Dupoin

Abstract:Dupoin, a newly established brokerage company with its domain registered in 2002, offers trading services on forex, commodities, indices, shares and cryptocurrencies to global clients. There are 3 tiered accounts with minimum deposit starting from $10, affordable to most traders. Trades can be executed on 3 platforms: the renowned MT5, its proprietary Dupoin and ActsTrade. Copy trading function allows investors to quickly gain profits by imitating strategies from successful predecessors.

| Dupoin Review Summary | |

| Founded | 2023 |

| Registered Country/Region | Union of Comoros |

| Regulation | FCA, BAPPEBTI, JFX |

| Market Instruments | Forex, Commodities, Indices, Shares, Cryptocurrencies |

| Demo Account | / |

| Spread | From 1.2 pips (Standard account) |

| Leverage | Up to 1:1000 |

| Minimum Deposit | USD10 |

| Trading Platform | Dupoin App, ActsTrade, MetaTrader 5 |

| Customer Support | Live chat |

| Social media: Facebook, Twitter, LinkedIn, Instagram | |

| Address: Hamchako, Mutsamudu, The Autonomous Island of Anjouan, Union of Comoros | |

| Email: support@dupoin.com; live chat (Monday - Friday 9:00 a.m.- 5:30 p.m.) | |

Dupoin Information

Dupoin, a newly established brokerage company with its domain registered in 2002, offers trading services on forex, commodities, indices, shares and cryptocurrencies to global clients. There are 3 tiered accounts with minimum deposit starting from $10, affordable to most traders. Trades can be executed on 3 platforms: the renowned MT5, its proprietary Dupoin and ActsTrade. Copy trading function allows investors to quickly gain profits by imitating strategies from successful predecessors.

One exciting news is that the broker is decently regulated by FCA (Financial Conduct Authority) and BAPPEBTI (Badan Pengawas Perdagangan Berjangka Komoditi Kementerian Perdagangan), proving a certain level of liability and legality. What's more, the broker implements negative balance to ensure you will not lose more than the amount you have deposited.

Pros and Cons

| Pros | Cons |

| FCA, BAPPEBTI regulated | No MT4 |

| MT5 platform | |

| Affordable minimum deposit | |

| Tiered live accounts | |

| Tight starting spreads | |

| Negative balance protection implemented |

Is Dupoin Legit?

Dupoin is regulated by multiple authorities, including the UK Financial Conduct Authority (FCA), where it holds an STP (Straight Through Processing) license (License No. 622574), signifying compliance with UK financial regulations; additionally, it is regulated in Indonesia by the Commodity Futures Trading Regulatory Agency (Bappebti) under the Ministry of Trade, holding a Retail Forex License (License No. 423/BAPPEBTI/SI/VII/2004), as well as by the Jakarta Futures Exchange (JFX), which has authorized it under a Retail Forex License (License No. SPAB-064/BBJ/04/04), demonstrating its operational compliance in both the UK and Indonesian financial markets.

What Can I Trade on Dupoin?

Dupoin provides trading services to a wide range of market instruments, mainly in 5 asset classes.

Forex: Forex, or foreign exchange, is the global marketplace for trading national currencies against one another, facilitating international trade and investment.

Commodities: Commodities are basic goods used in commerce that are interchangeable with other goods of the same type, such as precious metals as well as energy products.

Indices: Indices are statistical measures that represent the performaDupoin of a specific group of assets, such as stocks or bonds, helping investors gauge market trends and economic health.

Shares: Shares represent ownership stakes in large companies such as Apple, Tesla etc., allowing investors to participate in their profits and losses.

Cryptos: Cryptocurrencies are digital or virtual currencies that use cryptography for security and operate on decentralized networks based on blockchain technology.

When dealing with investment activities, always adhere to the principle of diversification by allocating funds across various products rather than coDupoinntrating on a single one you feel optimistic about.

| Tradable Instruments | Supported |

| Forex | ✔ |

| Commodities | ✔ |

| Indices | ✔ |

| Cryptocurrencies | ✔ |

| Shares | ✔ |

| ETFs | ❌ |

| Bonds | ❌ |

| Mutual Funds | ❌ |

Account Type

Dupoin provides 3 tiered live account types:

The Cent and Standard account suitable for beginners only require minimum deposits of USD10 and USD 10 respectively, affordable to most investors. Starting spread is the same from 1.2 pips.

While those who gain enough experience and capital can try to go to the next level and try the Premium account, which requires an entry level of USD10000, with a very tight spread from 0 pip.

For commissions, the broker only mentions “low commissions”, which is not explicit, you should seek confirmation from them if you want to trade with them.

| Account Type | Cent | Standard | Premium |

| Min Deposit | USD 10 | USD 10 | USD 10,000 |

| Spread | From 1.2 pips | From 1.2 pips | From 0.0 pips |

| Min Volume per Trade | 0.01 cent lot | 0.01 lot | 0.01 lot |

| Max Volume per Trade | 20 cent lots | 20 lots | 20 lots |

| Margin Call / Stop-out Level | 100% / 20% | ||

Leverage

Leverage, a trading tool that enables you to control larger positions with smaller capital, should always be used cautiously, with risk management indispensable for every investors. On Dupoin, leverage level is up to 1:1000 for all accounts.

Trading Platform

Dupoin offers three trading platforms: MetaTrader5, Dupoin App and ActsTrade.

MetaTrader5 is a widely-used platform that is capable of executing orders instantly and displaying 100 charts simultaneously. You can use it by downloading an app from PC, Mac and mobile phones.

While Dupoin app, developed by the broker itself, can be used on both Apple and Android phones. It boasts analysis charting as well as account and fund management tools, alongside economic events for traders to catch up with market trends to seize investment opportunities.

ActsTrade, on the other hand, is the web version of the broker's proprietary platform with basic and simple functions. It is accessible from web browsers from any device. You can access the analysis tools as well on the web version as well.

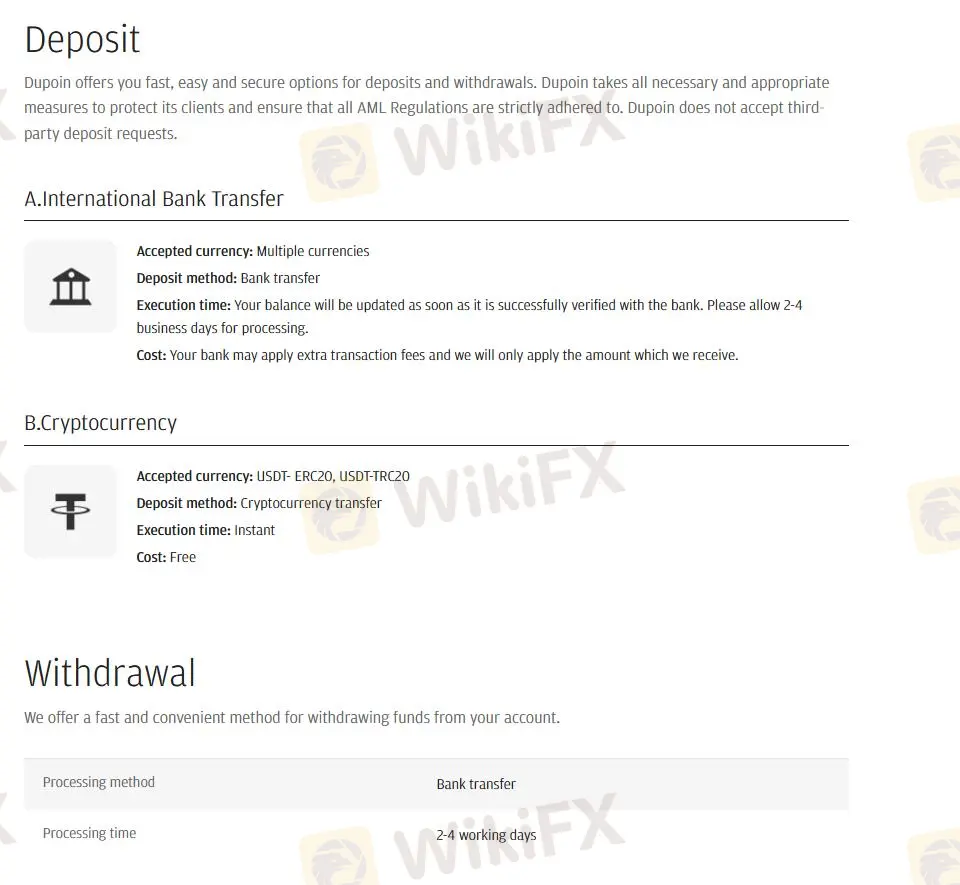

Deposit and Withdrawal

Dupoin enables deposits via international bank transfer with 2-4 business days for processing and cryptocurrencies (accepted currencies: USDT-ERC20, USDT-TRC20) with instant handling.

While for withdrawals, only the method of bank transfer, which takes 2-4 business days, is allowed.

Read more

BitForex Review: What Traders are Saying About Fund Scams and Withdrawal Issues

Earned profits on the BitForex platform, but could not withdraw because of tax payment and other liabilities? Does the forex broker even flag your account with fake money laundering charges? Do you consistently face login issues when using the BitForex trading platform? Is your deposited capital directed to the wrong address by the forex broker? All these have become very typical of the way the broker goes about the business. Many traders have opposed the broker on several review platforms online. It’s time to check their comments in this BitForex review article.

FXPN Complete Review: Understanding the High-Risk Warnings and Trading Rules

For traders asking the important question, "Is FXPN safe and worth trying?", our research gives a clear and warning answer. After looking closely at its legal status, how it operates, and what users say, FXPN shows a high-risk situation that needs extreme care. We have gathered a quick summary to give you an immediate answer before you read the detailed results. The proof shows major warning signs that potential investors cannot ignore.

IMPERIAL Regulatory Status: Understanding Their Licenses and Company Registration

If you're asking 'Is IMPERIAL a regulated and safe broker?', you are doing important research. This question is the most important one any trader can ask before putting capital into an account. The answer, based on our detailed study of available information, is clear: IMPERIAL Markets is registered as a company in Saint Lucia but operates without a valid forex trading license from any major financial authority. This finding immediately raises red flags, placing the broker under the labels of "Suspicious Regulatory License" and "High potential risk." For traders, this means working with IMPERIAL involves a significant level of risk that must be fully understood. This article will break down the details of the company registration, explain what its MetaTrader 5 (MT5) license really means, examine conflicting user reviews, and provide a clear guide for how you can protect yourself from the dangers of trading with unregulated offshore companies.

IMPERIAL Legitimacy Check (Addressing fears: Is This a Fake Broker or a Legitimate Trading Partner?)

You're asking 'Is IMPERIAL Legit' or worried about an 'IMPERIAL Scam', and that's the right question to ask before investing. The online world is full of brokers promising high returns and easy trading, but the reality is often way more complicated and risky. Your main concern should always be keeping your money safe. This article will provide a detailed, fact-based analysis to answer your question clearly. The most important factor that determines if a broker can be trusted is whether it's regulated. We will state this upfront: IMPERIAL operates without supervision from any major, trusted financial regulatory body. This is a major warning sign for any trader, no matter how experienced it is. You may have seen mixed information—maybe some positive user reviews or attractive marketing about its platform. We will examine every piece of available information, from the company registration to the user feedback, to give you a clear, honest picture of the risks involved.

WikiFX Broker

Latest News

US Trade Deficit Collapses In October: Structural Shifts In Global Trade Revealed

EURUSD Fails to Make New Highs

Situation In Venezuela Adds To Dollar Uncertainty

TP ICAP Expands Global Reach with Acquisition of Vantage Capital Markets

Dollar Dives and Metals Surge: Powell Investigation Sparks Institutional Crisis

Dollar on Edge: Supreme Court Tariff Ruling and Deficit Warnings Collide

Silver Markets Face 'Liquidity Squeeze' Risk, Warns Goldman Sachs

Top Forex Brokers Offering Free Demo Accounts

Dollar Reigns Supreme: Economic Resilience Eclipses Political Noise Ahead of

Global Central Bank Policy Fractures: The End of "Synchronized Action"

Rate Calc