MHMarkets:The dollar was weak in a small intraday range, non-U.S. currencies and precious metals were strong intraday, and U.S. crude oil accelerated to the upside!

Abstract:Spot gold traded in a narrow range during Asian hours on Thursday (August 10), trading around $1,918.21 per ounce, as investors await the US CPI data for July due in the evening.

Market Overview

Spot gold traded in a narrow range during Asian hours on Thursday (August 10), trading around $1,918.21 per ounce, as investors await the US CPI data for July due in the evening. US growth is expected to rise to 3.3% YoY from 3% in June due to the recent rise in oil prices. Core CPI growth is expected to remain unchanged at 4.8%, meaning the Fed will keep interest rates higher for at least longer, weighing on gold prices. Technical shows, gold prices still have a certain short - term downside risk, pay attention to the 1900 mark near the support.

In addition, there are signs of easing labor tightness in the United States. The market is expected to see initial jobless claims rise slightly to 230,000 for the week ended August 5 from 227,000 previously, which provides a bit of support for gold, which needs to watch out for the possibility of a bottom out.

With the Fed widely expected to be near the end of its rate hike cycle, this is still providing support for gold in the medium to long term.

Also on the watch this session are speeches from Philadelphia Fed President Harker and Atlanta Fed President Raphael Bostic.

U.S. crude oil edged higher, hitting a near 10-month high of $84.68 a barrel before trading near $84.31 a barrel after a big drawdown in U.S. oil inventories, output cuts by Saudi Arabia and Russia outweighed concerns about slowing demand from Asian powers and expectations that the Federal Reserve is nearing the end of its cycle of raising interest rates.

However, investors are mindful of changes in market sentiment, and if concerns about the economic outlook rise, it could weigh on oil prices in the short term. Oil prices have risen sharply in the short term, and after breaking above the April high of 83.51, there is also a need for confirmation and even the possibility of a deep correction in the short term.

This trading day, focus on OPEC monthly crude oil market report, pay attention to the USD Inflation Rate (JUL) and USDInitial Jobless Claims (JUL).

MHMarkets strategy is only for reference and not for investment advice. Please carefully read the statement at the end of the text. The following strategy will be updated at 15:00 on August 10, Beijing time.

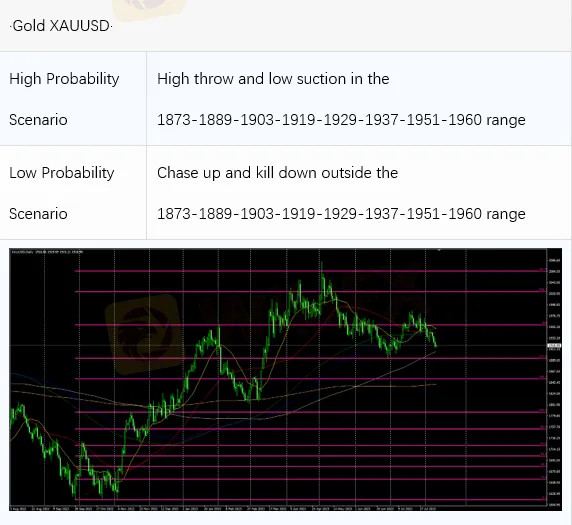

Intraday Oscillation Range: 1873-1889-1903-1919-1929-1937-1951-1960

Overall Oscillation Range: 1730-1756-1780-1801-1817-1833-1856-1873-1889-1903-1919-1929-1937-1951-1960-1977-1985-1998-2007-2016-2033-2046-2057-2066-2077-2089-2097-2100

In the subsequent period of spot gold, 1873-1889-1903-1919-1929-1937-1951-1960 can be operated as the bull and bear range; High throw low suction in the range, chase up and kill down outside the range!

Note: The above strategy was updated at 15:00 on August 10. This policy is a daytime policy. Please pay attention to the policy release time.

Intraday Oscillation Range: 20.6-21.5-22.3-23.1-23.9-24.5

Overall Oscillation Range: 19.7-20.1-20.6-21.5-22.3-23.1-23.9-24.5-25.3-26.1-26.6-27.3

In the subsequent period of spot silver, 20.6-21.5-22.3-23.1-23.9-24.5 can be operated as the bull and bear range. High throw and low suction in the range, chase up and kill down outside the range!

Note: The above strategy was updated at 15:00 on August 10. This policy is a daytime policy. Please pay attention to the policy release time.

Intraday Oscillation Range: 79.9-80.7-82.3-83.5-85.3-87.3-89.1

Overall Oscillation Range:

62.1-63.7-64.5-65.8-66.9-67.3-68.9-70.1-71.2-72.3-73.1-73.8-75.1-77.9-78.5-79.9-80.7-82.3-83.5-85.3-87.3-89.1-90.7

In the subsequent period of crude oil, 79.9-80.7-82.3-83.5-85.3-87.3-89.1 can be operated as the bull and bear range. High throw and low suction in the range, chase up and kill down outside the range!

Note: The above strategy was updated at 15:00 on August 10. This policy is a daytime policy. Please pay attention to the policy release time.

Intraday Oscillation Range: 1.0755-1.0830-1.0950-1.1157-1.1220

Overall Oscillation Range: 1.0290-1.0360-1.0460-1.0570-1.0690-1.0755-1.0830-1.0950-1.1157-1.1220-1.1303-1.13340

In the subsequent period of EURUSD, 1.0755-1.0830-1.0950-1.1157-1.1220 can be operated as the bull and bear range. High throw and low suction in the range, chase up and kill down outside the range!

Note: The above strategy was updated at 15:00 on August 10. This policy is a daytime policy. Please pay attention to the policy release time.

Intraday Oscillation Range: 1.25460-1.26505-1.27000-1.28200-1.29300

Overall Oscillation Range: 1.1610-1.1830-1.1920-1.2030-1.2135-1.2250-1.2375-1.2400-1.2470-1.25460-1.26505-1.27000-1.28200-1.29300-1.30000-1.30600-1.31000-1.31660-132000

In the subsequent period of GBPUSD, 1.25460-1.26505-1.27000-1.28200-1.29300 can be operated as the bull and bear range. High throw and low suction in the range, chase up and kill down outside the range!

Note: The above strategy was updated at 15:00 on August 10. This policy is a daytime policy. Please pay attention to the policy release time.

Read more

MHMarkets:2024.03.29 MHM European Time Analysis

Fed Governor Christopher Waller's recent comments have highlighted a cautious stance towards adjusting interest rates, marking a significant moment for the financial markets.

MHMarkets:2024.03.28 MHM European Time Analysis

In the forex market, stability was the theme for the U.S. dollar index, holding firm at 104.30. Minor fluctuations were observed across major currency pairs: the Euro slightly weakened against the dollar, closing at 1.0827

MHMarkets:2024.03.27 MHM European Time Analysis

In the latest market wrap focusing on the foreign exchange sector, the U.S. dollar index showed minimal movement, holding at 104.31.

MHMarkets:March 27, 2024 Economic Highlights

On Tuesday, due to February's US durable goods orders growth exceeding expectations and an optimistic economic growth outlook for the first quarter in the US, the US dollar index initially fell but then rose, briefly touching below the 104 mark before recovering during the US trading session, closing up 0.07% at 104.29.

WikiFX Broker

Latest News

Forex 101: Welcome to the $7.5 Trillion Beast

Commodities Focus: Gold Pulls Back & Silver targets Retail Traders

Fed Holds Firm: January Rate Cut Hopes Fade Despite Cooling CPI

Oil Surge: WTI Reclaims $60 as Middle East Tensions Override Venezuela Deadlock

TopWealth Trading User Reviews: A Complete Look at Real Feedback and Warning Signs

ThinkMarkets Regulation: Safe Trading or Risky Broker?

ehamarkets Review 2026: Regulation, Score and Reliability

8xTrade Review 2025: Safety, Features, and Reliability

VEBSON Review 2025: Is This Broker Safe or a Potential Scam?

Seacrest Markets Under Fire Over Withholding Salaries and IB Payments

Rate Calc