BrighterFields

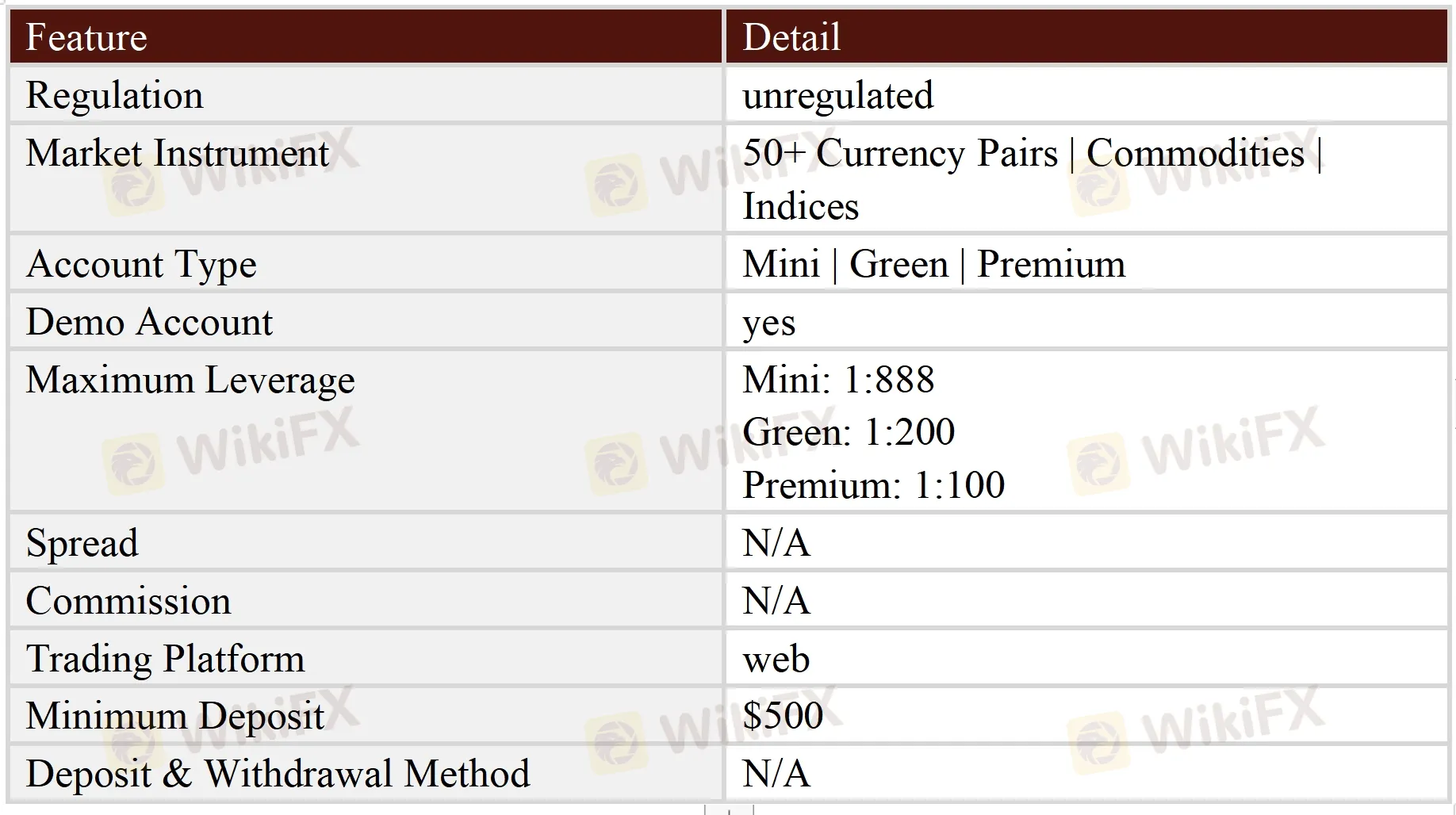

Abstract:BrighterFields presents itself as an internet-based investment firm registered in Singapore that provides trading in the CFD/Forex market. The broker claims to provide its clients with various tradable financial instruments with flexible leverage up to 1:888 on the web-based trading platform, as well as a choice of three different real account types and 24/7 customer support service.

Note: For some unknown reason, we cannot open BrighterFieldss official site (https://www.brighterfieldstrade.com) while writing this introduction, therefore, we could only gather relevant information from the Internet to present a rough picture of this broker. Traders should be careful about this issue.

General Information & Regulation

BrighterFields presents itself as an internet-based investment firm registered in Singapore that provides trading in the CFD/Forex market. The broker claims to provide its clients with various tradable financial instruments with flexible leverage up to 1:888 on the web-based trading platform, as well as a choice of three different real account types and 24/7 customer support service. Here is the home page of this brokers official site:

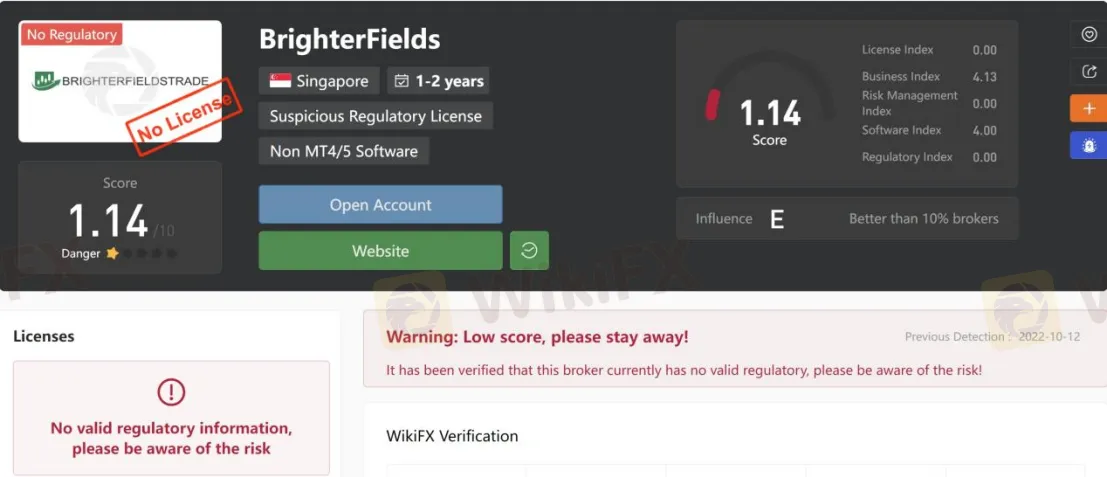

As for regulation, it has been verified that BrighterFields does not fall under any valid regulations. That is why its regulatory status on WikiFX is listed as “No License” and receives a relatively low score of 1.14/10. Please be aware of the risk.

Market Instruments

BrighterFields advertises that it offers access to a wide range of trading instruments in financial markets which include 50+ Currency Pairs, Commodities, and Indices.

Account Types

Apart from demo accounts, BrighterFields claims to offer three types of real trading accounts, namely Mini, Green and Premium. The minimum initial deposit amount is $500 for the Mini account, while the other two account types have much higher minimum initial capital requirements of $5,000 and $10,000 respectively. In comparison, licensed brokers allow setting up a starter account with a minimum deposit of $100 or even less.

Leverage

The specified leverage for different account types at BrighterFields varies between 1:100 and 1:888. Clients on the Mini account can enjoy the maximum leverage of 1:888, while the Green and Premium account members can experience leverage ratios of 1:200 and 1:100 respectively. It is important to keep in mind that the greater the leverage, the greater the risk of losing your deposited capital. The use of leverage can both work in your favour and against you.

Trading Platform Available

The platform available for trading at BrighterFields is web-based. In any case, we recommend using MT4 or MT5 for your trading platform. Forex traders praise MetaTrader's stability and trustworthiness as the most popular forex trading platform. Expert Advisors, Algo trading, Complex indicators, and Strategy testers are some of the sophisticated trading tools available on this platform. There are currently 10,000+ trading apps available on the Metatrader marketplace that traders can use to improve their performance. By using the right mobile terminals, including iOS and Android devices, you can trade from anywhere and at any time through MT4 and MT5.

Deposit & Withdrawal

The minimum initial deposit requirement at BrighterFields is said to be as high as $500. However, the broker says nothing about the acceptable deposit and withdrawal methods.

Customer Support

BrighterFields‘ customer support can be reached by email: support@brighterfieldstrade.com. Company address: 14 Woodlands Square Singapore 737716. However, this broker doesn’t disclose other more direct contact information like telephone numbers that most brokers offer.

Risk Warning

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information contained in this article is for general information purposes only.

Read more

KUBERA MARKETS Payout & Withdrawal Issues — What Traders Are Saying

Did you fail to receive payouts from KUBERA MARKETS despite successfully passing the trading challenge? Failed to log in to the trading account despite passing both the evaluation and funded phase? Were you surprised by the sudden nominal fee norm to receive a funded account? Did you have to go through a long withdrawal process? We have investigated these user claims while preparing this KUBERA MARKETS review article. Keep reading!

BelleoFX Review: Allegations of Controversial Profit Cancellations & Account Closure

Have your past good experiences been marred by recent cases of profit cancellations by BelleoFX, a Mauritius-based forex broker? Has your trading account been blown away by the broker’s official upon your refusal to deposit more? Did the broker’s official tell you to deposit more, even if the earlier attempt turned unsuccessful? Did the high-return promise fall flat on the ground? In this BelleoFX review article, we have investigated these allegations. Take a look!

Is Dbinvesting Real or Fake: A Simple Check to See if This Trading Company Can be Trusted

When a trading company like Dbinvesting shows up and says it's an experienced partner with great deals like high leverage up to 1:1000 and different account types, it gets people's attention. But this appeal gets clouded by more and more serious complaints from users. This creates a big problem for people thinking about investing. The main question that needs a clear answer based on facts is: Is Dbinvesting legit, or is it a clever scam that could cause you to lose a lot of capital? This investigation wants to give you that answer. We will look past the company's marketing claims to study facts we can check. Our study will carefully look at the main worries: Is Dbinvesting watched over by a trustworthy authority? What are the real, honest experiences of people who used it? Are the many reports about withdrawal problems and Dbinvesting scam claims believable? To do this, we will use solid data from third-party checking services, such as WikiFX, including their complete regulatory check

Dbinvesting Complete Review (2026): A Detailed Look at Safety, Costs, and Customer Experiences

An Honest First Look When checking out a forex broker, the main question is always about trust: "Is Dbinvesting a safe place for my investments?" This review answers that question directly. Dbinvesting says it's an experienced broker that offers the popular MT5 platform, different account options, and access to worldwide markets. But as we look closer, we find a very different story. Our research found serious warning signs, especially its weak overseas regulation and a very low trust score from independent reviewers. This review gives you a short summary of what we found, comparing what the broker promises with the serious problems shown by real data and lots of user feedback. We want to give you a clear, fact-based answer to help you understand the major risks before investing. The difference between what it promises and what users actually report is the main focus of our investigation.

WikiFX Broker

Latest News

Arena Capitals User Reputation: Looking at Real User Reviews and Common Problems

Stop Letting Your Trading Rewards Gather Dust: A Limited-Time 30% Opportunity

Is FINOWIZ Safe or Scam? 2026 Deep Dive into Its Reputation and User Complaints

What Will US-Iran War Affect Stock Market: A Comprehensive Investor's Guide to 2026

FX Deep Dive: Dollar King Returns as Energy Shock Splits G10 Currencies

The 25-Day Tipping Point: Energy Markets Stare Down a Hormuz Blockade

Middle East Escalation Rocks Markets: Oil Surges while Brokers Tighten Leverage

Eightcap Review: Understanding Fees, Features, and Important User Warnings

Exnova Review 2026: Is this Forex Broker Legit or a Scam?

Moneycorp Problems Exposed: Fund Transfer Failures & Customer Support Complaints

Rate Calc