IronBeam-Overview of Minimum Deposit, Spreads & Leverage

Abstract:IronBeam is a futures broker, platform, and FCM (a registered Futures Commission Merchant) providing cutting-edge tech, support, and clearing services to traders worldwide. IronBeam offers multiple trading platforms and products and have exclusive access to the firetip trading platform.

General Information

IronBeam is a futures broker, platform, and FCM (a registered Futures Commission Merchant) providing cutting-edge tech, support, and clearing services to traders worldwide. IronBeam offers multiple trading platforms and products and have exclusive access to the firetip trading platform.

Account Types

Here IronBeam offers quite a few trading accounts to satisfy different investors trading needs and strategies. See the following account types:

Individual Accounts

Joint Account

IRA

Corporate/LLC

Trust Accounts

Partnership Accounts

Margins

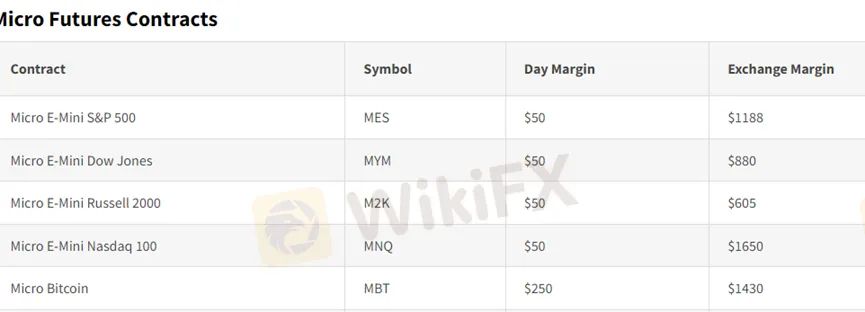

The day margin is set by Ironbeam. This is the amount required per contract to trade on an intraday basis. Day margins are in effect during all market hours except the last 10 minutes preceding the market close. The exchange margin is set by the exchange, and it is the amount required to carry a position past the market close. Exchange margins are believed to be accurate but can change without notice. Exchange margins last updated 02/07/2022. Here we take Micro Futures Contracts as an example:

Commission Rates

Ironbeams rates are determined by a number of factors including volume, risk, and leverage. For a detailed commission rate you can reached a licensed account specialist at 312-765-7200 or email them at sales@ironbeam.com.

Trading Platforms

When it comes to trading platforms available,Ironbeam offers quite a few platform in addition to its proprietary platform-The Ironbeam platform (which was built for the modern futures traders). They also include CQG, CTS, TRADINGVIEW, SIERRA CHART, BOOKMAP, MULTICHART, Motivewave, BOOKMAP and more. All of the platforms are offered at-cost. Ironbeam promises that it does not add fees on top of what the vendor charges.

Deposit & Withdrawal

In terms of payment methods, you can deposit funds via wire transfer, ACH, or Checks. Wires are the quickest funding method. Check typically take three business days to clear and ACHs take five business days to clear. You can send funds via a foreign currency however it will be automatically converted by Ironbeams bank upon receiving the funds. There are some fees charged for certain services:

-Wire Transfer Out (Domestic): $40

-Wire Transfer Out (International): $60

-Check Issued Overnight (International) : $60

-Risk Liquidation: $50 per contract

-Stop Payment/ Insufficient Funds/Returned Item fee: $45

-Account Transfer Out: $100

Telephone Orders: $50 per order placed or modified (cancellation is no charge)

Customer Support

Ironbeam customer support hours: 24 hours Monday to Thursday. Closed at 4 pm CST Friday. Opened at 4 PM CST Sundays. They can be reached through 1-800-588-9055, 1-800-341-1941, as well as email: clientservices@ironbeam.com.

Read more

What’s the Secret in Trading Chart Behind 90% Winning Trades?

Discover the secret to 90% winning trades with chart patterns, indicators, and pro strategies. Master trading charts for consistent wins!

NovaTech Scam Alert: Avoid Unregulated Forex & Crypto Fraud

Novatech FX Ltd. (“Novatech”), founded in 2019, was registered in St. Vincent and the Grenadines, a jurisdiction known for its minimal regulations and booming unlicensed brokers. NovaTech, which said it was a leading forex and crypto trading platform, claimed to have its own trading software with deep liquidity. Mostly active from 2020 to 2023, they attracted investors by promising monthly returns of 3% to 5%. Accusing them of a $600 million investment fraud, the SEC filed charges on August 12, 2024, against NovaTech FX, Cynthia and Eddy Petion, and several promoters.

Maxxi Markets Review

Maxxi Markets is a forex broker founded in Comoros that offers traders access to a diverse range of financial instruments. With product offerings spanning commodities, forex, indices, metals, cryptocurrencies, and bonds, the broker caters to a wide spectrum of trading interests. Backed by the Mwali International Services Authority (MISA) under an offshore Retail Forex License (license number T2023425), Maxxi Markets combines innovative technology with varied account options to serve both novice and experienced traders.

What Impact on Investors as Oil Prices Decline?

Oil prices have come under pressure amid mounting concerns over U.S. import tariffs and rising output from OPEC+ producers. With tariffs on key trading partners and supply increases dampening fuel demand expectations, investor appetite for riskier assets has cooled. This shift in sentiment poses a range of implications for different segments of the investment landscape.

WikiFX Broker

Latest News

Beware: Online Share Buying Scam Costs 2,791,780 PHP in Losses

5 things I wish someone could have told me before I chose a forex broker

Unmasking a RM24 Million Forex Scam in Malaysia

U.S., Germany, and Finland Shut Down Garantex Over Money Laundering Allegations

Gold Prices Fluctuate: What Really Determines Their Value?

Dollar Under Fire—Is More Decline Ahead?

What Impact on Investors as Oil Prices Decline?

Plunging Oil Prices Spark Market Fears

Celebrate Ramadan 2025 with WelTrade & YAMarkets

WikiFX App Version 3.6.4 Release Announcement

Rate Calc