Caution: Clients Report Withdrawal Issues in Fair Forex

Abstract:Forex remains a very popular form of investment, but it can be hard to spot the tricks online. Even legitimate forex trading platforms can be risky to traders.

Here we found Fair Forex receives a collective complaints from its clients though they are not aggressive when marketing their expertise or service to prospective investors.

Fair Forex - Overview

Fair Forex (https://fairforex.com/) has been in the business for a few years. RoboForex provides trading instruments across 5 assets classes including forex, commodities, indices, stocks and cryptocurrencies, via 4 different account types.

The platform was operated by Fair Forex (V) Ltd, which is regulated by the Vanuatu Financial Services Commission(VFSC) under company number 700478. The company claims to be one of the most reputable forex broker in the industry.

However, the broker is criticized for its withdrawal issues, and extra trading fees.

Clients Feedback

Fair Forex follows unethical practices and makes people suffer losses.

Some victims of Fair Forex have consistently reported the broker's malpractices on various channels.

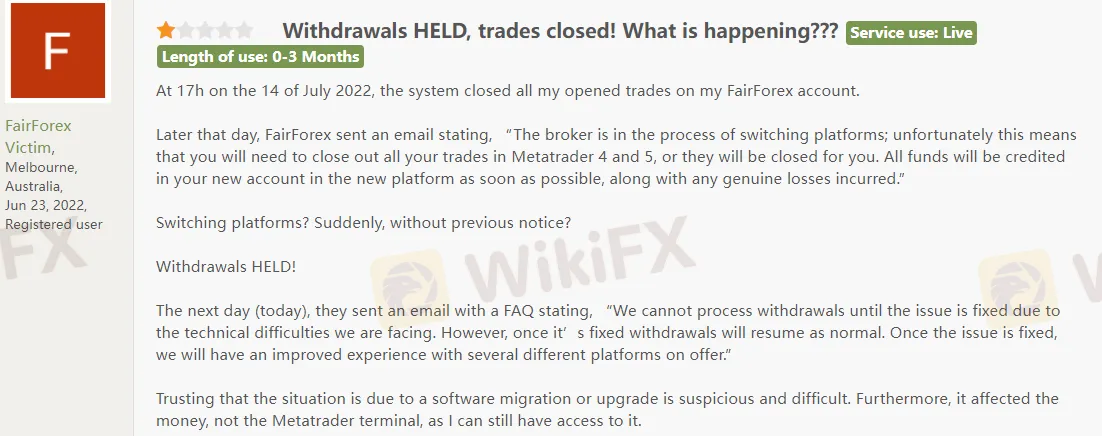

An investor has been traded with Fair Forex for 3 months. He said the system closed all his opened trades on Fair Forex account and has held his withdrawals at 17h on the 14 of July 2022.

Back to last year, we see some clients revealed that they cannot withdraw their money, such as their Fair Forex accounts did not show their deposit or they will be told to pay a 20% fee when trying to withdrawal money.

The above images show that the company's objective is not to facilitate traders but to take money out of their pockets.

No broker can always keep up to 100% client satisfaction. Although customer feedback can tell quite a lot about an entity's affairs, it still partly reflects a broker's reputation.

Always be careful when dealing with self-claimed reputable brokers, especially revolves in money issues. To see more regulated broker with good reviews, you can check on WikiFX.

Read more

FXORO Review: Investigating Withdrawal Denial and Fund Scam Allegations

FXORO, a Seychelles-based forex broker, has been receiving quite a few negative reviews from traders. Looking at the overall complaints, traders are not happy with the way the broker handles withdrawal issues. Even more concerning is the loss due to its alleged advice of not using risk management tools. Some traders even alleged to have been taken advantage of by the broker’s officials. In this FXORO review article, we have collected a list of complaints against the broker. Keep reading to know about them.

EPFX Exposure: Examining Complaints Concerning Withdrawal Denials & Account Blocks

Lured into trading on the EPFX platform with an attractive bonus that did not come to your account? Was your profile disabled by the broker upon raising a technical query concerning a profit withdrawal request? Did the South Africa-based forex broker deny you access to withdraw your hard-earned capital from the platform? Have you faced account closure by the EPFX broker without any reason? These alleged scams have become the centre of discussion on broker review platforms. We have shared these complaints in this EPFX review article. Keep reading!

Arena Capitals Complete Review: Finding High Risks and Major Warning Signs

Is Arena Capitals a safe and trustworthy broker? The evidence gives us a clear answer: no. Our research into Arena Capitals shows a high-risk business that doesn't have the basic protections needed to keep investor capital safe. The main reason for this conclusion is that no respected financial authority regulates them at all. This main problem gets worse when you add extremely low trust scores on checking websites, official warnings telling traders to stay away, and a troubling pattern of user complaints, especially about not being able to withdraw funds. Based on our study of public information, we strongly recommend against opening an account or investing in Arena Capitals. This Arena Capitals review will explain the evidence behind this warning, helping you make a smart and safe choice.

Monaxa Scam Exposed: Withdrawal Delays and Fraud

Monaxa scam exposed: denied payouts, downtime, profit manipulation, weak offshore license. Protect your money—read full broker review now!

WikiFX Broker

Latest News

CONSOB Blocks Five More Unauthorised Investment Websites as Online Scam Tactics Evolve

Retail Trading Momentum Extends into 2026, Reshaping FX and CFD Activity

FX SmartBull Regulation: Understanding Their Licenses and Company Information

Stock Trading Guru Scams Contractor Out of RM1.2 Million with ‘Guaranteed Profits’

Neptune Securities Exposure: Real Forex Scam Warnings

Admiral Markets Review: Regulation, Licences and WikiScore Analysis

1,789 Victims, Nearly $300 Million Lost: Gold High-Return Scam Exposed

UPFOREX Regulatory Status: A 2026 Deep Dive into Its Licenses and Risks

HKEX Profit Surge Signals Massive Chinese Capital Inflow and Asian Market Resilience

The micro-documentary "Let Trust Be Seen" is officially launched today!

Rate Calc