Quant Pip FX-Some Important Details about This Broker

Abstract:Registered in the United Kingdom, Quant Pip FX is a forex broker providing a series of trading services to retail clients. With the Quant Pip FX platform, five trading accounts are available and the maximum leverage that can be used is up to 1:500.

Since the Quant Pip FXs official website (https://www.quantpipfx.com/) cannot be opened for now, we could only piece together the rough picture of this forex broker by gathering some relevant information from other websites.

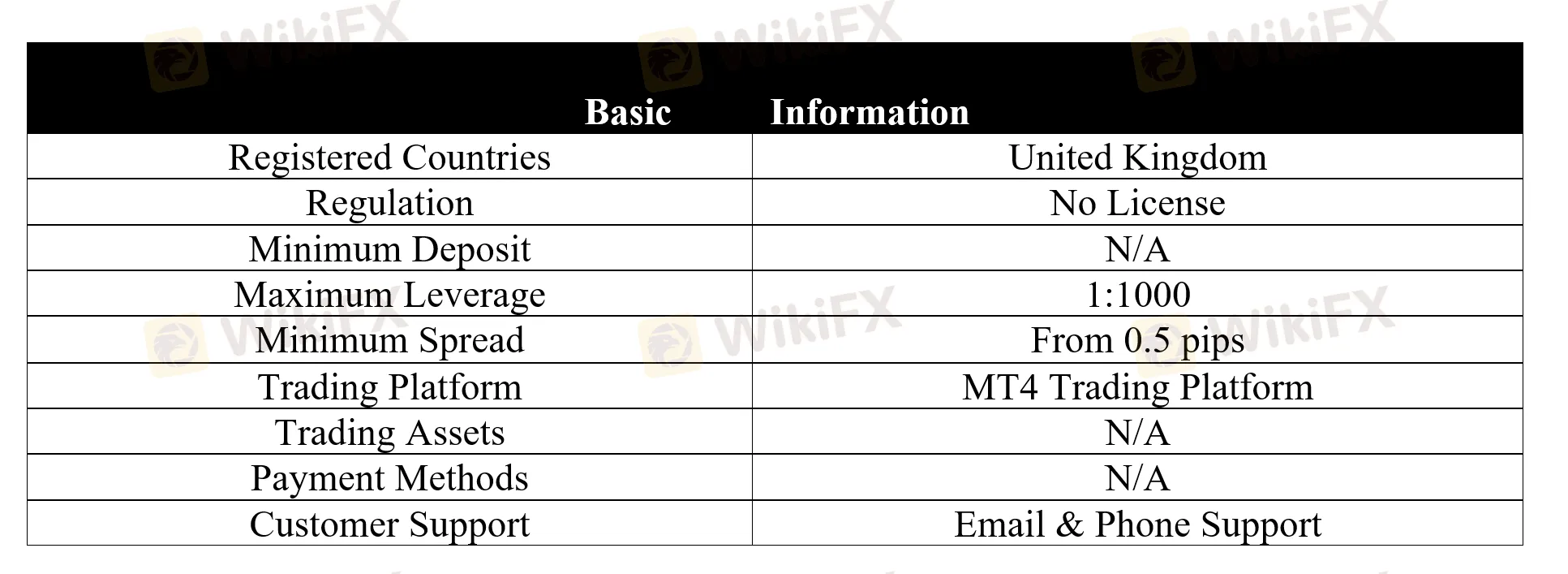

General Information

Registered in the United Kingdom, Quant Pip FX is a forex broker providing a series of trading services to retail clients. With the Quant Pip FX platform, five trading accounts are available and the maximum leverage that can be used is up to 1:500.

Quant Pip FX does not hold any regulatory license to show it operates legally. Please be aware of the risk.

Account Types

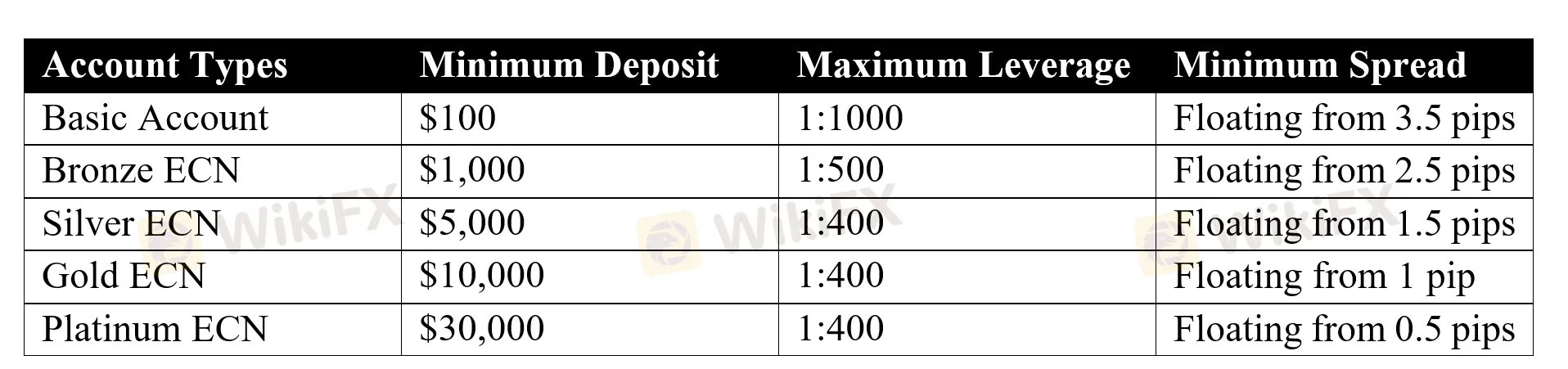

A total of five trading accounts are available, namely Basic, Bronze, Silver, Gold, and Platinum.

To open a Basic account, only $100 is required. While the other four trading accounts requires high deposits, with the Bronze account from $1,000, the Silver ECN account from $5,000, the Gold ECN account from 10,000 and the Platinum ECN account from $30,000.

Leverage

When it comes to leverage, Quant Pip FX allows its clients to use leverage of up to 1:1000, absurdly higher than the levels regarded appropriate by many regulators, with the maximum leverage for major forex up to 1:30 in Europe and Australia, and 1:50 in Canada and U.S.

Since leverage can magnify gains as well as losses, it can also cause serious fund losses, especially to inexperienced traders. Therefore, it is wise for beginners to choose the smaller size no more than 1:10 until they gain more trading experience.

Spreads & Commissions

With no commission charged, spread is determined by trading accounts, with the Basic account from 3.5 pips, the Bronze account from 2.5 pips, the Silver account from 1.5 pips, the Gold account from 1 pip, and the platinum account from 0.5 pips.

Trading Platform

Quant Pip FX provides access to the industry-leading MT4 trading platform, featuring one-click operations for opening and closing trades, setting stops and entry limits, placing direct orders, setting and editing limit and stop loss, as well as charting.

Customer Support

If clients have any trading-related issues, they can try to reach out to Quant Pip FX through the following channels:

Telephone: 020 7946 020

Email: support@quantpipfx.com

Registered Company Address: Unit no 44, headway business center, knowles lane, bradford,BD1 2AF ,United Kingdom.

Risk Warning

Trading leveraged products such as forex, cryptocurrencies and derivatives may not be suitable for all investors as they carry a high degree of risk to your capital. Please ensure that your fully understand the risks involved, taking into account your investments objectives and level of experience.

The information presented in this article is intended solely for reference purposes.

Read more

Unmasking the ‘Datuk’: The Anatomy of a RM638,205 Investment Scam

Authorities in Malaysia have launched an extensive investigation into a fraudulent stock investment scheme, which has resulted in losses amounting to RM638,205.

Unmasking the ‘Datuk’: The Anatomy of a RM638,205 Investment Scam

Authorities in Malaysia have launched an extensive investigation into a fraudulent stock investment scheme, which has resulted in losses amounting to RM638,205.

ATFX Enhances Trading Platform with BlackArrow Integration

ATFX integrates the BlackArrow trading platform, offering advanced tools for forex, crypto, and stocks with automation and real-time analytics for traders.

WikiFX Elites Club —— Fun Spring Camping in Malaysia Successfully Concluded!

From February 20 to 21, WikiFX Elites Club hosted an exclusive “Spring Camping” event in the stunning Cameron Highlands, blending forex trading excitement with the serenity of nature. Members engaged in simulated trading competitions, social networking, and outdoor adventures, fostering deep connections and valuable industry insights.

WikiFX Broker

Latest News

Brazilian Man Charged in $290 Million Crypto Ponzi Scheme Affecting 126,000 Investors

Become a Full-Time FX Trader in 6 Simple Steps

ATFX Enhances Trading Platform with BlackArrow Integration

IG 2025 Most Comprehensive Review

Construction Datuk Director Loses RM26.6 Mil to UVKXE Crypto Scam

SEC Drops Coinbase Lawsuit, Signals Crypto Policy Shift

Should You Choose Rock-West or Avoid it?

Scam Couple behind NECCORPO Arrested by Thai Authorities

Franklin Templeton Submitted S-1 Filing for Spot Solana ETF to the SEC on February 21

Top Profitable Forex Trading Strategies for New Traders

Rate Calc