced Fraud Detection

• AI algorithms can detect fraudulent activities, such as fake trades, market manipulation, or insider trading, by analyzing both trade data and external factors like news or public sentiment.

• Machine learning models can learn from historical fraud patterns, improving their ability to identify emerging fraudulent techniques and adapt to new threats.

B. Enhanced Data Integrity and Transparency

• AI enables better

Like 0

I want to comment, too

Submit

0Comments

There is no comment yet. Make the first one.

Submit

There is no comment yet. Make the first one.