TRADE MARKET

Abstract:TRADE MARKET 247, a trading name of trademarket247 LTD, is allegedly a forex and CFD broker registered in the United Kingdom that claims to provide its clients with various tradable financial instruments via four different live account types.

Note: TRADE MARKET 247 is to operate via the website - https://www.trademarket247.com/, which is currently not yet functional and no information about the company was immediately available. Therefore, we could only gather relevant information from the Internet to present a rough picture of this broker.

Risk Warning

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information contained in this article is for general information purposes only.

General Information & Regulation

| Feature | Detail |

| Regulation | No Regulation |

| Market Instrument | Forex, CFDs on cryptocurrencies and other assets |

| Account Type | Starter, Premium, DElux and VIP |

| Demo Account | N/A |

| Maximum Leverage | N/A |

| Spread | N/A |

| Commission | N/A |

| Trading Platform | no |

| Minimum Deposit | $200 |

| Deposit & Withdrawal Method | Bitcoin |

TRADE MARKET 247, a trading name of trademarket247 LTD, is allegedly a forex and CFD broker registered in the United Kingdom that claims to provide its clients with various tradable financial instruments via four different live account types.

As this brokerage's website cannot be accessed, we were unable to obtain further details about its leverage, spreads, etc.

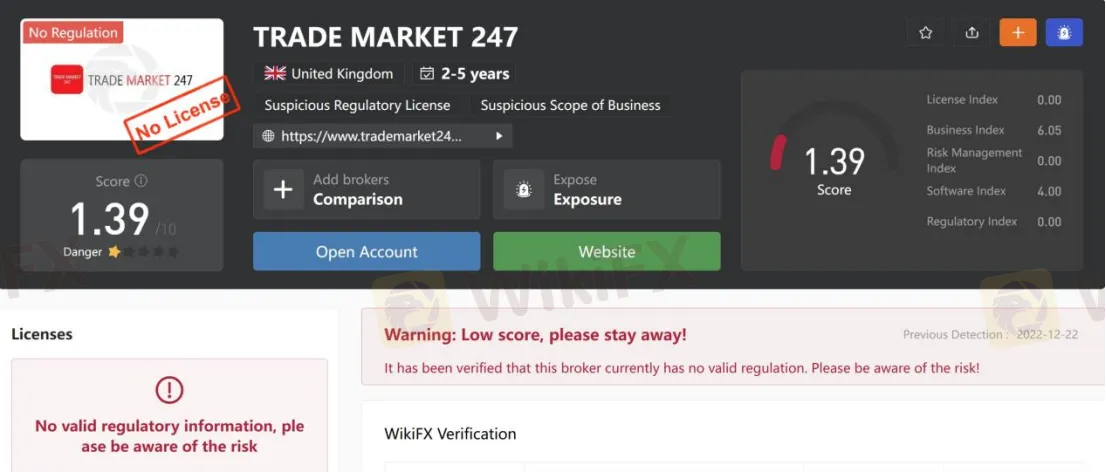

As for regulation, it has been verified that TRADE MARKET 247 currently has no valid regulation. That is why its regulatory status on WikiFX is listed as “No License” and receives a relatively low score of 1.39/10. Please be aware of the risk.

Market Instruments

TRADE MARKET 247 advertises that it offers access to a wide range of trading instruments in financial markets, including forex and CFDs on cryptocurrencies and other assets.

Account Types

TRADE MARKET 247 claims to offer four types of trading accounts, namely Starter, Premium, DElux and VIP, with minimum initial deposit requirements of $200, $500, $1,000 and $2,000 respectively. In comparison, licensed brokers allow setting up a starter account with a minimum deposit of $100 or even less.

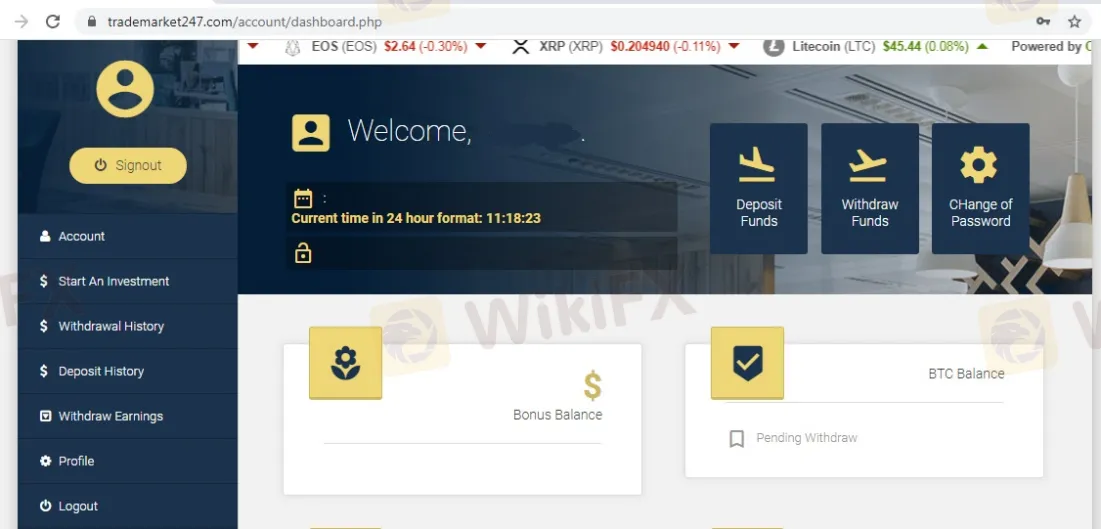

Trading Platform Available

Factually, there is no trading platform available at TRADE MARKET 247. Anyway, you had better choose brokers who offer the leading MT4 and MT5, which are highly praised by traders and brokers alike due to their ease of use and great functionality, offering top-notch charting and flexible customization options. They are especially popular for their automated trading bots, a.k.a. Expert Advisors.

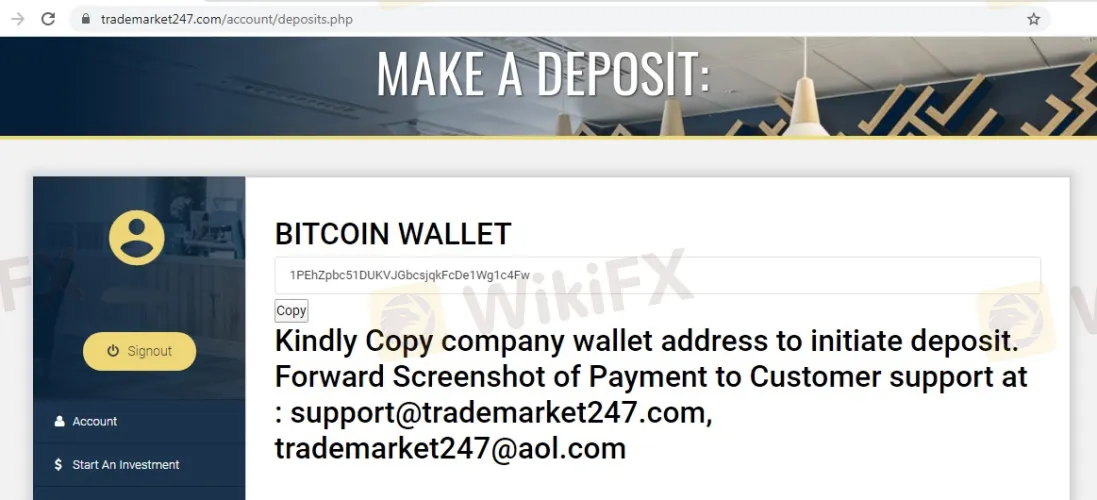

Deposit & Withdrawal

TRADE MARKET 247 accepts payments solely with Bitcoin. The minimum initial deposit requirement is said to be $200.

Customer Support

TRADE MARKET 247s customer support can be reached by telephone: +1 530 431 8039, email: SUPPORT@TRADEMARKET247.COM. Company address: 4th Floor The Harbour Centre, 42 N Church St, George Town, Cayman Islands.

Pros & Cons

| Pros | Cons |

| • Multiple tradable assets and account types offered | • No regulation |

| • Website inaccessible | |

| • No trading platform | |

| • High minimum deposit ($200) | |

| • Only Bitcoin payments supported |

Frequently Asked Questions (FAQs)

| Q 1: | Is TRADE MARKET 247 regulated? |

| A 1: | No. It has been verified that TRADE MARKET 247 currently has no valid regulation. |

| Q 2: | Does TRADE MARKET 247 offer the industry-standard MT4 & MT5? |

| A 2: | No. There is no trading platform available at TRADE MARKET 247. |

| Q 3: | What is the minimum deposit for TRADE MARKET 247? |

| A 3: | The minimum initial deposit at TRADE MARKET 247 to open the most basic account is $200. |

| Q 4: | Is TRADE MARKET 247 a good broker for beginners? |

| A 4: | No. TRADE MARKET 247 is not a good choice for beginners. Not only because of its unregulated condition, but also because of its inaccessible website. |

Read more

Zenstox Review: Do Traders Face Withdrawal Blocks & Fund Scams?

Does Zenstox give you good trading experience initially and later scam you with seemingly illicit contracts? Were you asked to pay an illegitimate clearance fee to access fund withdrawals? Drowned financially with a plethora of open trades and manipulated execution? Did you have to open trades when requesting Zenstox fund withdrawals? You have allegedly been scammed, like many other traders by the Seychelles-based forex broker. In this Zenstox review article, we have investigated multiple complaints against the broker. Have a look!

Smart Trader Exposure: Login Glitches, Withdrawal Delays & Scam Allegations

Did your Smart Trader forex trading account grow substantially from your initial deposit? But did the forex broker not respond to your withdrawal request? Failed to open the Smart Trader MT4 trading platform due to constant login issues? Does the list of Smart Trader Tools not include the vital ones that help determine whether the reward is worth the risk involved? Have you witnessed illegitimate fee deduction by the broker? These issues have become too common for traders, with many of them criticizing the broker online. In this article, we have highlighted different complaints against the forex broker. Take a look!

Investing24.com Review – Can Traders Trust the App Data for Trading?

Does trading on Investing24.com data cause you losses? Do you frequently encounter interface-related issues on the Investing24.com app? Did you witness an annual subscription charge at one point and see it non-existent upon checking your forex trading account? Did the app mislead you by charging fees for strong buy ratings and causing you losses? You are not alone! Traders frequently oppose Investing24.com for these and more issues. In this Investing24.com review article, we have examined many such complaints against the forex broker. Have a look!

Zenstox Review: Is This Offshore Forex Broker Safe?

Is Zenstox safe or a scam? Learn about its 2.24/10 WikiFX rating, offshore regulation, bonus tactics, and trader reports of blocked or delayed withdrawals.

WikiFX Broker

Latest News

Labuan Forex Scam Costs Investors RM104 Million | Authorities Pressed to Act

ThinkMarkets Review 2025: Safety, Features, and Reliability

LMS Forex Broker Review (2026): Is LMS Legit or a Scam?

RockwellHalal User Reputation: Looking at Real User Feedback and Common Complaints to Check Trust

FXNovus Review: Traders Report Fund Scams & Illegitimate Tax Payment Demands on Withdrawals

Profit Wipeout: Why AccuIndex Traders Are losing Their Hard-Earned Money

Inside the Elite Committee: Talk with LadyChiun

US Imposes 25% Tariff on AI Chips, Elevating Tech Trade Tensions

Is DRW Legit or a Scam? 5 Key Questions Answered (2026)

Are You Trading Against the Central Banks? Know Your Competition

Rate Calc