WikiFX Review: Something you need to know about FinFX-Pro

Abstract:FinFX-Pro is an online forex broker rooted in the UK, FinFx-pro is a trusted professional-grade Research and Analysis Company that provides complete solutions for all the segments of the market, ranging from Currency, Commodities, Global Indices, and Individual Stocks. But can this broker make your money safe? In this article, we will look closely at this broker so you can make a wise decision yourself afterward.

About FinFX-Pro

FinFx-Pro is a forex and CFD broker registered in the UK, that provides investors with popular financial instruments, including forex currency pairs, gold, silver, oil, cryptocurrencies, and index CFDs.

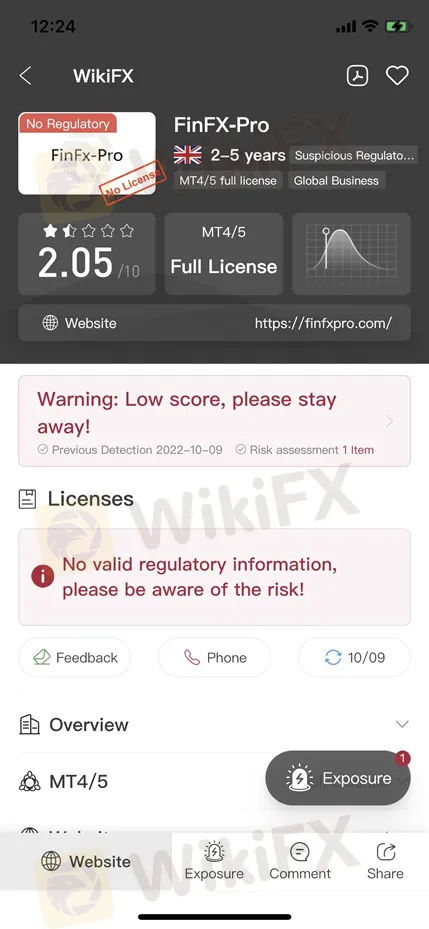

Regulation

FinFx-Pro is an unregulated broker. A regulatory certificate by a well-respected financial authority is probably the most important factor in the forex industry, as this gives credibility to the broker and security to potential traders. Therefore, Traders are advised to get away from any brokers that are not subject to any regulation.

Accounts & Minimum Deposit

There are five different trading accounts available. Micro (minimum deposit of $5), Standard STP (minimum deposit of $100), Pure ECN (minimum deposit of $200), VIP (minimum deposit of $25,000), and Islamic (minimum deposit of $200).

Leverage

When it comes to trading leverage, leverage levels vary depending on trading accounts. The maximum leverage is 1:100 for the VIP account, 1:200 for the Islamic account, and up to 1:400 for the rest of the accounts.

Spreads & Commissions

Standard STP accounts have spreads starting from 0.7 pips and no commissions. Micro accounts have spread starting at 0.2 pips and commissions of $4/standard lot. Pure ECN and VIP accounts have spreads starting at 0 pips, with pure ECN accounts charging $4/standard lot, and VIP accounts have commissions of $2/standard lot. Spreads for Islamic accounts start from 1 pip, and there is no commission.

Trading Platforms

FinFx-Pro offers traders the classic MT4 trading platform, one of the most widely used trading platforms on the market today, with support for algorithmic and automated trading, traders to create their trading programs, in addition to FinFx-Pro MT4 with powerful charting tools and 50 built-in technical indicators for seasoned traders and novice traders.

Exposure

This victim from Paraguay claimed that FinFX-Pro lures him to invest and take his money away fraudulently.

Conclusion

Since FinFX-Pro is an unregulated broker with a low rating, we advise you to avoid this broker as possible as you can. If you want to know more information about the reliability of certain brokers, you can open our website (https://www.WikiFX.com/en). Or you can download the WikiFX APP to find the most trusted broker for yourself.

Read more

MYFX Markets: Is it Legit or a Scam? This Review Will Tell You the Answer!

Is your trading experience with MYFX markets full of fund withdrawal denials despite repeated communications with its customer support team? Has the broker deleted all your profits? Did the broker accuse you of false trading strategy implementation while deleting your profits? There have been many such instances reported by traders against these activities online. In this MYFX Markets review article, we have shared some complaints. Take a look!

Exfor Exposure: Investigating Alleged Withdrawal Denials, Illegitimate Account Closure & More

Exfor, a Malaysia-based forex broker, has allegedly been the centre of attention for all the wrong reasons. These include long-pending withdrawal denials, no communication or assistance from the broker’s customer support team, manipulated pricing upon a withdrawal request by the trader, and account blowups due to bonus-related issues. It’s the traders who allegedly bear the brunt of all these suspicious trading activities. A lot of them have criticized it on broker review platforms. We have highlighted some of their complaints in this Exfor review article. Take a look!

Axiory Exposed: Low WikiFX Score & Trader Complaints!

Axiory WikiFX score 1.5: Active Belize FSC license (no FX authorization), multiple complaints. Reports show withdrawal/support issues. Traders beware.

RCG Markets Exposed: License Verification & Trader Complaints

RCG Markets holds a valid FSCA license. Reports show withdrawal rejections & stop‑loss issues. Traders urged to verify details and exercise caution.

WikiFX Broker

Latest News

WikiFX Invitation Rewards Program

Mentari Mulia Review : Is This BAPPEBTI-Regulated Indonesian Forex Broker Right for You?

Energy Crisis Deepens: Hormuz Blockade Risks Physical Supply Shock

ECB Watch: Energy Shock Won't Derail Policy Path, Says Nomura

Oil War Shock: Diesel Futures Surge 34% as White House Pledges Military Escort for Tankers

Middle East conflict poses fresh test to central banks as oil shock fuels inflation

AUD & NZD Slip as Mixed China PMI Data Clouds Recovery Signal

Nigeria: Tinubu Overhauls Fiscal Team Amid Fuel Price Hike and Inflationary Pressures

Global Divergence: Eurozone Inflation Fears vs. China's "Value" Play

Geopolitical Shock: Reports of Iranian Drone Strike on U.S. Embassy in Riyadh

Rate Calc