Debt ceiling suspended, but challenges persist

Abstract:Based on the recent piece of opinion released by some news agency highlighted that the latest budget deal successfully suspended the debt ceiling, averting a potential debt default. However, it also pointed out that this measure does little to address the United States’ long-term fiscal challenges, as US deficits continue to accelerate.

Based on the recent piece of opinion released by some news agency highlighted that the latest budget deal successfully suspended the debt ceiling, averting a potential debt default. However, it also pointed out that this measure does little to address the United States long-term fiscal challenges, as US deficits continue to accelerate.

Escalating US debts

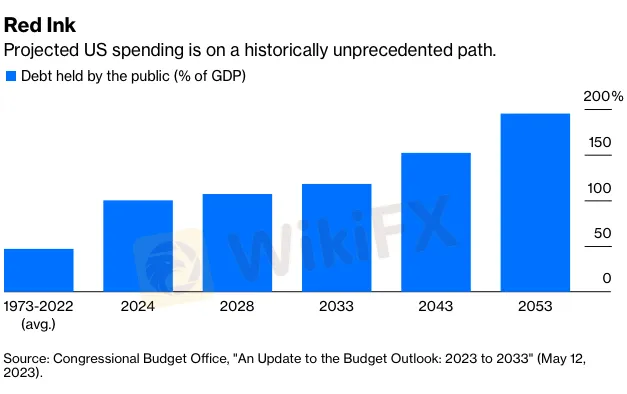

According to the Congressional Budget Office, the US is projected to have deficits exceeding 5% of its Gross Domestic Product for an extended period. In the next decade alone, the countrys total debt is expected to reach approximately $20 trillion. Despite the recent agreement, this reduction is a mere $1.5 trillion. The debt-to-GDP ratio, which compares the US debt to its income, will continue to rise and is estimated to reach around 115% by 2033, with further increases projected beyond that. By the middle of the century, US debt could potentially approach 200% of the public debt-to-GDP ratio.

Concerns and projections

The article also highlights that these projections are somewhat optimistic, as they do not account for potential events like another global financial crisis or urgent need for investment due to factors such as global warming. These factors could significantly impact the US debt landscape and necessitate additional financial measures.

Where does that put the US in the G20 rankings?

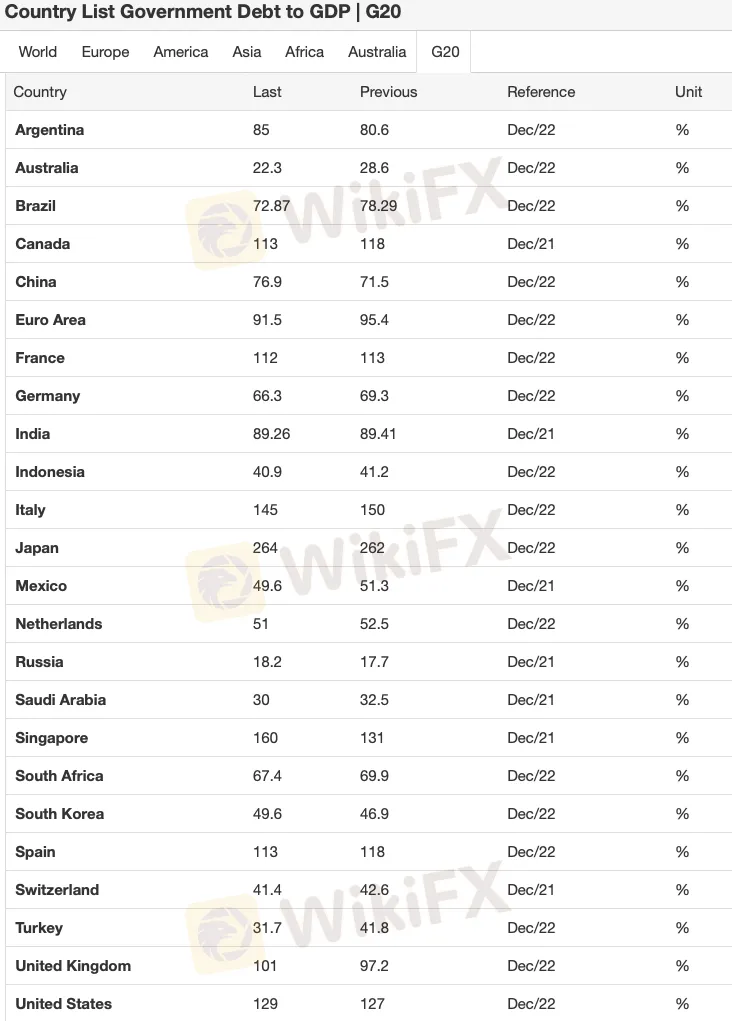

Among G20 nations, the United States currently holds the second-highest debt-to-GDP ratio, second only to Japan. However, it is crucial to note that Japan‘s ratio stands at a significant 264%, making it an outlier in this regard. Japan has managed to finance its debt due to its large domestic investor base, strong savings culture, and intervention by the Bank of Japan in the bond market. Nevertheless, the long-term sustainability of Japan’s debt remains a concern.

The larger the US debt becomes, the more and more concerns there will be surrounding how that debt is managed. Expect this to become more and more of a focus in US politics moving forward, but for now, there is no immediate danger for the US from its high debt-to-GDP ratio.

Read more

WikiFX Wishes You a Happy New Year!

Dear Global Users, Thank you for journeying alongside WikiFX. Every query you make, every review you share, and every piece of feedback you provide serves as the most vital driving force behind our continuous efforts to promote transparency and security in the trading industry.

Celebrate the New Year and Usher in a Safer 2026 for All Traders!

As the new year begins, WikiFX extends our sincere gratitude to traders worldwide, our industry partners, and all users who have consistently supported us.

Become a Broker Reviewer: Your Experience is Worth Its Weight in Gold

Dear Forex Traders, When choosing a forex broker, have you ever faced these dilemmas? Dozens of broker advertisements, but unsure which one is truly reliable? Online reviews are either promotional content or outdated/incomplete? Want to learn about real users’ deposit/withdrawal experiences but can’t find firsthand accounts? Now, your experience can help thousands of traders and earn you generous rewards! The campaign is long-term and you can join anytime.

Fed Minutes in Focus as USD Stabilizes, Gold Slips from Record Highs

Markets turn cautious as investors await the Fed’s December meeting minutes. The US Dollar stabilizes near 98.10, gold drops sharply from record highs, while GBP/USD, EUR/USD, and USD/JPY react to central bank signals.

WikiFX Broker

Latest News

2025 Global Economic Year in Review: How Tariffs and AI Rewrote the Playbook

Forex Daily: USD/JPY and AUD/USD Falter as Year-End Liquidity Thins

It’s a Scam, Not Romance: How This Woman Lost US$1 Million

Gold and Silver Plummet from Record Highs as Profit-Taking Sweeps the Market

Crude Oil Surges as US Strikes Venezuela Facility and Ukraine Talks Stall

He Thought He Was Investing BUT US$500,000 Disappeared!

Fed Watch: Powell Sounds Alarm on "Excessive" Valuations

US Dollar on Edge: Fed Minutes and Trump Attacks Rattling Central Bank Independence

WM Markets Review (2025): Is this Broker Safe or a Scam?

Is ehamarkets Legit or a Scam? 5 Key Questions Answered (2025)

Rate Calc