Bitso

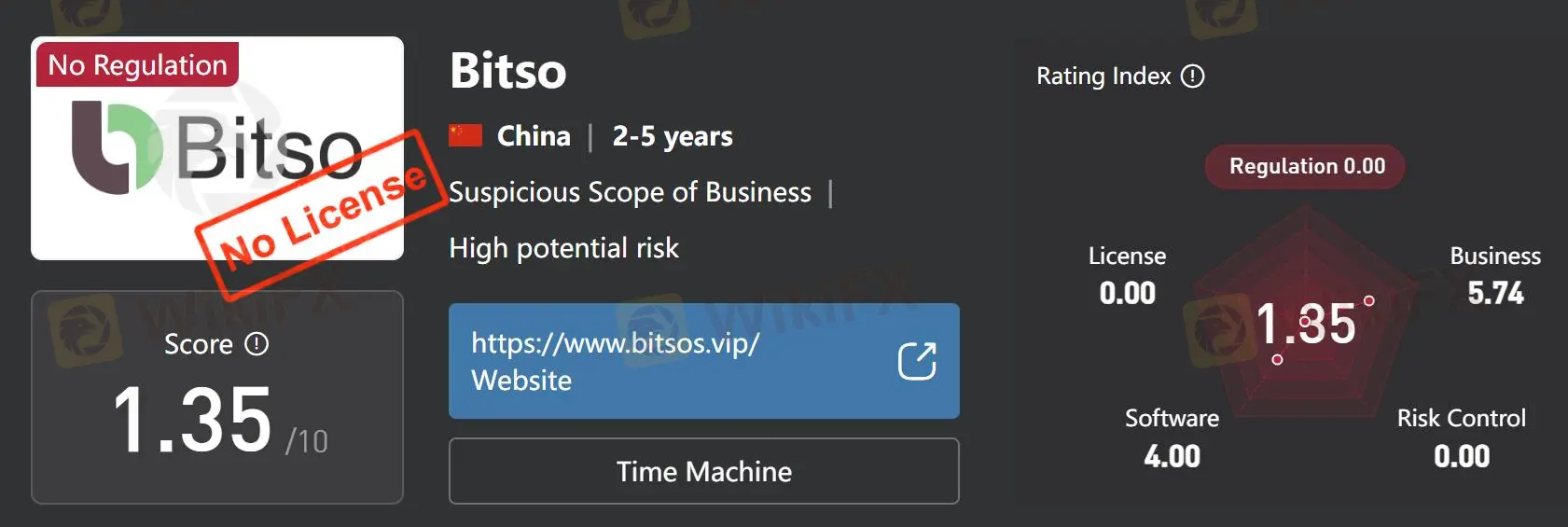

Abstract:Bitso presents itself as an online forex broker, purportedly registered in China with a claimed operational history spanning 2-5 years. Notably, this broker currently operates under no regulation.

| Bitso | Basic Information |

| Founded in | 2-5 years ago |

| Registered in | Unknown |

| Regulation | Not Regulated |

| Tradable Assets | Unknown |

| Trading Platform | Unknown |

| Customer Support | None |

About Bitso

Bitso presents itself as an online forex broker, purportedly registered in China with a claimed operational history spanning 2-5 years. Notably, this broker currently operates under no regulation.

Regulation: Is Bitso legit?

Bitso operates outside the purview of recognized financial regulatory bodies, a fact that raises significant concerns. The broker's credibility is further compromised by its exceptionally low rating of 1.35 out of 10 on WikiFX, a respected broker evaluation platform. This combination of regulatory absence and poor industry standing casts doubt on Bitso's legitimacy and operational integrity.

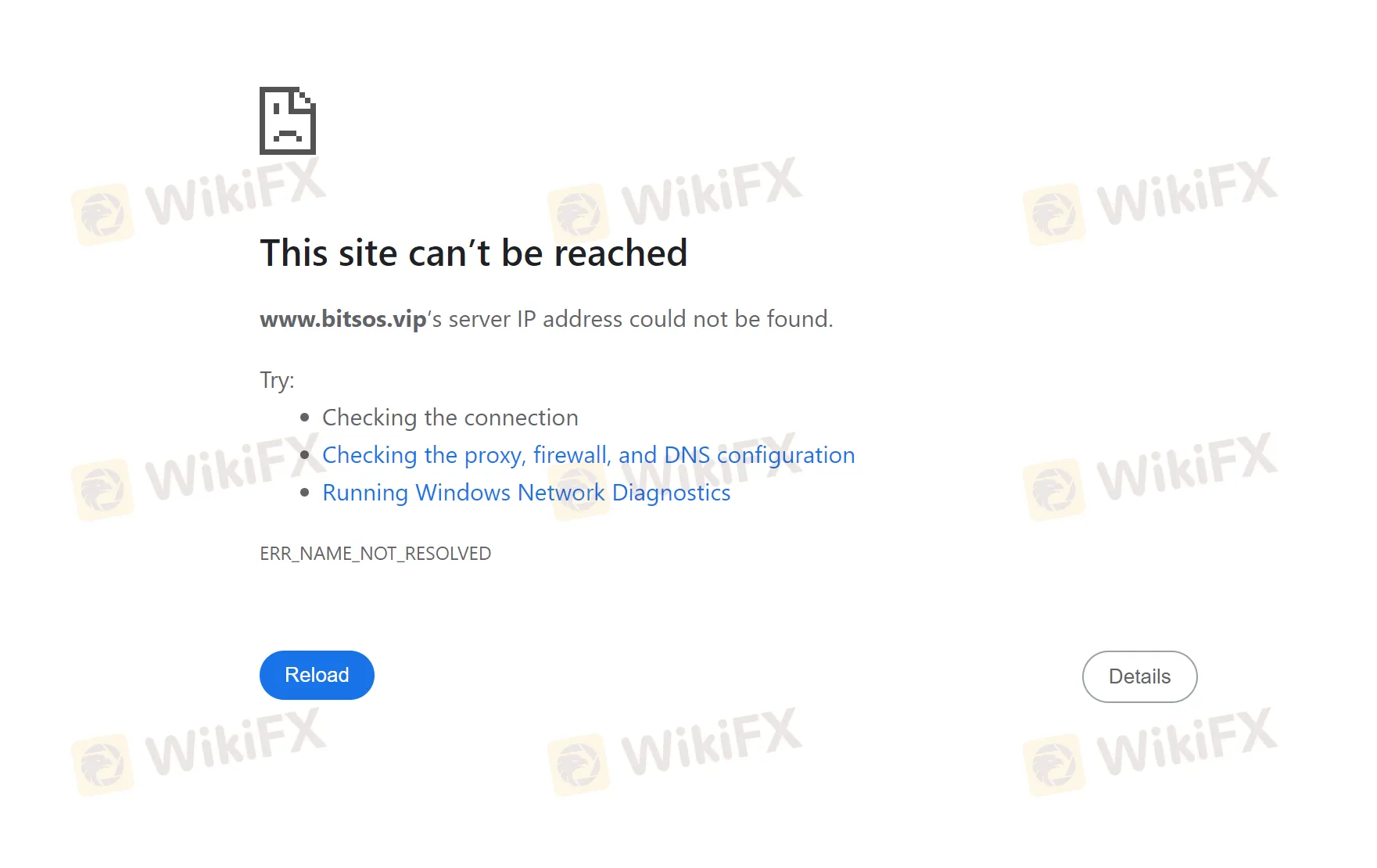

Unaccessible Website

Currently, Bitso's digital footprint is virtually non-existent, with its official website being inaccessible. This lack of online presence severely hinders potential and existing clients from accessing vital information about the broker's services, terms, and operational details. In the digital age of financial services, such inaccessibility is a major red flag.

Trading Platform

Bitso deviates from industry norms by not offering MetaTrader 4 (MT4) or MetaTrader 5 (MT5), the most widely adopted trading platforms in the forex market. This absence potentially limits traders' access to advanced tools, features, and the familiarity these platforms provide.

Contact Information

An alarming aspect of Bitso's operations is the complete lack of provided contact information. The absence of any communication channels is highly unusual in the brokerage industry and raises serious questions about the firm's commitment to client support and overall transparency.

Conclusion

To provode a summary, Bitso appears unsuitable for traders of any experience level or risk appetite. The potential hazards associated with this broker seem to substantially outweigh any conceivable advantages. Traders prioritizing security, transparency, and regulatory compliance would be well-advised to explore alternative options among regulated, well-established brokers with verifiable operations and clear communication channels.

FAQs

Is Bitso a legitimate broker?

Bitso's legitimacy is highly suspect. The lack of regulation, extremely poor industry rating, absence of an accessible website, and non-existent contact information all point to significant risks. Potential clients are strongly advised to steer clear of this broker.

Is Bitso suitable for novice traders?

Bitso is not recommended for beginners or experienced traders alike. The absence of regulatory oversight, poor reputation, lack of industry-standard trading platforms, and overall opacity render it unsuitable for any trading activities.

Can one trade safely with Bitso?

Engaging in trading activities with Bitso appears to entail substantial risks. The absence of regulatory safeguards, critically low industry rating, and lack of verifiable operations strongly suggest that trading with this broker is not a safe proposition. Traders are urged to prioritize their financial security by opting for regulated, reputable brokers with established track records.

Risk Warning

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information provided in this review may be subject to change due to the constant updating of the company's services and policies. In addition, the date on which this review was generated may also be an important factor to consider, as information may have changed since then.

Read more

Lirunex Joins Financial Commission, Boosts Trader Protection

Lirunex joins the Financial Commission, offering traders €20,000 protection per claim. A multi-asset broker regulated by CySEC, LFSA, and MED.

Capital.com Review 2025: Trading Account & Withdrawal to Explore

Despite its relative youth, the Cyprus-registered online broker Capital.com has garnered respectable attention from a large number of retail and professional investors since its 2016 launch. Capital.com is a frontrunner among low-cost trading products; it allows individual and institutional investors to trade contracts for difference (CFDs) on three thousand markets, including Forex, Stocks, Commodities, Indices, Cryptocurrencies, and more. Impressively, Capital.com is on board with ESG investments as well. You can begin trading CFDs on the Capital.com platform with as little as $20. You can trade CFDs on this platform without paying any commissions; the only fees involved are the spreads. This broker offers a wide range of platforms, including mobile apps, a desktop trading app, an API from Capital.com, Tradingview, and MetaTrader 4. Among Capital.com's many distinguishing features is the wealth of educational content and high-quality research it offers its users. The platform's Marke

Italy’s Securities Regulator Consob Orders Shutdown of 6 Illegal Financial Service Websitese

Italy’s financial regulator, Consob, has ordered the shutdown of six unauthorized financial service websites to combat illegal financial activities and protect investors. This action is based on regulatory powers granted under the 2019 “Crescita Decree.” Since 2019, Consob has blocked 1,211 fraudulent websites. Investors can use WikiFX to verify compliance and avoid investment scams.

Win $100,000 in XM Competitions: Trade for Cash Prizes!

Join XM Competitions from 20-27 Feb for a chance to win $100,000! Compete by skill or luck. No entry fees. Trade on a secure, award-winning platform.

WikiFX Broker

Latest News

Spotting Red Flags: The Ultimate Guide to Dodging WhatsApp & Telegram Stock Scams

WikiFX Review: Why so many complaints against QUOTEX?

Trans X Markets: Licensed Broker or a Scam?

Judge halts Trump\s government worker buyout plan: US media

BaFin Unveils Report: The 6 Biggest Risks You Need to Know

IMF Warns Japan of Spillover Risks from Global Market Volatility

Beware of Comments from the Fed's Number Two Official

RBI: India\s central bank slashes rates after five years

Nomura Holdings Ex-Employee Arrested in Fraud Scandal

Pepperstone Partners with Aston Martin Aramco F1 Team for 2025

Rate Calc