WikiFX Broker Review: FinexTrader is a Scam Broker - Beware

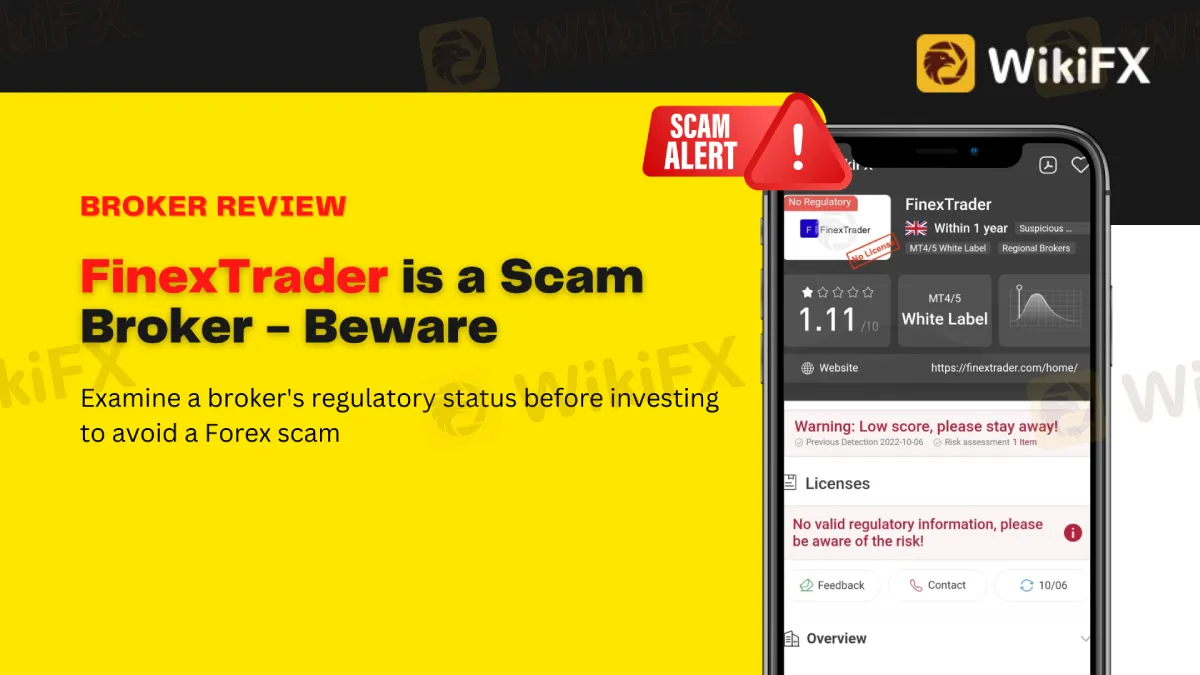

Abstract:We all know forex is risky. Examine a broker's regulatory status before investing to avoid a Forex scam. FinexTrader is a phony forex broker since it claimed to be licensed, but none of the regulators are correct. If you don't know what a regulator does or who the forex regulators are, you're in danger.

We are all aware that forex trading is a dangerous trade. To prevent fraud as a Forex trader, it is important to examine the regulatory status of a certain broker before investing. FinexTrader is an example of a fake forex broker since it claimed to be licensed but after further research, none of the regulators cited are correct. If you don't understand what a regulator does or who the world's forex regulators are, you're on the verge of slipping into this kind of trap.

About FinexTrader

FinexTrader is a UK-based online trading broker owned by Finex Group Ltd and situated at 173 Latchmere Road, London, SW11 2JZ.

FinexTrader begins with a highly bright website that seems to be designed to celebrate the arrival of a new year rather than a broker. It was also excruciatingly sluggish to load, irritating in its lack of consistency, and very glitchy. It was a hassle to go through, and it certainly made our experience with FinexTrader worse than we expected. And we haven't even gotten started on the other features that each broker, including FinexTrader, defines. So keep reading to learn more.

Regulating FinexTrader

According to its official website, the name FinexTrader is licensed by RBEM, MFA, and SFINS, all of which are currently renowned as major forex broker regulators. However, based on their location, we can determine whether they are indeed regulated by one of the world's most respected authorities, the UK FCA.

There are no results when their names are searched on the FCA's official website.

The clause that is unreasonable

Many individuals are not used to carefully reading the Conditions and Conditions, so when there is a problem with the trades, some fraudsters may discreetly put some absurd terms and claim that everything was agreed to in advance by the investor.

It, like FinexTrader, states that it reserves the right to stop a customer's usage of the website at any moment for any reason and without prior notification to the client. When a consumer signs such an absurd provision, whether legal or not, it becomes a justification for fraudsters when complaints arise.

Several Warnings

The hoax was discovered by WikiFX around a month ago. Over time, authorities have increased their monitoring of scammers. Three separate forex authorities have issued warnings to FinexTrader during the last three months.

See how CONSOB alerted FinexTrader here: https://www.wikifx.com/en/newsdetail/202209136304627931.html.

The Austrian Financial Market Authority (Austria FMA) has issued a warning that FinexTrader is not allowed to carry out financial operations in Austria that need a license, implying that the firm is not licensed to do forex trading.

FinexTrader is not permitted to offer forex services in France or Italy, according to France's Autorité des Marchés Financiers (AMF) and Italy's Commissione Nazionale per le Società e la Borsa (CONSOB).

Every forex trader should be familiar with forex regulators, and WikiFX may be of great assistance in gathering all broker information.

WikiFX Support may also assist in recovering cash from fraudulent forex brokers. You may get in touch with them using the information provided below.

WikiFX Overview

WikiFX is a search engine for worldwide corporate financial information. Its primary duty is to search for basic information, regulatory licenses, the credit assessment, platform identification, and other services for the participating foreign currency trading firms.

There are about 39,000 brokers listed on the marketplace, both licensed and unregistered. WikiFX's staff has been working hard with 30 financial regulators from across the world to guarantee that the information supplied is accurate and up to date.

You can check out more of FinexTraders on WikiFX Dealer Page

Keep an eye out for more Broker updates.

WikiFX App may be downloaded via the App Store or Google Play.

Read more

Vonway Review: A Series of Unfair Account Suspension & Withdrawal Denial Complaints

Have made substantial profits through Vonway, but could not withdraw? Initiated the Vonway withdrawal request, but the same was denied on the grounds of hedging violation? Were your trade orders executed at an unfair price? Have you faced a trading account suspension by the broker without any explanation? These have allegedly become regular for many traders here. In this Vonway review article, we have shared a list of the top complaints against the forex broker.

Advanced Markets Exposed: Faulty Copy Trading & Execution Failures Cost Traders Dearly

Attracted to Advanced Markets for the expert-led copy trading experience? Did you earn profits from the copy trade executed by the expert hired by the forex broker? But did the broker question some trades even though you paid the performance fee to the expert? Is the trade order execution time too slow at Advanced Markets? Do you witness high slippage issues? You are not alone! Many traders have shared these concerns online. In this Advanced Markets review article, we have described some complaints. Take a look!

Is WisunoFX Safe? An Unbiased 2025 Assessment of Platform Risks and Red Flags

Is WisunoFX a safe broker for your money? The answer is not simple. After looking at everything carefully, the platform gets a score of 7.21 out of 10. This means it has both good points and serious risks. For traders who want to research before investing, WisunoFX has two sides: it offers good trading conditions, but it also has some structural and regulatory issues that need careful thought. The broker has been operating for 5-10 years and has built up a presence in the market. However, it's officially labeled as a "Medium potential risk" platform, which cannot be ignored. Before investing, it's important to compare its good points with its bad ones.

A Simple Guide to WisunoFX Rules: Understanding Safety and Risks When Trading

When evaluating any trading company, it is essential to conduct a thorough WisunoFX regulation check first. This broker operates under two distinct sets of rules, which you must understand carefully. First, it has a license from the Cyprus Securities and Exchange Commission (CySEC), which is a trusted European regulator. Second, it has another license from the Financial Services Authority (FSA) in Seychelles, which is located offshore. These two licenses don't give traders the same level of protection. The CySEC license means the broker must follow strict European Union financial rules, while the FSA license has much less supervision. This guide will explain what each license means to traders, look at the company structure behind the brand, and examine the safety factors every potential client should think about.

WikiFX Broker

Latest News

Coinlocally Broker Review: Coinlocally Regulation & Real User Complaints Exposed

A Simple Guide to WisunoFX Rules: Understanding Safety and Risks When Trading

The "VIP" Trap: Inside the Algo-Trading Nightmare at Zenstox

Advanced Markets Exposed: Faulty Copy Trading & Execution Failures Cost Traders Dearly

Exposure: NAGA’s "Phantom Bonus" Trap and the $80,000 Silent Treatment

ATFX Partners with KX to Enhance Real-Time Trading Solutions

RM783,000 Gone: Restaurant Owner Fell Victim to an 85%-Return Investment Scheme

ThinkMarkets Hit By Chaos Ransomware In Major Data Breach

Complete Breakdown: MARKET-HUB Regulation & All Negative Reviews Exposed

Interactive Brokers Opens Access to Brazil’s B3 Exchange

Rate Calc