MHMarkets:

Abstract:At the end of the Asian market on Monday (December 11), the employment situation report released by the US Department of Labor last Friday evening showed that the US non-farm payrolls was stronger than market expectations in November, and the unemployment rate also decreased by 0.2 percentage points.

December 11, 2023-MHM European Perspective

Non-farm payrolls are sharply favorable, and the Fed's path to rate cuts buried hidden dangers.

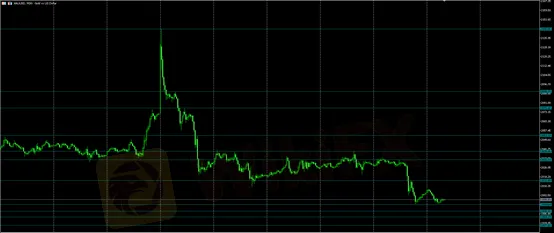

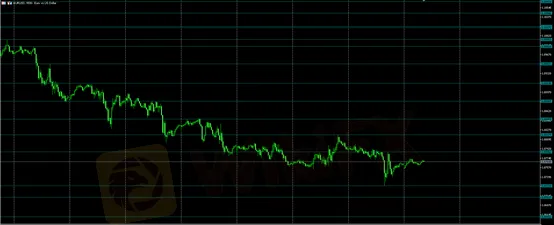

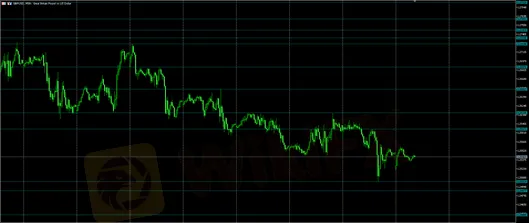

At the end of the Asian market on Monday (December 11), the employment situation report released by the US Department of Labor last Friday evening showed that the US non-farm payrolls was stronger than market expectations in November, and the unemployment rate also decreased by 0.2 percentage points. Specific data shows that the US non-farm payrolls increased by 199,000 people after the November quarterly adjustment, which was stronger than the market expectation of 180,000 people. This indicates that the labor market remains strong as the Fed attempts to slow down economic growth. The US November unemployment rate recorded 3.7%, which was the lowest level in nearly four months, and was a decrease of 0.2 percentage points from 3.9% in October. After the data was released, the US dollar index experienced intense fluctuations in the short term, and until Friday's close, the US dollar index had not yet formed an effective market trend. At the opening of the Asian market today, the US dollar index fluctuated slightly, with a current price around 104.05. Gold fell sharply in the market on Friday due to the impact of US non-farm payrolls data, and showed a structural downward trend. It closed near the intraday low on Friday. At the opening of the Asian market today, gold prices continued to decline, with the current price around 1997.93. US crude oil has been continuously declining in the market recently due to the impact of market supply fundamentals. If the fundamentals do not change, it is difficult for crude oil to change its current trend. Last Friday, US crude oil fluctuated upwards overall for the day, but was consistently included in last Wednesday and did not form a structural upward trend, ultimately closing near the intraday high. At the opening of the Asian market today, US crude oil continued to rise slightly, with a current price around 71.91.EURUSD experienced intense fluctuations during the US market period last Friday due to the impact of US non-farm data. However, in response to last Friday's non-farm data, the market has not shown a structural trend. EURUSD closed below the intraday median on Friday. At the opening of the Asian market today, EURUSD saw a slight increase and is currently priced around 10.768. Recently, USDJPY has experienced several major declines in the market due to the influence of the Bank of Japan, reaching a low of around 141.61. Last Friday, USDJPY was affected by the US non-farm payrolls data during the US trading session, and the market fluctuated violently. Before Friday's close, it showed an overall upward trend. At the opening of the Asian market today, USDJPY continued to rise, with a current price around 145.63.

MHMarkets strategy is only for reference and not for investment advice. Please carefully read the statement at the end of the text. The following strategy will be updated at 15:00 on December 11, Beijing time.

| Gold XAUUSD· | |

| Resistance | 2015.09 – 2032.71 – 2039.66 |

| Support | 1994.64 – 1988.93 – 1984.19 |

| |

| Crude Oil USOUSD· | |

| Resistance | 72.73 – 74.24 – 74.81 |

| Support | 70.41 – 69 – 67.11 |

| |

| EURUSD· | |

| Resistance | 1.0786 - 1.0817 - 1.0847 |

| Support | 1.0723 - 1.0701 - 1.0665 |

| |

| GBPUSD· | |

| Resistance | 1.2587 – 1.2613 – 1.2651 |

| Support | 1.2502 - 1.2487 – 1.2448 |

| |

Read more

MHMarkets:2024.03.29 MHM European Time Analysis

Fed Governor Christopher Waller's recent comments have highlighted a cautious stance towards adjusting interest rates, marking a significant moment for the financial markets.

MHMarkets:2024.03.28 MHM European Time Analysis

In the forex market, stability was the theme for the U.S. dollar index, holding firm at 104.30. Minor fluctuations were observed across major currency pairs: the Euro slightly weakened against the dollar, closing at 1.0827

MHMarkets:2024.03.27 MHM European Time Analysis

In the latest market wrap focusing on the foreign exchange sector, the U.S. dollar index showed minimal movement, holding at 104.31.

MHMarkets:March 27, 2024 Economic Highlights

On Tuesday, due to February's US durable goods orders growth exceeding expectations and an optimistic economic growth outlook for the first quarter in the US, the US dollar index initially fell but then rose, briefly touching below the 104 mark before recovering during the US trading session, closing up 0.07% at 104.29.

WikiFX Broker

Latest News

If you haven't noticed yet, the crypto market is in free fall, but why?

Emerging Markets: Nigeria's Debt Market Valuation Hits N99.3 Trillion

JPY In Focus: Takaichi Wins Snap Election to Become Japan's First Female Leader

Amaraa Capital Scam Alert: Forex Fraud Exposure

Vebson Scam Exposure: Forex Withdrawal Failures & Fake Regulation Warning

EGM Securities Review: Investigating Multiple Withdrawal-related Complaints

Galileo FX Exposure: Allegations of Fund Losses Due to Trading Bot-related Issues

Fed Balance Sheet Mechanics: The Silent Risk to Liquidity

Gold Eclipses $5,070 as China Treasury Shift Hammers the Dollar

SkyLine Guide 2026 Thailand — Official Launch of the Judge Panel Formation!

Rate Calc