TM Inversiones-Some Details about This Broker

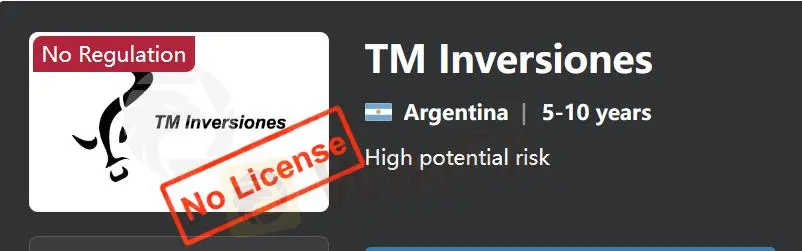

Abstract:TM Inversiones, headquartered in Argentina, operates as an online trading platform, offering a diverse array of financial instruments to traders. TM Inversiones facilitates trading in various assets such as stocks, bonds, options, and futures Rofex. However, it's important to note that TM Inversiones operates without regulatory oversight, emphasizing the necessity for caution due to potential risks associated with unregulated trading.

| TM Inversiones | Basic Information |

| Company Name | TM Inversiones |

| Headquarters | Argentina |

| Regulations | Not regulated |

| Tradable Assets | Stocks, bonds, options, futures Rofex, and more |

| Trading Platforms | Online platform |

| Customer Support | Email (contacto@tomarinversiones.com.ar)Phone (011-5258-8210) |

Overview of TM Inversiones

Based in Argentina, TM Inversiones functions as an online trading platform, providing traders access to a wide range of financial instruments. From stocks and bonds to options and futures Rofex, TM Inversiones offers diverse trading opportunities. However, it's crucial to recognize that TM Inversiones operates without regulatory oversight, underscoring the importance of exercising caution due to the potential risks inherent in unregulated trading.

Is TM Inversiones Legit?

TM Inversiones is not regulated. It's crucial to highlight that this broker lacks valid regulation, indicating it operates without supervision from established financial regulatory bodies. Traders must proceed with caution and acknowledge the risks associated with trading through an unregulated broker like TM Inversiones. Such risks may include limited options for resolving disputes, potential concerns regarding the safety of funds, and a lack of transparency in the broker's operations. Therefore, it's advisable for traders to conduct comprehensive research and evaluate a broker's regulatory status before initiating any trading activities, thereby ensuring a more secure and reliable trading experience.

Pros and Cons

TM Inversiones offers traders a diverse range of trading instruments, providing ample opportunities to diversify their portfolios and explore various financial markets. However, it's essential to note that the platform operates without regulatory oversight, posing potential risks to traders. The absence of regulatory scrutiny may lead to concerns regarding fund security, dispute resolution, and transparency in business practices. Additionally, TM Inversiones lacks educational resources or transparency regarding company policies and procedures, which may hinder traders' ability to make informed decisions. Furthermore, there is a lack of clarity regarding payment methods and account types, making it challenging for traders to understand the platform's fee structures and features fully.

| Pros | Cons |

|

|

|

|

|

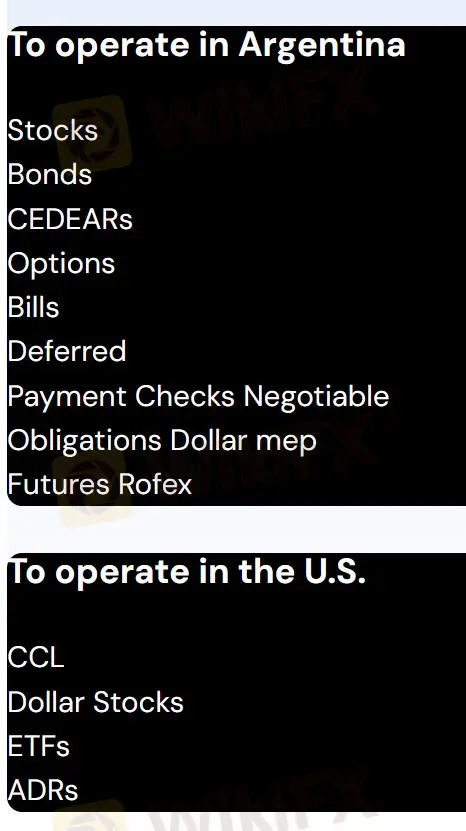

Trading Instruments

TM Inversiones provides a diverse range of trading instruments for investors operating in Argentina and the U.S. In Argentina, investors can trade in stocks, bonds, CEDEARs, options, bills, deferred payment checks negotiable, obligations Dollar mep, and futures Rofex. For those looking to operate in the U.S., TM Inversiones offers access to CCL (Contado con Liquidación), Dollar Stocks, ETFs (Exchange-Traded Funds), and ADRs (American Depositary Receipts).

Account Types

At Take Investments, opening an account involves no fees, and there's no minimum initial investment necessary to start trading. However, it's advised to consider an initial investment of $20,000 to establish a diversified portfolio primed for short-term profitability.

How to open an account

To open an account with TM Inversiones, follow these simple steps:

Complete the online form free of charge by attaching the requested information.

Once the opening is confirmed, activate your username on the Home Broker platform.

Start trading from wherever you are with personalized advice.

Trading Platforms

The trading platform offered by TM Inversiones is a modern online platform designed to provide users with seamless access to financial markets and advanced trading tools.

Customer Support

TM Inversiones can be contacted through the following methods: For inquiries, questions, or assistance, you can reach out via email at contacto@tomarinversiones.com.ar. Alternatively, during office hours, you can make contact by phone at 011-5258-8210.

Conclusion

In conclusion, TM Inversiones offers traders a wide range of trading instruments and account types, along with popular trading platforms, fostering flexible and accessible trading opportunities. However, the lack of regulatory oversight poses potential risks, while the limited educational resources and unclear company policies may hinder traders' decision-making process. It's essential for traders to proceed with caution, conduct thorough research, and fully understand the platform's features and risks to ensure a safer trading experience.

FAQs

Q: Is TM Inversiones regulated?

A: No, TM Inversiones operates without regulation, which means it lacks oversight from recognized financial regulatory authorities.

Q: What trading instruments are available on TM Inversiones?

A: TM Inversiones provides a diverse range of trading instruments for investors operating in Argentina and the U.S. In Argentina, investors can trade in stocks, bonds, CEDEARs, options, bills, deferred payment checks negotiable, obligations Dollar mep, and futures Rofex. For those looking to operate in the U.S., TM Inversiones offers access to CCL, Dollar Stocks, ETFs, and ADRs.

Q: How can I contact TM Inversiones's customer support?

A: For inquiries, questions, or assistance, you can reach out via email at contacto@tomarinversiones.com.ar. Alternatively, during office hours, you can make contact by phone at 011-5258-8210.

Risk Warning

Trading online carries substantial risks, and there's a possibility of losing all invested capital, making it unsuitable for all traders or investors. It's crucial to fully comprehend the associated risks and note that the details provided in this review may change due to the company's ongoing updates to its services and policies. Moreover, the date of this review's generation could impact its relevance, as information may have evolved since then. Therefore, readers are encouraged to independently verify updated information directly from the company before making any decisions or taking action. Ultimately, the reader bears sole responsibility for using the information provided in this review.

Read more

T4Trade Review 2025: Live & Demo Accounts, Withdrawal to Explore

T4Trade, established in 2021 and regulated by the FSA in the Seychelles, allows trading on a modest portfolio of over 300 instruments, spanning forex, metals, indices, commodities, futures, and shares, all accessible via the popular MetaTrader 4 and their proprietary WebTrader platforms. Notably, T4Trade offers a zero-commissions pricing model where both floating and fixed spreads are offered on its MetaTrader—flexible leverage up to 1000:1 to increase trading flexibility. T4Trade also introduces a copy trading service called “TradeCopier”, which enables traders who lack experience or time to join in the markets by copying the trades of seasoned professionals.

GQFX Trading Review 2025: Read Before You Trade

GQFX Trading review 2025: Unregulated broker with poor ratings. Learn why trading with GQFX is risky and unsafe for your investments.

Swissquote Review 2025: Live and Demo Account to Explore

Swissquote is a unique online broker with a solid banking background in Switzerland. As a forex-focused platform, it provides one of the most respective range in the industry, over 80 currency pairs in major, minor and exotic. Notably, Swissquote offers different trading conditions for traders from Switzerland, Europe, Middle East, Hong Kong, South Africa, and other regions, and traders at Swissquote can enjoy the benefit of trading with its well-regulated brand and entities. Besides, Swissquote offers excellent research offerings along with its product offerings.

Oanda Shines As Frop Trading Firm After Being Acquired By FTMO

FTMO enhances prop trading with the OANDA Prop Trader Community and loyalty program, integrating CRM automation and rewards post-acquisition.

WikiFX Broker

Latest News

2025 SkyLine Guide Thailand Opening Ceremony: Jointly Witnessing New Skyline in a New Chapter

TriumphFX: The Persistent Forex Scam Draining Millions from Malaysians

Safety Alert: FCA Discloses These 11 Unlicensed Financial Websites

Unbelievable! Trump to 'Sell US Green Cards'?

GQFX Trading Review 2025: Read Before You Trade

WikiFX Community Ramadan Charity Creator Program

Massive Crypto Scam in Philippines: Education Pioneer Wealth Society Exposed

Arab Trading Market Stunned by this Scam! Know about it & Beware

Skype announces it will close in May

DOJ Investigates LIBRA Memecoin Scam: $87M Lost by Investors

Rate Calc