【MACRO Insight】Gold Plunges, Yen Makes a Strong Comeback - Asia-Pacific Market Sentiment Worsens Amidst Rising Safe-Haven Sentiment!

Abstract:The Asia-Pacific market sentiment has worsened, and the yen has risen for the fourth consecutive day in safe-haven sentiment and rate hike expectations, significantly impacting the Japanese stock market and global assets. Although the market generally expects the Bank of Japan to raise interest rates, the uncertainty of the final decision and the Federal Reserve's interest rate cut signal will have a key impact on the yen's trend. Investors need to closely monitor policy trends, flexibly adjust

On Thursday, the Asia-Pacific market experienced a deterioration in sentiment, primarily due to investors withdrawing from the artificial intelligence boom, leading to a significant drop in the U.S. stock market and triggering a safe-haven sentiment. Meanwhile, as the Bank of Japan's meeting next week approaches, the yen has risen for the fourth consecutive day, significantly impacting the Japanese stock market. Driven by safe-haven sentiment and expectations of a rate hike by the Bank of Japan, the yen has shown a clear strength against other G10 currencies and Asian currencies.

Specifically, the U.S. dollar fell 0.68% against the yen to 152.85, the euro fell 0.65% against the yen to 165.72, and the British pound fell 0.74% against the yen to 197.09. In addition, the overnight implied volatility of the U.S. dollar/yen rose to a one-month high of 14.325%, with the one-week and two-week implied volatilities also rising to 14.015% and 11.99%, respectively, the highest levels since May 3. Both Japanese and South Korean stock markets saw declines of more than 2%. The Nikkei 225 index fell below 38,000 points, with a daily drop of 2.97%, falling 10% from the July high and entering a technical correction range. The FTSE China A50 index futures also fell by 1%. At the same time, the spot gold price fell below $2,370 per ounce, with a daily drop of 1.14%, and the spot silver price continued to fall, breaking below the $28 mark, with a drop of more than 3%.

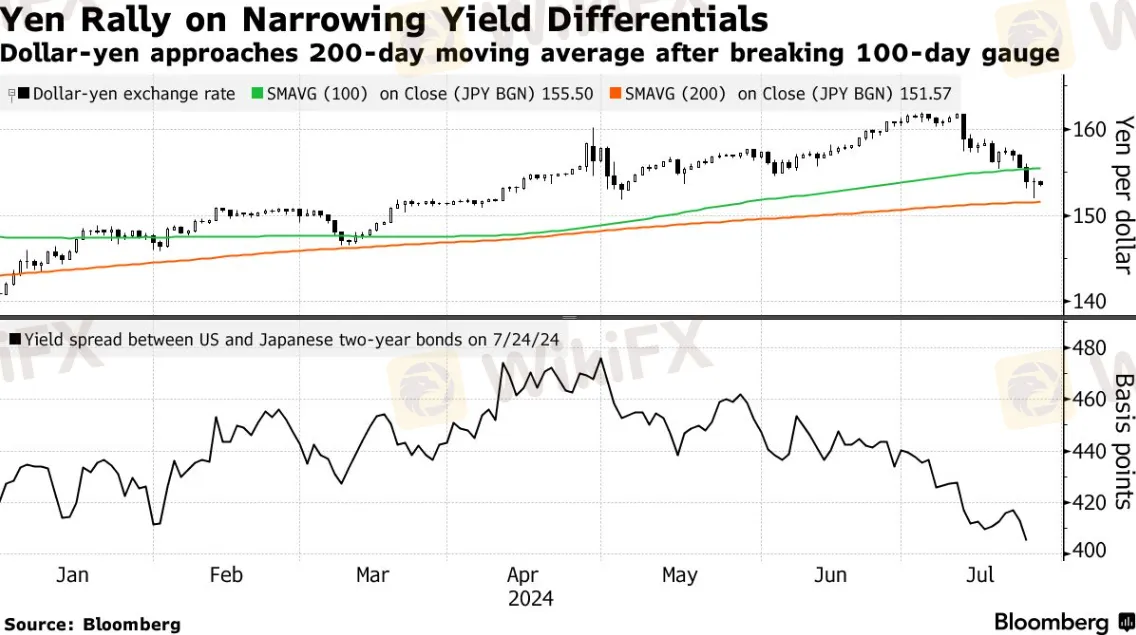

The market expects that the Bank of Japan may raise interest rates next week, with 90% of Bank of Japan observers believing there is a possibility of a rate hike. The yen has risen against the U.S. dollar to its strongest level since May, rebounding more than 5% from the lowest point in the 1980s within two weeks. The potential tightening of monetary policy by the Bank of Japan contrasts with the expectations of rate cuts by the Federal Reserve and the European Central Bank. Data from the U.S. Commodity Futures Trading Commission (CFTC) shows that leveraged funds reduced their net short yen positions in the week ending July 16, with the largest decrease since March 2011. Asset management companies have also reduced their bets on the yen, with the largest drop in a year.

The astonishing recovery of the yen is overturning the global market, causing Japanese stocks, gold, and Bitcoin to suffer, and investors are reassessing their leveraged bets. The significant recovery trend is not only overturning the global market but also causing Japanese stocks, gold, and Bitcoin to suffer, with investors reassessing their leveraged bets. Since the surge began on July 11, the yen's exchange rate against the U.S. dollar has maintained an increase of about 5%, with suspected intervention by Japan amplifying this increase. However, the rise is not solid, as the yen quickly gave up gains overnight following stronger-than-expected U.S. economic growth data.

The strengthening of the yen has hurt Japanese exporters and pushed the Nikkei 225 index into a technical correction. The yen's strength has also hit currencies like the Australian dollar, as well as gold and Bitcoin, as carry trade becomes less popular, and traders seem to be selling off previously popular short yen bets. Kyle Rodda, a senior market analyst at Capital.com, said: “This is actually a deleveraging event triggered by yen short covering, and it is forcing a broad market clearance.”

The recent strength of the yen has become an additional source of volatility for global assets, which have already been shaken by the fading enthusiasm for the artificial intelligence boom that has driven Wall Street this year. The yen has risen nearly 5% against the U.S. dollar since touching a multi-year low at the beginning of the month, but this momentum will be tested next week with the release of new U.S. data and the upcoming meetings of both the Bank of Japan and the Federal Reserve. The reason behind the yen's rebound is the massive withdrawal of global carry trades, which use low-yielding currencies like the yen to fund investments in high-yielding currencies like the Mexican peso or the Australian and New Zealand dollars. Expectations that the Federal Reserve may ease policy as early as September are also a key driver of the yen's rebound.

Swap markets show that there is a 43% chance that the Bank of Japan will raise interest rates by 15 basis points at the policy meeting on July 31, indicating that the Bank of Japan is very cautious. Only 30% of Bank of Japan observers surveyed by Bloomberg predict a rate hike, although more than 90% believe there is a risk of a rate hike. This puts the yen bulls in a weak position, especially if the Bank of Japan disappoints by significantly cutting bond purchases, or if the Federal Reserve takes any measures later in the day to curb hopes for U.S. rate cuts in the coming months.

Some industry insiders worry that the Bank of Japan may become a party pooper, not playing its expected role in tightening policy. If the Bank of Japan disappoints the market, the carry trade that has kept the yen weak “may make a comeback.” From BlackRock to former central bank officials, others expect the Bank of Japan to keep interest rates unchanged for a longer period. Incomplete economic data supports this view: although a key indicator tracking the strength of Japan's service industry rebounded in July, the indicator measuring factory activity showed a contraction. Insiders say that weak consumer spending makes the Bank of Japan's decision next week more complicated.

That is to say, if the Bank of Japan takes no action, the U.S. dollar-yen exchange rate may soar again. Nathan Swami, Managing Director of Foreign Exchange Trading at Citigroup in Singapore, believes that after the significant yen volatility this week, the demand for bullish yen options has increased. He said: “It is too early to judge whether this heralds a shift in long-term investor sentiment, so it is more likely a tactical shift in short-term positions or hedging activities at present.” Traders are also watching the Bank of Japan's interest rate meeting next Wednesday. Swap markets predict that there is about a 70% chance that the Bank of Japan will raise interest rates at this meeting, up from 44% earlier this week. ING strategists such as Chris Turner wrote in a report on Thursday, “The yen short covering is undoubtedly intensifying global risk aversion. There is definitely more closing of positions, and data or events in the coming days will bring further downside risks to the U.S. dollar-yen.”

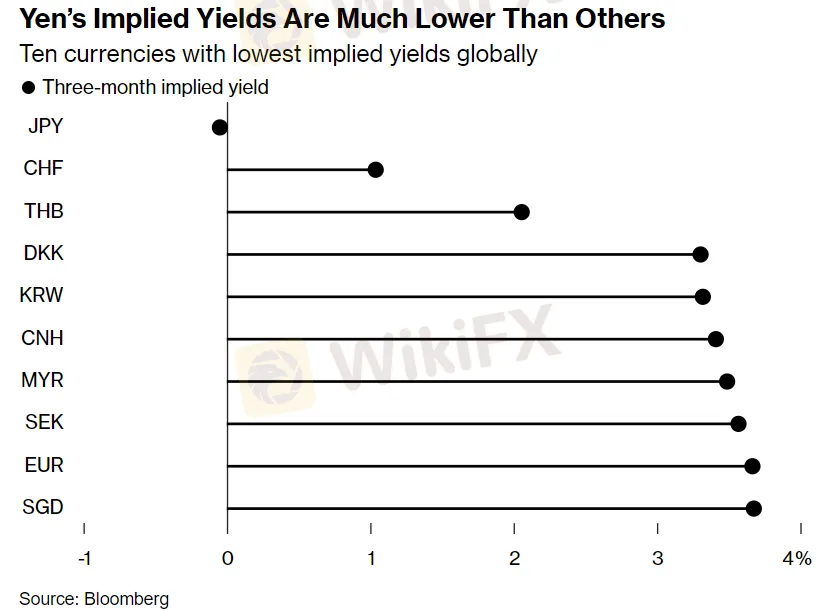

Rodrigo Catril of the National Australia Bank (NAB) said that if the Bank of Japan “does not fully deliver on its promises,” the yen-U.S. dollar exchange rate could fall to the 158 level. However, even if the Bank of Japan really tightens policy next Wednesday, it still has reasons to continue to be favored in carry trades, where investors borrow yen at ultra-low interest rates and then invest in higher-yielding currencies. Even after the Bank of Japan raises interest rates, the implied yield of the yen will still be about 90 basis points lower than that of the Swiss franc, which is an alternative financing currency for carry trades.

The implied yield of the yen is still far lower than that of other currencies. The risks brought by U.S. interest rates are also significant. If the possibility of the Federal Reserve cutting interest rates decreases, the yen may be attacked again. Charu Chanana, head of currency strategy at Saxo Capital Markets, said: “If the Federal Reserve does not signal a rate cut in September and U.S. data starts to strengthen, the yen against the U.S. dollar may test 160.” Calvin Yeoh, managing partner of the Merlion Fund at Blue Edge Advisors, said: “Although the summer temperature is very high, liquidity is low. If the yen continues to soar, it will further lead to cross-asset liquidation, which will increase volatility and may trigger some funds' risk control alarms and forced liquidation.”

The Asia-Pacific market sentiment has worsened, and the yen has risen for the fourth consecutive day in safe-haven sentiment and rate hike expectations, significantly impacting the Japanese stock market and global assets. Although the market generally expects the Bank of Japan to raise interest rates, the uncertainty of the final decision and the Federal Reserve's interest rate cut signal will have a key impact on the yen's trend. Investors need to closely monitor policy trends, flexibly adjust their investment strategies to cope with market fluctuations, and pay attention to the positive correlation between the yen and gold prices that may bring investment opportunities.

WikiFX Broker

Latest News

Kraken Review 2025: Is This Forex Broker Safe?

IQ Option Review: The High-Stakes Game of Withholding Trader Capital

AssetsFX Regulation: A Complete Guide to Licenses and Trading Risks

Grand Capital Review 2026: Is this Broker Safe?

MultiBank Group Review: A Regulatory Titan or a Master of Liquidation?

ZarVista User Reputation: Looking at Real User Reviews to Check if It's Trustworthy

ZaraVista Legitimacy Check: Addressing Fears: Is This a Fake Broker or a Legitimate Trading Partner?

Pinnacle Pips Forex Fraud Exposed

S. Africa Energy Gridlock: Glencore Proposal Stalls Amid Regulatory Clash

TP Trader Academy ‘The Axis Event’: Pioneering Trading Education at the Heart of Tech and Data

Rate Calc