June 8, 2023-MHM European Perspective

Abstract:Spot gold rebounded slightly during Asian hours on Thursday (June 8) and is now trading at US $1946.92 an ounce, as the US dollar weakened slightly.

Market Overview

Spot gold rebounded slightly during Asian hours on Thursday (June 8) and is now trading at US $1946.92 an ounce, as the US dollar weakened slightly. Now, however, markets are generally awaiting US CPI data for May and Fed rate decision next week. Gold is being supported by expectations that U.S. core CPI will grow at its slowest pace in nearly a year and a half. However, concerns that the Fed would maintain its hawkish outlook next week after both the Bank of Canada and the Reserve Bank of Australia unexpectedly raised rates by 25 basis points this week helped Treasury yields surge overnight, weighing on gold prices

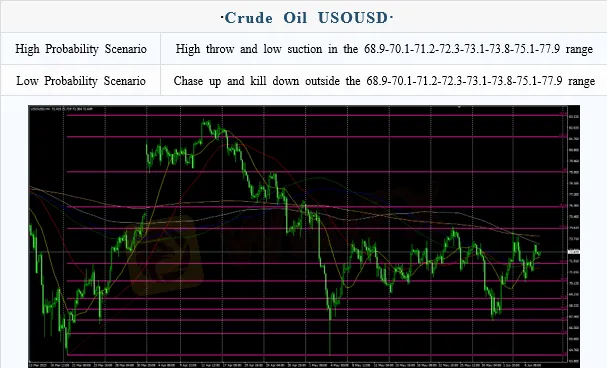

U.S. crude traded near $72.40 a barrel; Oil prices rose more than 1% Wednesday, buoyed by an unexpected drop in U.S. crude inventories and the highest rate utilization since 2019, a rising chance the Federal Reserve will hold interest rates steady and Saudi Arabia's plans to deepen production cuts.

The day focuses on USD Initial Jobless Claims (June/03)and USD Wholesale Inventories MoM Final (APR).

MHMarkets strategy is only for reference and not for investment advice. Please carefully read the statement at the end of the text. The following strategy will be updated at 15:00 on June 8, Beijing time.

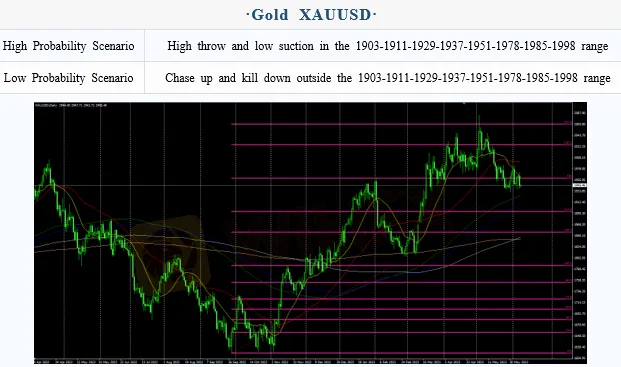

Intraday Oscillation Range: 1903-1911-1929-1937-1951-1978-1985-1998

Overall Oscillation Range: 1730-1756-1780-1801-1817-1833-1856-1873-1889-1903-1911-1929-1937-1951-1978-1985-1998-2007-2016-2033-2046-2057-2066-2077-2089-2097-2100

In the subsequent period of spot gold, 1903-1911-1929-1937-1951-1978-1985-1998 can be operated as the bull and bear range; High throw low suction in the range, chase up and kill down outside the range!

Note: The above strategy was updated at 15:00 on June 8. This policy is a daytime policy. Please pay attention to the policy release time.

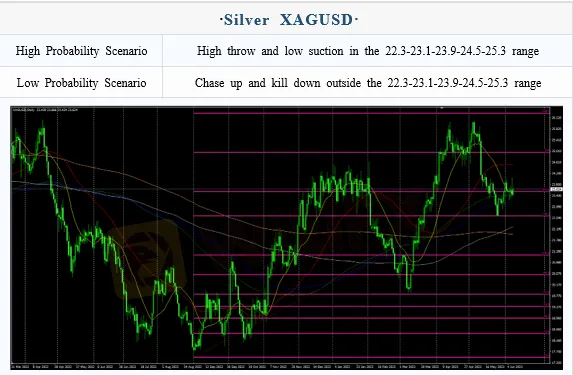

Intraday Oscillation Range: 22.3-23.1-23.9-24.5-25.3

Overall Oscillation Range: 19.7-20.1-20.6-21.5-22.3-23.1-23.9-24.5-25.3-26.1-26.6-27.3

In the subsequent period of spot silver, 22.3-23.1-23.9-24.5-25.3 can be operated as the bull and bear range. High throw and low suction in the range, chase up and kill down outside the range!

Note: The above strategy was updated at 15:00 on June 8. This policy is a daytime policy. Please pay attention to the policy release time.

Intraday Oscillation Range: 68.9-70.1-71.2-72.3-73.1-73.8-75.1-77.9

Overall Oscillation Range: 62.1-63.7-64.5-65.8-66.9-67.3-68.9-70.1-71.2-72.3-73.1-73.8-75.1-77.9-78.5-79.9-80.7-82.3-83.5-85.3-87.3-89.1

In the subsequent period of Crude Oil, 68.9-70.1-71.2-72.3-73.1-73.8-75.1-77.9 can be operated as the bull and bear range. High throw and low suction in the range, chase up and kill down outside the range!

Note: The above strategy was updated at 15:00 on June 8. This policy is a daytime policy. Please pay attention to the policy release time.

Intraday Oscillation Range: 1.0460-1.0570-1.0690-1.0755-1.0830

Overall Oscillation Range: 1.0290-1.0360-1.0460-1.0570-1.0690-1.0755-1.0830-1.0950-1.1157-1.1220-1.1303

In the subsequent period of EURUSD, 1.0460-1.0570-1.0690-1.0755-1.0830 can be operated as the bull and bear range. High throw and low suction in the range, chase up and kill down outside the range!

Note: The above strategy was updated at 15:00 on June 8. This policy is a daytime policy. Please pay attention to the policy release time.

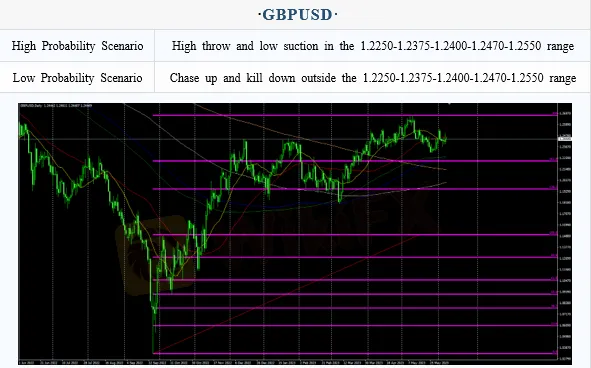

Intraday Oscillation Range: 1.2250-1.2375-1.2400-1.2470-1.2550

Overall Oscillation Range: 1.1610-1.1830-1.1920-1.2030-1.2135-1.2250-1.2375-1.2400-1.2470-1.2550-1.27000

In the subsequent period of GBPUSD, 1.2250-1.2375-1.2400-1.2470-1.2550 can be operated as the bull and bear range. High throw and low suction in the range, chase up and kill down outside the range!

Note: The above strategy was updated at 15:00 on June 8. This policy is a daytime policy. Please pay attention to the policy release time.

Read more

MHMarkets:2024.03.29 MHM European Time Analysis

Fed Governor Christopher Waller's recent comments have highlighted a cautious stance towards adjusting interest rates, marking a significant moment for the financial markets.

MHMarkets:2024.03.28 MHM European Time Analysis

In the forex market, stability was the theme for the U.S. dollar index, holding firm at 104.30. Minor fluctuations were observed across major currency pairs: the Euro slightly weakened against the dollar, closing at 1.0827

MHMarkets:2024.03.27 MHM European Time Analysis

In the latest market wrap focusing on the foreign exchange sector, the U.S. dollar index showed minimal movement, holding at 104.31.

MHMarkets:March 27, 2024 Economic Highlights

On Tuesday, due to February's US durable goods orders growth exceeding expectations and an optimistic economic growth outlook for the first quarter in the US, the US dollar index initially fell but then rose, briefly touching below the 104 mark before recovering during the US trading session, closing up 0.07% at 104.29.

WikiFX Broker

Latest News

Mitrade Arabic Platform Targets MENA Gold Trading Boom

Israeli Arrested in Rome Over €50M Forex Scam

New FCA Consumer Alert 2025: Important Warning for All Consumers

EmiraX Markets Withdrawal Issues Exposed

Global Guide to Finding Forex IBs/Brokers — Share Your Pick and Win Big!

Consob Targets Political Deepfake “Clone Sites” and Unlicensed Platforms in Latest Enforcement Round

WikiEXPO Global Expert Interviews: Gustavo Antonio Montero: ESG in Finance

Trump tariffs are helping drive U.S. beef prices to new highs

Scam Alert: GINKGO-my.com is Draining Millions from Malaysians!

Ghost Global Limited (ghostgloballtd.com ) Review: Users Complain About Slow Replies, Fake Portfolio

Rate Calc