Leverate Losses ICF Membership & CIF Authorization

Abstract:CySEC recently addressed the termination of Leverate Financial Services Ltd.'s membership in the Investors Compensation Fund (ICF), clarifying that clients remain eligible for compensation despite the loss of membership, while highlighting broader regulatory actions and enforcement measures undertaken by the commission.

Cyprus Securities and Exchange Commission (CySEC) recently addressed the Investors Compensation Fund (ICF) and the termination of membership status for Leverate Financial Services Ltd.

According to CySEC, Leverate Financial Services Ltd.'s loss of ICF membership doesn't mean clients covered under the fund lose their right to compensation for previous investment activities. The criteria for compensation as per the Directive remain intact.

The decision to withdraw ICF membership followed CySEC's move to revoke Leverate Financial Services Ltd.'s authorization as a Cyprus Investment Firm. Leverate Financial Services Ltd. voluntarily relinquished its authorization, leading to CySEC's withdrawal of CIF authorization on December 4, 2023. This action barred the company from operating under CySEC's supervision, with no mention of a judicial review, implying finality pending legal developments.

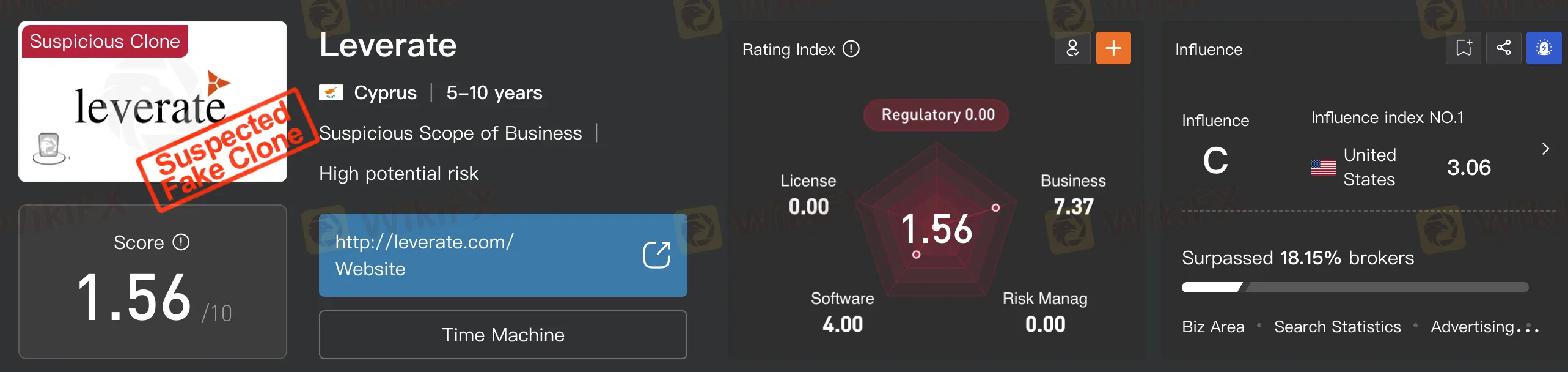

View WikiFXs evaluation on Leverate here: https://www.wikifx.com/en/dealer/9351661905.html

In 2023, CySEC conducted over 700 inspections, both on-site and remote, on supervised entities, imposing fines exceeding $2.2 million to ensure regulatory compliance and protect investors. Thematic audits focused on entities affected by Russia-Ukraine sanctions, examining their business relationships and probing forced transfers of Russian securities.

The Market Surveillance and Investigations Department completed 42 investigations, with one case referred to the Attorney General for possible criminal prosecution, while ongoing inquiries totalled 48 by year-end. CySEC imposed administrative penalties totalling approximately €2.2 million, with one investment firm facing a penalty of €1 million.

Over three years, sanctions totalling €6 million have been imposed, primarily against investment firms for regulatory breaches. In comparison, the UK's Financial Conduct Authority revoked licenses for 1,266 unauthorized firms and issued record fines of £52,802,900, while U.S. regulators collectively imposed fines exceeding $9 billion. CySEC also directed entities to rectify issues in 103 cases, with 35 entities required to comply with anti-money laundering and counter-terrorist financing laws.

Moreover, CySEC revoked or suspended licenses for 19 investment firms and two collective investment undertakings. In an exclusive interview, George Theocharides, CySEC's Chairman, emphasized cryptocurrencies and artificial intelligence as key regulatory concerns, foreseeing their transformative impact on the financial sector.

Read more

WikiFX Elite Club Stages Elite Pickleball Networking Event in Ho Chi Minh City

Ho Chi Minh City, Vietnam – The WikiFX Elite Club recently concluded a successful offline pickleball networking event, “Elite Gathering Day · Vietnam: Rally for Connection, Rally for Healthy Development.” The event drew over 50 local industry participants, including prominent Introducing Brokers (IBs), Key Opinion Leaders (KOLs), and representatives from multiple trading firms. This unique gathering seamlessly blended sporting energy with high-value professional networking.

Mazi Finance Scam Exposure: A Warning to Indian Traders

Latest India Mazi Finance scam: Failed XAUUSD execution despite margin, costing $675—fake “insufficient balance” excuse. Protect funds, read the full report now!

Pemaxx Review: Fund Scams & No Withdrawals, Say Traders

Does Pemaxx prevent you from withdrawing funds once you make profits? Has the Mauritius-based forex broker disabled your trading account upon your withdrawal request? Do you fail to withdraw funds despite meeting the trading lot requirements? These scam-like trading activities have allegedly become a part of the broker’s operation, as many traders have complained about them online. In this Pemaxx review article, we have highlighted their comments against the forex broker. Keep reading!

Fortune Prime Global Exposure: Withdrawal Denials & Profit Cancellations Frustrate Traders

Did Fortune Prime Global deduct all your profits by accusing you of market manipulation? Are you struggling to access withdrawals for months? Has the forex broker disabled your forex trading account upon the withdrawal application? Does the broker stipulate tax payments as a condition for fund withdrawals? You are not alone! In this Fortune Prime Global review article, we have highlighted these complaints. Read on!

WikiFX Broker

Latest News

New AI laws to arrest deepfakes

Global Macro: Real Wage Growth Expected to Return by 2026

XAU/USD: Gold Rally Signals 'Paradigm Shift' as Middle East Tensions Simmer

MONAXA Review 2026: Comprehensive Safety Assessment

BoC Preview: Macklem to Hold at 2.25% Amidst Trade Anxiety

Fed Holds Rates as Political Storm Intensifies; Trump to Name New Chair Imminently

Meta and Samsung Fuel AI Capex Boom, Keeping Risk Sentiment Alive

Gold Smashes $5,600 Record on Shutdown Fears; Analysts Flash Crash Warning for Silver

FxPro Enhances MetaTrader 5 Execution with New LD4 Cross-Connect

Fed Holds Rates Amidst Political Siege; Dollar Sinks to Four-Year Lows

Rate Calc