ABC Bullion-Some important Details about This Broker

Abstract:ABC Bullion, namely Australian Bullion Company (NSW) Pty Ltd, is Australasias largest independent bullion dealer, which offers precious metals and bullion specialists for several years, with a large number of clients spread over the world, moreover, the corporation was registered in Australia with several actual residents at Level 6, 88 Pitt Street Sydney, NSW 2000/ Level 3, 40 St Georges Terrace Perth, WA 6000/ Suite 4, Level 12, 141 Queen Street Brisbane QLD Australia/ Suite 801, Level 8, 227 Collins Street Melbourne VIC Australia.

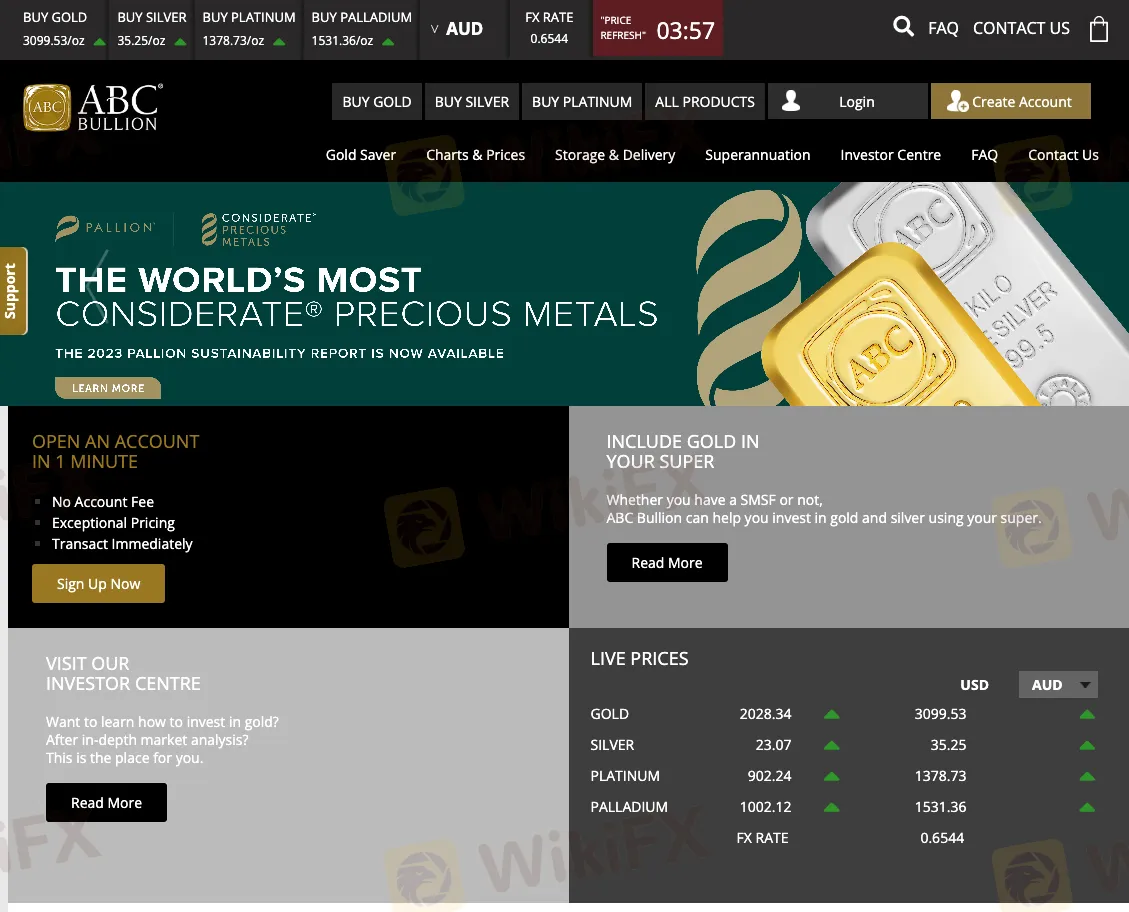

| Aspect | Information |

| Company Name | ABC Bullion |

| Registered Country/Area | Australia |

| Years | 2-5 years |

| Regulation | Unregulated |

| Market Instruments | Gold Products, Silver Products, Platinum, Palladium Products, Pool Allocated Bullion, SMSF Products, Bullion Coins, Monster Boxes, Lunar Products, Diwali Products, and Special Products |

| Demo Account | Yes |

| Customer Support | Sydney Head Office (Phone: 1300 361 261 or +61 2 9231 4511 and Email: comms@abcbullion.com.au) Perth Office (Phone: +61 8 9325 0888 and Email: comms@abcbullion.com.au)Brisbane Office (Phone: +61 7 3211 1114 and Email: comms@abcbullion.com.au)Melbourne Office (Phone: +61 3 9654 9200 and Email: comms@abcbullion.com.au) |

| Educational Resources | Investor Centre, Market Updates, Key Market Statistics, Technical Analysis, Videos, Media, Events Calendar, and Blog |

Overview of ABC Bullion

ABC Bullion, based in Australia and operating for 2-5 years, offers a wide array of precious metal products. While the company is unregulated, it provides an extensive range of market instruments including Gold Products, Silver Products, Platinum, Palladium Products, Pool Allocated Bullion, SMSF Products, Bullion Coins, Monster Boxes, Lunar Products, Diwali Products, and Special Products.

Traders have access to a demo account for practicing trading strategies. For customer support, ABC Bullion offers multiple contact options including the Sydney Head Office, Perth Office, Brisbane Office, and Melbourne Office, each with respective phone numbers and email addresses.

Additionally, the company provides various educational resources such as the Investor Centre, Market Updates, Key Market Statistics, Technical Analysis, Videos, Media, Events Calendar, and Blog to assist traders in making informed decisions.

Regulatory Status

ABC Bullion operates as an unregulated trading platform, meaning it does not fall under the oversight of any financial regulatory authority. Traders and investors should be aware that the absence of regulatory supervision may entail additional risk.

Pros and Cons

| Pros | Cons |

| Wide range of precious metal products | Unregulated |

| Multiple office locations for support | Potential for Limited Liquidity |

| Demo account available for practice | Limited Transparency |

| Established presence in Australia | Limited Technology and Innovation |

| Extensive customer support options | Potential for Higher Costs |

Pros:

Wide Range of Precious Metal Products: ABC Bullion offers a selection of precious metal products, providing traders with various options for investment diversification.

Multiple Office Locations for Support: The company has multiple office locations across Australia, ensuring accessibility and availability of customer support services.

Demo Account Available for Practice: Traders can access a demo account to practice trading strategies and familiarize themselves with the platform's features before committing to real funds.

Established Presence in Australia: ABC Bullion has an established presence in Australia, which instills confidence in traders regarding the reliability and trustworthiness of the company.

Extensive Customer Support Options: The company offers multiple customer support options, including phone and email support, providing convenience and assistance to traders as needed.

Cons:

Unregulated: ABC Bullion operates without regulatory oversight.

Potential for Limited Liquidity: As a smaller broker, ABC Bullion may face challenges in providing liquidity for certain assets or during periods of high trading volume, which could result in wider spreads and difficulties in executing trades at desired prices.

Limited Transparency: The lack of regulatory oversight may lead to limited transparency regarding the company's operations, financial standing, or order execution practices, potentially creating uncertainty for traders.

Limited Technology and Innovation: Smaller brokers like ABC Bullion may have fewer resources to invest in technology and innovation, which could result in outdated trading platforms, slower execution speeds, or fewer features compared to larger competitors.

Potential for Higher Costs: While ABC Bullion may offer competitive pricing for its products, there could be hidden costs or fees associated with certain services or transactions that are not readily apparent to traders, impacting overall profitability.

Market Instruments

ABC Bullion offers a range of market instruments for the needs of precious metal investors.

Gold Products: ABC Bullion provides various gold products, including bars and coins, allowing investors to buy and trade in this highly sought-after precious metal.

Silver Products: Investors can access a variety of silver products, such as bars and coins, offering opportunities to invest in silver bullion.

Platinum: ABC Bullion offers platinum products, providing investors with exposure to this precious metal known for its industrial and investment applications.

Palladium Products: Investors can trade palladium products through ABC Bullion, allowing them to diversify their precious metal portfolio.

Pool-Allocated Bullion: ABC Bullion offers pool-allocated bullion, enabling investors to purchase and own a share of a larger pool of precious metals, providing flexibility and cost-effectiveness.

SMSF Products: Self-managed super fund (SMSF) products are available, for investors looking to include precious metals in their retirement savings strategy.

Bullion Coins: ABC Bullion offers a selection of bullion coins from various mints around the world, allowing investors to collect and trade these highly valued items.

Monster Boxes: Investors can purchase monster boxes containing a large quantity of bullion coins, providing convenience and cost savings for bulk purchases.

Lunar Products: ABC Bullion offers lunar-themed bullion products, celebrating the Chinese zodiac lunar calendar and appealing to collectors and investors alike.

Diwali Products: Special Diwali-themed bullion products are available, providing a unique investment opportunity for those celebrating the festival of lights.

Special Products: ABC Bullion also offers special products, which may include limited edition or commemorative items, for collectors and investors seeking unique additions to their portfolios.

How to Open an Account?

Opening an account with ABC Bullion is a straightforward process that can be completed online in a matter of minutes. Here's a breakdown of the steps involved:

Visit the ABC Bullion website and click “Sign Up Now.”

Fill out the online application form: The form will request your personal information Be sure to have your identification documents (passport or ID card) and proof of address handy for uploading.

Fund your account: ABC Bullion offers various deposit methods, including bank transfers, credit/debit cards, and e-wallets. Choose your preferred method and follow the instructions to complete the deposit.

Verify your account: Once your account is funded, you'll need to verify your identity and address. This typically involves submitting scanned copies of your ID documents and proof of address.

Start trading: Once your account is verified, you're ready to explore the ABC Bullion trading platform and start making trades.

Customer Support

ABC Bullion provides comprehensive customer support through its various office locations across Australia.

The Sydney Head Office can be reached via phone at 1300 361 261 or +61 2 9231 4511 and through email at comms@abcbullion.com.au.

Similarly, the Perth Office is accessible via phone at +61 8 9325 0888 and email at comms@abcbullion.com.au.

The Brisbane Office can be contacted by phone at +61 7 3211 1114 and email at comms@abcbullion.com.au.

Additionally, the Melbourne Office is reachable by phone at +61 3 9654 9200 and email at comms@abcbullion.com.au.

Educational Resources

Conclusion

In summary, ABC Bullion offers a variety of precious metal products and has several support offices, making it accessible. They provide a demo account and ample customer support. However, being unregulated attracts concerns about transparency.

There's also a risk of limited liquidity, and the company might lack advanced technology. Traders should be mindful of potential higher costs associated with trading with ABC Bullion.

FAQs

Q: How do I track my ABC Bullion order?

A: All parcels are sent via a third-party supplier. You will be emailed a tracking number so you can track your order through the suppliers website.

Q: How long will my order take to arrive?

A: ABC Bullion dispatches orders within an after your payment clears. You will be sent a tracking number via email once your order has been dispatched. The current time frame for dispatch is 5 to 10 business days following payment.

Q: Can my parcel be left on my doorstep if I am not at home?

A: Parcels are delivered straight to your door by secure courier, and a recipients signature is required. If no one is available to sign the parcel, the courier will leave a note and the package will be taken to the nearest post office or depot.

Q: Can I send someone to collect an order on my behalf?

A: Yes, if that person is an operating authority on your account OR if they have been added to your account as a collection authority. Your nominated collection agent must bring their ID for verification purposes at the time of collection. These forms are downloadable from within your account.

Q: How do I update my personal details?

A: ABC Bullion will ask you for personal details over the telephone to ensure the security of your account and investment.

Read more

Lirunex Joins Financial Commission, Boosts Trader Protection

Lirunex joins the Financial Commission, offering traders €20,000 protection per claim. A multi-asset broker regulated by CySEC, LFSA, and MED.

Capital.com Review 2025: Trading Account & Withdrawal to Explore

Despite its relative youth, the Cyprus-registered online broker Capital.com has garnered respectable attention from a large number of retail and professional investors since its 2016 launch. Capital.com is a frontrunner among low-cost trading products; it allows individual and institutional investors to trade contracts for difference (CFDs) on three thousand markets, including Forex, Stocks, Commodities, Indices, Cryptocurrencies, and more. Impressively, Capital.com is on board with ESG investments as well. You can begin trading CFDs on the Capital.com platform with as little as $20. You can trade CFDs on this platform without paying any commissions; the only fees involved are the spreads. This broker offers a wide range of platforms, including mobile apps, a desktop trading app, an API from Capital.com, Tradingview, and MetaTrader 4. Among Capital.com's many distinguishing features is the wealth of educational content and high-quality research it offers its users. The platform's Marke

Italy’s Securities Regulator Consob Orders Shutdown of 6 Illegal Financial Service Websitese

Italy’s financial regulator, Consob, has ordered the shutdown of six unauthorized financial service websites to combat illegal financial activities and protect investors. This action is based on regulatory powers granted under the 2019 “Crescita Decree.” Since 2019, Consob has blocked 1,211 fraudulent websites. Investors can use WikiFX to verify compliance and avoid investment scams.

WikiFX Review: Is Fortune Prime Global Reliable?

Founded in 2011, Fortune Prime Global (FPG) is an Australia-registered broker that offers a wide range of investment products (Forex pairs, Commodities, Stocks, Cryptocurrencies, Indices, and so on). Today’s article will show you what it looks like in 2025.

WikiFX Broker

Latest News

Judge halts Trump\s government worker buyout plan: US media

Spotting Red Flags: The Ultimate Guide to Dodging WhatsApp & Telegram Stock Scams

WikiFX Review: Why so many complaints against QUOTEX?

Trans X Markets: Licensed Broker or a Scam?

IMF Warns Japan of Spillover Risks from Global Market Volatility

Beware of Comments from the Fed's Number Two Official

BaFin Unveils Report: The 6 Biggest Risks You Need to Know

Nomura Holdings Ex-Employee Arrested in Fraud Scandal

RBI: India\s central bank slashes rates after five years

Pepperstone Partners with Aston Martin Aramco F1 Team for 2025

Rate Calc