LD Trading Review - Is It a Reliable Forex Broker? - WikiFX

Abstract:LD Trading is a Chinese trading company who offers trading in forex, bullion, indices, commodities, and cryptocurrencies.

| LD Trading Review Summary | |

| Founded | 2020 |

| Registered Country/Region | China |

| Regulation | No regulation |

| Market Instruments | FX, Bullions, Indices, Commodities and Cryptocurrencies |

| Demo Account | ✅ |

| Leverage | Up to 1:300 |

| Spread | From 0.1 pips |

| Trading Platform | Prodigy Mobile, MT4 |

| Minimum Deposit | $100 |

| Customer Support | Live chat |

| TEL: +44 203 598 6591 | |

| Email: support@ldfx.net | |

| Address: China (Shanghai) Pilot Free Trade Zone, Taigu Road, Room 252, 2nd Floor, No. 78 | |

LD Trading Information

LD Trading, with a full name ShangHai LuDie International Trading Limited, is a Chinese trading company who offers more than 200 instrument options including forex, bullion, indices, commodities, and cryptocurrencies.

It provides a demo account for practicing before actual trading and 4 tiered accounts, with a minimum deposit of $100. Leverage ranges from 1:10 to 1:300. You can excute trades on the Prodigy Mobile, as well as the well-recognized MetaTrader 4.

However, one of the facts that cannot be neglected is that the broker is not being well-regulated by any official authorities so far, which degrades its credibility and trustworthiness.

Pros and Cons

| Pros | Cons |

| Demo accounts available | No regulation |

| Acceptable minimum deposit | |

| Tiered accounts | |

| MT4 platform |

Is LD Trading Legit?

The most important factor in measuring the safety of a brokerage platform is whether it is formally regulated. LD Trading is an unregulated broker, which means that the safety of users' funds and trading activities are not effectively protected. Investors should choose LD Trading with caution.

What Can I Trade on LD Trading?

LD Trading mainly focuses on trading services in FX, Bullions, Indices, Commodities and Cryptocurrencies.

| Tradable Instruments | Supported |

| Forex | ✔ |

| Bullions | ✔ |

| Indices | ✔ |

| Commodities | ✔ |

| Cryptocurrencies | ✔ |

| Stocks | ❌ |

| Bonds | ❌ |

| Options | ❌ |

| ETFs | ❌ |

Account Type & Fees

Except for a demo account for practicing before commiting real money, LD Trading offers a 4 tiered live accounts with varying trading conditions, each targets different customer groups with various experience levels:

| Account Type | Minimum Deposit | Spread | Commission | Suitable for |

| Swap Free | $100 | 2 pips | $6 | Beginners |

| Retail | $200 | 0.6-0.7 pips | $6 | Mediate traders |

| Crypto | $1,000 | Tightest | ❌ | Experiences traders |

| Institutional | $3,000 | 0.1 pips | $4 | Institutional traders |

Leverage

| Account Type | Maximum Leverage |

| Swap Free | 1:100 |

| Retail | 1:300 |

| Crypto | 1:2 |

| Institutional | 1:100 |

Note that high leverage can amplify not only profits but also losses.

Trading Platform

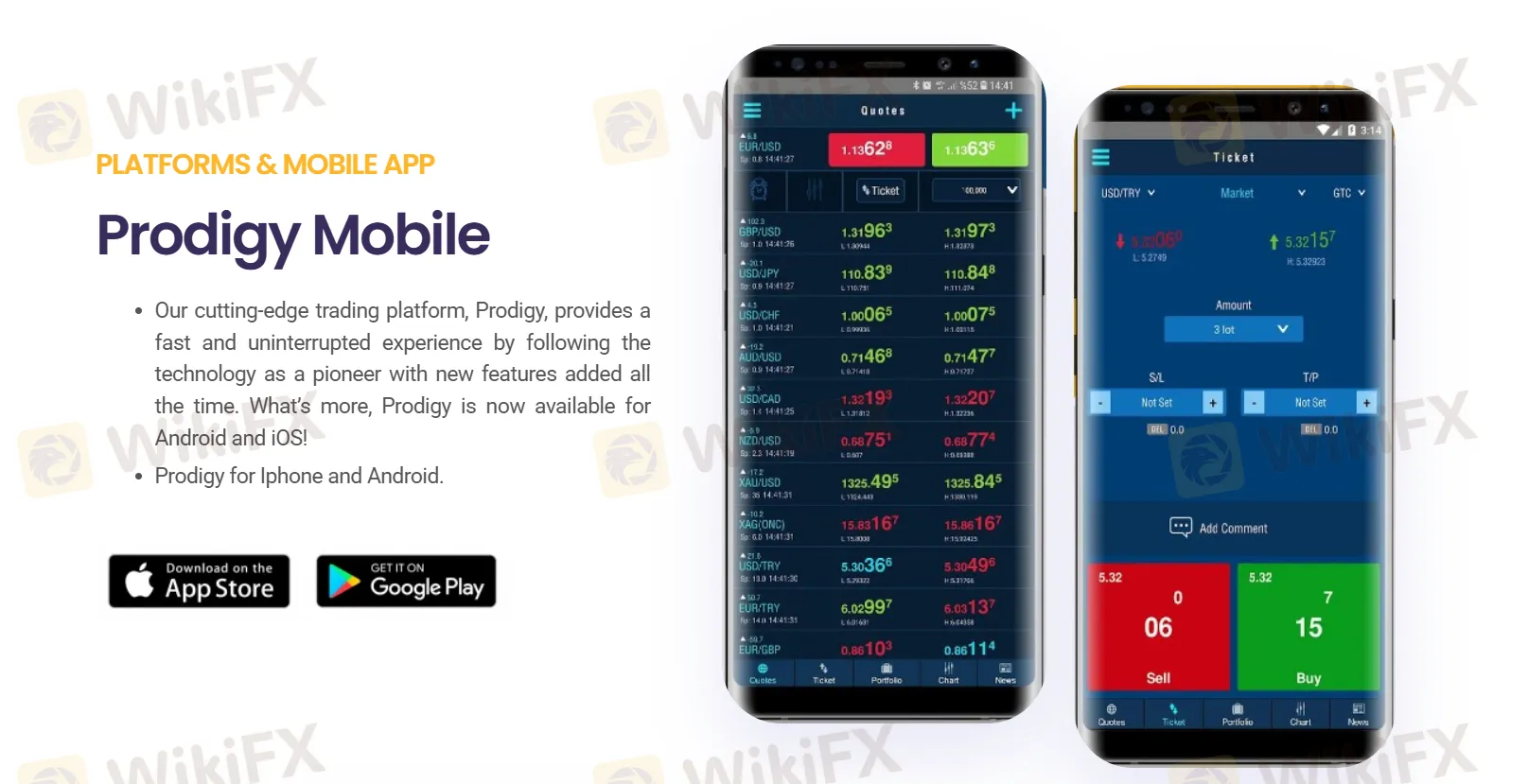

Except for the world leading MetaTrader 4 platform, which is accessible via Android and Windows.

LD Trading also offers a proprietary mobile trading platform called Prodigy Mobile. You can download Prodigy Mobile on both Android and iOS devices.

| Trading Platform | Supported | Available Devices | Suitable for |

| Prodigy Mobile | ✔ | Android/iOS | / |

| MT4 | ✔ | Android/Windows | Beginners |

| MT5 | ❌ | / | Experienced traders |

Read more

Scam Alert: 8,500 People Duped with Fake 8% Monthly Return Promises from Forex and Stock Investments

In a major revelation, the Economic Intelligence Unit of the Police Economic Offices Wing (EOW) is overseeing a cheating case where around 8,500 people were scammed in the name of 7-8% monthly return promises from forex and stock investments. While inquiring about the investment scheme, the Enforcement Directorate (ED), Surat, confiscated illegal cash worth INR 1.33 crore, foreign currency worth INR 3 lakh, and digital proof related to fraudulent transactions.

Long Position vs Short Position in Forex Trading: Know the Differences

When investing through forex, you often come across terms such as long position and short position. You may wonder what these two mean and how they impact your trading experience. So, the key lies in understanding the very crux of this forex trading aspect, as one wrong step can put you behind in your trading journey. Keeping these things in mind, we have prepared a guide to long position vs short position forex trading. Keep reading!

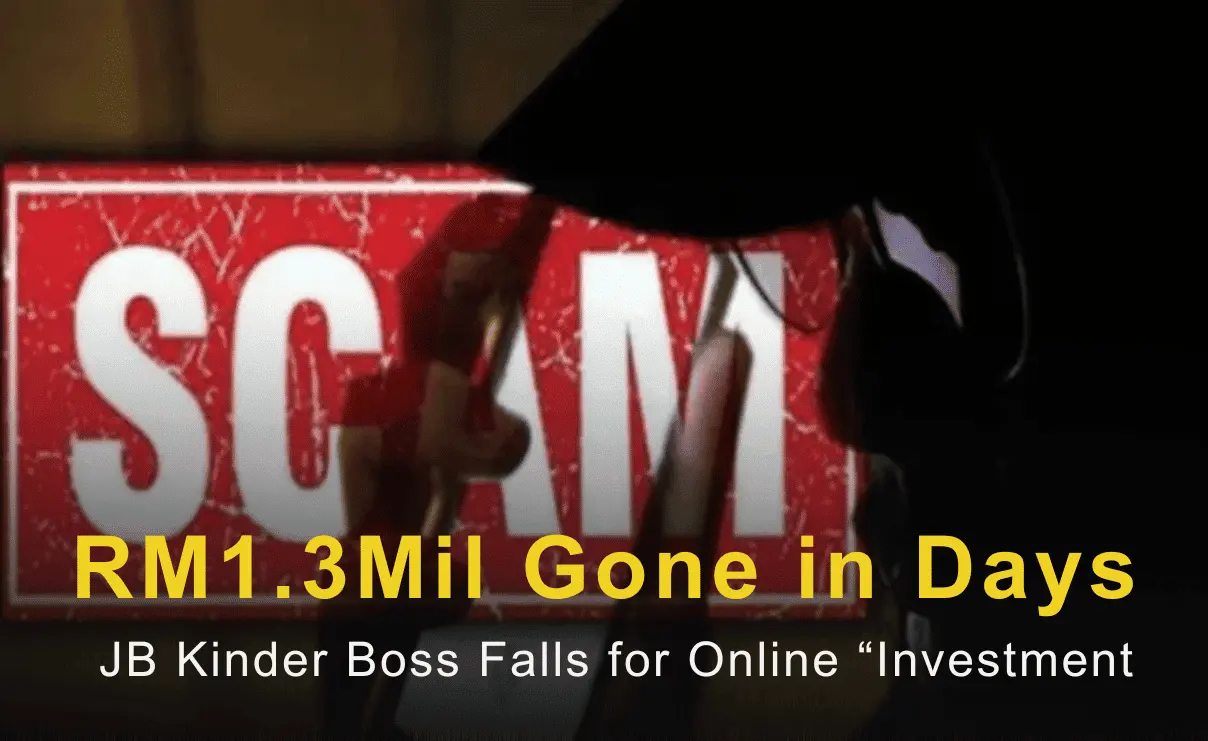

RM1.3Mil Gone in Days: JB Kinder Boss Falls for Online “Investment”

A Johor Baru kindergarten owner lost her life savings of RM1.3 million to a non-existent online investment scheme after responding to a social media ad promising returns of up to 41%. Between Nov 6–21, she made multiple transfers to several accounts and was later pressured to “add funds” to release profits that never materialised. She lodged a police report on Nov 28; the case is being probed under Section 420 (cheating).

FTMO Completes Acquisition of Global CFDs Broker OANDA, Marking a Major Milestone

Czech-based retail prop trading firm FTMO has officially completed its acquisition of OANDA Global Corporation, one of the world’s leading online multi-asset trading groups. The deal, which has been in progress since early 2024, was finalized on December 1 after receiving all required regulatory approvals.

WikiFX Broker

Latest News

'Worse Than COVID': Weak US Manufacturing Surveys Signal Stagflation In November

Offshore Forex Brokers Ramp Up Expansion in Vietnam as Authorities Crack Down on Scams

Absolute Markets 2025: Is It Scam or Safe? Suitable for Traders in Pakistan?

UK snack brand Graze to be sold to Jamie Laing\s Candy Kittens

FTMO Completes Acquisition of Global CFDs Broker OANDA, Marking a Major Milestone

Scam Alert: 8,500 People Duped with Fake 8% Monthly Return Promises from Forex and Stock Investments

ThinkMarkets Review: Why High Ratings Are Masking a "Withdrawal Black Hole"

FXGROW Exposed: Complete Review & Customer Complaints Analysis

The Impossible Two Percent: Why Central Banks Cannot Afford Price Stability

Deriv Review and Global Regulation Explained

Rate Calc