Inside Invest

Abstract:Based in China, Inside Invest offers traders a variety of trading tools through its unregulated platform. The platform offers four categories of accounts, including Starter accounts, Standard accounts, Classic accounts and Advanced accounts. Inside Invest traders can access a range of trading instruments, including forex, stocks, indices and commodities, by utilizing the WebTrader platform.

| Inside Invest Review Summary | |

| Founded | 1-2 years |

| Registered Country/Region | China |

| Regulation | Unregulated |

| Market Instruments | Forex, stocks, indices, commodities |

| Demo Account | Not mentioned |

| Leverage | Up to 1:200 |

| Spread | Not mentioned |

| Trading Platform | WebTrader |

| Min Deposit | $250.00 |

| Customer Support | Email: support@insideinvest.pro |

Inside Invest Information

Based in China, Inside Invest offers traders a variety of trading tools through its unregulated platform. The platform offers four categories of accounts, including Starter accounts, Standard accounts, Classic accounts and Advanced accounts.

Inside Invest traders can access a range of trading instruments, including forex, stocks, indices and commodities, by utilizing the WebTrader platform.

Pros and Cons

| Pros | Cons |

| Wide variety of trading instruments available | Lack of Regulatory Oversight |

| Limited customer support options, primarily through email | |

| Payment methods information is unclear |

Is Inside Invest Legit?

Inside Invest is currently in a state of no effective supervision, which means that its activities are not supervised by the government or financial institutions.

What Can I Trade on Inside Invest?

Inside Invest offers traders the opportunity to trade forex, stocks, indices and commodities.

| Tradable Instruments | Supported |

| Stock | ✔ |

| Forex | ✔ |

| Indices | ✔ |

| Commodities | ✔ |

| Raw materials | ❌ |

| Bonds | ❌ |

| Binary Options | ❌ |

| Mutual Funds | ❌ |

| Futures | ❌ |

Account Types

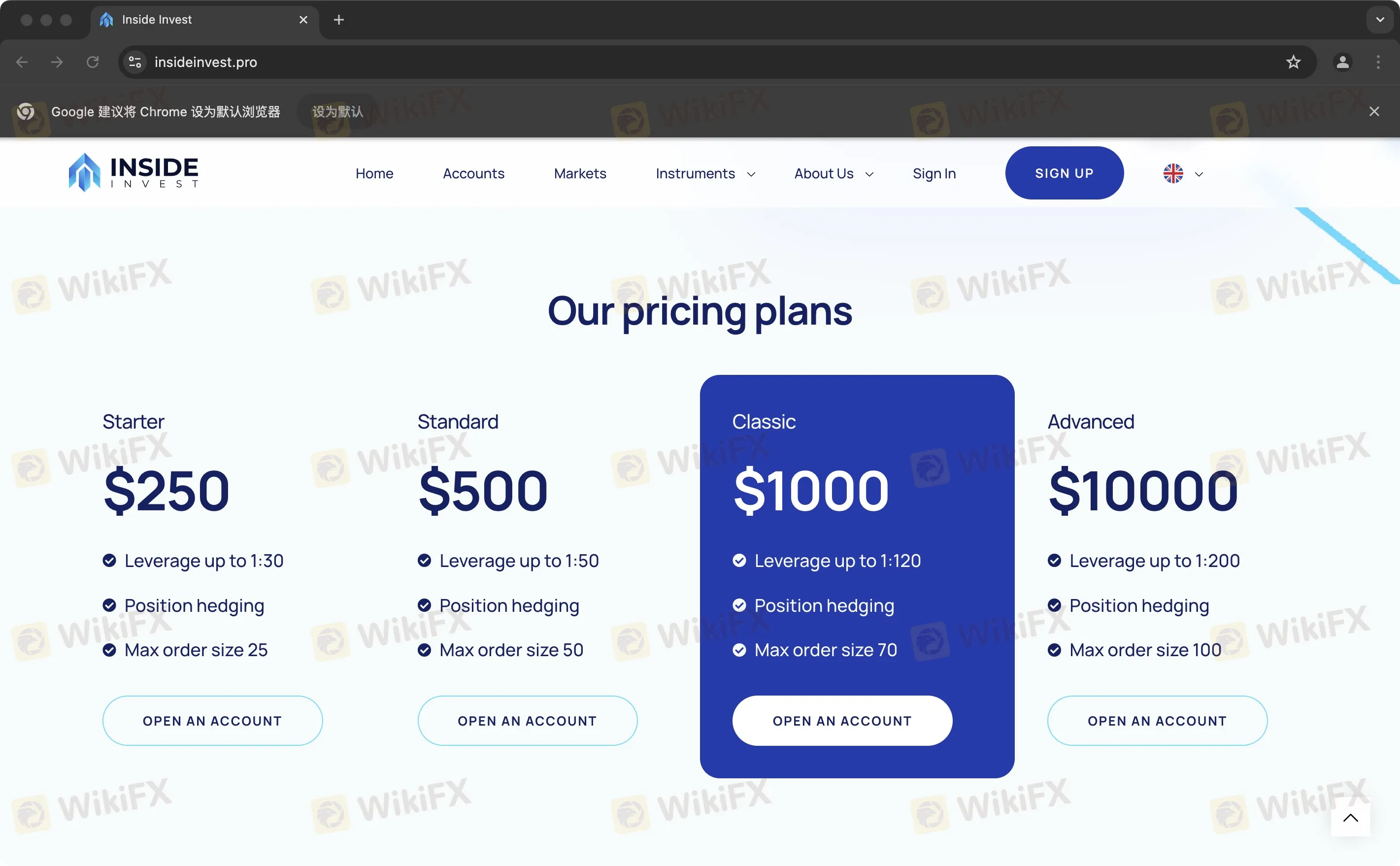

Inside Invest offers four live account types, namely Starter account, Standard account, Classic account and Advanced account.

The minimum deposit of four types of account is $250, $500, $1,000 and $10,000 for each.

The max order size for four types of account is 25, 50, 70 and 100 respectively.

| Account Type | Minimum Deposit | Maximum Leverage |

| Starter Account | $250 | 1:30 |

| Standard Account | $500 | 1:50 |

| Classic Account | $1,000 | 1:120 |

| Advanced Account | $10,000 | 1:200 |

Leverage

Inside Invest's starter account has a maximum leverage of 1:30. The maximum leverage of a standard account is 1:50, providing moderate leverage for traders seeking a balance of risk and opportunity.

Classic accounts offer 1:200 maximum leverage, and premium accounts offer 1:2000 maximum leverage.

Inside Invest Fees

The exact amount of its fees was not disclosed.

Trading Platform

WebTrader is chosen by Inside Invest to serve clients of different preferences.

| Trading Platform | Supported | Available Devices | Suitable for |

| WebTrader | ✔ | Windows, MAC, IOS, Android | Investors of all experience levels |

Deposit and Withdrawal

It claims to provide commission-free deposits. However, other specific deposit and withdrawal information was not mentioned.

Read more

QuoMarkets Exposed: High Slippage, Profit Withholding & Other Scams

Failed to receive unlimited leverage as promised by QuoMarkets? Witnessing higher slippage and a subsequent drop in your trading account balance? Does the forex broker withhold your profits? These have become typical of the way QuoMarkets runs its operations. In this article, we have exposed the forex broker on all these points. Keep reading different QuoMarkets reviews.

Nostro Exposed: Payout Delays & Server Downtime Plague Traders

Have you gone through a scam in your forex trading account balance with Nostro? Do you witness constant server downtime and losses thereafter? Has the customer support team been unresponsive to your queries? Many forex traders have faced these issues and therefore criticized the broker on review platforms. In this Nostro review article, we have pointed out their specific concerns that were not addressed by the India-based forex broker. Keep reading!

Galileo FX Review 2025: About Its Regulation, Reviews & Risks

Galileo FX is a trading robot that runs on platforms like MetaTrader 4 and MetaTrader 5. Check its regulation and decide if it’s a good choice for your investment or not?

Is Jefferies A Regulated Broker? A Broker’s Review

Regulated global broker review: Jefferies’ FCA license 139253, CIRO oversight in Canada, core services, address at 100 Bishopsgate, London, and risk notes in one guide.

WikiFX Broker

Latest News

KOT4X Signals Wind-Down: Clients Told to Close Positions and Withdraw Funds

ADCB Faces Customer Backlash on All Fronts: Check Top Complaints

Fxnice Review 2025: Is Fxnice a Scam?

How to Trade Forex in Malaysia | Know These Before You Start

Travelex Launches Same Rate Guarantee at Changi

ZForex Review Alert: 5 Red Flags About Its Regulation, Leverage & Withdrawal

Forex Market Time Converter Explained: Trading Hours, Sessions & More

Trump Announces New Round Of Tariffs On Drugs, Heavy Trucks And Furniture

Assembly of 100 Authoritative Judges Marks Commencement of Second SkyLine Guide Thailand!

QuoMarkets Exposed: High Slippage, Profit Withholding & Other Scams

Rate Calc