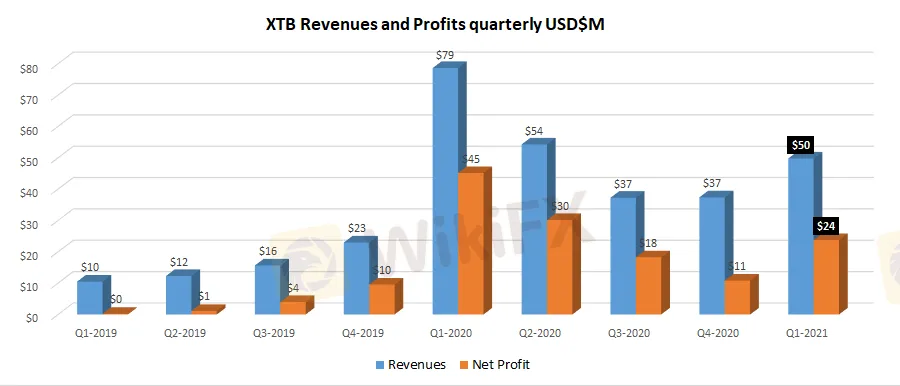

WIKIFX REPORT: XTB revenues up 33% in Q1-2021 to $49 million

Abstract:Following a rather dismal second half of 2020, X Trade Brokers Dom Maklerski SA, the operator of the XTB.com and X Open Hub brands, has revealed early financial figures for Q1-2021, indicating a considerable increase in activity and profitability.

Following a fairly disappointing second half of 2020, Poland based Retail FX and CFDs brokerage house X Trade Brokers Dom Maklerski SA – operator of the XTB.com and X Open Hub brands – has released preliminary financial results for Q1-2021 indicating a significant pickup in activity and profitability.

Revenues at XTB were up 33% in Q1 over Q4-2020, at PLN 186.7 million (USD $49 million). Net profit for the quarter was PLN 89.0 million (USD $24 million), up 120% from Q4s PLN 40.5 million.

Like many FX/CFD brokers, XTB had an absolute fantastic first-six-months of 2020, as market volatility (and client trading volumes) soared in the wake of the COVID-19 crisis. However unlike some of its peers activity waned in both Q3 and Q4, and along with it XTB shares.

XTB released the results after markets closed on Friday. It will be interesting to note how the stock market reacts to the news come Monday. XTB shares (WSE:XTB) had actually traded down sharply by about 17% over the past week in anticipation of the Q1 results announcement.

Some more info on XTBs Q1… The company signed up 67,231 new clients – a new record for the company – and saw a total of 103,425 active clients during the quarter.

XTB saw client trading volumes of USD $386.3 billion during Q1, or $128 billion monthly.

Looking at revenues in terms of the classes of instruments, XTB said that in Q1 2021 CFDs based on commodities dominated. Their share in the structure of revenues on financial instruments reached 53.8%, versus 51.2% a year earlier. The company said that this is a consequence of the high interest of XTB clients in CFD instruments based on gold, silver and oil prices. The second most profitable class were CFD instruments based on indices. Their share in the structure of revenues in Q1 2021 reached 39.9% (Q1 2020: 36.2%). The most profitable instruments among this asset class were instruments based on the German DAX stock index (DE30) and American stock index US 100. Revenues of CFD based on currencies was just 2.7% of all revenues, compared to 11.1% a year earlier.

XTB did a higher concentration of revenue geographically in Q1 versus last year, with the companys core Central and Eastern Europe geo comprising 59% of revenue, versus 49% in Q1-2020.

Despite the increased concentration, XTB said that international expansion remains a key goal for the company, with efforts focused on the start of operational activities in the United Arab Emirates and the Republic of South Africa. At the end of November 2020 XTB received preliminary approval of the DFSA regulator to conduct brokerage activities in the UAE. It is an approval of the “in principal” type, that requires the fulfilment of conditions (mainly operational) before the actual start of operations. One of the conditions was the establishment of the company XTB MENA Limited in the DIFC (Dubai International Financial Centre) which took place on 9 January 2021. The process is currently underway over the fulfilment of other conditions.

The intention of the XTB Management Board is to start operating activities in the United Arab Emirates in the first half of 2021.

In terms of the Republic of South Africa, due to the complex local formal and legal conditions, the Management Board said it is currently not able to indicate the expected date of the start of operations in this market. Subsidiary XTB Africa (PTY) has been in the licensing process since February 2019.

XTB also noted that while it would entertain growth via acquisitions, the company is currently not involved in any acquisition process.

Read more

Is 9X markets Legit or a Scam? 5 Key Questions Answered (2025)

You are likely here because you are considering trading with 9X markets, but their very recent launch date has you worried about the safety of your funds. You are right to be cautious.

MYFX Markets Review (2025): Is it Safe or a Scam?

If you are considering depositing funds with MYFX Markets, you need to pause and read this safety review immediately. While many brokers operate with high standards of transparency, our analysis of the data suggests MYFX Markets poses significant risks to retail investors.

9Cents Review 2025: Institutional Audit & Risk Assessment

9Cents (established 2024) presents the risk profile of a newly formed, unsupervised financial entity. Despite utilizing the reputable MT5 trading infrastructure, the broker operates without effective regulatory oversight and has already accrued serious allegations regarding fund safety. 9Cents is classified as a High-Risk Platform, primarily due to the discord between its high minimum deposit requirements for competitive accounts and its lack of legal accountability or capital protection schemes.

Hong Kong Regulator Warns Against CoinCola

Hong Kong’s financial watchdog, the Securities and Futures Commission (SFC), has issued a public warning against CoinCola, adding the platform to its Alert List of suspicious virtual asset trading platforms (VATPs). According to the SFC, CoinCola operates through the website and is suspected of conducting unlicensed virtual asset activities while appearing to target or operate in Hong Kong.

WikiFX Broker

Latest News

Stop Chasing Headlines: The Truth About "News Trading" for Beginners

Why Markets Pump When the News Dumps: The "Bad Is Good" Trap

Common Questions About GLOBAL GOLD & CURRENCY CORPORATION: Safety, Fees, and Risks (2025)

Yen in Peril: Wall Street Eyes 160 as Structural Outflows Persist

Is CMC Markets Legit or a Scam? Key Questions Answered (2025)

Biggest Scams In Malaysia In 2025

RMB Breaks 7.0: Seasonal Flows and Dollar Weakness Drive Surge

Rate Calc