XO

Abstract:Registered in 1995 in Malaysia, XO is an unregulated brokerage, and its official website is currently inaccessible. It is flagged as a scam.

XO Information

Registered in 1995 in Malaysia, XO is an unregulated brokerage, and its official website is currently inaccessible. It is flagged as a scam.

Is XO Global Legit?

XO is an unregulated platform, which means it lacks regulatory oversight. The platform could potentially run away with funds at any time, making it impossible for investors to recover their money. Trading on unregulated platforms carries high risks, and investors need to exercise caution.

Downsides of XO

- Unavailable WebsiteXO's official website is currently inaccessible, indicating a lack of transparency and reliability.

- Lack of TransparencySince XO's website cannot be accessed, there is also limited and potentially inaccurate information available online through search engines. This makes it difficult for investors to make informed decisions.

- Regulatory ConcernsXO is not regulated by any official platform, which may expose it to issues such as fraudulent activities, false information, and difficulties in seeking recourse.

- Fraudulent Operations

Historical user feedback indicates that invested funds could not be recovered and withdrawn, which is a red flag for traders.

Negative XO Reviews on WikiFX

On WikiFX, “Exposure” is posted as a word of mouth received from users.

Traders are encouraged to review information and assess risks before trading on unregulated platforms. Please consult our platform for related details. Report fraudulent brokers in our Exposure section and our team will work to resolve any issues you encounter.

As of now, there were 2 pieces of XO exposure in total. The details are as follows:

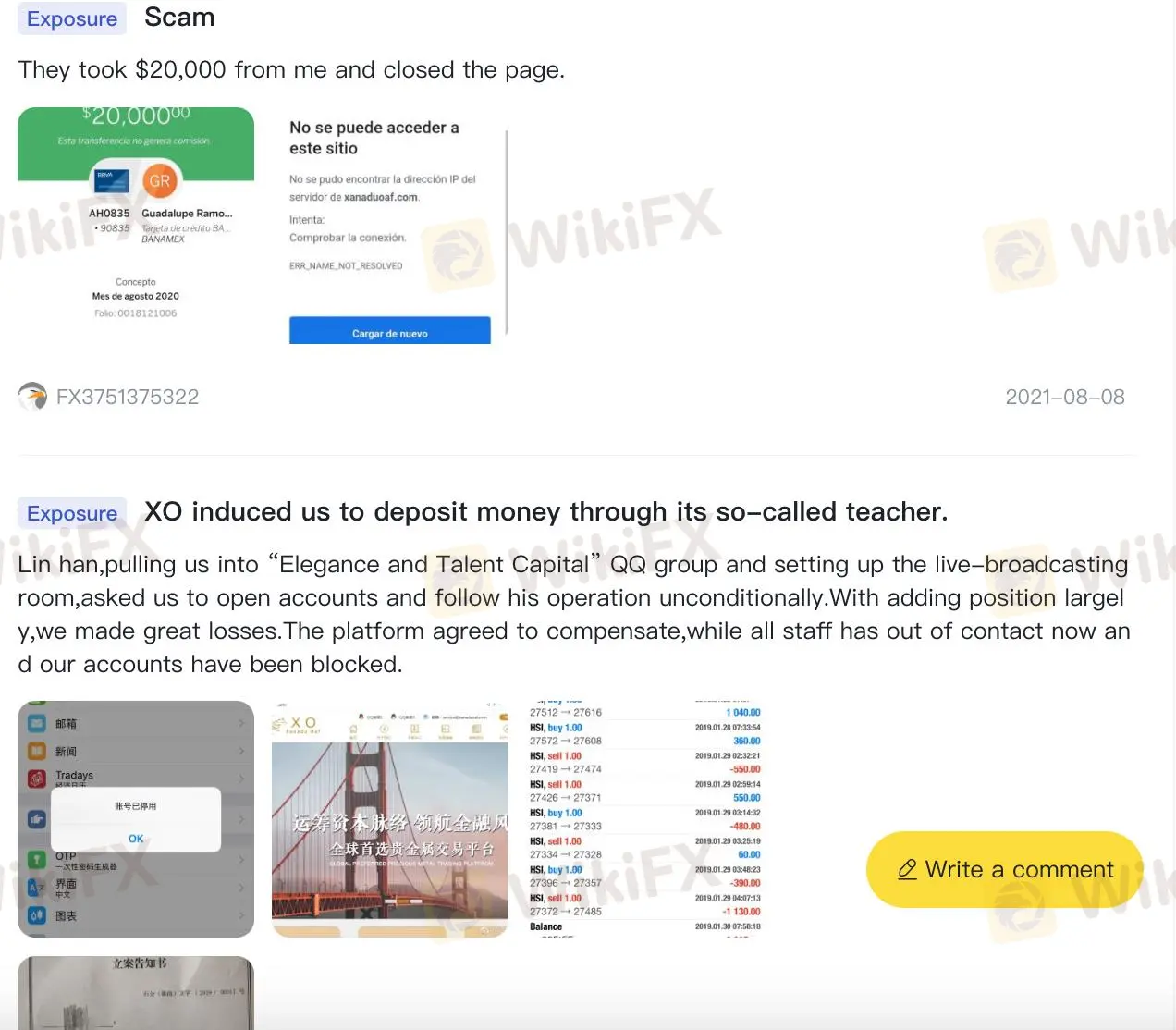

Exposure 1.Fund Fraud

| Classification | Fund Fraud |

| Date | 2021-08-08 |

| Post Country | Colombia |

The user reported that after investing $20,000, the platform can't be loggin again, and the funds could not be recovered.

Exposure 2.Fraudulent Operations

| Classification | Fraudulent Operations |

| Date | 2021-08-08 |

| Post Country | Colombia |

The user reported that the platform's operators deceived them into continually increasing their position, resulting in significant losses. The platform initially agreed to provide compensation, but now all related personnel have gone dark, and the account has been frozen.

Conclusion

XO is flagged as a scam because of its lack of regulatory oversight and the fact that its website is inaccessible. Historical user feedback indicates that invested amounts could not be recovered. It is not recommended to use this platform for trading. Investors should choose regulated trading platforms to ensure trading safety.

Read more

What Impact on Investors as Oil Prices Decline?

Oil prices have come under pressure amid mounting concerns over U.S. import tariffs and rising output from OPEC+ producers. With tariffs on key trading partners and supply increases dampening fuel demand expectations, investor appetite for riskier assets has cooled. This shift in sentiment poses a range of implications for different segments of the investment landscape.

Teacher Lost Life Savings in WhatsApp Investment Fraud

A Malaysian teacher recently became the victim of an elaborate investment scam, losing more than RM200,000 after being lured into a fraudulent Bitcoin scheme through WhatsApp.

Unmasking a RM24 Million Forex Scam in Malaysia

Authorities in Malaysia have identified the prime suspect behind a foreign exchange (forex) investment fraud that has caused losses exceeding RM24 million.

How to Choose the Best Forex Pairs? Avoid Common Trading Pitfalls

Choosing the right forex pair is crucial for success. This guide explores volatility, trading sessions, and costs to help traders make informed decisions and maximize profitability.

WikiFX Broker

Latest News

Forex Trading: Scam or Real Opportunity?

The Hidden Tactics Brokers Use to Block Your Withdrawals

Beware: Online Share Buying Scam Costs 2,791,780 PHP in Losses

5 things I wish someone could have told me before I chose a forex broker

Unmasking a RM24 Million Forex Scam in Malaysia

U.S., Germany, and Finland Shut Down Garantex Over Money Laundering Allegations

Gold Prices Fluctuate: What Really Determines Their Value?

Dollar Under Fire—Is More Decline Ahead?

What Impact on Investors as Oil Prices Decline?

Is the North Korea's Lazarus Group the Biggest Crypto Hackers or Scapegoats?

Rate Calc