MHMarkets:Dollar day unilateral strength, non-US currency precious metals collectively weak, US crude oil shock is very weak! Dollar day unilateral strength, non-US currency precious metals collectively weak, US crude oil shock is very weak! Dollar day unilateral strength, non-US currency precious metals collectively weak, US crude oil shock is very weak!

Abstract:Spot gold fell slightly in Asia on Monday (August 7), trading at $1,936.68 an ounce, pressured by a hawkish price statement from Federal Reserve Governor Ben Bowman on Saturday, which provided momentum for a rebound in the dollar index.

Market Overview

Spot gold fell slightly in Asia on Monday (August 7), trading at $1,936.68 an ounce, pressured by a hawkish price statement from Federal Reserve Governor Ben Bowman on Saturday, which provided momentum for a rebound in the dollar index. From the technical point of view, gold prices still have further downside risks in the afternoon before the double resistance of the top breaking Bollinian mid-track and the 55-day average.

USD Consumer Price Data on Wednesday will be in focus to see if more rate hikes are needed to tame inflation.

Watch for EUR Germany Industrial Production MoM s.a (JUN) this session and watch for further speeches from Fed officials.

U.S. crude's surge was halted, earlier hitting its highest since April 14 at $83.27 a barrel and moving closer to resistance around a near nine-month high of 83.51 hit on April 12, after Saudi Arabia and Russia pledged to extend output cuts for another month to further tighten global markets and support prices. And over the weekend, Saudi Arabia raised the prices it sells crude to the U.S. and Asia, signaling strong demand. For now, however, prices are back near $82.64 / BBL as some bulls take profits around strong resistance.

Saudi Arabia on Thursday extended a voluntary cut of 1 million barrels a day through the end of September and said the cuts could be extended or deepened. Saudi production will be about 9 million barrels a day in September.

Russia said Thursday that oil exports would fall by 300,000 barrels a day in September. In addition, a Russian warship was severely damaged in a Ukrainian navy drone attack on Russia's Black Sea naval base in Novorossiysk last week. The port, which handles 2% of the world's oil supply, has resumed operations.

Also, weekly data from oilfield services company Baker Hughes showed the number of active oil RIGS in the US fell again in the latest week, decreasing by 4 to 525, the lowest since March 2022. That suggested U.S. supply could be cut further, also supporting oil prices.

MHMarkets strategy is only for reference and not for investment advice. Please carefully read the statement at the end of the text. The following strategy will be updated at 15:00 on August 7, Beijing time.

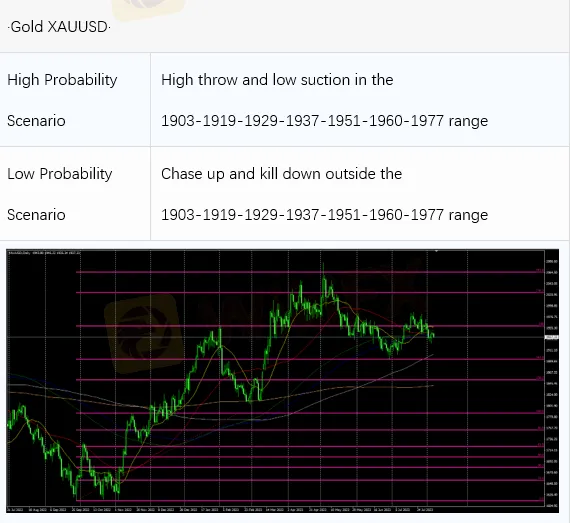

Intraday Oscillation Range: 1903-1919-1929-1937-1951-1960-1977

Overall Oscillation Range: 1730-1756-1780-1801-1817-1833-1856-1873-1889-1903-1919-1929-1937-1951-1960-1977-1985-1998-2007-2016-2033-2046-2057-2066-2077-2089-2097-2100

In the subsequent period of spot gold, 1903-1919-1929-1937-1951-1960-1977 can be operated as the bull and bear range; High throw low suction in the range, chase up and kill down outside the range!

Note: The above strategy was updated at 15:00 on August 7. This policy is a daytime policy. Please pay attention to the policy release time.

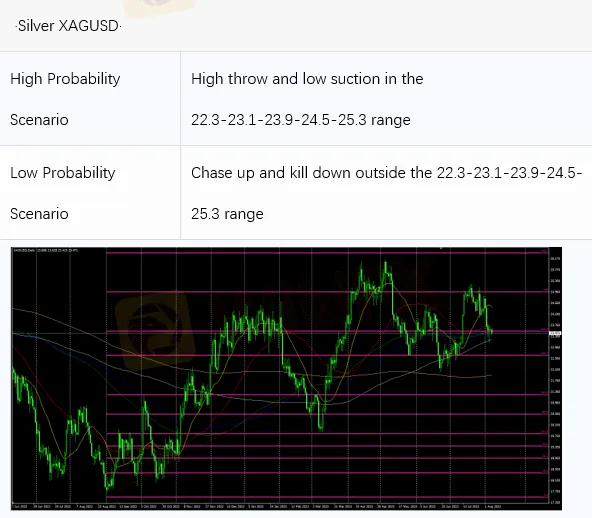

Intraday Oscillation Range: 22.3-23.1-23.9-24.5-25.3

Overall Oscillation Range: 19.7-20.1-20.6-21.5-22.3-23.1-23.9-24.5-25.3-26.1-26.6-27.3

In the subsequent period of spot silver, 22.3-23.1-23.9-24.5-25.3can be operated as the bull and bear range. High throw and low suction in the range, chase up and kill down outside the range!

Note: The above strategy was updated at 15:00 on August 7. This policy is a daytime policy. Please pay attention to the policy release time.

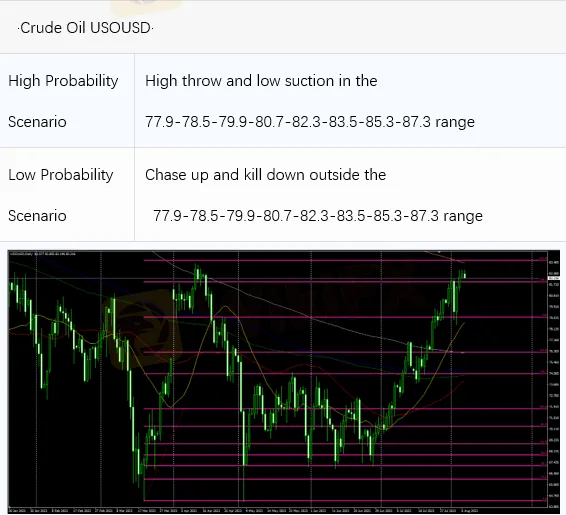

Intraday Oscillation Range: 77.9-78.5-79.9-80.7-82.3-83.5-85.3-87.3

Overall Oscillation Range: 62.1-63.7-64.5-65.8-66.9-67.3-68.9-70.1-71.2-72.3-73.1-73.8-75.1-77.9-78.5-79.9-80.7-82.3-83.5-85.3-87.3-89.1

In the subsequent period of crude oil, 77.9-78.5-79.9-80.7-82.3-83.5-85.3-87.3 can be operated as the bull and bear range. High throw and low suction in the range, chase up and kill down outside the range!

Note: The above strategy was updated at 15:00 on August 7. This policy is a daytime policy. Please pay attention to the policy release time.

Intraday Oscillation Range:1.0755-1.0830-1.0950-1.1157-1.1220

Overall Oscillation Range: 1.0290-1.0360-1.0460-1.0570-1.0690-1.0755-1.0830-1.0950-1.1157-1.1220-1.1303-1.13340

In the subsequent period of EURUSD, 1.0755-1.0830-1.0950-1.1157-1.1220can be operated as the bull and bear range. High throw and low suction in the range, chase up and kill down outside the range!

Note: The above strategy was updated at 15:00 on August 7. This policy is a daytime policy. Please pay attention to the policy release time.

Intraday Oscillation Range:1.2470-1.25460-1.26505-1.27000-1.28200-1.29300

Overall Oscillation Range: 1.1610-1.1830-1.1920-1.2030-1.2135-1.2250-1.2375-1.2400-1.2470-1.25460-1.26505-1.27000-1.28200-1.29300-1.30000-1.30600-1.31000-1.31660-132000

In the subsequent period of GBPUSD, 1.2470-1.25460-1.26505-1.27000-1.28200-1.29300 can be operated as the bull and bear range. High throw and low suction in the range, chase up and kill down outside the range!

Note: The above strategy was updated at 15:00 on August 7. This policy is a daytime policy. Please pay attention to the policy release time.

Read more

MHMarkets:2024.03.29 MHM European Time Analysis

Fed Governor Christopher Waller's recent comments have highlighted a cautious stance towards adjusting interest rates, marking a significant moment for the financial markets.

MHMarkets:2024.03.28 MHM European Time Analysis

In the forex market, stability was the theme for the U.S. dollar index, holding firm at 104.30. Minor fluctuations were observed across major currency pairs: the Euro slightly weakened against the dollar, closing at 1.0827

MHMarkets:2024.03.27 MHM European Time Analysis

In the latest market wrap focusing on the foreign exchange sector, the U.S. dollar index showed minimal movement, holding at 104.31.

MHMarkets:March 27, 2024 Economic Highlights

On Tuesday, due to February's US durable goods orders growth exceeding expectations and an optimistic economic growth outlook for the first quarter in the US, the US dollar index initially fell but then rose, briefly touching below the 104 mark before recovering during the US trading session, closing up 0.07% at 104.29.

WikiFX Broker

Latest News

FortressFX Review: Examining Reported Withdrawal Denials, Slippages & Account Blocks

Middle East Geopolitical Crisis Triggers Energy Supply Disruption and Risk Repricing

Goldman Sachs: Qatari LNG Disruption to Persist Beyond Expectations

AI Infrastructure Enters Dual-Growth Cycle Amid Supply Chain Volatility

Crude Oil Rally Recedes as APAC Markets Stage Rebound

Can Traders Still Trust Their Forex Broker?

IQ Option Review: The High-Stakes Game Where the Only Winner is the House

Geopolitical Risk Reshapes Energy and Equity Markets: The 'Trump Playbook' in Focus

traze Review 2026: Trading Conditions, Regulation & Real User Feedback

7 Clear Signs You’re Ready to Enter Forex Market in 2026

Rate Calc