GBP vs GDP: UK Q3 growth revised lower - how long can sterling rally last?

Abstract:The gap between financial markets’ expectations for future inflation and interest rates and the OBR vary a lot. What does the pound make of the UK outlook?

The gap between financial markets expectations for future inflation and interest rates and the OBR vary a lot. What does the pound make of the UK outlook?

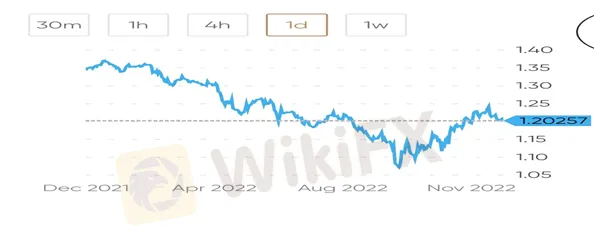

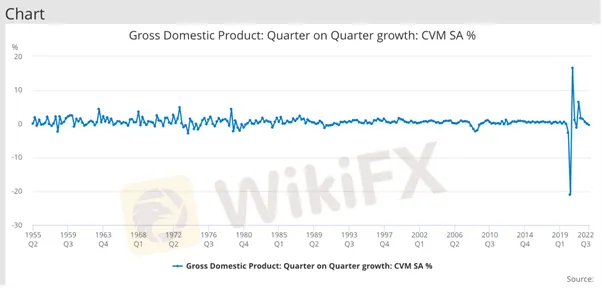

The sheens off UK GDP again: output slipped 0.3% over the second and third quarter, not 0.2% as originally thought, helping knock GBP/USD to 1.2091 mid-morning from 1.2141.

The dismaying Office of National Statistics stats are even more unflattering when pinned against pre-Covid numbers. For example, UK GDP for Q3 is 0.8% below that of the last 2019 quarter. A previous estimate suggested 0.4% – some tumble.

Poundland: recession is coming but sterling is looking resilient – for now

Poorer living standards are central to GDP numbers and the UK electorate is definitely looking stretched: real disposable income slumped 0.5% between the second and third quarters as wages trailed cost of living pressures.

Living standards prepare to plunge again

While that figure might look modest the Office for Budget Responsibility reckons surging prices will see UK living standards, overall, see the biggest hit for six decades, down 7% for the two financial years 2023-2024. Check out the OBR numbers. Tellingly this is more than enough to wipe out the previous eight years growth despite over £100 billion of additional government support, admits the OBR.

Does this mean full-on recession misery, not a milder less infectious variant? Quite possibly. Capital Economics is bearish on UK assets and warns sterlings recent rally looks date and time-stamped.

Running on reserve

While a weaker pound “may provide some support for UK equity prices, we doubt that will be enough to offset a decline in investors appetite for risk in the near-term”, says the UK economics team at Capital Economics.

The market watchers think the FTSE 100 could fall from around 7,400 currently “to a trough of around 6,800 by the middle of 2023, before rebounding as the markets see the end of the global recession approaching”.

FX strategist and finance consultant at Keirstone, Francis Fabrizi

Fabrizi

• GBP/USD has been bearish since failing to push beyond 1.2500 last week says Fabrizi. “Price is now attempting to break below the 1.2050 support level.”

• “If we see a break and hold below this level, 1.2000 will be the next target. However, we could see price rebound from 1.2050 which could push it back towards 1.2200.”

• “Looking at the weekly timeframe, I believe it is possible price will continue to gain bearish momentum and fall lower towards 1.1900 in the coming days. In my opinion, price has confirmed it will remain bearish as it remains below1.2500.”

UK recession claims are hardly news; the direction of travel has been clear for some time. What todays GDP update does is supply more texture, such as business investment, which slumped even more than thought, now a huge 8.1% below pre-Covid levels.

“Investment,” says Danni Hewson of AJ Bell, “is the fuel that helps stoke the embers of a cooling economy and with the UK now at the bottom of the table of G7 countries when it comes to growth, its clear more needs to be done.”

2023-2024 – rate cuts deeper, faster?

• While the Bank of England may hike rates from 3.50% to a peak of 4.50% – very possibly – the recent gilt yield rise looks less sustainable.

• “We think gilt yields,” says Capital Economics, “may fall from 3.60% currently to 2.75% by the end of 2023 as a weaker economy and falling inflation will likely push the Bank to cut interest rates further and faster than investors expect in 2024.” [12 months ago UK 10-year gilts were paying around 0.70%.]

• They also think sterlings recent rally is set to reverse “as the global recession will probably strengthen the US dollar and weaken the pound.”

Mid-morning DXY was 0.05% lower at 103.83 while EUR/USD was 0.16% up at 1.0630; GBP/USD was 0.33% down at 1.2050 while USD/JPY was 0.24% lower at 132.11.

Read more

What Determines Currency Prices?

The price of currency directly impacts investor returns. Understanding the underlying causes of currency fluctuations can help investors make more informed decisions in the foreign exchange market.

AvaTrade Launches Advanced Automated Trading Tools AvaSocial and DupliTrade

AvaTrade launches enhanced automated trading solutions, featuring AvaSocial and DupliTrade for seamless, emotion-free trading. Explore cutting-edge tools today!

T4Trade Enhances Forex Trading with Advanced Tools for 2025

T4Trade empowers traders with advanced tools like trading calculators, Trading Central features, and an economic calendar for 2025.

NAGA Launches CryptoX: Zero Fees, 24/7 Crypto Trading

NAGA introduces CryptoX, a new crypto trading feature with zero overnight fees, 24/7 access, and copy trading. Trade Bitcoin, Ethereum & more!

WikiFX Broker

Latest News

Fake ‘cyber fraud online complaint’ website Exposed!

Day Trading Guide: Key Considerations

NAGA Launches CryptoX: Zero Fees, 24/7 Crypto Trading

Scam Alert: 7 Brokers You Need to Avoid

AvaTrade Launches Advanced Automated Trading Tools AvaSocial and DupliTrade

What Determines Currency Prices?

Why More Traders Are Turning to Proprietary Firms for Success

MC Markets Review 2025

How to Use an Economic Calendar in Forex Trading

T4Trade Enhances Forex Trading with Advanced Tools for 2025

Rate Calc