Mai hui MHmarkets: July 6, 2023-MHM European Perspective

Abstract:Spot gold rose slightly and is currently trading near $1919.40 per ounce. International trade tensions have provided some safe-haven support to gold prices.

Market Overview

Spot gold rose slightly and is currently trading near $1919.40 per ounce. International trade tensions have provided some safe-haven support to gold prices. However, the minutes of the Federal Reserve meeting that came out overnight reflected the general view of Fed officials that further rate hikes are still needed, with U.S. bond yields hitting a near four-month high, and gold prices closing lower after being blocked by the 21-day SMA overnight. Technical short-term bearish signals have also increased, with the short term facing the risk of a return to downtrend.

This trading day will usher in the U.S. June ADP employment data, the U.S. initial jobless claims change, the U.S. May JOLTs job openings and the U.S. June ISM non-manufacturing PMI data, investors need to focus on.

Investors also need to watch for news related to Fed officials' speeches and the international trade situation (export controls in large Asian countries).

U.S. crude oil is in a narrow range, currently trading near $71.66 per barrel. Although concerns about the international trade situation have made bulls wary, Saudi Arabia shouted on Wednesday that OPEC+ would take “all necessary measures” to support the market. And early morning data showed a sharp drop in API crude inventories, still giving support to oil prices. Technically, the short term is slightly long, and is expected to further test the upper Bollinger Bands resistance around 72.80.

The EIA crude oil inventory series will be watched this trading day as the data is delayed until today due to the US Independence Day holiday.

MHMarkets strategy is only for reference and not for investment advice. Please carefully read the statement at the end of the text. The following strategy will be updated at 15:00 on July 6, Beijing time.

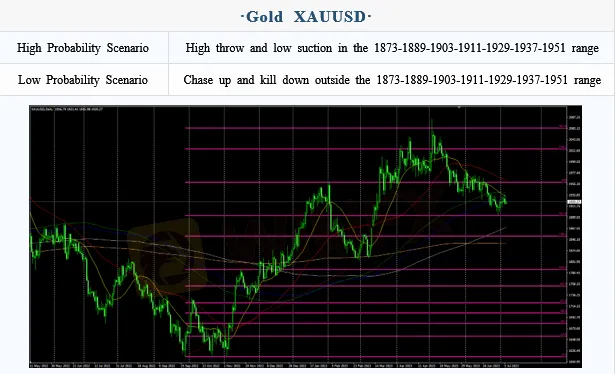

Intraday Oscillation Range: 1873-1889-1903-1911-1929-1937-1951

Overall Oscillation Range: 1730-1756-1780-1801-1817-1833-1856-1873-1889-1903-1911-1929-1937-1951-1960-1978-1985-1998-2007-2016-2033-2046-2057-2066-2077-2089-2097-2100

In the subsequent period of spot gold, 1873-1889-1903-1911-1929-1937-1951 can be operated as the bull and bear range; High throw low suction in the range, chase up and kill down outside the range!

Note: The above strategy was updated at 15:00 on July 6. This policy is a daytime policy. Please pay attention to the policy release time.

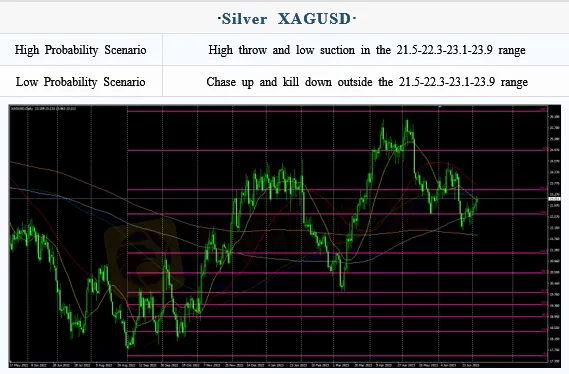

Intraday Oscillation Range: 21.5-22.3-23.1-23.9

Overall Oscillation Range: 19.7-20.1-20.6-21.5-22.3-23.1-23.9-24.5-25.3-26.1-26.6-27.3

In the subsequent period of spot silver, 21.5-22.3-23.1-23.9 can be operated as the bull and bear range. High throw and low suction in the range, chase up and kill down outside the range!

Note: The above strategy was updated at 15:00 on July 6. This policy is a daytime policy. Please pay attention to the policy release time.

Intraday Oscillation Range: 67.3-68.9-70.1-71.2-72.3-73.1-73.8

Overall Oscillation Range: 62.1-63.7-64.5-65.8-66.9-67.3-68.9-70.1-71.2-72.3-73.1-73.8-75.1-77.9-78.5-79.9-80.7-82.3-83.5-85.3-87.3-89.1

In the subsequent period of crude oil, 67.3-68.9-70.1-71.2-72.3-73.1-73.8 can be operated as the bull and bear range. High throw and low suction in the range, chase up and kill down outside the range!

Note: The above strategy was updated at 15:00 on July 6. This policy is a daytime policy. Please pay attention to the policy release time.

Intraday Oscillation Range: 1.0690-1.0755-1.0830-1.0950-1.1157

Overall Oscillation Range: 1.0290-1.0360-1.0460-1.0570-1.0690-1.0755-1.0830-1.0950-1.1157-1.1220-1.1303

In the subsequent period of EURUSD, 1.0690-1.0755-1.0830-1.0950-1.1157 can be operated as the bull and bear range. High throw and low suction in the range, chase up and kill down outside the range!

Note: The above strategy was updated at 15:00 on July 6. This policy is a daytime policy. Please pay attention to the policy release time.

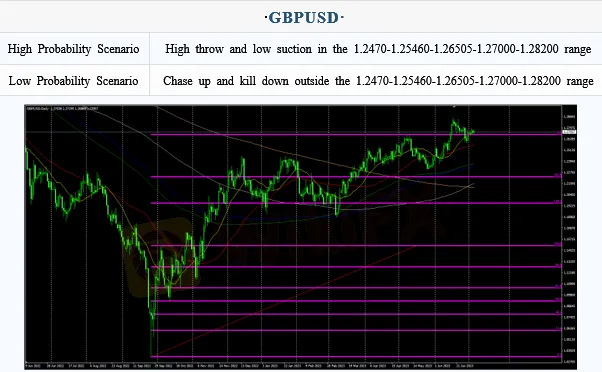

Intraday Oscillation Range: 1.2470-1.25460-1.26505-1.27000-1.28200

Overall Oscillation Range: 1.1610-1.1830-1.1920-1.2030-1.2135-1.2250-1.2375-1.2400-1.2470-1.25460-1.26505-1.27000-1.28200-1.29300-1.30000-1.30600

In the subsequent period of GBPUSD, 1.2470-1.25460-1.26505-1.27000-1.28200 can be operated as the bull and bear range. High throw and low suction in the range, chase up and kill down outside the range!

Note: The above strategy was updated at 15:00 on July 6. This policy is a daytime policy. Please pay attention to the policy release time.

Read more

MHMarkets:2024.03.29 MHM European Time Analysis

Fed Governor Christopher Waller's recent comments have highlighted a cautious stance towards adjusting interest rates, marking a significant moment for the financial markets.

MHMarkets:2024.03.28 MHM European Time Analysis

In the forex market, stability was the theme for the U.S. dollar index, holding firm at 104.30. Minor fluctuations were observed across major currency pairs: the Euro slightly weakened against the dollar, closing at 1.0827

MHMarkets:2024.03.27 MHM European Time Analysis

In the latest market wrap focusing on the foreign exchange sector, the U.S. dollar index showed minimal movement, holding at 104.31.

MHMarkets:March 27, 2024 Economic Highlights

On Tuesday, due to February's US durable goods orders growth exceeding expectations and an optimistic economic growth outlook for the first quarter in the US, the US dollar index initially fell but then rose, briefly touching below the 104 mark before recovering during the US trading session, closing up 0.07% at 104.29.

WikiFX Broker

Latest News

$128M Crypto Scam: Chinese Suspect Nabbed in Thailand

Is AssetsFX Safe or Scam: Looking at Real User Feedback and Complaints

FIBOGroup Critical Withdrawal Scam Exposed

Institutional Players Pivot to Physical Gold: CMC Markets Eyes Singapore Expansion Amid Macro Uncertainty

Prop Trading Industry Pivots to Futures to Secure US Market Access

GODO Legitimacy Check: Addressing Fears - Is This a Fake Broker or a Legitimate Trading Partner?

Fintech Partnership Targets "False Positive" Crisis in Market Surveillance

The Trading Pit Launches Regulated Brokerage Unit 'TTP Markets' in Strategic Pivot

CME Group Moves to 24/7 Trading for Digital Asset Derivatives

Trump Defies Supreme Court with 15% Global Tariff; Record Retail Flows Buffer Market Impact

Rate Calc