FX Analysis – Yield spike on hot retail sales fails to lift USD, AUD outperforms, JPY , NZD.

Abstract:On Tuesday, despite a significant rise in treasury yields driven by better-than-expected US retail sales figures (which increased by 0.7% month-on-month compared to the expected 0.3%), the US dollar (USD) remained within a narrow trading range.

On Tuesday, despite a significant rise in treasury yields driven by better-than-expected US retail sales figures (which increased by 0.7% month-on-month compared to the expected 0.3%), the US dollar (USD) remained within a narrow trading range. The Dollar Index (DXY) experienced sharp fluctuations, reaching a high of 106.52 initially in response to the retail sales data, but quickly retracing gains and hitting a low of 106.02. Federal Reserve (Fed) member Barkin also commented that the Federal Open Market Committee (FOMC) would have a thorough discussion concerning the possibility of a Fed rate hike at their November meeting. In the coming days, market participants should expect to hear from more Fed speakers, including Chair Powell on Thursday. Additionally, any update on geopolitical events will be closely monitored by USD traders.

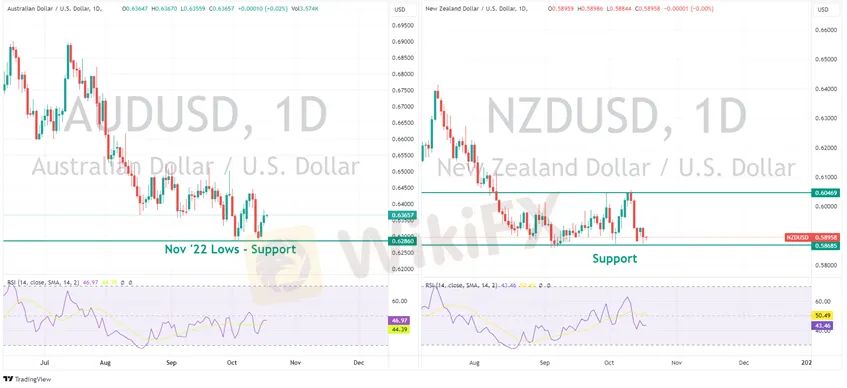

AUD and NZD were divergent on Tuesday, with the Aussie the G10 outperformer and the Kiwi the laggard. AUDUSD continuing its bounce off the major support at 0.6286 to rally to a high of 0.6380, helped along by what was seen as hawkish RBA minutes released during the session. NZDUSD on the other hand struggled after a not as hot as expected NZ CPI, NZDUSD dipping to test the October lows at 0.5871 before finding some support..

AUDNZD surged higher, retaking the key 1.07 level and within a whisker of also breaching 1.08

JPY faltered against the USD despite seeing strength early in the session after a Bloomberg report that the BoJ was considering revising their inflation forecasts higher. The surge in the Yen swiftly faded with yield differentials pushing USDJPY higher, to hover just below the 150 “intervention zone”

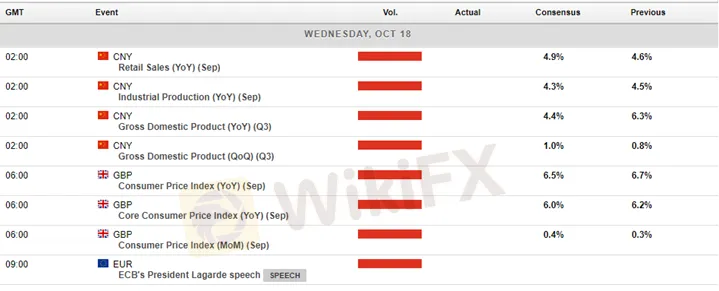

Check Todays calendar below:

Read more

WikiFX Trending Topics Analyst Initiative

Share Your Expertise on What’s Moving the Market.

Effective Stop Loss Trading Strategies

In a forex market where fundamental and technical factors impact the currency pair prices, volatility is expected. If the price volatility acts against the speculation made by traders, it can result in significant losses for them. This is where a stop-loss order comes to their rescue. It is one of the vital investment risk management tools that traders can use to limit potential downside as markets get volatile. Read on as we share its definition and several strategies you should consider to remain calm even as markets go crazy.

Exchange Rate Fluctuations: Key Facts Every Forex Trader Should Know

The forex market is a happening place with currency pairs getting traded almost non-stop for five days a week. Some currencies become stronger, some become weaker, and some remain neutral or rangebound. If you talk about the Indian National Rupee (INR), it has dipped sharply against major currencies globally over the past year. The USD/INR was valued at around 85-86 in Feb 2025. As we stand in Feb 2026, the value has dipped to over 90. The dip or rise, whatever the case may be, impacts our daily lives. It determines the price of an overseas holiday and imported goods, while influencing foreign investors’ perception of a country. The foreign exchange rates change constantly, sometimes multiple times a day, amid breaking news in the economic and political spheres globally. In this article, we have uncovered details on exchange rate fluctuations and key facts that every trader should know regarding these. Read on!

ACY Securities Deposit and Withdrawal: The Complete 2025 Guide (Fees, Methods & User Warnings)

Understanding how to add funds to your account and, more importantly, how to take them out is essential for safe trading. For any trader thinking about ACY Securities, making an ACY SECURITIES deposit is simple, but the ACY SECURITIES withdrawal process has many serious complaints and concerns. While ACY says it is an established, regulated broker, many users have complained specifically about withdrawal problems, creating a confusing and often contradictory picture. This guide provides a complete and critical analysis. We will first explain the official steps for deposits and withdrawals, including methods, fees, and stated timelines. We will then take a deep look at patterns found in over 180 real user complaints, examining the potential warning signs and risks. By combining official information with real-world user experiences and regulatory warnings, this article aims to give you the clarity needed to make an informed decision about the safety of your funds with ACY Securities.

WikiFX Broker

Latest News

Arena Capitals User Reputation: Looking at Real User Reviews and Common Problems

What Will US-Iran War Affect Stock Market: A Comprehensive Investor's Guide to 2026

Is FINOWIZ Safe or Scam? 2026 Deep Dive into Its Reputation and User Complaints

FX Deep Dive: Dollar King Returns as Energy Shock Splits G10 Currencies

The 25-Day Tipping Point: Energy Markets Stare Down a Hormuz Blockade

Eightcap Review: Understanding Fees, Features, and Important User Warnings

Exnova Review 2026: Is this Forex Broker Legit or a Scam?

Stop Letting Your Trading Rewards Gather Dust: A Limited-Time 30% Opportunity

Middle East Escalation Rocks Markets: Oil Surges while Brokers Tighten Leverage

Moneycorp Problems Exposed: Fund Transfer Failures & Customer Support Complaints

Rate Calc