Mai hui MHmarkets: USD has started to weaken, while non US currencies and precious metals have not strengthened, and US crude oil has a mixed positive and negative trend!

Abstract:On Friday (August 4) , spot gold fluctuated narrowly during the Asian session and is currently trading around $1936.56 per ounce. After a series of strong economic data this week drove US government bond yields to a nine month high, investors began preparing for the closely watched US employment report.

Market Overview

On Friday (August 4) , spot gold fluctuated narrowly during the Asian session and is currently trading around $1936.56 per ounce. After a series of strong economic data this week drove US government bond yields to a nine month high, investors began preparing for the closely watched US employment report.

The United States Department of Labor will release the closely watched July non farm employment report on Friday, which is expected to still show a tight labor market, and the unemployment rate is stable near the low point in decades, although wage growth may slow down. Last month's data showed that consumer spending is elastic, and the annual inflation rate slowed down significantly in June.

There is a possibility of surprise or shock in the July non farm employment data. After the data is released, the gold price may fluctuate widely and violently in the short term, with a high possibility of diving after a rapid rise in the short term. There is also a possibility of gold prices rising again after a rapid decline in the short term, and it is necessary to pay attention to the specific performance of the data and market interpretation.

The ADP National Employment Report released on Wednesday showed that the growth rate of private employment in July exceeded expectations. Compared to June, the number of people applying for state unemployment benefits for the first time in July was much lower.

The United States Department of Labor reported on Tuesday that each unemployed person had 1.6 job vacancies in June, little change compared with May. A large number of vacant jobs, together with the Consumer confidence survey conducted by the Conference Board in July, show that families are optimistic about the labor market, posing a risk to the unemployment rate.

The unemployment rate is expected to remain unchanged at 3.6% in July, not far from the level of over 50 years ago. This is far below the latest median estimate of the Federal Reserve, which means that the unemployment rate will be 4.1% by the fourth quarter of this year.

Saudi Arabia announced on Thursday that it will extend its voluntary production reduction plan of 1 million barrels per day for another month until the end of September. The ministers of OPEC+, an oil producing country alliance formed by allies of the OPEC (OPEC), including Russia, will hold a meeting on Friday.

Sources said that the OPEC+Joint Ministerial Supervisory Committee (JMMC) is unlikely to adjust the overall oil production reduction policy at Friday's meeting. However, Saudi Arabia's commitment and Deputy Chairman of the Government Novak's statement that Russia will also reduce production by 300000 barrels/day in September triggered market concerns about supply, which in turn supported oil prices.

Investors need to pay attention to the upcoming OPEC+Joint Ministerial Supervisory Committee meeting, as well as the changes in the US July non farm employment report and US crude oil drilling data.

MHMarkets strategy is only for reference and not for investment advice. Please carefully read the statement at the end of the text. The following strategy will be updated at 15:00 on August 4, Beijing time.

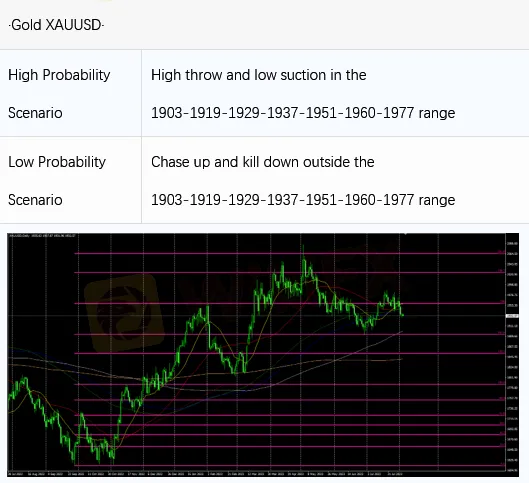

Intraday Oscillation Range: 1903-1919-1929-1937-1951-1960-1977

Overall Oscillation Range: 1730-1756-1780-1801-1817-1833-1856-1873-1889-1903-1919-1929-1937-1951-1960-1977-1985-1998-2007-2016-2033-2046-2057-2066-2077-2089-2097-2100

In the subsequent period of spot gold, 1903-1919-1929-1937-1951-1960-1977 can be operated as the bull and bear range; High throw low suction in the range, chase up and kill down outside the range!

Note: The above strategy was updated at 15:00 on August 4. This policy is a daytime policy. Please pay attention to the policy release time.

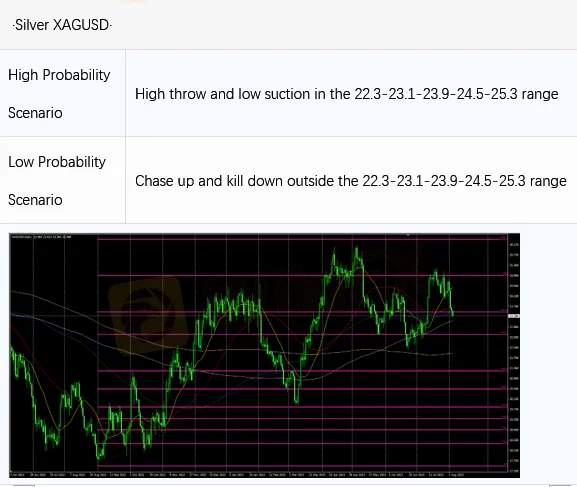

Intraday Oscillation Range: 22.3-23.1-23.9-24.5-25.3

Overall Oscillation Range: 19.7-20.1-20.6-21.5-22.3-23.1-23.9-24.5-25.3-26.1-26.6-27.3

In the subsequent period of spot silver, 22.3-23.1-23.9-24.5-25.3can be operated as the bull and bear range. High throw and low suction in the range, chase up and kill down outside the range!

Note: The above strategy was updated at 15:00 on August 4. This policy is a daytime policy. Please pay attention to the policy release time.

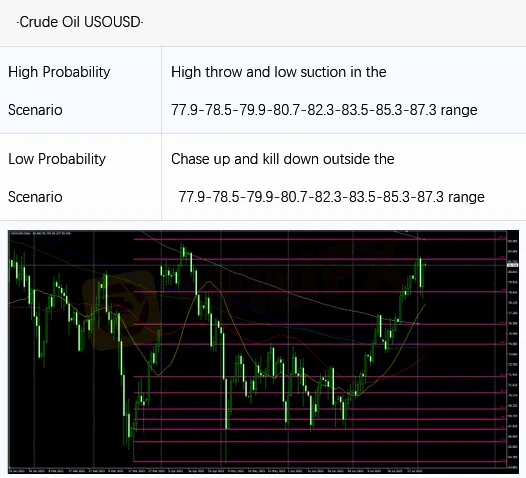

Intraday Oscillation Range: 77.9-78.5-79.9-80.7-82.3-83.5-85.3-87.3

Overall Oscillation Range: 62.1-63.7-64.5-65.8-66.9-67.3-68.9-70.1-71.2-72.3-73.1-73.8-75.1-77.9-78.5-79.9-80.7-82.3-83.5-85.3-87.3-89.1

In the subsequent period of crude oil, 77.9-78.5-79.9-80.7-82.3-83.5-85.3-87.3 can be operated as the bull and bear range. High throw and low suction in the range, chase up and kill down outside the range!

Note: The above strategy was updated at 15:00 on August 4. This policy is a daytime policy. Please pay attention to the policy release time.

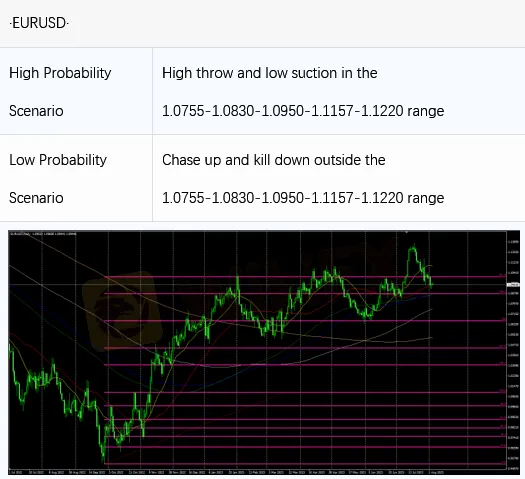

Intraday Oscillation Range:1.0755-1.0830-1.0950-1.1157-1.1220

Overall Oscillation Range: 1.0290-1.0360-1.0460-1.0570-1.0690-1.0755-1.0830-1.0950-1.1157-1.1220-1.1303-1.13340

In the subsequent period of EURUSD, 1.0755-1.0830-1.0950-1.1157-1.1220can be operated as the bull and bear range. High throw and low suction in the range, chase up and kill down outside the range!

Note: The above strategy was updated at 15:00 on August 4. This policy is a daytime policy. Please pay attention to the policy release time.

Intraday Oscillation Range:1.2470-1.25460-1.26505-1.27000-1.28200-1.29300

Overall Oscillation Range: 1.1610-1.1830-1.1920-1.2030-1.2135-1.2250-1.2375-1.2400-1.2470-1.25460-1.26505-1.27000-1.28200-1.29300-1.30000-1.30600-1.31000-1.31660-132000

In the subsequent period of GBPUSD, 1.2470-1.25460-1.26505-1.27000-1.28200-1.29300 can be operated as the bull and bear range. High throw and low suction in the range, chase up and kill down outside the range!

Note: The above strategy was updated at 15:00 on August 4. This policy is a daytime policy. Please pay attention to the policy release time.

Read more

MHMarkets:2024.03.29 MHM European Time Analysis

Fed Governor Christopher Waller's recent comments have highlighted a cautious stance towards adjusting interest rates, marking a significant moment for the financial markets.

MHMarkets:2024.03.28 MHM European Time Analysis

In the forex market, stability was the theme for the U.S. dollar index, holding firm at 104.30. Minor fluctuations were observed across major currency pairs: the Euro slightly weakened against the dollar, closing at 1.0827

MHMarkets:2024.03.27 MHM European Time Analysis

In the latest market wrap focusing on the foreign exchange sector, the U.S. dollar index showed minimal movement, holding at 104.31.

MHMarkets:March 27, 2024 Economic Highlights

On Tuesday, due to February's US durable goods orders growth exceeding expectations and an optimistic economic growth outlook for the first quarter in the US, the US dollar index initially fell but then rose, briefly touching below the 104 mark before recovering during the US trading session, closing up 0.07% at 104.29.

WikiFX Broker

Latest News

Upway (JRJR) Review: A Deep Dive into Safety and Regulation

Coinbase Banks Push Advances Crypto Rules

RM668K Gone Overnight: Factory Supervisor Trapped in Fake Investment Scam

Dollar Softens as Fed Signals Shifts; Warsh Leads Nomination Race

Safe-Haven Supercycle: Gold Hits $4,690 as Silver Squeeze Intensifies

Trans-Atlantic Rupture: Markets Brace for Trade War as Trump Issues Greenland Ultimatum

China Delivers 5% Growth Target, Yet December Data Reveals Deepening Consumption and Property Cracks

Italy’s Consob Blocks Five Unauthorized Investment Websites in New Enforcement Action

Gold Tears Through $4,700 Barrier as Risk Premiums Spike

Investigation: The "Imposter" Trap Draining OANDA Traders

Rate Calc