MHMarkets :MHM European Market

Abstract:On Friday (April 28) in the Asian session, spot gold fluctuated slightly and is currently trading around $1983.95 per ounce. Overnight, PCE data for the first quarter of the United States showed that inflation in the United States remains high, raising expectations for another rate hike by the Federal Reserve in June after the May rate hike. The expected rate cut for the year cooled down, and overnight US bond yields surged. A rising dollar index weighed on gold prices on Friday, while a rally i

April 27, 2023-MHM European Perspective

Market Overview

On Friday (April 28) in the Asian session, spot gold fluctuated slightly and is currently trading around $1983.95 per ounce. Overnight, PCE data for the first quarter of the United States showed that inflation in the United States remains high, raising expectations for another rate hike by the Federal Reserve in June after the May rate hike. The expected rate cut for the year cooled down, and overnight US bond yields surged. A rising dollar index weighed on gold prices on Friday, while a rally in U.S. stocks on strong U.S. technology earnings also weighed on safe-haven demand for gold. After repeatedly hitting the 2000 mark and losing, the short-term downside risk has increased.

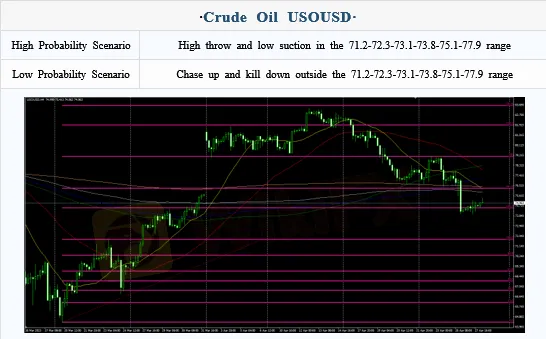

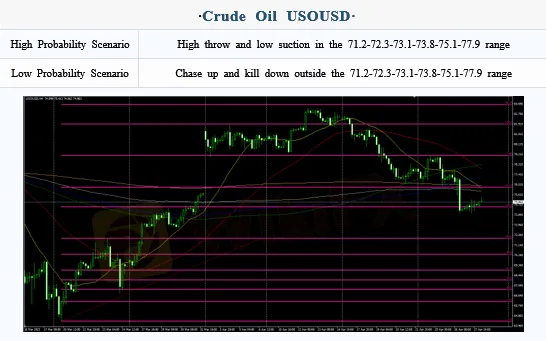

US crude oil rebounded slightly and is currently trading near $75.08 per barrel. Bright US technology company financial reports overshadowed economic concerns, and the US stock market surged overnight. Asian stock markets also generally followed suit on Friday, providing support for oil prices. However, the expected rate cut by the Federal Reserve for the year has cooled, and the rebound in the US dollar index has also raised concerns among oil bulls, with short-term oil prices leaning towards volatile operations.

From the technical perspective, after falling behind the support of the 100 day moving average and 55 day moving average, oil prices tend to fluctuate downward in the future.

However, concerns about the US banking crisis remain, and negotiations on the debt ceiling are deadlocked, which may limit the downward space for gold prices.

On this trading day, we need to pay attention to the performance of core PCE data in the United States for March and changes in US crude oil drilling data. In addition, we need to pay attention to the first quarter GDP data of Germany, France, and the Eurozone, as well as Germany's April employment and CPI data.

The MHMarkets strategy is for reference only and is not intended as investment advice. Please carefully read the statement terms at the end of the text. The following strategy update was made on April 28, 2023 at 15:00 Beijing time.

Intraday Oscillation Range: 1951-1978-1985-1998-2007-2016-2033

Overall Oscillation Range: 1730-1756-1780-1801-1817-1833-1856-1873-1889-1903-1911-1929-1937-1951-1978-1985-1998-2007-2016-2033-2046-2057-2066-2077-2089-2097-2100

In the subsequent period of spot gold, 1951-1978-1985-1998-2007-2016-2033 can be operated as the bull and bear range; High throw low suction in the range, chase up and kill down outside the range!

Note: The above strategy was updated at 15:00 on April 28. This policy is a daytime policy. Please pay attention to the policy release time.

Intraday Oscillation Range: 23.9-24.5-25.3-26.1

Overall Oscillation Range: 19.7-20.1-20.6-21.5-22.3-23.1-23.9-24.5-25.3-26.1-26.6-27.3

In the subsequent period of spot silver, 23.9-24.5-25.3-26.1 can be operated as the bull and bear range. High throw and low suction in the range, chase up and kill down outside the range!

Note: The above strategy was updated at 15:00 on April 28. This policy is a daytime policy. Please pay attention to the policy release time.

Intraday Oscillation Range: 71.2-72.3-73.1-73.8-75.1-77.9

Overall Oscillation Range: 62.1-63.7-64.5-65.8-66.9-67.3-68.9-70.1-71.2-72.3-73.1-73.8-75.1-77.9-78.5-79.9-80.7-82.3-83.5-85.3-87.3-89.1

In the subsequent period of spot silver, 71.2-72.3-73.1-73.8-75.1-77.9 can be operated as the bull and bear range. High throw and low suction in the range, chase up and kill down outside the range!

Note: The above strategy was updated at 15:00 on April 28. This policy is a daytime policy. Please pay attention to the policy release time.

Intraday Oscillation Range: 1.0690-1.0755-1.0830-1.0950-1.1157

Overall Oscillation Range: 1.0290-1.0360-1.0460-1.0570-1.0690-1.0755-1.0830-1.0950-1.1157-1.1220-1.1303

In the subsequent period of EURUSD, 1.0690-1.0755-1.0830-1.0950-1.1157 can be operated as the bull and bear range. High throw and low suction in the range, chase up and kill down outside the range!

Note: The above strategy was updated at 15:00 on April 28. This policy is a daytime policy. Please pay attention to the policy release time.

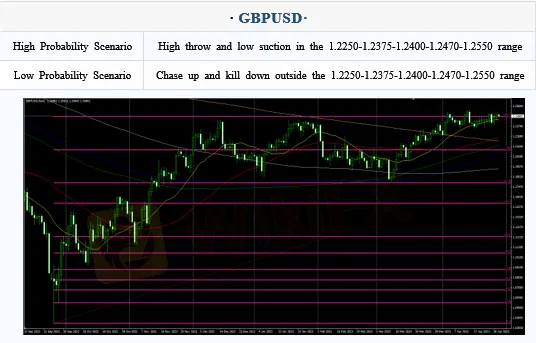

Intraday Oscillation Range: 1.2250-1.2375-1.2400-1.2470-1.2550

Overall Oscillation Range: 1.1610-1.1830-1.1920-1.2030-1.2135-1.2250-1.2375-1.2400-1.2470-1.2550-1.27000

In the subsequent period of GBPUSD, 1.2250-1.2375-1.2400-1.2470-1.2550 can be operated as the bull and bear range. High throw and low suction in the range, chase up and kill down outside the range!

Note: The above strategy was updated at 15:00 on April 28. This policy is a daytime policy. Please pay attention to the policy release time.

Read more

MHMarkets:2024.03.29 MHM European Time Analysis

Fed Governor Christopher Waller's recent comments have highlighted a cautious stance towards adjusting interest rates, marking a significant moment for the financial markets.

MHMarkets:2024.03.28 MHM European Time Analysis

In the forex market, stability was the theme for the U.S. dollar index, holding firm at 104.30. Minor fluctuations were observed across major currency pairs: the Euro slightly weakened against the dollar, closing at 1.0827

MHMarkets:2024.03.27 MHM European Time Analysis

In the latest market wrap focusing on the foreign exchange sector, the U.S. dollar index showed minimal movement, holding at 104.31.

MHMarkets:March 27, 2024 Economic Highlights

On Tuesday, due to February's US durable goods orders growth exceeding expectations and an optimistic economic growth outlook for the first quarter in the US, the US dollar index initially fell but then rose, briefly touching below the 104 mark before recovering during the US trading session, closing up 0.07% at 104.29.

WikiFX Broker

Latest News

Identity Theft in FX: FCA Flags New 'Clone' Broker Mimicking Fortrade

Oron Limited Regulation: A Complete 2025 Review of Its License and Safety

Trade.com Review & Complaints Hidden from New Investors! Tell Different Story

FXCM Broker ASIC Stop Order Halts CFD Sales

Exnova Exposed: Reports of Failed Deposits & Withheld Withdrawals from Traders

The "Profit Eraser" Clause: Why Traders Are Losing Their Gains with Admirals

Souq Capital Exposed: DFSA Warns of Fake Licensing Claims and Unauthorized Status

Is FXCC Regulated? Full FXCC Regulation Overview

Is Tiger Brokers Regulated? Investor Protection Guide

Tag Markets Exposed: Withdrawal Issues, Inflated Spreads & Market Manipulation Concerns

Rate Calc