Mai hui MHmarkets: July 12, 2023-MHM European Perspective

Abstract:Spot gold edged higher to a near three-week high of $1940.84 an ounce after the Reserve Bank of Australia said on Wednesday (July 12) in Asia, providing support to the metal after the dollar and bond yields retreated, though investors cautiously awaited US inflation data that could provide more clues on the path of the Federal Reserve's rate hike policy.

Market Overview

Spot gold edged higher to a near three-week high of $1940.84 an ounce after the Reserve Bank of Australia said on Wednesday (July 12) in Asia, providing support to the metal after the dollar and bond yields retreated, though investors cautiously awaited US inflation data that could provide more clues on the path of the Federal Reserve's rate hike policy.

Investors now await June inflation data due at 20:30 Beijing time, with economists expecting the consumer price index (CPI) to rise 3.1%, following a 4% rise in May, while the core CPI is expected to fall to 5% from 5.3%.

Markets see a 92% chance the Fed will raise rates by a quarter point at its July 25-26 policy meeting, according to CME's Fedwatch.

U.S. crude oil traded in a narrow range around $74.72 a barrel as Federal Reserve officials signaled the end of their rate-hike cycle on Monday and the dollar index continued to weakness, hitting a near two-month low of 101.34 on Wednesday. That helped oil prices continue to surge after rising more than 2% on Tuesday, hitting a more than two-month high of $75.12 a barrel. While bulls remain wary of an unexpectedly large increase in API Crude Oil Stocks, technical bullish signals continue to strengthen and are expected to test resistance near the 200-day average of 77.19 further in the future.

The oil market will remain tight in the second half of 2023, the International Energy Agency said, citing strong demand from China and the developing world as well as recent supply cuts announced by major exporters including Saudi Arabia and Russia.

Meanwhile, the US EIA on Tuesday projected demand to outpace supply by 100,000 BPD in 2023 and 200,000 BPD in 2024.

“A break above recent highs can be seen as a bullish step that could give momentum back above $80,” said Craig Erlam, senior market analyst at OANDA. “The rally still has momentum at this stage,” he added.

Markets are awaiting US inflation data on Wednesday for clues on the interest rate outlook. Higher interest rates could slow economic growth and reduce oil demand.

In addition, investors also keep an eye on the U.S. EIA Crude Oil Stocks Change; API data out in the early hours of the morning showed crude stocks up by about 3 million barrels for the week ended July 7, gasoline stocks up by about 1 million barrels and distillate stockpiles up by about 2.9 million barrels.

If the forecast is confirmed in data from the U.S. Energy Information Administration (EIA) due later on Wednesday, it would be the first increase in crude inventories in four weeks, compared with a 3.3 million barrel increase in the year-ago period and the five-year average decline of 6.9 million barrels.

In addition, a number of Fed officials will be speaking throughout the session, which investors need to pay attention to.

MHMarkets strategy is only for reference and not for investment advice. Please carefully read the statement at the end of the text. The following strategy will be updated at 15:00 on July 12, Beijing time.

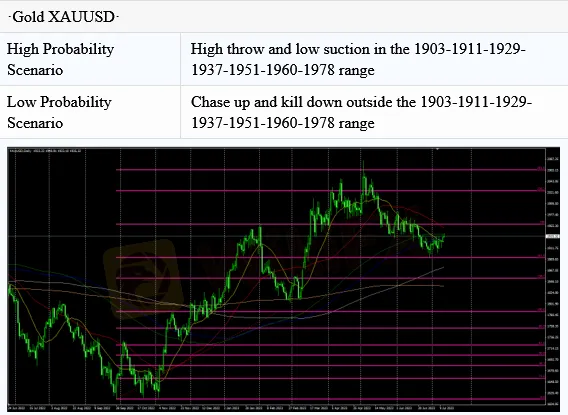

Intraday Oscillation Range: 1903-1911-1929-1937-1951-1960-1978

Overall Oscillation Range: 1730-1756-1780-1801-1817-1833-1856-1873-1889-1903-1911-1929-1937-1951-1960-1978-1985-1998-2007-2016-2033-2046-2057-2066-2077-2089-2097-2100

In the subsequent period of spot gold, 1903-1911-1929-1937-1951-1960-1978 can be operated as the bull and bear range; High throw low suction in the range, chase up and kill down outside the range!

Note: The above strategy was updated at 15:00 on July 12. This policy is a daytime policy. Please pay attention to the policy release time.

Intraday Oscillation Range: 22.3-23.1-23.9-24.5

Overall Oscillation Range: 19.7-20.1-20.6-21.5-22.3-23.1-23.9-24.5-25.3-26.1-26.6-27.3

In the subsequent period of spot silver, 22.3-23.1-23.9-24.5 can be operated as the bull and bear range. High throw and low suction in the range, chase up and kill down outside the range!

Note: The above strategy was updated at 15:00 on July 12. This policy is a daytime policy. Please pay attention to the policy release time.

Intraday Oscillation Range:70.1-71.2-72.3-73.1-73.8-75.1-77.9

Overall Oscillation Range: 62.1-63.7-64.5-65.8-66.9-67.3-68.9-70.1-71.2-72.3-73.1-73.8-75.1-77.9-78.5-79.9-80.7-82.3-83.5-85.3-87.3-89.1

In the subsequent period of crude oil, 70.1-71.2-72.3-73.1-73.8-75.1-77.9 can be operated as the bull and bear range. High throw and low suction in the range, chase up and kill down outside the range!

Note: The above strategy was updated at 15:00 on July 12. This policy is a daytime policy. Please pay attention to the policy release time.

Intraday Oscillation Range: 1.0830-1.0950-1.1157-1.1220-1.1303

Overall Oscillation Range: 1.0290-1.0360-1.0460-1.0570-1.0690-1.0755-1.0830-1.0950-1.1157-1.1220-1.1303

In the subsequent period of EURUSD, 1.0830-1.0950-1.1157-1.1220-1.1303 can be operated as the bull and bear range. High throw and low suction in the range, chase up and kill down outside the range!

Note: The above strategy was updated at 15:00 on July 12. This policy is a daytime policy. Please pay attention to the policy release time.

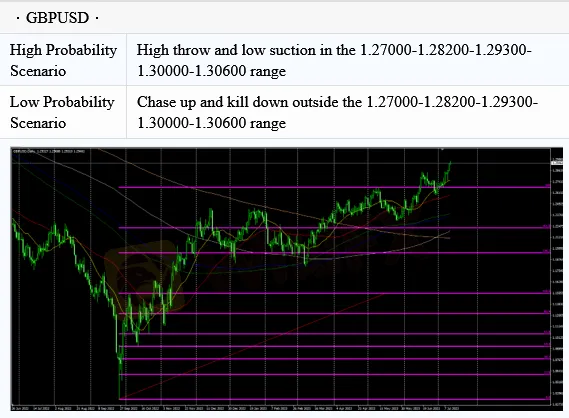

Intraday Oscillation Range: 1.27000-1.28200-1.29300-1.30000-1.30600

Overall Oscillation Range: 1.1610-1.1830-1.1920-1.2030-1.2135-1.2250-1.2375-1.2400-1.2470-1.25460-1.26505-1.27000-1.28200-1.29300-1.30000-1.30600

In the subsequent period of GBPUSD, 1.27000-1.28200-1.29300-1.30000-1.30600 can be operated as the bull and bear range. High throw and low suction in the range, chase up and kill down outside the range!

Note: The above strategy was updated at 15:00 on July 12. This policy is a daytime policy. Please pay attention to the policy release time.

Read more

MHMarkets:2024.03.29 MHM European Time Analysis

Fed Governor Christopher Waller's recent comments have highlighted a cautious stance towards adjusting interest rates, marking a significant moment for the financial markets.

MHMarkets:2024.03.28 MHM European Time Analysis

In the forex market, stability was the theme for the U.S. dollar index, holding firm at 104.30. Minor fluctuations were observed across major currency pairs: the Euro slightly weakened against the dollar, closing at 1.0827

MHMarkets:2024.03.27 MHM European Time Analysis

In the latest market wrap focusing on the foreign exchange sector, the U.S. dollar index showed minimal movement, holding at 104.31.

MHMarkets:March 27, 2024 Economic Highlights

On Tuesday, due to February's US durable goods orders growth exceeding expectations and an optimistic economic growth outlook for the first quarter in the US, the US dollar index initially fell but then rose, briefly touching below the 104 mark before recovering during the US trading session, closing up 0.07% at 104.29.

WikiFX Broker

Latest News

Yen Fragility Persists: Inflation Miss Cements BoJ 'Hold' Expectation

Trade War Averted: Euro Rallies as US Withdraws Tariff Threats

Sticky US Inflation Data Dashes Near-Term Fed Rate Cut Hopes

Yen Volatility Spikes: PM Takaichi Calls Snap Election Amid BoJ 'Hawkish Pause'

ECB Minutes: Service Inflation and Wage Spikes Kill Rate Cut Speculation

BoJ "Politically Paralyzed" at 0.75% as Takaichi Calls Snap Election

'Bond Vigilantes' Return: JGB Rout Sparks Contagion Fears for US Treasuries

ZarVista User Reputation: Looking at Real User Reviews to Check Is ZarVista Safe or Scam?

Gold Fun Corporation Ltd Review 2025: Is This Forex Broker Safe?

MONAXA Review: Safety, Regulation & Forex Trading Details

Rate Calc