CXMarkets

Abstract:CXMarket is an unregulated broker offering a specialized platform for trading weather-related financial products, including rain, snow, temperature, and landfall contracts. They provide various fee schedules, with no fees for application, deposit, or withdrawal.

| CXMarkets Review Summary | |

| Founded | 1999 |

| Registered Country/Region | United States |

| Regulation | No regulation |

| Market Instruments | Weather-related financial protection products |

| Customer Support | Monday - Friday, 9:00 AM to 5:00 PM ET |

| Tel: +1 877-300-4555; +1 212-829-5455 | |

| Email: customerservice@cantorexchange.com | |

CXMarkets Information

CXMarket is an unregulated broker offering a specialized platform for trading weather-related financial products, including rain, snow, temperature, and landfall contracts. They provide various fee schedules, with no fees for application, deposit, or withdrawal.

Pros and Cons

| Pros | Cons |

| No application or deposit/withdrawal fees | Lack of regulation |

| Specific products for weather risk | |

| Long operation time | |

| Various channels for customer support |

Is CXMarkets Legit?

CXMarkets is an unregulated broker. The WHOIS search shows the domain cxmarkets.com was registered on August 02, 1999. Its present state is “client transfer prohibited,” which indicates the domain is locked and cannot be moved to another registrar. Therefore, please be aware of the risks!

CXMarkets Products and Markets

CXMarkets offers a trading platform and API access for weather-related financial protection products, providing market information, trade execution, and clearing/settlement services.

CXMarkets Fees

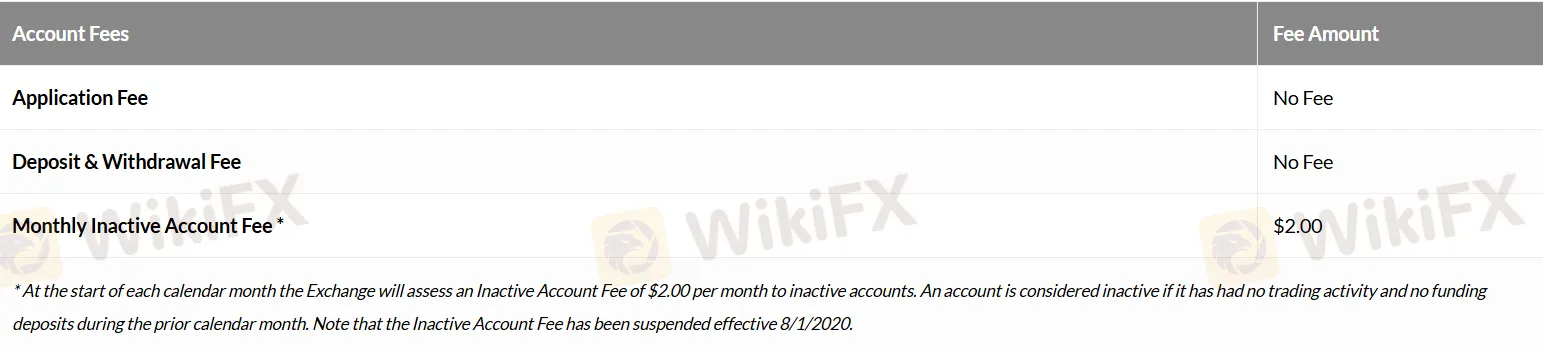

- General Fee Schedule

| Types of Fees | Fee Amount |

| Application Fee | ❌ |

| Deposit & Withdrawal Fee | ❌ |

| Monthly Inactive Account Fee | $2 (suspended after August 1, 2020) |

- Weekly Rain Markets Fee Schedule

| Trading Fees (on all completed trades) | Fee Amount (per contract) |

| Executed Buy Order | ❌ |

| Executed Sell Order | $0.02 |

| Settlement Fees (on all open positions at contract settlement) | Fee Amount (per contract) |

| All settlements | ❌ |

- Forex & Metals Markets and Monthly Rain Markets Fee Schedule

| Trading Fees (on all completed trades) | Fee Amount (per contract) |

| All Market Orders | ❌ |

| Limit Orders that execute at the market | ❌ |

| Other limit orders | $0.01 |

| Settlement Fees (on all open positions at contract expiration) | Fee Amount (per contract) |

| Out-of-the-money settlements | ❌ |

| In-the-money settlements | $0.01 |

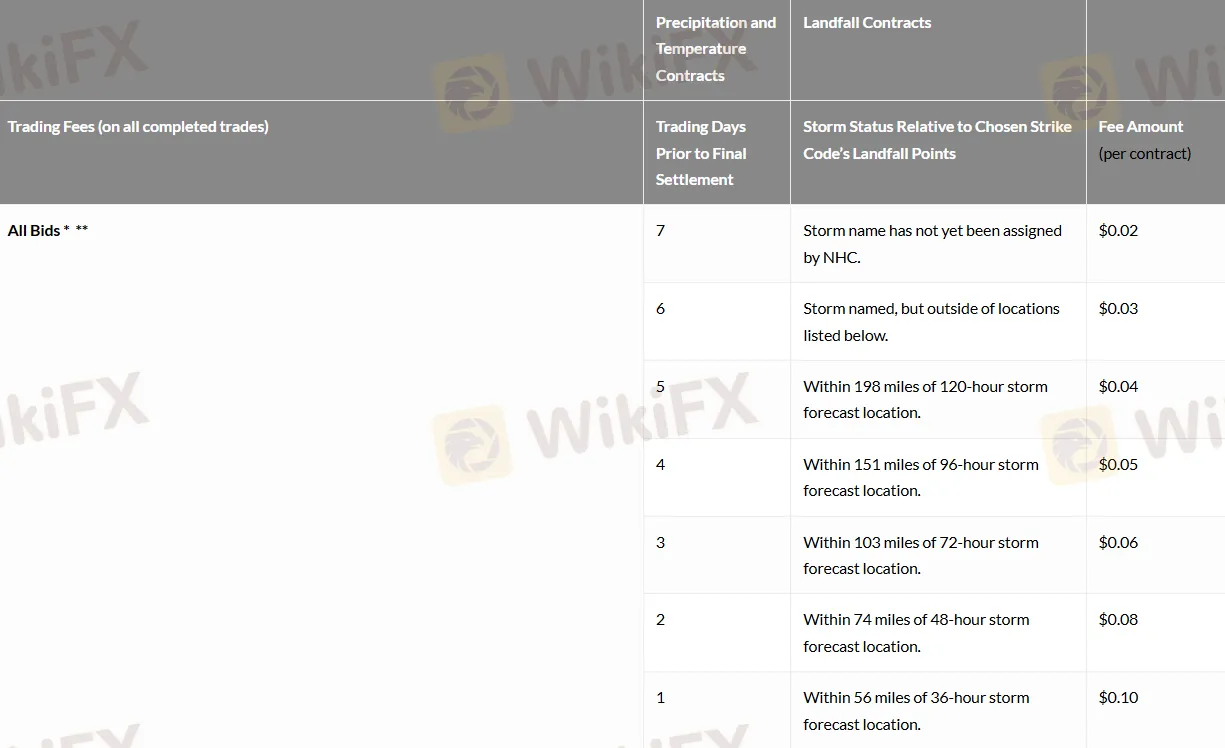

- Daily Rain, Snow, Temperature, and Landfall Markets Fee Schedule:

| Trading Fees (on all completed trades) | Precipitation and Temperature Contracts: Trading Days Prior to Final Settlement | Landfall Contracts: Storm Status Relative to Chosen Strike Code's Landfall Points | Fee Amount (per contract) |

| All Bids ** | 7 | Storm name has not yet been assigned by NHC | $0.02 |

| 6 | Storm named, but outside of locations listed below | $0.03 | |

| 5 | Within 198 miles of 120-hour storm forecast location | $0.04 | |

| 4 | Within 151 miles of 96-hour storm forecast location | $0.05 | |

| 3 | Within 103 miles of 72-hour storm forecast location | $0.06 | |

| 2 | Within 74 miles of 48-hour storm forecast location | $0.08 | |

| 1 | Within 56 miles of 36-hour storm forecast location | $0.10 |

Read more

Trive Scam Warning: Cases in Mexico, India, Hong Kong

Trive scam warning: clients in Mexico, India & Hong Kong report stolen funds and blocked withdrawals. Protect yourself—read exposure cases now.

Plus500 Scam Alert: Withdrawal Issues Exposed

Plus500 forex trading scam alert: multiple cases of blocked withdrawals. Read the warnings and safeguard your money!

GLOBAL GOLD & CURRENCY CORPORATION Legitimacy Check

When traders ask, "Is GLOBAL GOLD & CURRENCY CORPORATION Legit?" They want a clear answer about whether their capital will be safe. After looking into this company carefully, the answer is clear: GLOBAL GOLD & CURRENCY CORPORATION (GGCC) is an extremely risky broker that shows many signs of being unsafe and illegitimate. The company operates without proper regulation, has been officially warned by financial authorities, and has received many serious complaints from users. Read on!

GLOBAL GOLD & CURRENCY CORPORATION Regulation: A Complete Guide to Its Unregulated Status and Risks

When choosing a forex broker, the most important thing to check is whether it has proper regulation. This article answers a key question: Is GLOBAL GOLD & CURRENCY CORPORATION (GGCC) regulated? After looking at detailed data and public records, the answer is clear: GGCC operates without a valid financial services license from any trusted authority. This broker is registered in Saint Lucia and shows warning signs that should make any potential investor very careful. Checking a broker's license isn't just paperwork - it's the most important step to protect your capital from unnecessary risks.

WikiFX Broker

Latest News

If you haven't noticed yet, the crypto market is in free fall, but why?

Emerging Markets: Nigeria's Debt Market Valuation Hits N99.3 Trillion

JPY In Focus: Takaichi Wins Snap Election to Become Japan's First Female Leader

Amaraa Capital Scam Alert: Forex Fraud Exposure

Vebson Scam Exposure: Forex Withdrawal Failures & Fake Regulation Warning

EGM Securities Review: Investigating Multiple Withdrawal-related Complaints

Galileo FX Exposure: Allegations of Fund Losses Due to Trading Bot-related Issues

Fed Balance Sheet Mechanics: The Silent Risk to Liquidity

Gold Eclipses $5,070 as China Treasury Shift Hammers the Dollar

SkyLine Guide 2026 Thailand — Official Launch of the Judge Panel Formation!

Rate Calc