FX Analysis – Yields and USD rise again, AUD clobbered, JPY intervention?

Abstract:The first week of the new quarter has so far been an interesting one, rampant US treasury yields breaking out to 16-year highs, a USD that just keeps going up and now it seems the Japanese Ministry of Finance is directly intervening in currency markets.

The first week of the new quarter has so far been an interesting one, rampant US treasury yields breaking out to 16-year highs, a USD that just keeps going up and now it seems the Japanese Ministry of Finance is directly intervening in currency markets.

USD rose to a high of 107.35 on the back of a surge in yields and a hawkish US JOLTS report which showed the US labor markets resilience. Fed member Mester also spoke noting the Fed will likely need to hike rates one more time this year adding to the higher for longer narrative. The USD did dip later in the session on what seemed to be a Japanese FX intervention, DXY still holding the key 107 level though.

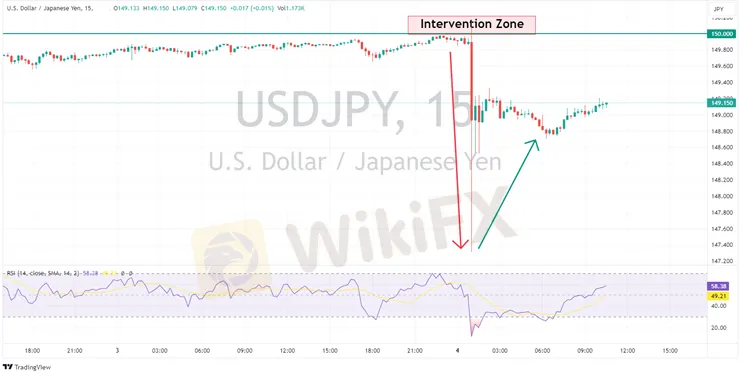

JPY was again weak early in the session with USDJPY hitting a high of 150.16 , above the “line in the sand” at 150. The weakness dramatically reversed on what could only be a BoJ intervention in the FX market seeing USDJPY sharply move lower 3 big figures in a heartbeat, hitting a low of 147.31. There has been no official confirmation this was an intervention but with recent jaw boning from Japanese officials threatening just that, it seems obvious it was. USDJPY recovered after the dust settled to reclaim the 149 level, but from my experience this wont be the last intervention so USDJPY longs should tread with caution from here.

AUD underperformed with the Aussie struggling against a strong USD, sour risk sentiment and post RBA where the Aussie Central Bank kept rates on hold and gave nothing extra for the hawks in their statement. AUDUSD dipped below 0.63 before finding some support around the Nov 22 lows and retaking the 0.63 support level for now.

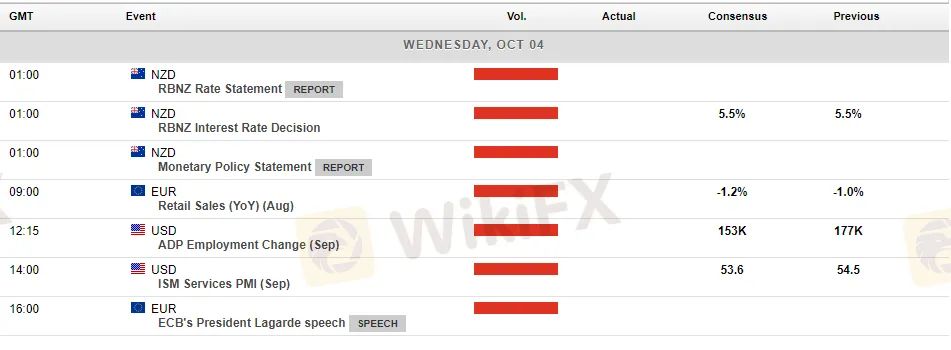

Todays economic announcements:

Read more

Zenstox Review: Do Traders Face Withdrawal Blocks & Fund Scams?

Does Zenstox give you good trading experience initially and later scam you with seemingly illicit contracts? Were you asked to pay an illegitimate clearance fee to access fund withdrawals? Drowned financially with a plethora of open trades and manipulated execution? Did you have to open trades when requesting Zenstox fund withdrawals? You have allegedly been scammed, like many other traders by the Seychelles-based forex broker. In this Zenstox review article, we have investigated multiple complaints against the broker. Have a look!

Smart Trader Exposure: Login Glitches, Withdrawal Delays & Scam Allegations

Did your Smart Trader forex trading account grow substantially from your initial deposit? But did the forex broker not respond to your withdrawal request? Failed to open the Smart Trader MT4 trading platform due to constant login issues? Does the list of Smart Trader Tools not include the vital ones that help determine whether the reward is worth the risk involved? Have you witnessed illegitimate fee deduction by the broker? These issues have become too common for traders, with many of them criticizing the broker online. In this article, we have highlighted different complaints against the forex broker. Take a look!

Investing24.com Review – Can Traders Trust the App Data for Trading?

Does trading on Investing24.com data cause you losses? Do you frequently encounter interface-related issues on the Investing24.com app? Did you witness an annual subscription charge at one point and see it non-existent upon checking your forex trading account? Did the app mislead you by charging fees for strong buy ratings and causing you losses? You are not alone! Traders frequently oppose Investing24.com for these and more issues. In this Investing24.com review article, we have examined many such complaints against the forex broker. Have a look!

Gold Price Surges Above $4,600 as Fed Rate-Hold Bets Offset Fading Safe-Haven Demand

Gold prices climb above $4,600 after rebounding from recent losses. US jobless claims reinforce Fed rate-hold expectations, while easing geopolitical tensions limit safe-haven demand.

WikiFX Broker

Latest News

Forex 101: Welcome to the $7.5 Trillion Beast

Commodities Focus: Gold Pulls Back & Silver targets Retail Traders

Fed Holds Firm: January Rate Cut Hopes Fade Despite Cooling CPI

Oil Surge: WTI Reclaims $60 as Middle East Tensions Override Venezuela Deadlock

TopWealth Trading User Reviews: A Complete Look at Real Feedback and Warning Signs

ThinkMarkets Regulation: Safe Trading or Risky Broker?

ehamarkets Review 2026: Regulation, Score and Reliability

8xTrade Review 2025: Safety, Features, and Reliability

VEBSON Review 2025: Is This Broker Safe or a Potential Scam?

Seacrest Markets Under Fire Over Withholding Salaries and IB Payments

Rate Calc