PrimeMarketCap

Abstract:PrimeMarketCap is allegedly a multi-asset broker incorporated in 2022 and registered in Saint Vincent and the Grenadines that claims to provide its clients with various tradable financial instruments with flexible leverage up to 1:500 and floating spreads on WebTrader, APP for Mobile and Desktop trading platforms via five different live account types, as well as 24/7 customer support service.

Risk Warning

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information contained in this article is for general information purposes only.

General Information & Regulation

| Feature | Detail |

| Regulation | No regulation |

| Market Instrument | Currency Pairs, Indices, Metals, Energies, Futures, and Shares |

| Account Type | Classic, Silver, Gold, Platinum and Premium |

| Demo Account | N/A |

| Maximum Leverage | 1:500 |

| Spread (EUR/USD) | 22 pips |

| Commission | 0 |

| Trading Platform | WebTrader, APP for Mobile and Desktop |

| Minimum Deposit | no |

| Deposit & Withdrawal Method | credit/debit cards (Visa / MasterCard / Maestro), Bank transfers |

PrimeMarketCap is allegedly a multi-asset broker incorporated in 2022 and registered in Saint Vincent and the Grenadines that claims to provide its clients with various tradable financial instruments with flexible leverage up to 1:500 and floating spreads on WebTrader, APP for Mobile and Desktop trading platforms via five different live account types, as well as 24/7 customer support service. Here is the home page of this brokers official site:

As for regulation, it has been verified that PrimeMarketCap currently has no valid regulation. That is why its regulatory status on WikiFX is listed as “No License” and receives a relatively low score of 1.15/10. Please be aware of the risk.

Note: The screenshot date is January 11, 2023. WikiFX gives dynamic scores, which will update in real time based on the broker's dynamics. So the scores taken at the current time do not represent past and future scores.

Market Instruments

PrimeMarketCap advertises that it offers access to a wide range of trading instruments in financial markets, including Currency Pairs, Indices, Metals, Energies, Futures, and Shares.

Account Types

PrimeMarketCap claims to offer five types of real trading accounts, namely Classic, Silver, Gold, Platinum and Premium, with no minimum deposit requirement.

Leverage

Leverage is adjusted based on the account type and certain assets. Just take forex as an example, clients on the Classic and Silver accounts can experience leverage of 1:100, while the Gold, Platinum and Premium accounts can enjoy a higher leverage of 1:200, 1:400 and 1:500 separately. It is important to keep in mind that the greater the leverage, the greater the risk of losing your deposited capital. The use of leverage can both work in your favour and against you.

Spreads & Commissions

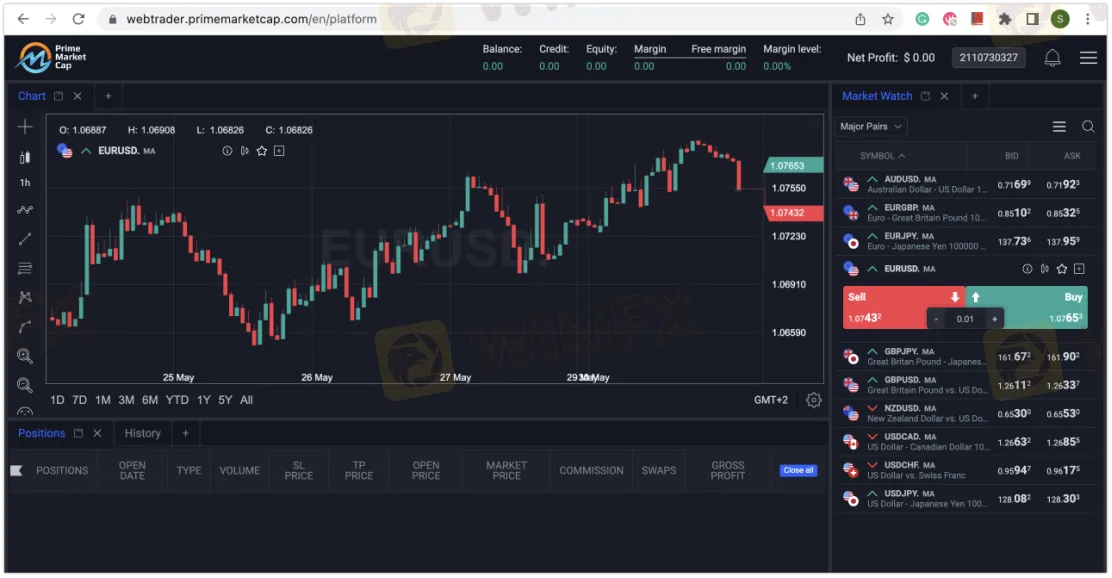

All spreads with PrimeMarketCap are a floating type and scaled with the accounts offered. Spreads on the Gold account can be reduced by 20%, while the Platinum and Premium account holders can enjoy a reduction of 30% and 50% respectively. However, as we see on their platform, the EUR/USD spread is 22 pips on average. By contrast, the industry average spread is just 1.5 pips. As for the commission, there is no commission charged.

Trading Platform Available

Instead of the world's most advanced and popularly-used MT4 and MT5 platforms, PrimeMarketCap gives traders WebTrader, APP for Mobile and Desktop. Anyway, you had better choose brokers who offer the leading MT4 and MT5, which are highly praised by traders and brokers alike due to their ease of use and great functionality, offering top-notch charting and flexible customization options. They are especially popular for their automated trading bots, a.k.a. Expert Advisors.

Deposit & Withdrawal

PrimeMarketCap says to support credit/debit cards (Visa / MasterCard / Maestro), and Bank transfers. The broker charges no deposit or withdrawal fees.

Bonuses

PrimeMarketCap claims to offer some bonuses for different account types. For example, 10% for the Silver account, 30% for the Gold account, 50% for the Platinum account, and 100% for the Premium account. However, for a $200 bonus, clients should trade 50 lots (5 million USD in turnover) to become eligible for withdrawals.

Customer Support

PrimeMarketCaps customer support can be reached by email: support@primemarketcap.com, live chat or send messages online to get in touch. Company address: First Floor, First St. Vincent Bank Ltd Building, James Street, Kingstown, VC0100, St. Vincent and the Grenadines.

Pros & Cons

| Pros | Cons |

| • Multiple trading assets and account types | • No regulation |

| • No minimum deposit | • Uncompetitive spreads |

Frequently Asked Questions (FAQs)

| Q 1: | Is PrimeMarketCap regulated? |

| A 1: | No. It has been verified that PrimeMarketCap currently has no valid regulation. |

| Q 2: | At PrimeMarketCap, are there any regional restrictions for traders? |

| A 2: | Yes. PrimeMarketCap doesnt accept clients from the USA, Israel, Japan and Russian Federation. |

| Q 3: | Does PrimeMarketCap offer the industry-standard MT4 & MT5? |

| A 3: | No. Instead, PrimeMarketCap offers WebTrader, APP for Mobile and Desktop. |

| Q 4: | What is the minimum deposit for PrimeMarketCap? |

| A 4: | There is no minimum deposit requirement. |

| Q 5: | Is PrimeMarketCap a good broker for beginners? |

| A 5: | No. PrimeMarketCap is not a good choice for beginners. Not only because of its unregulated condition, but also because of its uncompetitive trading costs. |

Read more

Advanced Markets Exposed: Faulty Copy Trading & Execution Failures Cost Traders Dearly

Attracted to Advanced Markets for the expert-led copy trading experience? Did you earn profits from the copy trade executed by the expert hired by the forex broker? But did the broker question some trades even though you paid the performance fee to the expert? Is the trade order execution time too slow at Advanced Markets? Do you witness high slippage issues? You are not alone! Many traders have shared these concerns online. In this Advanced Markets review article, we have described some complaints. Take a look!

Is WisunoFX Safe? An Unbiased 2025 Assessment of Platform Risks and Red Flags

Is WisunoFX a safe broker for your money? The answer is not simple. After looking at everything carefully, the platform gets a score of 7.21 out of 10. This means it has both good points and serious risks. For traders who want to research before investing, WisunoFX has two sides: it offers good trading conditions, but it also has some structural and regulatory issues that need careful thought. The broker has been operating for 5-10 years and has built up a presence in the market. However, it's officially labeled as a "Medium potential risk" platform, which cannot be ignored. Before investing, it's important to compare its good points with its bad ones.

A Simple Guide to WisunoFX Rules: Understanding Safety and Risks When Trading

When evaluating any trading company, it is essential to conduct a thorough WisunoFX regulation check first. This broker operates under two distinct sets of rules, which you must understand carefully. First, it has a license from the Cyprus Securities and Exchange Commission (CySEC), which is a trusted European regulator. Second, it has another license from the Financial Services Authority (FSA) in Seychelles, which is located offshore. These two licenses don't give traders the same level of protection. The CySEC license means the broker must follow strict European Union financial rules, while the FSA license has much less supervision. This guide will explain what each license means to traders, look at the company structure behind the brand, and examine the safety factors every potential client should think about.

Is TradeEU Global Safe? Reports of Extra Deposit Requests, High Spreads & Trader Losses

Does TradeEU Global demand an extra deposit every time you raise fund withdrawal requests? Does the constant deposit and trading pressure make you bear capital losses? Are the high spreads lowering your trading gains? Many traders have criticized the Mauritius-based forex broker for allegedly carrying out these fraudulent trading activities. In this TradeEU review article, we have disclosed some complaints. Take a look.

WikiFX Broker

Latest News

Is Deriv Safe? A Deep Dive into Regulatory Claims vs. Withdrawal Nightmares

WisunoFX Review 2025: A Complete Look at Costs, Trading Platforms, and Safety

9X Markets Review: Is It Reliable?

IQ Option Review: Real User Experiences

Bessent to propose major overhaul of regulatory body created from financial crisis

Coinlocally Broker Review: Coinlocally Regulation & Real User Complaints Exposed

A Simple Guide to WisunoFX Rules: Understanding Safety and Risks When Trading

The "VIP" Trap: Inside the Algo-Trading Nightmare at Zenstox

Advanced Markets Exposed: Faulty Copy Trading & Execution Failures Cost Traders Dearly

The case for more Fed rate cuts could rest on a 'systematic overcount' of jobs numbers

Rate Calc