Santander Denies Breach of U.S. Sanctions in Iran-Linked Accounts Case

Abstract:Santander Asserts Compliance Amid Financial Times' Claims on Iran-Linked Accounts: Get the latest updates on the bank's stance and commitment to international financial regulations.

Spain's banking giant Santander (SAN.MC) has maintained that it has found no indication of a breach of US sanctions against Iran. This announcement came on Tuesday, after a thorough investigation prompted by a Financial Times exposé on Iranian-linked accounts.

Last week, the Financial Times (FT) startled the financial world by reporting that Iran has accounts with Santander and Lloyds (LLOY.L) in the United Kingdom. According to the FT, these accounts were part of a covert operation to move funds across the globe while evading penalties. The Iranian intelligence services were behind this scheme.

Santander's internal correspondence, first reported by Bloomberg News and then obtained by Reuters, reveals a different narrative. The global head of communications at Santander said that the bank uncovered no instances of sanction breaches in its global operations after completing a comprehensive assessment of the businesses and individuals mentioned in the FT piece.

Previously, the FT stated that Lloyds and Santander UK were giving accounts to British front companies. A London-based Iranian petrochemical company that had received sanctions was privately in charge of these businesses. Despite these allegations, Santander and Lloyds declared last week that bank inspections found no breaches of penalties.

The issue centers on Iran's state-owned Petrochemical Commercial Company (PCC) and its British branch, PCC UK. According to the Financial Times, the United States has sanctioned both since November 2018. The United States accuses them of raising significant cash for the Iranian Revolutionary Guards Quds Force and coordinating with Russian intelligence.

One of the alleged front firms, Pisco UK, established at a detached property in Surrey, is said to have utilized a Santander UK business account.

However, Santander clarified in a statement issued on Tuesday that this account was closed in 2022 for reasons unconnected to these concerns.

According to Santander, “Neither the account holder nor the identified owners of the business were targeted for sanctions during the life of the account, and none are today.” The bank also said that the number of transactions done via this account while it was active was minimal.

This development comes at a time when global financial institutions are under severe scrutiny for their adherence to international sanctions.

The claims and ensuing investigations emphasize the difficulties banks confront as they navigate the complicated network of global financing and sanctions.

Santander's straightforward announcement and the closure of the involved account may give some confidence to stakeholders worried about international regulatory compliance. However, the case demonstrates banks' persistent difficulties in detecting and combating illegal financial activity, particularly those involving sanctioned groups and governments.

The findings of such investigations are critical since the whole financial world is watching them. They have far-reaching ramifications for the global financial system's integrity and the reputations of the institutions involved. Other financial institutions, regulatory agencies, and governments throughout the world will undoubtedly be monitoring Santander's reply.

Finally, Santander's denial of any infringement of US sanctions in this instance is a watershed moment in the continuing battle to preserve a transparent and compliant international financial system. The bank's comprehensive examination and open communication demonstrate its dedication to following global financial standards.

For more detailed information about Santander and its stance on international financial compliance, visit their profile on WikiFX at Santander on WikiFX. Stay informed about the latest developments in the financial world and how they impact global banking institutions like Santander by checking out WikiFX Daily News. Keep up-to-date with the latest financial news and insights to navigate the complexities of the global financial landscape.

Read more

Exchange Rate Fluctuations: Key Facts Every Forex Trader Should Know

The forex market is a happening place with currency pairs getting traded almost non-stop for five days a week. Some currencies become stronger, some become weaker, and some remain neutral or rangebound. If you talk about the Indian National Rupee (INR), it has dipped sharply against major currencies globally over the past year. The USD/INR was valued at around 85-86 in Feb 2025. As we stand in Feb 2026, the value has dipped to over 90. The dip or rise, whatever the case may be, impacts our daily lives. It determines the price of an overseas holiday and imported goods, while influencing foreign investors’ perception of a country. The foreign exchange rates change constantly, sometimes multiple times a day, amid breaking news in the economic and political spheres globally. In this article, we have uncovered details on exchange rate fluctuations and key facts that every trader should know regarding these. Read on!

VPS Review: Do Clients Face Trading Issues Due to Constant Login Errors?

Do you face numerous login errors with VPS, a Vietnam-based forex broker? Did these errors lead to missed opportunities or losses? Does your trading account often have an insufficient balance despite numerous trades on the VPS login? Does the broker compel you to renew your subscription even if it’s not required? These issues have become synonymous with many of its traders. They have highlighted these online. In this VPS review article, we have investigated these issues. Read on!

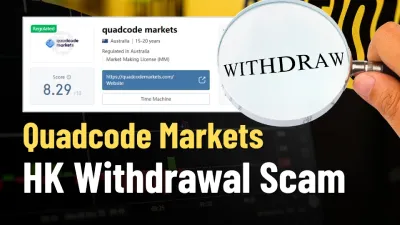

Quadcode Markets HK Withdrawal Scam

HK victims slam Quadcode Markets: Jan 2025 delays, frozen accounts, no replies; “withdrawal too long!” Report scam, recover funds now!

ThinkMarkets Scam Alert: 83/93 Negative Cases Exposed

ThinkMarkets has 83/93 negative cases, with withdrawal delays and scam alerts. Check regulation and details on the WikiFX App before trading.

WikiFX Broker

Latest News

Is Fortune Prime Global Legit Broker? Answering concerns: Is this fake or trustworthy broker?

AssetsFX Regulation: A Complete Guide to Licenses and Trading Risks

ZaraVista Legitimacy Check: Addressing Fears: Is This a Fake Broker or a Legitimate Trading Partner?

ZarVista User Reputation: Looking at Real User Reviews to Check if It's Trustworthy

TP Trader Academy ‘The Axis Event’: Pioneering Trading Education at the Heart of Tech and Data

S. Africa Energy Gridlock: Glencore Proposal Stalls Amid Regulatory Clash

Capital.com Review: Is Your Money Locked Inside this Broker?

FxPro Broker Analysis Report

Pinnacle Pips Forex Fraud Exposed

Grand Capital Review 2026: Is this Broker Safe?

Rate Calc