Capital Trade

Abstract:Capital Trade is an unregulated brokerage company registered in the United States. hundreds of markets access to forex, indices, stocks, commodities, cryptocurrencies, and crude oil. While the broker's official website has been closed, so traders cannot obtain more security information.

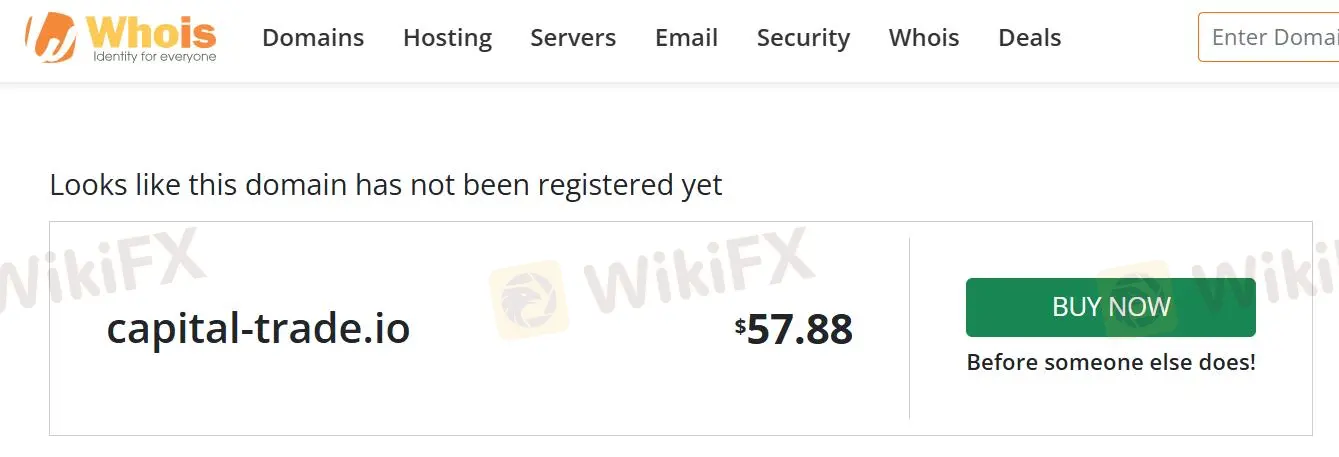

Note: Capital Trade's official website: https://capital-trade.io/ is normally inaccessible.

Capital Trade Information

Capital Trade is an unregulated brokerage company registered in the United States. hundreds of markets access to forex, indices, stocks, commodities, cryptocurrencies, and crude oil. While the broker's official website has been closed, so traders cannot obtain more security information.

Is Capital Trade Legit?

Capital Trade is not regulated, which will increase trading non-compliance and reduce traders investment security. Caution is advised when dealing with the company.

After a Whois query, we found that this company's domain name is for sale, showing that Capital Trade has not registered it securely.

Downsides of Capital Trade

- Unavailable Website

Capital Trade's website is inaccessible, raising concerns about its reliability and accessibility.

- Lack of Transparency

Since Capital Trade does not explain more transaction information, especially regarding fees and services, this will bring huge risks and reduce transaction security.

- Regulatory Concerns

Capital Trade is not regulated, which is less safe than a regulated one.

Conclusion

Capital Trade Since the official website cannot be opened, traders cannot get more information about security services. In addition, the unregulated status and unregistered domain name indicate the broker's trading risks are high. Traders can learn more about other brokers through WikiFX. Information improves transaction security.

Read more

Understanding the New York Forex Trading Session Time in the Philippines

The forex market operates 24 hours a day, 5 days a week, with different trading sessions that overlap and offer various trading opportunities. One of the most active trading sessions is the New York session, which plays a crucial role in the global forex market. If you're in the Philippines, understanding when the New York session overlaps with local time is essential for maximizing your trading potential.

Malaysia’s Former PM’s Social Media Hacked to Promote Crypto Scam

A recent cryptocurrency scam has highlighted a growing and concerning trend—hackers hijacking the social media accounts of political figures to promote fraudulent digital assets. The latest incident involved Malaysia’s former Prime Minister, Mahathir Mohamad, whose X (formerly Twitter) account was compromised to market a fake meme coin called "Malaysia."

Lirunex Joins Financial Commission, Boosts Trader Protection

Lirunex joins the Financial Commission, offering traders €20,000 protection per claim. A multi-asset broker regulated by CySEC, LFSA, and MED.

Capital.com Review 2025: Trading Account & Withdrawal to Explore

Despite its relative youth, the Cyprus-registered online broker Capital.com has garnered respectable attention from a large number of retail and professional investors since its 2016 launch. Capital.com is a frontrunner among low-cost trading products; it allows individual and institutional investors to trade contracts for difference (CFDs) on three thousand markets, including Forex, Stocks, Commodities, Indices, Cryptocurrencies, and more. Impressively, Capital.com is on board with ESG investments as well. You can begin trading CFDs on the Capital.com platform with as little as $20. You can trade CFDs on this platform without paying any commissions; the only fees involved are the spreads. This broker offers a wide range of platforms, including mobile apps, a desktop trading app, an API from Capital.com, Tradingview, and MetaTrader 4. Among Capital.com's many distinguishing features is the wealth of educational content and high-quality research it offers its users. The platform's Marke

WikiFX Broker

Latest News

IMF Warns Japan of Spillover Risks from Global Market Volatility

Beware of Comments from the Fed's Number Two Official

BaFin Unveils Report: The 6 Biggest Risks You Need to Know

Nomura Holdings Ex-Employee Arrested in Fraud Scandal

RBI: India\s central bank slashes rates after five years

Judge halts Trump\s government worker buyout plan: US media

Spotting Red Flags: The Ultimate Guide to Dodging WhatsApp & Telegram Stock Scams

WikiFX Review: Why so many complaints against QUOTEX?

Trans X Markets: Licensed Broker or a Scam?

Pepperstone Partners with Aston Martin Aramco F1 Team for 2025

Rate Calc