FAB

Abstract:First Abu Dhabi Bank (FAB), established in 2017 and headquartered in the United Arab Emirates, is a financial institution offering a diverse range of services. While FAB operates without regulation from recognized financial authorities, it provides comprehensive personal and corporate banking, investment banking, and specialized services. The document raises concerns about the legitimacy of FAB due to its unregulated status, emphasizing potential risks for traders, such as limited dispute resolution avenues and questions about fund safety. Despite these concerns, FAB showcases a commitment to customer support, innovative digital solutions, and a broad spectrum of account types, demonstrating its dedication to meeting varied financial needs.

| FAB | Basic Information |

| Company Name | FAB |

| Founded | 2017 |

| Headquarters | United Arab Emirates |

| Regulations | Not regulated |

| Products and Services | Personal Banking, Corporate & Commercial Banking, Investment Banking, Specialized Services |

| Account Types | Current Accounts, Savings Account |

| Customer Support | Personal, Corporate & Investment Banking, Investor Relations, PR and Media, Social Media |

| Education Resources | Market Insights, Investment View, Global Investment Outlook |

Overview of FAB

First Abu Dhabi Bank (FAB), established in 2017 and headquartered in the United Arab Emirates, stands as a prominent financial institution offering a comprehensive suite of banking and financial services. Serving both individual and corporate clients, FAB has positioned itself as a key player in the financial landscape of the region. The bank's services encompass Personal Banking, Corporate & Commercial Banking, Investment Banking, and Specialized Services, providing a holistic approach to meeting diverse financial needs.

In the realm of Personal Banking, FAB offers a range of current and savings accounts, loans tailored to various financial requirements, investment opportunities through wealth management, and a variety of cards with convenient functionalities. The bank has embraced digital transformation, offering a user-friendly online and mobile banking platform that allows clients to manage their finances on the go. FAB's commitment extends to Corporate & Commercial Banking, addressing the intricate financial needs of businesses through trade finance solutions, treasury services, project finance, and investment banking services such as mergers and acquisitions advisory. The bank also caters to specialized needs through Islamic banking, private banking for high-net-worth individuals, and dedicated solutions for small and medium-sized enterprises (SMEs).

Despite concerns raised about its lack of regulation, FAB showcases a commitment to customer support, with accessible helplines for various services, including Personal, Corporate & Investment Banking, and Investor Relations. The bank has integrated digital solutions into its account opening process, allowing for instant account opening through the FAB Mobile app. FAB Rewards, the bank's loyalty program, adds an extra layer of benefit for customers, enhancing the overall banking experience. While the document highlights potential risks associated with FAB's unregulated status, the bank's extensive range of services and commitment to innovation underscore its significance in the financial landscape.

Is FAB Legit?

FAB is not regulated by any recognized financial regulatory authority. As an unregulated broker, it operates without oversight from regulatory bodies that are responsible for ensuring compliance with industry standards and protecting the interests of traders. This lack of regulation raises concerns about the safety and security of funds, as well as the transparency of the broker's business practices.

Trading with an unregulated broker like FAB carries inherent risks. Without regulatory supervision, there may be limited avenues for dispute resolution, and traders may face challenges in seeking recourse in case of any issues or disputes. Additionally, unregulated brokers may not be subject to stringent financial and operational standards, potentially leading to inadequate client fund protection and unfair trading practices.

Pros and Cons

FAB, as a financial institution, presents a mix of advantages and disadvantages. On the positive side, the bank offers a comprehensive range of financial products and services, catering to the diverse needs of both individuals and businesses. The FAB Mobile app facilitates instant account opening, providing a streamlined and convenient banking experience. The inclusion of travel benefits, rewards programs, and specialized services, such as Islamic banking and support for SMEs, adds versatility to its offerings. Additionally, FAB demonstrates a commitment to customer support through various channels, embracing both traditional helplines and a strong social media presence.

However, significant concerns arise due to FAB's unregulated status, as it operates without oversight from recognized financial regulatory authorities. This lack of regulation raises apprehensions about the safety of funds and the transparency of its business practices. Trading with an unregulated broker like FAB carries inherent risks, including limited avenues for dispute resolution and potential challenges in seeking recourse in case of issues. The absence of stringent financial and operational standards could impact client fund protection and may lead to concerns about the fairness of trading practices. Prospective clients must weigh these considerations carefully when deciding whether to engage with FAB for their banking and financial needs.

| Pros | Cons |

|

|

|

|

|

|

|

|

|

Products and Services

FAB, or First Abu Dhabi Bank, provides a comprehensive range of financial products and services catering to diverse customer needs.

Personal Banking:

In the realm of personal banking, FAB offers a variety of current and savings accounts, each equipped with perks such as loyalty programs, digital banking tools, and competitive interest rates. The bank provides tailored loans, including personal loans, car loans, and mortgages, designed to meet different financial requirements. FAB also extends investment opportunities through wealth management solutions, mutual funds, and Islamic banking options. Their range of cards, encompassing debit, credit, and prepaid cards, features convenient functionalities and rewards programs. For the digitally inclined, FAB provides a user-friendly online and mobile banking platform, enabling clients to manage their finances on the go.

Corporate & Commercial Banking:

FAB's corporate and commercial banking services address the intricate financial needs of businesses. This includes trade finance solutions facilitating import/export transactions, treasury services for managing cash flow and financial risks, project finance for large-scale infrastructure projects, and supply chain finance to enhance working capital efficiency. Additionally, FAB offers investment banking services covering capital markets access, mergers and acquisitions advisory, structured finance solutions, and private equity investment opportunities across various sectors.

Investment Banking:

Under the umbrella of investment banking, FAB provides access to capital markets for equity and debt, advisory services for mergers and acquisitions, tailored solutions for complex financing needs through structured finance, and investment opportunities in diverse sectors via private equity.

Specialized Services:

FAB caters to specific financial needs through specialized services. This includes Islamic banking, offering Sharia-compliant products for both individuals and businesses. Private banking services are tailored for high-net-worth individuals, providing personalized wealth management solutions. FAB also supports small and medium-sized enterprises (SMEs) with dedicated banking solutions to foster their growth and success.

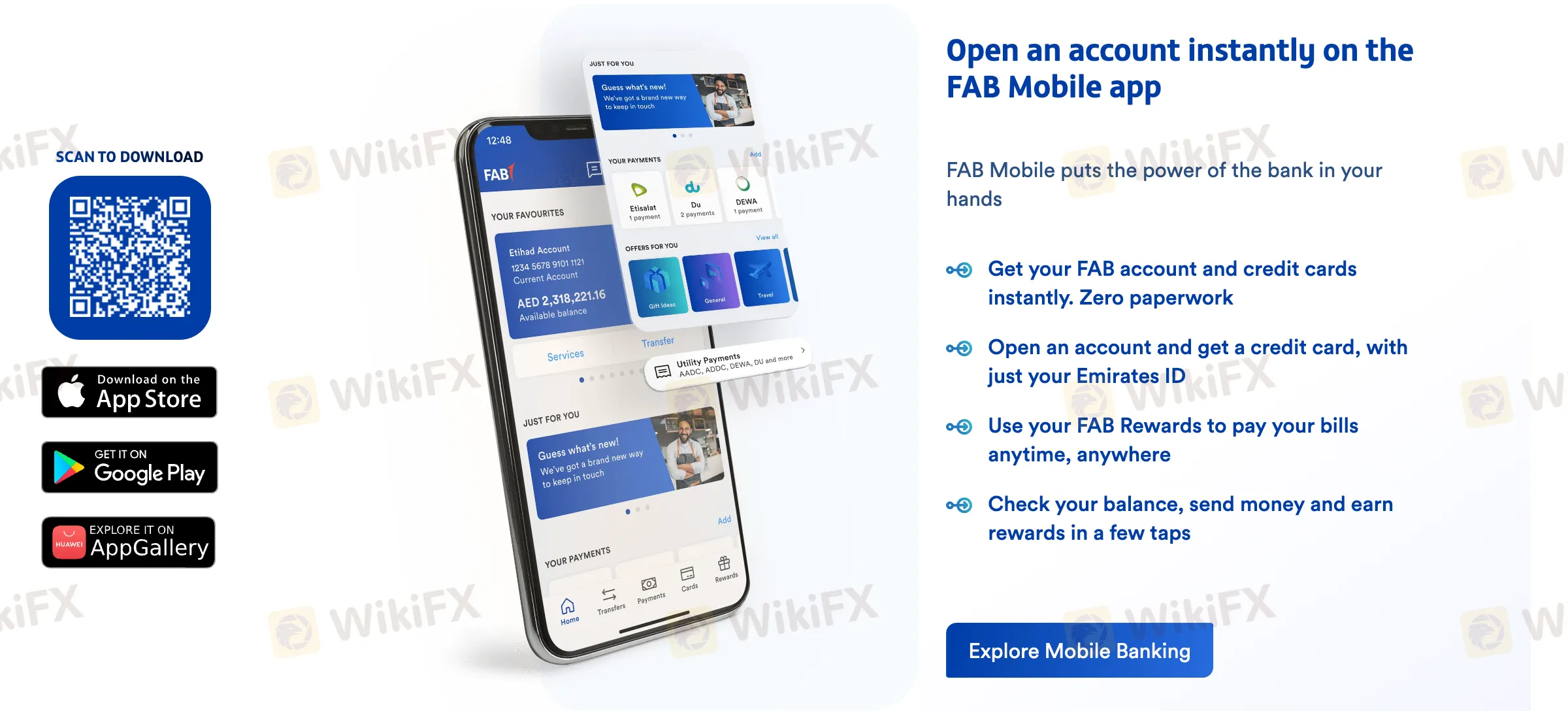

How to Open an Account?

Opening an account with FAB is designed to be a convenient and streamlined process, allowing customers to access banking services effortlessly. The FAB Mobile app plays a key role in empowering users to manage their banking needs efficiently.

Instant Account Opening:

FAB Mobile app enables users to open an account instantly, eliminating the need for extensive paperwork. The process is quick and hassle-free, providing customers with immediate access to essential banking features.

Accessible Credit Cards:

Upon opening an account through the FAB Mobile app, users can also acquire credit cards seamlessly. The accessibility of credit cards is integrated into the account opening process, ensuring that customers have a comprehensive banking solution readily available.

Emirates ID Verification:

The account opening process requires minimal documentation, with a focus on simplicity. Customers can open an account and obtain a credit card by presenting just their Emirates ID, streamlining the verification process and expediting account activation.

FAB Rewards Integration:

FAB Rewards, the bank's loyalty program, adds an extra layer of benefit for customers. Users can leverage their FAB Rewards to conveniently pay bills at any time and from anywhere, enhancing the flexibility and utility of their banking experience.

Mobile Banking Features:

The FAB Mobile app provides a user-friendly interface, enabling customers to check their account balance, initiate money transfers, and earn rewards with just a few taps. This accessibility ensures that users can manage their finances on the go, bringing banking convenience to their fingertips.

By leveraging the FAB Mobile app, customers can experience a modern and efficient approach to account opening, credit card acquisition, and day-to-day banking operations, reflecting FAB's commitment to providing innovative and customer-centric financial services.

Account Types

FAB (First Abu Dhabi Bank) offers a diverse range of account types to cater to the varied needs of its customers, providing a comprehensive banking experience. Whether you are looking for travel benefits, rewards, or a solution for daily expenses, FAB has tailored account options to suit different preferences.

1. Current Accounts with Travel Benefits:

FAB understands the enriching power of travel, and its current accounts offer exciting travel benefits. The FAB Etihad Guest Account combines banking and travel experiences, earning users bonus Etihad Guest miles and providing perks like free international remittance. The FAB One Account, designed for busy lifestyles, offers special offers and discounts from premium retailers, while the Elite Current Account provides superior banking with features like free lounge access.

2. Current Accounts with Rewards:

For those who wish to earn rewards as they spend, FAB's current accounts with rewards are an ideal choice. The FAB One Account, with no minimum balance charges, offers special discounts from premium retailers. The Elite Current Account not only provides free lounge access at selected airports but also offers a free international transfer, catering to expats looking for economical ways to send funds internationally.

3. Current Accounts with Transfer Benefits:

FAB acknowledges the importance of seamless and cost-effective international fund transfers. The FAB Etihad Guest Account, Elite Current Account, and FAB Etihad Guest Elite Account provide options for free international remittances, making them advantageous for expats and individuals with international financial needs.

4. Savings Account:

FAB's Personal Current Account is designed to offer flexibility and convenience in managing daily expenses. It comes with a free debit card and lounge access at selected airports. In addition, FAB provides various savings accounts and investment opportunities to help customers achieve their financial goals, whether it's saving for a dream vacation, buying a car, planning a wedding, or preparing for early retirement.

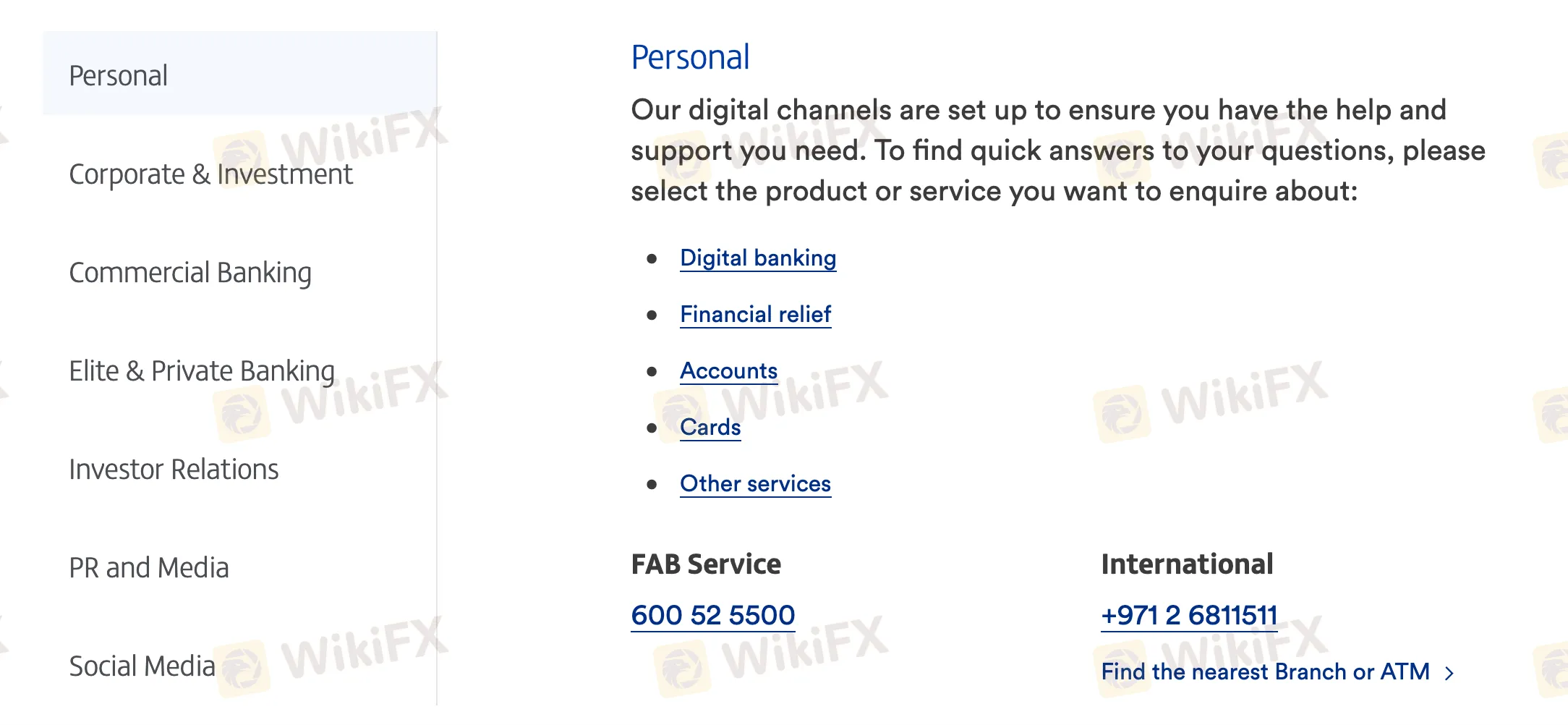

Customer Support

Personal:

FAB's commitment to customer support is evident through its accessible and comprehensive services. For personal banking inquiries, customers can find quick answers to their questions related to digital banking, financial relief, accounts, cards, and other services through various digital channels. The FAB Service helpline is available at 600 52 5500 for national inquiries, while international customers can contact +971 2 6811511. For specific services like the National Housing Loan (NHL), e-Dirham, Ratibi, Payit, POS, and FAB Islamic, dedicated helplines are provided for both UAE and international customers.

Corporate & Investment Banking:

FAB extends robust support to its corporate and investment banking clients through dedicated client service channels. Technical support for Corporate Online Banking channels can be accessed at +971 2 6920766 or tbchannel.support@bankfab.com. For Global Corporate Finance and FIG (Financial Institutions Group) client services, clients can contact gcf@bankfab.com and FIGClientServices@bankfab.com, respectively. The bank also provides specialized services for Government (GOV), International Business Group (IBG) in Abu Dhabi and Dubai, Commercial Banking Group (CBG), Multinational Corporations (MNC) in Abu Dhabi and Dubai. Elite Banking and Private Banking customers have their dedicated helplines, ensuring personalized support.

Customer Services:

For general customer services, FAB has a client service helpline in Abu Dhabi at 600 52 2235 (international: +971 2 499 6700), and email contact at CMB-ClientServices@bankfab.com. Trade-related queries can be directed to +971 4 6079722 or BBGTradeCS@bankfab.com. Elite Banking and Private Banking have their respective helplines, and customer services for Commercial Banking in the UAE and internationally are also available.

Investor Relations:

Investors can reach the Investor Relations team at ir@bankfab.com, and queries related to the registrar can be sent to SFAS-Inquiry@bankfab.com.

PR and Media:

For PR and media inquiries, the dedicated email is prandmedia@bankfab.com.

Social Media:

FAB maintains an active presence on various social media platforms, including Facebook, Instagram, LinkedIn, Twitter, and YouTube. Customers seeking assistance or engagement through social media can connect with FAB on Twitter at @FABConnects or through Facebook Messenger. FAB encourages respectful interactions and provides a platform for customer engagement and support through its social media channels.

Educational Resources

FAB (First Abu Dhabi Bank) is committed to empowering its customers with knowledge and insights, providing educational resources that cater to both corporate and retail clients. The bank's educational offerings are designed to keep clients informed about global economic trends, financial markets, and investment opportunities.

1. Market Insights:

- FAB's research team delivers customer-focused insights on a range of topics, including regional macroeconomics, geopolitical developments, and trends in foreign exchange, rates, credit, and commodity markets. These insights serve as valuable resources for clients seeking a deeper understanding of the factors influencing the financial landscape.

2. Investment View:

- FAB provides a weekly perspective on current investment issues through its “Investment View.” This resource is crafted by the Global Asset Management team, offering clients valuable perspectives on topical investment matters. It serves as a tool for staying updated on market dynamics and making informed investment decisions.

3. Global Investment Outlook:

- Developed by industry experts within FAB, the “Global Investment Outlook” is a comprehensive analysis that examines the current global economic and investment environment. This resource provides insights into overarching trends for the year, helping clients navigate the complexities of the global market and make strategic decisions aligned with their financial goals.

By offering these educational resources, FAB aims to empower its clients with the knowledge needed to make informed financial decisions. Whether clients are interested in market trends, investment strategies, or global economic outlooks, FAB's educational resources serve as a valuable tool for staying informed in a dynamic financial landscape.

Conclusion

In conclusion, First Abu Dhabi Bank (FAB) presents a comprehensive suite of financial products and services, ranging from personal and corporate banking to investment and specialized services. Its commitment to customer support, accessible account opening through the FAB Mobile app, and diverse account options underscore its customer-centric approach. However, notable disadvantages include its unregulated status, raising concerns about fund safety and transparency. Operating without oversight from recognized financial authorities poses inherent risks, potentially impacting dispute resolution avenues and client fund protection. While FAB's offerings cater to a broad spectrum of financial needs, clients should weigh the advantages against the risks associated with its unregulated status.

FAQs

Q: Is FAB regulated by any financial authorities?

A: No, FAB is not regulated by recognized financial regulatory authorities, operating without oversight from regulatory bodies.

Q: What types of accounts does FAB offer?

A: FAB provides a range of accounts, including current accounts with travel, rewards, and transfer benefits, as well as savings accounts.

Q: How can I open an account with FAB?

A: FAB offers a streamlined account opening process through the FAB Mobile app, allowing for instant account opening with minimal documentation.

Q: What educational resources does FAB provide?

A: FAB offers educational resources, including market insights, investment views, and a global investment outlook, designed to keep clients informed about global economic trends and investment opportunities.

Q: Does FAB offer services for small and medium-sized enterprises (SMEs)?

A: Yes, FAB supports SMEs with dedicated banking solutions to foster their growth and success.

Read more

Spec Trading Blocks Withdrawals on Big Profits

Spec Trading blocks profit withdrawals and traps funds. Victims face denied payouts—avoid Spec FX, read reviews, protect money now!

GFS Review: Reported Allegations of Fund Scams & Withdrawal Denials

Received a withdrawal notification from GFS, but the amount could not be credited to your wallet despite numerous follow-ups with the Australia-based forex broker? Did you witness massive slippage in your stop-loss settings or pay high transaction fees charged by the broker? Did the broker delete and deactivate your trading account without any explanation? The Internet is flooded with negative GFS reviews for these and many more alleged trading activities by the broker. Let’s begin examining all of these in this article.

Multibank Group UAE & Azerbaijan Scam Case – LATEST

Multibank Group forex scam cases reveal denied $70K+ withdrawals in the UAE & Azerbaijan. Stay alert with the WikiFX App and avoid risky forex brokers.

Ingot Broker Victims: $3K/$3200 Profits Stolen LATEST

Ingot Broker scam alert: Kenya victim lost $3K profit ($600 dep); Pakistan $3,200→$179 ($250 dep); HK halted post-2018. Avoid fraud—check WikiFX cases now!

WikiFX Broker

Latest News

BitPania Review 2026: Is this Broker Safe?

Kudotrade Review 2026: Is this Forex Broker Legit or a Scam?

Is EXTREDE Regulated? A 2026 Investigation into Warning Signs and Licensing Claims

XTB Analysis Report

GFS Review: Reported Allegations of Fund Scams & Withdrawal Denials

MONAXA Review: Safety, Regulation & Forex Trading Details

SOOLIKE Review 2026: Is this Forex Broker Legit or a Scam?

Macron's India Trip Exposes EU Tech Overreach And Policy Failures

Five key takeaways from the Supreme Court's landmark decision against Trump's tariffs

ALPEX TRADING Review 2025: Is This Forex Broker Safe?

Rate Calc