Gold to forget about bad times? Forecast as of 29.08.2023

Abstract:The gold response to the important economic events should have resulted in price growth amid the expectations for the cooling of the US economy and the end of the Fed’s monetary tightening cycle. However, the eventual result will depend on the actual data. Let's talk about this topic and draw up a trading plan.

The gold response to the important economic events should have resulted in price growth amid the expectations for the cooling of the US economy and the end of the Feds monetary tightening cycle. However, the eventual result will depend on the actual data. Let's talk about this topic and draw up a trading plan.

Weekly gold fundamental forecast

To accurately predict the future trajectory of an asset price, it's crucial to observe its reaction to key events. The recent rise in gold prices following the sub-par US PMI data, and its strong performance despite Jerome Powell's aggressive comments at the Jackson Hole gathering, indicate that the value of this precious metal may soon increase.

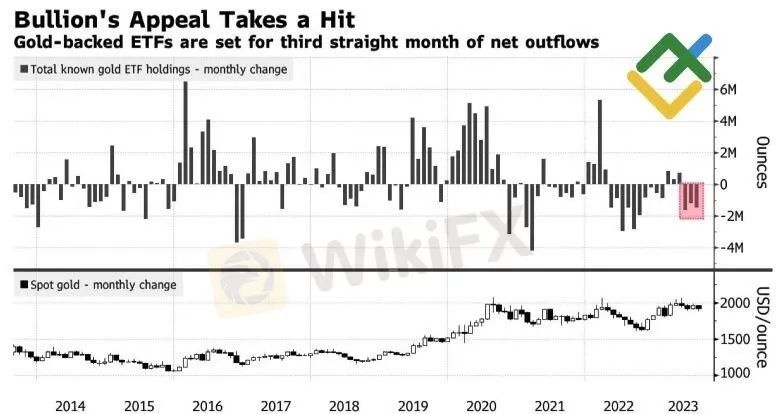

Judging by the 13-week capital outflow from gold ETFs, the longest since November, ETF gold holdings have fallen to their lowest levels since early 2020, and net speculative longs have dropped to the lowest level since March, gold continues falling in value. All the more surprising are the results of the MLIV Pulse survey. The median estimate of more than 600 investors assumes prices will rise to $2021 an ounce in 12 months.

Dynamics of ETF holding and gold prices

As the main drivers of the XAUUSD rally, respondents named the end of the Fed's monetary tightening cycle, geopolitical tensions, including between the US and China, the war in Ukraine, and active gold purchases by central banks. The factor of using gold as a portfolio diversification tool is also quite important. When stocks and bonds move in the same direction, adhering to the classic 60/40 rule is difficult. One needs an asset whose prices change differently.

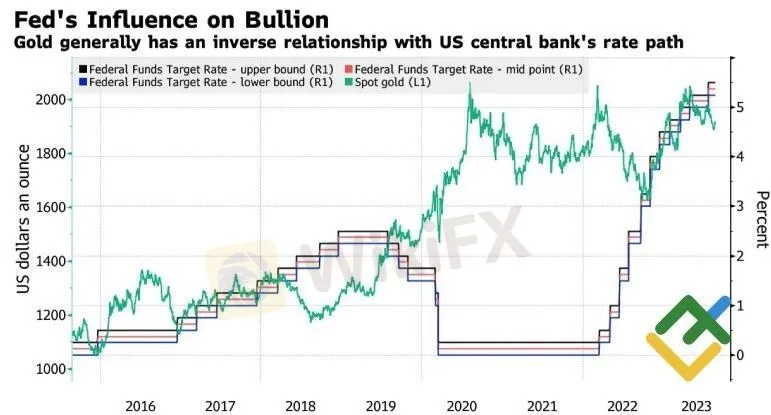

And yet, the main advantage of the XAUUSD bulls is the belief that the Fed should soon bring the inflation rate to its target. History shows that the completion of a monetary restriction cycle followed by a dovish shift creates a tailwind for the precious metal.

Dynamics of Fed rates and gold prices

The point of discussion is the uncertain nature of the Federal Reserve's (Fed) future actions - whether it will further tighten the money supply or put a halt to it. The decision is dependent on incoming data, particularly concerning the U.S. job market and inflation rates. The job market reports form an indicator of the U.S. economy's health. Issues related to employment will potentially hint at a deceleration in Gross Domestic Product (GDP). In this case, we can expect a decrease in Treasury yields and the U.S. dollar value, while triggering a surge in gold prices, possibly to $1950 or above. Interestingly, a prelude to this scenario was the release of weak PMI data, which saw an increase in XAUUSD as a result.

On the contrary, a strong US jobs market will increase the risks of an inflation rise. If Americans are not worried about their jobs, they will continue to spend money, thus raising prices. As a result, the Fed will be forced to resume the monetary tightening cycle, and the gold price will return below $1900.

Weekly XAUUSD trading plan

Thus, the US jobs report for August will give a clue to the gold trend. Strong employment of +170,000 or higher, predicted by Bloomberg experts, will encourage investors to sell the XAUUSD towards 1900 and 1880. A weak report will become a reason for buying with the targets of 1950 and 1970. Before the important data release, the gold price is likely to consolidate.

Read more

What Impact on the Forex Market as Former Philippine President Rodrigo Duterte is Arrested.

The sudden arrest of former Philippine President Rodrigo Duterte on an International Criminal Court (ICC) warrant has sent shockwaves through global markets and regional investors alike. While Duterte’s arrest is being hailed by human rights groups as a decisive step toward accountability for his controversial “war on drugs,” it also raises significant questions about factors that can strongly influence the forex market.

How Can Fintech Help You Make Money?

Fintech – short for financial technology – is rapidly transforming the way people manage, invest, and even earn money. In this article, we’ll explore various ways fintech can help you make money, from smarter investing to launching a side hustle, while also reducing costs and boosting your financial health.

What’s the Secret in Trading Chart Behind 90% Winning Trades?

Discover the secret to 90% winning trades with chart patterns, indicators, and pro strategies. Master trading charts for consistent wins!

What Impact on Investors as Oil Prices Decline?

Oil prices have come under pressure amid mounting concerns over U.S. import tariffs and rising output from OPEC+ producers. With tariffs on key trading partners and supply increases dampening fuel demand expectations, investor appetite for riskier assets has cooled. This shift in sentiment poses a range of implications for different segments of the investment landscape.

WikiFX Broker

Latest News

Beware: Online Share Buying Scam Costs 2,791,780 PHP in Losses

5 things I wish someone could have told me before I chose a forex broker

Unmasking a RM24 Million Forex Scam in Malaysia

U.S., Germany, and Finland Shut Down Garantex Over Money Laundering Allegations

What Impact on Investors as Oil Prices Decline?

Gold Prices Fluctuate: What Really Determines Their Value?

Dollar Under Fire—Is More Decline Ahead?

Plunging Oil Prices Spark Market Fears

Celebrate Ramadan 2025 with WelTrade & YAMarkets

WikiFX App Version 3.6.4 Release Announcement

Rate Calc