MHMarkets:The US dollar was generally shaky in Asian trading, while other currencies and precious metals and the US dollar maintained a shaky pace!

Abstract:On Thursday (September 28th), the overall trend of the US dollar index is fluctuating when the Asian market closed, and the current price is around 106.72

Market Overview

On Thursday (September 28th), the overall trend of the US dollar index is fluctuating when the Asian market closed, and the current price is around 106.72; Since yesterday's decline, gold has been supported at the bottom and is currently in a correction and consolidation state, with prices around 1874.3; Crude oil accelerated its upward trend after the opening of today's Asian session, but the momentum was not strong. It is currently undergoing a correction and consolidation process, and the current price is around 93.41; The EURUSD closed in the Asian session, with fluctuations also showing a sideways consolidation process, but the upward force of the EURUSD remains strong; After the sharp rise of the USDJPY yesterday, there has been a correction in the Asian session, but the support force below is still strong, with current prices around 149.42.

MHMarkets strategy is only for reference and not for investment advice. Please carefully read the statement at the end of the text. The following strategy will be updated at 15:00 on September 28, Beijing time.

·Gold XAUUSD· | |

Resistance | 1973-1905-1849 |

Support | 1973-1905-1849-1795 |

In the subsequent period of spot gold, the current price of gold is in a sideways consolidation state. Near 1884.7 above is the closest upper resistance, while 1871 below is the closest support below. The future market will be judged by whether to break through the upper and lower resistance levels; Note: The above strategy was updated at 15:00 on September 28. This policy is a daytime policy. Please pay attention to the policy release time. | |

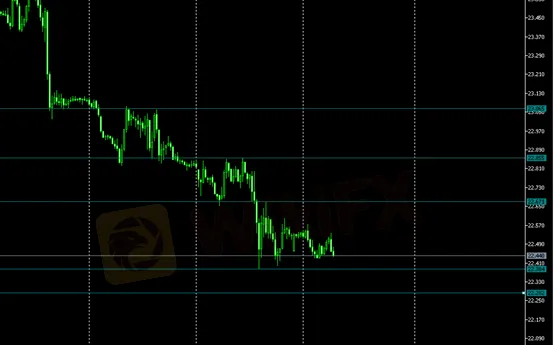

·SilverXAGUSD· | |

Resistance | 22.67—22.85—23.06 |

Support | 21.38—22.28 |

Silver is currently in a retracement consolidation after meeting support below yesterday. The future market will be judged by whether to break through the upper and lower support and resistance; Note: The above strategy was updated at 15:00 on September 28. This policy is a daytime policy. Please pay attention to the policy release time. | |

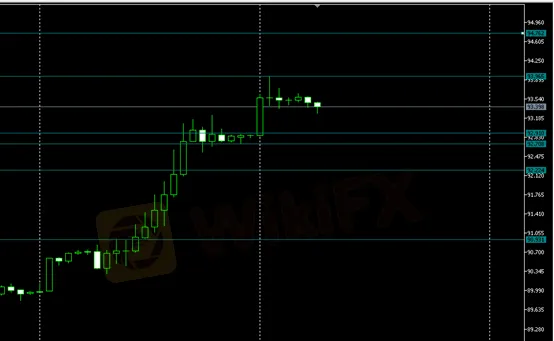

·Crude OilUSOUSD· | |

Resistance | 93.96—94.76 |

Support | 92.92—92.70—92.22—90.93 |

US crude oil rose sharply in yesterday's market and broke past resistance levels. After the opening of the Asian trading session, US crude oil quickly probed upward, and is currently in a state of consolidation. US crude oil in the future market will be judged by whether to break through the upper and lower support and resistance; Note: The above strategy was updated at 15:00 on September 28. This policy is a daytime policy. Please pay attention to the policy release time. | |

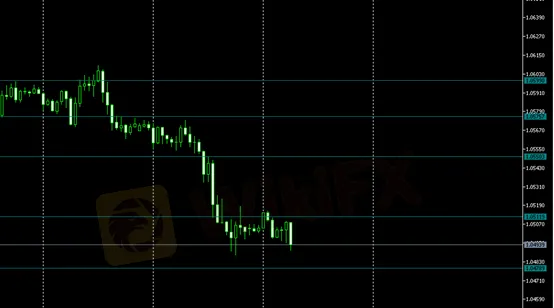

·EURUSD· | |

Resistance | 1.0511—1.0550—1.0575—1.0599 |

Support | 1.0478—1.0438 |

The EURUSD yesterday's market plunge, today in the Asian trading session was consolidation downward trend. The EURUSD in the future market will be judged by whether to break through the upper and lower support and resistance; Note: The above strategy was updated at 15:00 on September 28. This policy is a daytime policy. Please pay attention to the policy release time. | |

·GBPUSD· | |

Resistance | 1.2146—1.2163—1.2191 |

Support | 1.2109--1.2098 |

The GBPUSD in yesterday's market was shocked to the downside, today's judgment of the GBPUSD first rise and then fall. The operation of the future market will be judged by whether to break through the upper and lower support and resistance; Note: The above strategy was updated at 15:00 on September 28. This policy is a daytime policy. Please pay attention to the policy release time. | |

Read more

MHMarkets:2024.03.29 MHM European Time Analysis

Fed Governor Christopher Waller's recent comments have highlighted a cautious stance towards adjusting interest rates, marking a significant moment for the financial markets.

MHMarkets:2024.03.28 MHM European Time Analysis

In the forex market, stability was the theme for the U.S. dollar index, holding firm at 104.30. Minor fluctuations were observed across major currency pairs: the Euro slightly weakened against the dollar, closing at 1.0827

MHMarkets:2024.03.27 MHM European Time Analysis

In the latest market wrap focusing on the foreign exchange sector, the U.S. dollar index showed minimal movement, holding at 104.31.

MHMarkets:March 27, 2024 Economic Highlights

On Tuesday, due to February's US durable goods orders growth exceeding expectations and an optimistic economic growth outlook for the first quarter in the US, the US dollar index initially fell but then rose, briefly touching below the 104 mark before recovering during the US trading session, closing up 0.07% at 104.29.

WikiFX Broker

Latest News

Arena Capitals User Reputation: Looking at Real User Reviews and Common Problems

What Will US-Iran War Affect Stock Market: A Comprehensive Investor's Guide to 2026

Is FINOWIZ Safe or Scam? 2026 Deep Dive into Its Reputation and User Complaints

FX Deep Dive: Dollar King Returns as Energy Shock Splits G10 Currencies

The 25-Day Tipping Point: Energy Markets Stare Down a Hormuz Blockade

Eightcap Review: Understanding Fees, Features, and Important User Warnings

Exnova Review 2026: Is this Forex Broker Legit or a Scam?

Stop Letting Your Trading Rewards Gather Dust: A Limited-Time 30% Opportunity

Middle East Escalation Rocks Markets: Oil Surges while Brokers Tighten Leverage

Moneycorp Problems Exposed: Fund Transfer Failures & Customer Support Complaints

Rate Calc