Mohicans markets:Pay Attention to ECB Development

Abstract:Spot gold oscillated downward and extended losses in the U.S. session, once below $1,660, which was a new low since April 2020. It retraced about $38 from the daily high and finally closed down 1.91% at $1665.06 per ounce; spot silver moved downward with gold, once below the $19 mark, and finally closed down 2.36% at $19.17 per ounce.

At 16:30, the ECB President Lagarde and the member of ECB Governing Council Villeroy will give a speech. Recently the ECB officials said the Eurozone economy will slow down and 75 basis point rate hikes are not the norm.

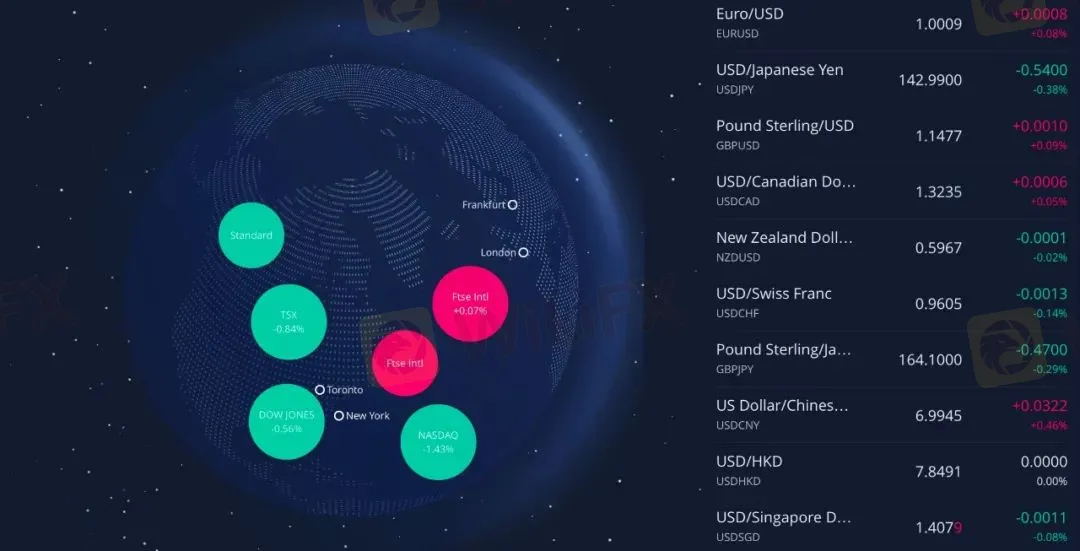

Global Views - List of Major Markets

Spot gold oscillated downward and extended losses in the U.S. session, once below $1,660, which was a new low since April 2020. It retraced about $38 from the daily high and finally closed down 1.91% at $1665.06 per ounce; spot silver moved downward with gold, once below the $19 mark, and finally closed down 2.36% at $19.17 per ounce.

The U.S. dollar index oscillated narrowly above 109, eventually closing up 0.06% at 109.72; the 10-year U.S. bond yield oscillated upward, closing at 3.449%. The inversion of the U.S. 5-year-30-year Treasury yield curve reached 19 basis points, which was the highest level since 2000. The yield on U.S. 5-year inflation-linked bonds rose above 1.0%.

In terms of crude oil, both oils fell more than 4%. WTI crude oil moved sharply lower since the European session, reaching a low of $84.52 per barrel and finally closing down 4.34% at $85.11 per barrel; Brent crude oil narrowly missed the $90 mark and finally closed down 4.03% at $90.66 per barrel. The U.S. natural gas prices in October were down 9.5% at one point, which was the biggest drop in more than a week. European natural gas futures prices were up 12% at one point to more than $2,500 per 1,000 cubic meters.

The U.S. Dow closed down 0.56%, the Nasdaq closed down 1.43% and the S&P 500 closed down 1.13%. Lithium battery, gold and silver sectors were the top losers, star technology stocks generally closed lower, Adobe closed down about 17% after the results, Microsoft closed down about 3%, Apple closed down about 2%.

European stocks were mixed, Germanys DAX index closed down 0.55% at 12,956.66 points, the FTSE 100 index closed up 0.07% at 7,282.07 points, the European Stoxx 50 index closed down 0.72% at 3,541.79 points.

Precious Metals

In early trading hours on Friday, September 16, Beijing time, spot gold ended up a little and traded above $1,667 per ounce in the short term. On Thursday, spot gold continued to move lower to its lowest level since April 2020, once below $1,660 per ounce, quickly breaking below the yearly low of $1,680.79 per ounce. The market expects the Fed to continue to aggressively tighten policy to curb the increasingly broad-based hyperinflation, even at great sacrifice.

At 20:30 Beijing time, the U.S. side released the horrible data U.S. retail sale in August that the market is concerned about. The result of the data performance slightly more than expected, but the core retail sales less than expected. The initial jobless claims data released at the same time as the retail data was less than expected, and the import and export data declined compared to the previous month. Specific data show that the U.S. monthly rate of retail sale in August actually announced 0.30%, with the expectation of 0.0% and the previous value of 0%; the U.S. core monthly rate retail sale in August actually announced -0.30%, with the expectation of 0.1%, the previous value of 0.4%. Retail sales measure spending in stores, online and at restaurants, etc. The core spending indicator, net of gasoline and auto sales, is also a focus of attention and is expected to still show that consumers maintain their spending power despite the majority of spending shifting online. The U.S. retail sale data is valued by the market because approximately 70% of the U.S. economic growth is driven by consumption. And retail sales account for even more than 40% of consumption, so retail sales data are an important guide in determining the current state and outlook of the U.S. economy. With the U.S. economy in a technical recession and the Federal Reserve continues to raise interest rates, the marginal growth rate of U.S. consumption put, the major U.S. retail importers are not optimistic about U.S. consumption expectations, and recently cut retail orders sharply. High inflation is expected to drive more consumers to shop online. Retail sales are likely to be further impacted by a decline in demand for consumer durables, which have been at the core of pandemic spending. However, spending on consumer services, such as restaurants, is expected to increase as the impact of the pandemic continues to wane.

Gold prices briefly recovered from losses to rebound somewhat while the market understood the data. But U.S. retail sales in August unexpectedly increased, while another data showed that U.S. initial jobless claims fell by 5,000 to a seasonally adjusted 213,000 last week. The market has fully understood expectations of a rate hike of at least 75 basis points at the end of next weeks Federal Reserve policy meeting, and even expects a possible hike of up to 100 basis points.

Previously, falling gasoline prices triggered a significant reduction in inflation expectations, investors once bet that the Federal Reserve will slow the pace of interest rate hikes. But this weeks release of U.S. inflation in August unexpectedly higher than expected, which prompted the market to revise bets on positioning, and the Fed hawks have no choice but to continue to raise rates sharply.

The latest data from CME‘s “Fed Watch” tool shows that the Fed will raise rates by at least 75 basis points for the third time in a row at next week’s policy meeting, with a nearly 25% chance of a 100 basis point hike. The continuation of the aggressive hawkish inertia at next weeks meeting means the dollar can continue to be supported.

Crude Oil

In early trading on Friday, September 16, Beijing time, U.S. oil traded around $85 a barrel. Oil prices fell more than 4% on Thursday, hitting their lowest level in a week. It was weighed down by a tentative deal to avoid a U.S. railroad strike, expectations of weaker global demand and the dollar's continued strength ahead of a possible large rate hike.

Bullish factors affecting oil prices

[US cannot save Europe by increasing oil and gas production]

[U.S. imposes new sanctions]

Bearish factors affecting oil prices

[Downside risks continue to dominate the global economic outlook]

[U.S. retail sales unexpectedly rebounded in August, but aggressive Fed rate hikes are cooling demand]

[U.S. stocks suffer from worries about Fed tightening and recession warnings]

[French national air traffic controllers will strike on the 16th, resulting in the cancellation of thousands of flights on the same day]

On the whole, oil prices were affected by a temporary agreement to avoid a US railroad strike, expectations of weak global demand, bets on the Fed's aggressive interest rate hike expectations, and the impact of a stronger dollar; As the Federal Reserve decides next week, short-term oil prices may still have room for downside; however, it is necessary to be wary that the United States cannot help Europe by increasing production, which may exacerbate the European energy crisis.

Foreign Exchange

In early trading on Friday, September 16, Beijing time, the U.S. dollar index rose slightly and is currently trading around 109.73. The dollar edged higher against the yen on Thursday after data showed U.S. retail sales unexpectedly rebounded in August, while the Swiss franc hit its highest level against the euro since 2015. The view that the Fed will continue to aggressively tighten policy has been supporting the dollar.

U.S. retail sales rose 0.3 percent in August, data showed, but demand for goods is cooling as the Federal Reserve raises interest rates, and economists surveyed had forecast sales would remain unchanged. The view that the Fed will continue to aggressively tighten policy has been supporting the dollar.Markets generally believe that recent data, including this week's data showing an unexpected rise in consumer prices in August, may give the Fed enough justification to announce a third consecutive rate hike of 75 basis points next Wednesday.

The dollar closed down 0.95% against the yen on Wednesday at 143.16 on news that the Bank of Japan had made exchange rate inquiries with banks - possibly in preparation for buying the yen. The exchange rate rebounded on Thursday and was last up 0.21% at 143.45. The euro closed up 0.18% against the dollar at 0.9997 on Thursday. The economic recession crisis persists, still limiting the upside of the euro. Some analysts believe that there are three major catalysts for the fall of the euro: one is the deterioration of the energy crisis, the other is the forced increase in EU finances, and the third is changes in the UK. The euro crisis is unlikely to turn around, and there is a possibility of further deterioration.

Institutional Currency Viewpoint

1. Goldman Sachs: The yen's decline is not over in the short term

2. Bank of America: The dollar will gradually weaken next year

3. State Street: USD/JPY should continue to rise

4. Rabobank: The dollar will continue to rise

Disclaimer

Disclaimer: The information contained in this material is for general advice only. It does not take into account your investment goals, financial situation or special needs. Every effort has been made to ensure the accuracy of the information as of the date of publication. MHMarkets makes no warranties or representations about this material. The examples in this material are for illustration only. To the extent permitted by law, MHMarkets and its employees shall not be liable for any loss or damage arising in any way, including negligence, from any information provided or omitted from this material. The features of MHMarkets products, including applicable fees and charges, are outlined in the Product Disclosure Statements available on the MHMarkets website. Derivatives can be risky; losses can exceed your initial payment. MHMarkets recommends that you seek independent advice.

MohicansMarkets, (abbreviation: MHMarkets or MHM, Chinese name: Maihui), Australian Financial Services License No. 001296777.

Read more

Mohicans markets:European Market

On Monday, October 10, during the Asian session, spot gold shock slightly down, and is currently trading near $ 1686 per ounce. Last Friday's better-than-market-expected U.S. non-farm payrolls report for September reinforced expectations that the Federal Reserve will raise interest rates sharply, and the dollar and U.S. bond yields surged and recorded three consecutive positive days, causing gold prices to weaken sharply.

Mohicans markets:Hitting Exhibition| See the Grand Occasion of Dubai Exhibition!

Focus on the industry highlight event, and explore the new future of trading. MHMarkets, the world's leading currency and CFD broker, is committed to providing better trading services to global traders and expanding its international markets.

Mohicans markets :MHM Today’s News

On Thursday, spot gold first fell and then rose. The US market once rose to a high of $1,664.78, and finally closed up 0.04% at $1,660.57 per ounce; spot silver finally closed down 0.34% at $18.82 per ounce.

Mohicans markets:Daily European Market Viewpoint

On Thursday, September 29, during the Asia-Europe period, spot gold fluctuated slightly and was currently trading around $1,652.26 an ounce. U.S. crude oil fluctuated in a narrow range and is currently trading around $81.63 a barrel, holding on to its sharp overnight gains.

WikiFX Broker

Latest News

Behind the Licences: Is Pepperstone Really Safe for Malaysians?

Promised Recession... So Where Is It?

Hirose Halts UK Retail Trading Amid Market Shift

CONSOB Blocks EurotradeCFD’s Solve Smart, 4X News

FINRA Fines United Capital Markets $25,000

IBKR Jumps on September DARTs, Equity Growth

Oanda: A Closer Look at Its Licenses

FCA Urges Firms To Report Online Financial Crime

Service Sector Surveys Show Slowdown In September Despite Rebound In Employment

Rate Calc