GDS-1467706117

Abstract:GDS's website is not functional so far, even though we recorded opened website of this company before, there's no valid information available either. So we are still totally in the dark about its business scope, trading condition or even contact channels. None of these necessary information are available through the internet, one only thing we can confirm is that the company has never been regulated any any recognized authorities.

Note: GDS's official website: https://www.osigupters.com/ is currently inaccessible normally.

GDS Information

GDS's website is not functional so far, even though we recorded opened website of this company before, there's no valid information available either. So we are still totally in the dark about its business scope, trading condition or even contact channels. None of these necessary information are available through the internet, one only thing we can confirm is that the company has never been regulated any any recognized authorities.

Is GDS Legit?

The broker operates without any valid supervision from any regulatory authorities. It raises a question about its legitimacy and credibility because regulated brokers usually adhere to strict industry standards to protect customer funds.

Downsides of GDS

Unavailable website: GDS's website cannot be opened currently. We can't test their trading conditions and trading platforms.

Lack of transparency: The unavailable website and limited info through internet about the company leave traders in the dark about its current operational status and trading conditions.

Regulatory concerns: The absence of regulatory supervision indicates less customer protections and compliance to industry standards of the broker. Trading with GDS is of high risk.

Numerous exposures on WikiFX: There are 8 exposures on WikiFX about GDS, all are about scams and withdrawal issue.

Absence of customer service channels: GDS does not provide any info on contact ways. Reliable brokers never behave like this.

Negative GDS Reviews on WikiFX

On WikiFX, “Exposure” is posted as a word of mouth received from users.

Traders are encouraged to review information and assess risks before trading on unregulated platforms. Please consult our platform for related details. Report fraudulent brokers in our Exposure section and our team will work to resolve any issues you encounter.

As of now, there are 8 piece of GDS exposure in total, I will introduct two of them.

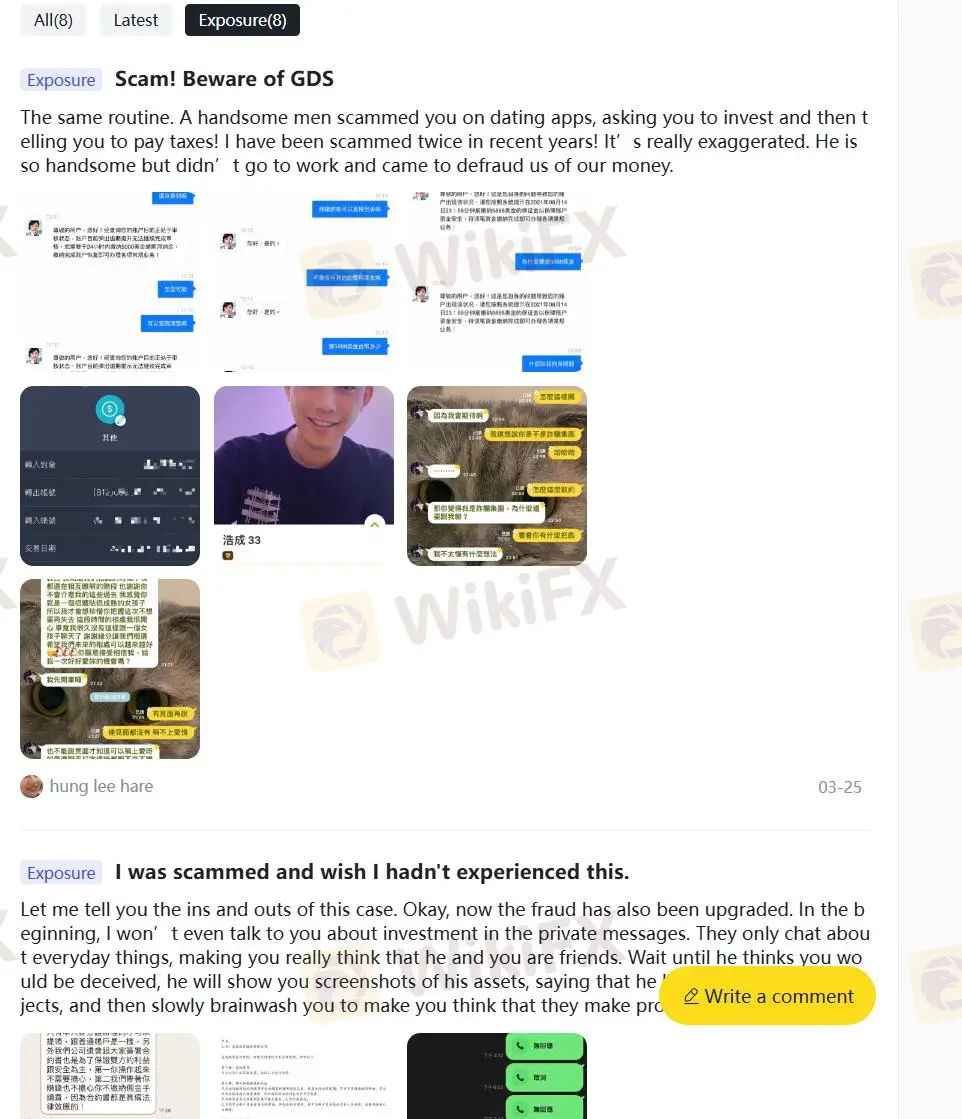

Exposure 1. Scam

| Classification | Scam |

| Date | 2024-03-25 |

| Post Country | China Taiwan |

The investor from China Taiwan said she met some really handsome guy from a dating app but he asked her to invest with GDS and then told her to pay taxes.

Exposure 1. Unable to withdraw

| Classification | Unable to withdraw |

| Date | 2023-12-13 |

| Post Country | China Taiwan |

Another China Taiwan investor reported that when withdrawing with GSD, they will ask you to pay 20% of the funds to prove it.

Conclusion

To sum up, we recommend you to get rid of unreliable brokers like GDS who does not maintain functional website and customer service channels. Its unregulated status and customer complaints are also worrisome. Most irritating of all, there are numerous exposures about scam and withdrawal issues on WikiFX. All these factors indicate that the broker is untrustworthy and might be a scam broker. Choosing reputable and regulated alternatives is a smart decision to protect your money.

Read more

Japan’s Shift in Crypto Policy and What It Means for Investors

Japan’s ruling Liberal Democratic Party (LDP) is moving forward with regulatory changes to update how cryptocurrency is taxed and classified. The proposed reforms aim to lower the capital gains tax on digital assets to 20% and officially recognise cryptocurrencies as a separate asset class within financial regulations.

Medical Officer Trapped in a Crypto Nightmare

A medical officer in Malaysia suffered a significant financial loss after falling prey to a cryptocurrency investment scam that originated on social media. The victim, a 39-year-old woman, was deceived into transferring her savings of RM86,200 following a series of fraudulent claims promising lucrative returns.

SBI VC Trade Pioneers USDC Transactions in Japan

SBI VC Trade, the cryptocurrency division of Japan’s financial giant SBI Group, has become the first entity in the country to process transactions involving the USDC stablecoin. The company confirmed the development on Tuesday, announcing that a beta version of USDC-related services would be introduced on 12 March for select users following scheduled system maintenance.

Ethereum’s Shock Drop: What’s The Real Reason?

Ethereum (ETH) has experienced a significant downturn, falling below the critical $2,000 threshold for the first time since November 2023. This sharp decline has triggered concern among investors and analysts, highlighting the broader volatility in the cryptocurrency market.

WikiFX Broker

Latest News

Forex Trading: Scam or Real Opportunity?

The Hidden Tactics Brokers Use to Block Your Withdrawals

Beware: Online Share Buying Scam Costs 2,791,780 PHP in Losses

5 things I wish someone could have told me before I chose a forex broker

Unmasking a RM24 Million Forex Scam in Malaysia

U.S., Germany, and Finland Shut Down Garantex Over Money Laundering Allegations

Gold Prices Fluctuate: What Really Determines Their Value?

Dollar Under Fire—Is More Decline Ahead?

What Impact on Investors as Oil Prices Decline?

Is the North Korea's Lazarus Group the Biggest Crypto Hackers or Scapegoats?

Rate Calc