WIKIFX REPORT: ATFX UK sees Revenues drop in 2021 as it ceases serving Retail clients

Abstract:ATFX UK (or more formally AT Global Markets UK Limited), the FCA regulated arm of Chinese controlled retail FX broker ATFX, saw a slight decrease in Revenues is fiscal 2021 (year ended October 31, 2021), although by reducing costs the company was able to reverse the previous year’s net loss.

ATFX UK (or more formally AT Global Markets UK Limited), the FCA regulated arm of Chinese controlled retail FX broker ATFX, saw a slight decrease in Revenues is fiscal 2021 (year ended October 31, 2021), although by reducing costs the company was able to reverse the previous years net loss.

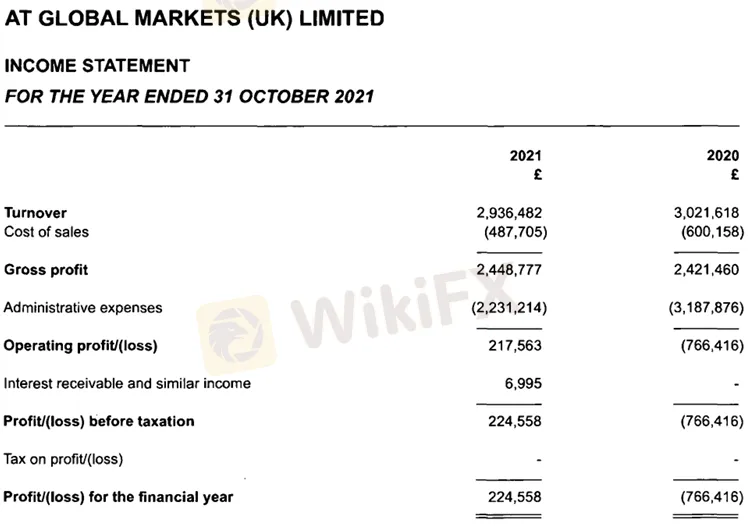

ATFX UK reported Revenues of £2.94 million in 2021, down 3% from £3.02 million in 2020. The company earned a net profit of £225,000 in 2021, versus a loss of £766,000 in 2020.

As a result of the UK leaving the European Union and the continued long term impact of COVID-19, ATFX UK said that it took the decision to cease offering services to Retail clients. Retail client activity was wound down during 2021. The firm shifted its focus to the provision or services to Professional institutional clients, via ATFX Connect. This resulted in a significant reduction of costs. The new focus of the business has resulted in lower costs, while volume has increased.

ATFX UK client assets were reduced to just £344,730 at year-end 2021, down from £3,116,832 in 2020, due mainly to the aforementioned decision to stop servicing Retail clients.

ATFX is controlled by Chinese entrepreneur Hiu Keung (Joe) Li. The group has licensed subsidiaries in the UK (FCA), Cyprus (CySEC), and offshore in Mauritius.

ATFX UKs 2021 income statement follows:

Read more

What the Movie Margin Call Taught Traders About Risk and Timing

The 2011 film Margin Call offers a gripping portrayal of the early hours of the 2008 financial crisis, set within a Wall Street investment firm. While the film is a fictionalised account, its lessons resonate strongly with traders and finance professionals. For one trader, watching the film had a lasting impact, shaping how they approached risk, decision-making, and the harsh realities of the financial world.

Why More Traders Are Turning to Proprietary Firms for Success

Over the past decade, one particular avenue has gained significant popularity: proprietary trading, or prop trading. As more traders seek to maximize their earning potential while managing risk, many are turning to proprietary firms for the resources, capital, and opportunities they offer. In this article, we’ll explore why an increasing number of traders are choosing proprietary trading firms as their preferred platform for success.

Day Trading Guide: Key Considerations

How does day trading balance freedom and precision in fast-moving markets? Learn key strategies to navigate risks and seize intraday opportunities effectively.

What Determines Currency Prices?

The price of currency directly impacts investor returns. Understanding the underlying causes of currency fluctuations can help investors make more informed decisions in the foreign exchange market.

WikiFX Broker

Latest News

Crypto.com Delists USDT and 9 Tokens to Comply with MiCA Regulations

AI Fraud Awareness Campaign: "We're Not All F**ked"

How to Use Financial News for Forex Trading?

Fake ‘cyber fraud online complaint’ website Exposed!

Day Trading Guide: Key Considerations

NAGA Launches CryptoX: Zero Fees, 24/7 Crypto Trading

Scam Alert: 7 Brokers You Need to Avoid

AvaTrade Launches Advanced Automated Trading Tools AvaSocial and DupliTrade

What Determines Currency Prices?

Why More Traders Are Turning to Proprietary Firms for Success

Rate Calc