KANETSU

Abstract: Founded 1996, KANETSU is a broker registered in Japan, offering trading on Commodity Futures, Click 365, Click Stock 365, and Gold bullion.

| KANETSU Review Summary | |

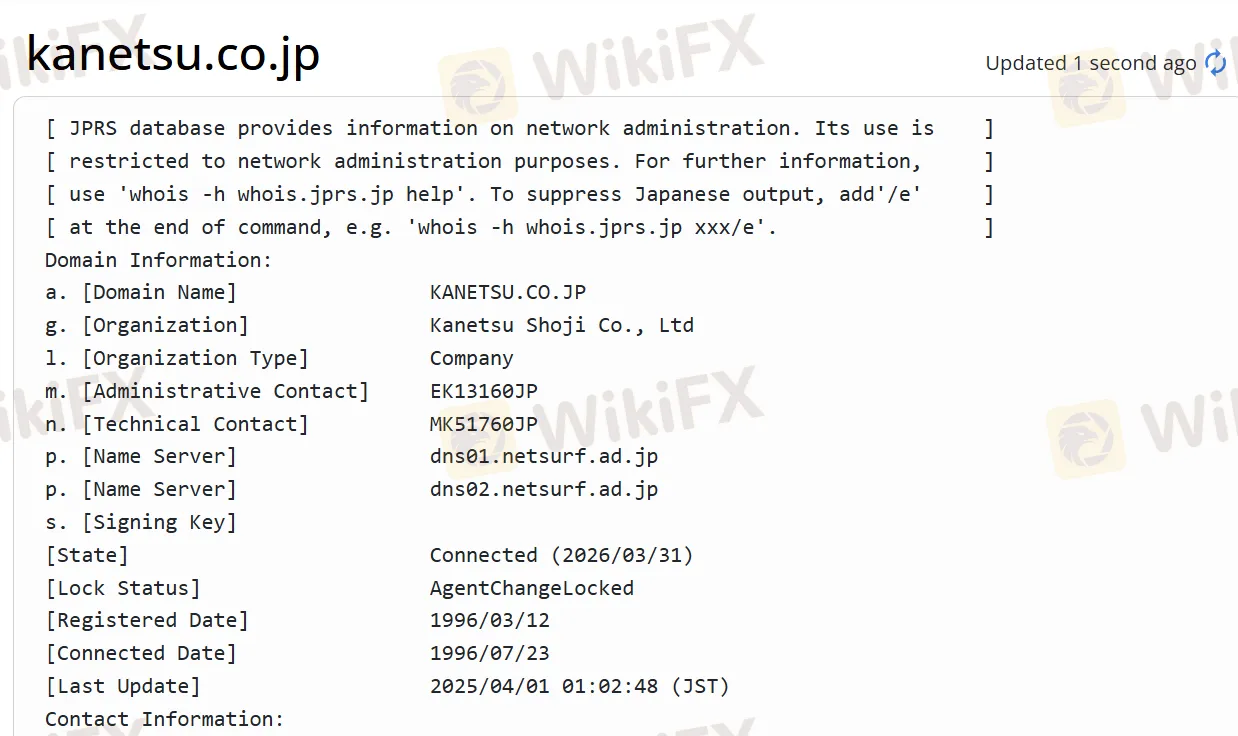

| Founded | 1996 |

| Registered Country/Region | Japan |

| Regulation | FSA (Suspicious Clone) |

| Trading Products | Commodity Futures, Click 365, Click Stock 365, Gold bullion |

| Trading Platform | / |

| Minimum Deposit | / |

| Customer Support | Tel:+81 0120-13-8686 |

| Email: support@kanetsu.co.jp | |

| Address: Prime Nihonbashi Hisamatsucho Building, 12-8 Nihonbashi Hisamatsucho, Chuo-ku, Tokyo | |

KANETSU Information

Founded 1996, KANETSU is a broker registered in Japan, offering trading on Commodity Futures, Click 365, Click Stock 365, and Gold bullion.

Pros and Cons

| Pros | Cons |

| Various trading products | Suspicious clone FSA license |

| Complex fee structure | |

| Limited payment methods |

Is KANETSU Legit?

Yes. KANETSU is licensed by FSA with license number 282 to offer services.

| Regulated Country | Regulator | Current Status | Regulated Entity | License Type | License No. |

| Japan | Financial Services Authority (FSA) | Suspicious Clone | AI Gold Securities Co., Ltd. | Retail Forex License | Kanto Finance Director (Financial Business) No. 282 |

What Can I Trade on KANETSU?

| Trading Products | Supported |

| Commodity Futures | ✔ |

| Click 365 | ✔ |

| Click Stock 365 | ✔ |

| Gold bullion | ✔ |

| Forex | ❌ |

| Indices | ❌ |

| Cryptocurrencies | ❌ |

| Bonds | ❌ |

| Options | ❌ |

| ETFs | ❌ |

KANETSU Fees

The trading fees vary depending on the product and the course.

Commodity Futures

| Course Type | Applicable Account Condition | Brand | New Commission | Settlement Commission - On Opening Date/2nd Business Day | Settlement Commission - From 2nd/3rd Business Day |

| General [Normal] | Completed acceptance screening on or after Feb 1, 2025 | Various (Gold Standard, Gold Mini, etc.) | Varies by brand (e.g., Gold Standard: 13,200 yen) | Commission: 0 yen; Width of cutout: Varies (e.g., Gold Standard: 14 yen) | Commission: Varies (e.g., Gold Standard: 13,200 yen); Width of cutout: Varies (e.g., Gold Standard: 27 yen) |

| Completed trustee review on or after Dec 1, 2023 | Various | Varies by brand (e.g., Gold Standard: 11,000 yen) | Commission: 0 yen; Width of cutout: Varies (e.g., Gold Standard: 11 yen) | Commission: Varies (e.g., Gold Standard: 11,000 yen); Width of cutout: Varies (e.g., Gold Standard: 22 yen) | |

| General [2 Days Trade] | Varies by brand (e.g., Gold Standard: 6,490 yen) | Commission: 0 yen; Width of cutout: Varies (e.g., Gold Standard: 7 yen) | Commission: Varies (e.g., Gold Standard: 22,660 yen); Width of cutout: Varies (e.g., Gold Standard: 30 yen) | ||

| Completed acceptance screening by Nov 30, 2023 | Varies by brand (e.g., Gold Standard: 4,400 yen) | Commission: 0 yen; Width of cutout: Varies (e.g., Gold Standard: 5 yen) | Commission: Varies (e.g., Gold Standard: 15,400 yen); Width of cutout: Varies (e.g., Gold Standard: 20 yen) | ||

| Internet Courses | / | Mostly 561 yen or 341 yen (e.g., Gold Standard: 561 yen; Gold Mini: 341 yen) | Commission: 0 yen; Width of cutout: Varies (e.g., Gold Standard: 1 yen; Gold Mini: 4 yen) | Commission: Varies (e.g., Gold Standard: 561 yen; Gold Mini: 341 yen); Width of cutout: Varies (e.g., Gold Standard: 2 yen; Gold Mini: 7 yen) |

Click 365

| Course Type | Total Fee (Including Tax) | Brokerage - Related Fees Breakdown |

| Comprehensive Course | 1,100 yen | Brokerage fee: 770 yen |

| Internet Course | 220 yen | Agency fee: 110 yen |

Click Stock 365

| Margin Trading | Comprehensive Course (Including Brokerage Fee, Yen) | Internet Course (Including Brokerage Fee, Yen) |

| Nikkei 225/DAX®/FTSE100 | 3,080 (2,156) | / |

| NY Dow/ASDAQ - 100/Russell 2000 | 308 (215.6) | 44 (22), Phone orders: 88 (44) |

| Nikkei 225 Micro | 770 (539) | 110 (77), Telephone orders: 220 (154) |

| Gold/Platinum/Crude Oil ETF | 2,310 (1,617) | 330 (165), Telephone orders: 660 (330) |

| Silver ETF | 1,540 (1,078) | 220 (110), Telephone orders: 440 (220) |

| Crude Oil ETF | 1,848 (1,293.6) | 264 (132), Phone orders: 528 (264) |

Gold bullion

| Transaction Type | Product Type | Simple Appraisal Fee |

| Sale | Specified bullion | 1,100 yen (tax included, per purchase) |

| Precious metal products | 0 |

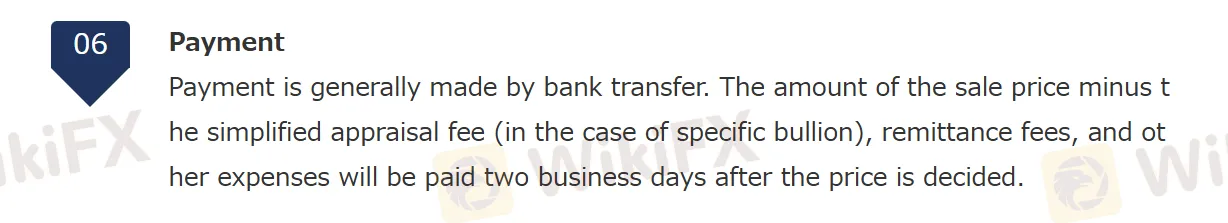

Deposit and Withdrawal

KANETSU accepts payments via bank transfer. Other info on deposits and withdrawals are not disclosed.

WikiFX Broker

Latest News

Stop Chasing Headlines: The Truth About "News Trading" for Beginners

Why Markets Pump When the News Dumps: The "Bad Is Good" Trap

Common Questions About GLOBAL GOLD & CURRENCY CORPORATION: Safety, Fees, and Risks (2025)

Yen in Peril: Wall Street Eyes 160 as Structural Outflows Persist

Is CMC Markets Legit or a Scam? Key Questions Answered (2025)

Biggest Scams In Malaysia In 2025

Rate Calc

USD

CNY

Current Rate: 0

Amount

USD

Available

CNY

Calculate