Amber Invest

Abstract:Amber Invest, headquartered in Singapore, offers a range of account types. These include PREMIUM, PLATINUM, GOLD, SILVER, and BRONZE accounts. The company's structure appears designed to accommodate various levels of investor experience and capital, from entry-level to high-net-worth individuals.

| Amber Invest | Basic Information |

| Company Name | Amber Invest |

| Headquarters | Singapore |

| Regulations | Not regulated |

| Account Types | PREMIUM,PLATINUM,GOLD,SILVER,BRONZE |

| Minimum Deposit | $250 |

| Maximum Leverage | 1:500 |

| Spreads | From 0.0 pips |

| Customer Support | Telephone number(+65 31590681)Email (support@amber-invest.org)(info@amberinvest.ltd) |

Overview of Amber Invest

Amber Invest, headquartered in Singapore, offers a range of account types. These include PREMIUM, PLATINUM, GOLD, SILVER, and BRONZE accounts. The company's structure appears designed to accommodate various levels of investor experience and capital, from entry-level to high-net-worth individuals.

Is Amber Invest Legit?

Regarding regulation, Amber Invest operates without regulatory oversight. This lack of regulation means the company's activities and financial practices are not subject to the scrutiny and standards typically imposed by financial authorities. Investors should be aware that this absence of regulation may impact the level of protection afforded to their investments.

Pros and Cons

Amber Invest presents a mix of advantages and potential drawbacks. On the positive side, it offers fast trade execution and risk management tools, which can be beneficial for active traders. The company also provides multiple account types to suit different investor profiles. However, the absence of regulatory oversight poses potential risks to investor protection. Additionally, the absence of clear information on key account features such as leverage and spreads may pose challenges for informed decision-making.

| Pros | Cons |

|

|

|

|

|

Account Types

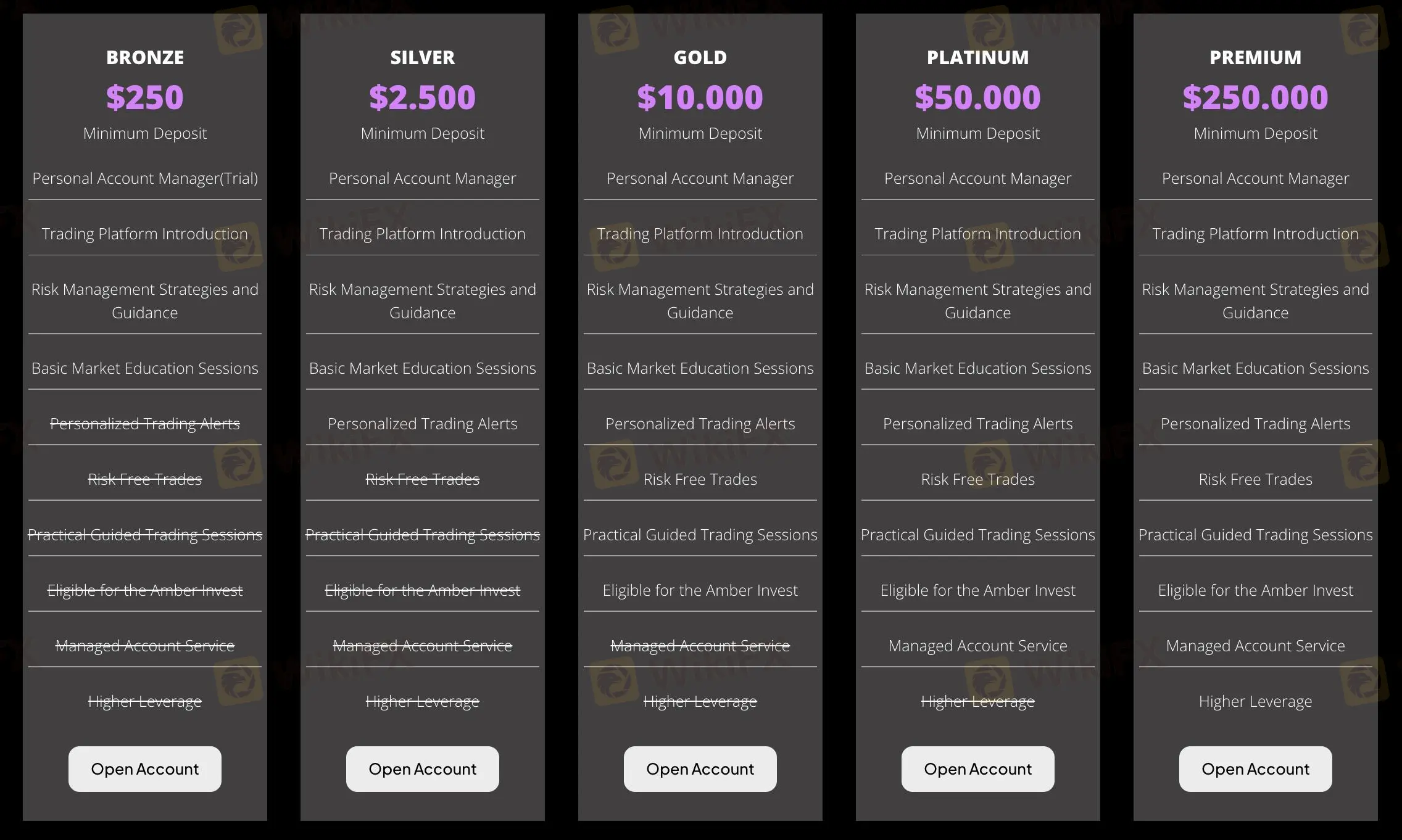

Amber Invest's account structure is tiered, offering five levels of service. The BRONZE account has the lowest entry point at $250, followed by SILVER at $2,500, GOLD at $10,000, PLATINUM at $50,000, and PREMIUM at $250,000. This graduated system allows investors to choose an account type that aligns with their investment capital and trading objectives.

| Account Type | PREMIUM | PLATINUM | GOLD | SILVER | BRONZE |

| Minimum Deposit | $250000 | $50000 | $10000 | $2500 | $250 |

Leverage

Amber Invest offers a maximum leverage of 1:500. This high leverage ratio can potentially amplify both gains and losses, making it suitable for experienced traders who understand and can manage the associated risks. However, investors should approach such high leverage with caution, as it can lead to significant losses if not used prudently.

Customer Support

For customer support, Amber Invest provides a telephone number (+65 31590681) and two email addresses (support@amber-invest.organd info@amberinvest.ltd). These contact options allow clients to reach out for assistance with their accounts or general inquiries about the company's services.

Conclusion

In conclusion, Amber Invest presents itself as a trading platform with a range of account options and high leverage potential. However, the lack of regulation and limited transparency on certain account features warrant careful consideration by potential investors.

FAQs

- What account types does Amber Invest offer?

Amber Invest offers PREMIUM, PLATINUM, GOLD, SILVER, and BRONZE account types.

- Is Amber Invest regulated?

No, Amber Invest is not currently regulated by any financial authority.

- What is the maximum leverage offered by Amber Invest?

Amber Invest offers a maximum leverage of 1:500.

Review

Amber Invest might be worth a look if you're into high-leverage trading and don't mind a bit of risk. They've got a decent spread of account types, so there's probably something for most traders. The quick execution is a plus, and their risk management tools could come in handy. But keep in mind, they're flying under the regulatory radar, which might make some folks a bit nervous. All in all, it's a mixed bag - could be a good fit for some, but definitely do your homework before jumping in.

Risk Warning

Trading online carries inherent risks, including the potential loss of your entire investment. It's essential to recognize that online trading may not be suitable for everyone, and individuals should carefully consider their risk tolerance before participating. Additionally, please be aware that the details provided in this review are subject to change as companies update their services and policies. Therefore, it's advisable to verify the most up-to-date information directly with the company before making any trading decisions. Ultimately, the responsibility for utilizing the information in this review lies solely with the reader.

Read more

Effective Stop Loss Trading Strategies

In a forex market where fundamental and technical factors impact the currency pair prices, volatility is expected. If the price volatility acts against the speculation made by traders, it can result in significant losses for them. This is where a stop-loss order comes to their rescue. It is one of the vital investment risk management tools that traders can use to limit potential downside as markets get volatile. Read on as we share its definition and several strategies you should consider to remain calm even as markets go crazy.

1Prime options Review: Examining Fund Scam & Trade Manipulation Allegations

Did you find trading with 1Prime options fraudulent? Were your funds scammed while trading on the broker’s platform? Did you witness unfair spreads and non-transparent fees on the platform? Was your forex trading account blocked by the broker despite successful verification? These are some issues that make the traders’ experience not-so memorable. In this 1Prime options review article, we have investigated the broker in light of several complaints. Keep reading!

EXTREDE Review (2026): A Complete Look at the Serious Warning Signs

This EXTREDE Review serves an important purpose: to examine the big differences between what the broker advertises and what we can actually prove. For any trader thinking about using this platform, the main question is about safety and whether it's legitimate. We will give you a clear answer right away. Our independent research, backed up by third-party information, shows that EXTREDE operates without proper regulation, creating a high-risk situation for all investors. The main focus of this investigation is the absolutely important need to check a broker's claims before investing. A broker's website is a marketing tool; it cannot replace doing your own research. The information that EXTREDE presents contains contradictions that every potential user must know about. A quick way to see these warnings gathered together is by checking the broker's live profile on verification platforms. For example, the EXTREDE page on WikiFX brings together regulatory status, user feedback and expert ri

NEWTON GLOBAL Deposit and Withdrawal Methods: A Complete 2026 Review

When traders look at a broker, they care most about how well its payment system works and what options it offers. You are probably looking for information about NEWTON GLOBAL deposit and withdrawal methods to see if they work for you. The broker says it has many modern payment options and promises fast processing times. However, a good review needs to look at more than just what it advertises. We need to check how safe your capital really is with this broker. One important factor that affects the safety of every transaction is whether the broker is properly regulated. Our research shows that NEWTON GLOBAL does not have any valid financial regulation from a trusted authority. This fact, along with a very low trust score, completely changes the situation. The question changes from "How can I withdraw?" to "Is it safe to invest here?" This background information is essential for protecting your capital.

WikiFX Broker

Latest News

You Keep Blowing Accounts Because Nobody Taught You This

HTFX Review: Safety, Regulation & Forex Trading Details

Promised 30% Returns, Lost RM630,000 Instead

Copy-Paste Broker Scams: How Template Websites Are Used to Impersonate Regulated FX Firms

BP PRIME Review: Safe Broker or Risky Broker

EXTREDE Review (2026): A Complete Look at the Serious Warning Signs

Effective Stop Loss Trading Strategies

Q4 GDP Unexpectedly Grows At 1.4%, Half Expected Pace, As Government Shutdown Hits Q4 Growth

Q4 GDP Unexpectedly Grows At 1.4%, Half Expected Pace, As Government Shutdown Slams Growth

BitPania Review 2026: Is this Broker Safe?

Rate Calc