The Most Complained Brokers in the United States in November!

Abstract:In this article, WikiFX will reveal nine forex brokers that have received the most complaints in the United States in November 2023.

In this article, WikiFX will reveal nine forex brokers that have received the most complaints in the United States in November 2023.

Several brokers faced complaints in November 2023, raising concerns about their practices and reliability. This article focuses on the most complained brokers during that month, as reported by WikiFX.

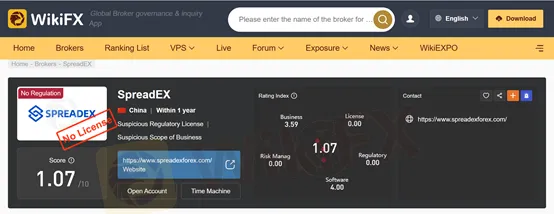

WikiFX Rating: 1.07/10

Number of Complaints in November: 1

Yun Shang Hui Xin Limited (YSHX) is an international investment service provider dedicated to serving both institutional and retail customers worldwide. With its focus on risk control and a pass-on scheme, Yun Shang Hui Xin aims to meet the needs of retail customers and international financial institutions.

However, it is important to note that Yun Shang Hui Xin Limited, operating under the name YSHX, currently lacks valid regulation. The regulatory status of NFA is reported as abnormal, with an official regulatory status marked as Unauthorized.

WikiFX Rating: 1.23/10

Number of Complaints in November: 1

According to its website, ElastosTrade is an industry-leading decentralized asset management company with a unique investment structure since 2019. ElastosTradet focuses on AGRO IMPORT/EXPORT, NFTs, and FOREX. This broker is an unregulated broker, which is not safe for you to invest with.

WikiFX Rating: 1.07/10

Number of Complaints in November: 1

SpreadEX is a newly-established broker and it does not hold a regulatory license. It would help if you avoided this broker as much as you can. Even worse, we already received a complaint against this broker. WikiFX warns you of the potential risk.

WikiFX Rating: 1.02/10

Number of Complaints in November: 1

This broker is also newly founded. It doesnt hold a regulatory license. Moreover, we cannot open its website, which shows us a sign of danger.

WikiFX Rating: 1.54/10

Number of Complaints in November: 4

KOT4X, a trading name of KOT4X Ltd., is a crypto and forex broker registered in Saint Vincent and the Grenadines that aims to provide investors with 250+ instruments with flexible leverage up to 1:500 and floating spreads from 0.4 pips on the MT4 trading platforms via four different live account types, as well as 24/7 customer support service.

WikiFX Rating: 1.30/10

Number of Complaints in November: 4

Olymphubs is a solution for creating an investment management platform. It is suited for hedge or mutual fund managers and also Forex, stocks, bonds, and cryptocurrency traders who are looking at running a pool trading system. Online trader simplifies the investment, monitoring, and management process. This firm was registered in the United Kingdom. As far as we know, this broker does not hold a legitimate license. Investing in an unregulated broker is extremely risky as no one can hold them accountable once your money is gone.

WikiFX Rating: 1.45/10

Number of Complaints in November: 4

FxBitCapital is an unregulated forex broker, providing trading services and facilities to both retail and institutional clients in more than 180 countries. The broker offers Contracts for Difference (CFDs) on 6 asset classes: Forex, Shares, Spot Indices, Futures, Spot Metals and Spot Energies through the industry-standard MT4 platform.

WikiFX Rating: 1.23/10

Number of Complaints in November: 8

WEEX, an online trading service based in China, purports to offer financial market trading to interested traders. However, it's crucial to note that the accessibility of the WEEX website is currently inaccessible, rendering it difficult to verify the broker's regulatory status or authenticity. Furthermore, the broker is not under any valid regulation from any authoritative bodies currently.

WikiFX Rating: 1.33/10

Number of Complaints in November: 19

Omega Pro is a UK-based forex brokerage firm that has been operating for two years. They offer trading in Forex, CFDs, and cryptocurrencies, and claim to provide their clients with access to a range of trading platforms and tools. Omega Pro offers trading in Forex, CFDs, and cryptocurrencies, including popular currency pairs like EUR/USD, GBP/USD, and USD/JPY, major cryptocurrencies like Bitcoin and Ethereum, and CFDs on indices, commodities, and shares.

Read more

JustForex vs JustMarkets: A Comprehensive Comparison in 2025

Selecting the right forex broker can make the difference between trading success and frustration for most investors, especially retail investors. As retail traders gain unprecedented access to global markets, the choice between platforms like JustForex and JustMarkets becomes increasingly significant. Both brokers offer some shining features within the forex and CFD trading space, but their approaches differ in some areas.

CPT Markets Secures UAE SCA License for FX and CFDs Services

CPT Markets’ UAE subsidiary, CPT MENA, secures an SCA Category Five license, expanding its FX and CFDs services in the region. Learn more about its UAE growth.

FCA Warns of Trading212 Clone Scam Targeting Investors

FCA alerts investors about a Trading212 clone scam using fake details. Learn how to spot clones and protect your funds with the WikiFX app.

Vault Markets Review 2025: Live & Demo Accounts, Withdrawal to Explore

Vault Markets, a South African-based broker, has attracted much attention in recent days, particularly within its region. This online broker only offers access to focused trading opportunities on Indices, Currencies, Energies, and Metals, yet it shines on low minimum deposits plus various bonus programmes, which would encourage more investors, especially beginners, to trade with a small budget. However, Vault Markets operates outside of the authorized scope, so we don't consider it solid to trade with.

WikiFX Broker

Latest News

Forex Trading: Scam or Real Opportunity?

The Hidden Tactics Brokers Use to Block Your Withdrawals

Beware: Online Share Buying Scam Costs 2,791,780 PHP in Losses

5 things I wish someone could have told me before I chose a forex broker

Unmasking a RM24 Million Forex Scam in Malaysia

U.S., Germany, and Finland Shut Down Garantex Over Money Laundering Allegations

Gold Prices Fluctuate: What Really Determines Their Value?

Dollar Under Fire—Is More Decline Ahead?

What Impact on Investors as Oil Prices Decline?

Is the North Korea's Lazarus Group the Biggest Crypto Hackers or Scapegoats?

Rate Calc