Stp Trading

Abstract:Stp Trading, established in Turkey in 2017, operates without regulatory oversight, posing significant risks to investors. Despite offering a variety of trading assets, including forex, stocks, and commodities, the platform lacks transparency and exposes users to potential fraud and market manipulation. While traders may benefit from competitive spreads, the platform's inaccessible official website and limited transparency raise risks about its reliability and integrity.

| Aspect | Information |

| Company Name | Stp Trading |

| Registered Country/Area | Turkey |

| Founded year | 2017 |

| Regulation | Unregulated |

| Market Instruments | N/A |

| Account Types | GoldIslamicStandard, IslamicStandard, and Standard |

| Minimum Deposit | N/A |

| Maximum Leverage | 1:100 |

| Spreads | From 0.7 pips |

| Trading Platforms | N/A |

| Customer Support | info@stp.forex |

| Deposit & Withdrawal | N/A |

Overview of Stp Trading

Stp Trading, established in Turkey in 2017, operates without regulatory oversight, posing significant risks to investors. Despite offering a variety of trading assets, including forex, stocks, and commodities, the platform lacks transparency and exposes users to potential fraud and market manipulation.

While traders may benefit from competitive spreads, the platform's inaccessible official website and limited transparency raise risks about its reliability and integrity.

Is Stp Trading legit or a scam?

Stp Trading operates without regulatory oversight. This absence of supervision poses risks such as potential market manipulation, lack of investor protection, and increased susceptibility to fraudulent activities.

Investors face uncertainty regarding fair trading practices, transparency, and dispute resolution. Without regulatory checks, Stp Trading may facilitate illicit activities, undermining market integrity and investor trust. This unregulated environment heightens the importance of due diligence and caution among investors, as they navigate the inherent vulnerabilities associated with unmonitored trading platforms.

Pros and Cons

| Pros | Cons |

| Competitive spreads as low as 0.7 pip | Official website inaccessible |

| Potential difficulty in accessing information | |

| Limited transparency | |

| Risk of information asymmetry | |

| Lack of regulatory oversight |

Pros:

Competitive spreads: Stp Trading offers competitive spreads as low as 0.7 pips, enabling traders to potentially reduce their trading costs and maximize profits.

Cons:

Official website inaccessible: The inability to access the official website may hinder users' ability to gather crucial information, conduct transactions, or access support, potentially causing frustration and inconvenience.

Potential difficulty in accessing information: Users may encounter challenges in accessing essential information such as account details, market updates, or educational resources, which could impede their decision-making process and overall trading experience.

Limited transparency: The lack of transparency regarding trading processes, fees, or company policies may lead to uncertainty and distrust among users, affecting their confidence in the platform and its integrity.

Risk of information asymmetry: Without transparent and readily accessible information, users may face a higher risk of misinformation or misunderstanding, potentially leading to suboptimal trading decisions and financial losses.

Lack of regulatory oversight: The absence of regulatory oversight exposes users to potential risks such as fraud, market manipulation, or inadequate investor protection measures, highlighting the importance of due diligence and caution when trading on the platform.

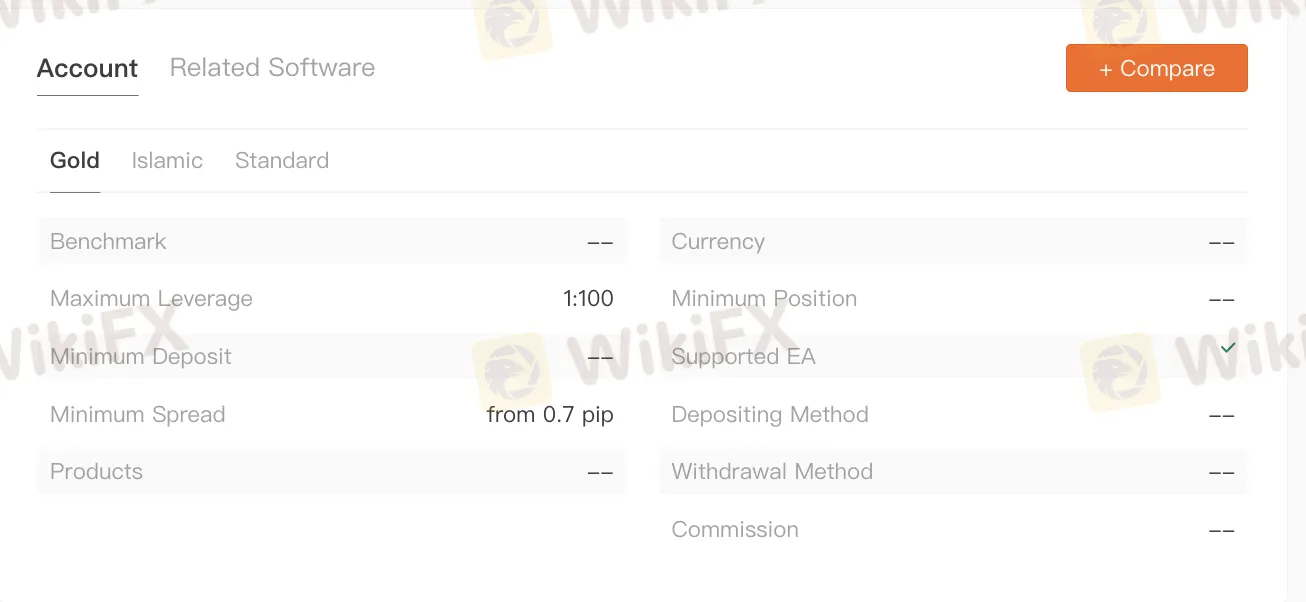

Account Types

Stp Trading offers three account types: GoldIslamicStandard, IslamicStandard, and Standard, each with a maximum leverage of 1:100.

GoldIslamicStandard boasts the lowest minimum spread starting from 0.7 pip, ideal for traders seeking tighter spreads.

IslamicStandard, with a minimum spread starting from 1.8 pips, adheres to Islamic principles, ensuring interest-free trading for Muslim investors.

Standard account, with a minimum spread starting from 1 pip, provides a balanced option for traders seeking standard trading conditions.

| GoldIslamicStandard | IslamicStandard | Standard | |

| Maximum Leverage | 1:100 | 1:100 | 1:100 |

| Minimum Spread | from 0.7 pip | from 1.8 pip | from 1 pip |

Leverage

Stp Trading offers a maximum leverage of 1:100, providing traders with significant buying power relative to their invested capital.

Spreads & Commissions

Stp Trading offers three spreads and commission structures across its account types.

The GoldIslamicStandard account features the tightest spreads, starting from 0.7 pips, making it suitable for active traders seeking minimal trading costs.

IslamicStandard follows with spreads starting from 1.8 pips, suitable for traders who prioritize adherence to Islamic principles.

The Standard account offers spreads starting from 1 pip, providing a balanced option for traders seeking standard trading conditions.

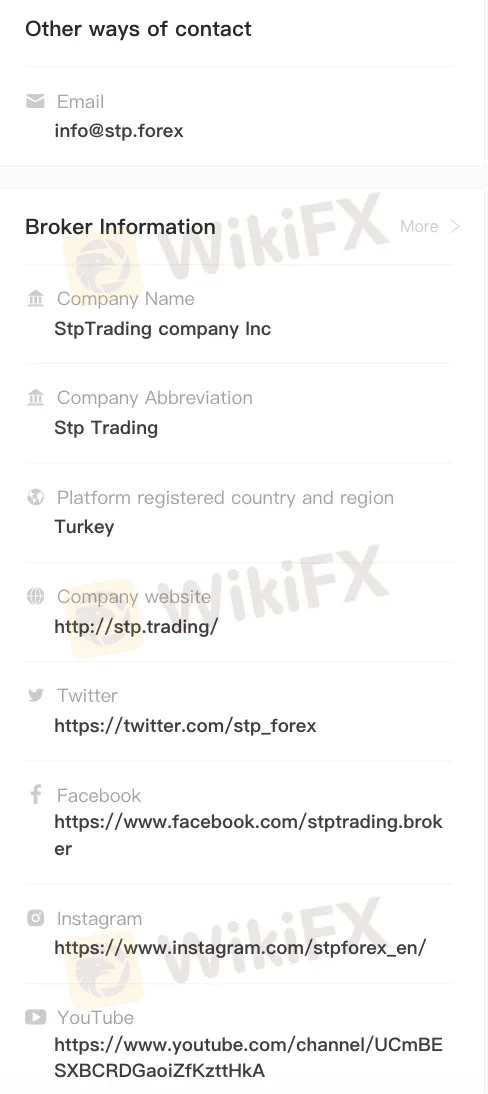

Customer Support

You can reach out to Stp Trading through their provided email address, info@stp.forex, or through their social media channels such as Twitter, Facebook, Instagram, and YouTube.

However, Stp Trading's customer support is lacking in responsiveness and effectiveness. Despite providing contact options such as email, Twitter, Facebook, Instagram, and YouTube, users frequently report slow or non-existent responses to queries or issues. The absence of live chat or phone support further exacerbates communication challenges, leaving users frustrated with unresolved inquiries.

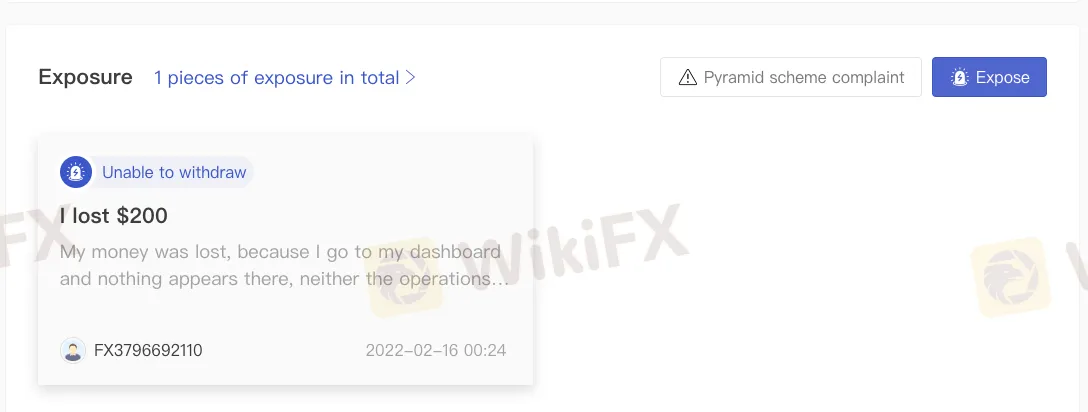

Exposure

The user exposure outlined involves a complaint related to a potential pyramid scheme, an inability to withdraw funds, and a loss of $200. The user reports difficulty accessing their dashboard, with neither operations nor deposits visible. Despite attempting to contact the platform's agent, they received no response. Such exposure highlights significant issues within the trading platform, including potential fraudulent activities, lack of transparency, and poor customer support. This not only erodes trust but also indicates operational deficiencies that could deter potential users and negatively impact existing traders' confidence in the platform's reliability and security.

Conclusion

In conclusion, Stp Trading, established in Turkey in 2017, operates without regulatory oversight, posing potential risks to investors. The lack of transparency and regulatory supervision raises risks regarding the platform's reliability and integrity.

FAQs

Q: Is Stp Trading regulated?

A: No, Stp Trading operates without regulatory oversight.

Q: What market instruments are available on Stp Trading?

A: Stp Trading offers forex, stocks, and commodities trading.

Q: What is the maximum leverage offered?

A: Stp Trading offers leverage up to 1:100.

WikiFX Broker

Latest News

The Debt-Reduction Playbook: Can Today's Governments Learn From The Past?

FIBO Group Ltd Review 2025: Find out whether FIBO Group Is Legit or Scam?

Is INGOT Brokers Safe or Scam? Critical 2025 Safety Review & Red Flags

Amillex Withdrawal Problems

Trillium Financial Broker Exposed: Top Reasons Why Traders are Losing Trust Here

Netflix Confirms 2025 Stock Split, FxPro Issues Update

Is WinproFx Safe or a Scam? A 2025 Simple Safety Review

FXCL Review: Broker License Revoked, No Regulation

XM Broker Launches $150K Partners Rising League

The Hidden Reason Malaysian Traders Lose Money And How Timing Can Fix It

Rate Calc