WTM

Abstract:WTM is a trading platform registered in the United Kingdom since 1994. It is currently not regulated by any authority, as it is not authorized by the NFA. The platform's official website is currently inaccessible.

Note: WTM's official website: https://wtmfx.net/en is currently inaccessible normally.

WTM Information

WTM is a trading platform registered in the United Kingdom since 1994. It is currently not regulated by any authority, as it is not authorized by the NFA. The platform's official website is currently inaccessible.

Is WTM Global Legit?

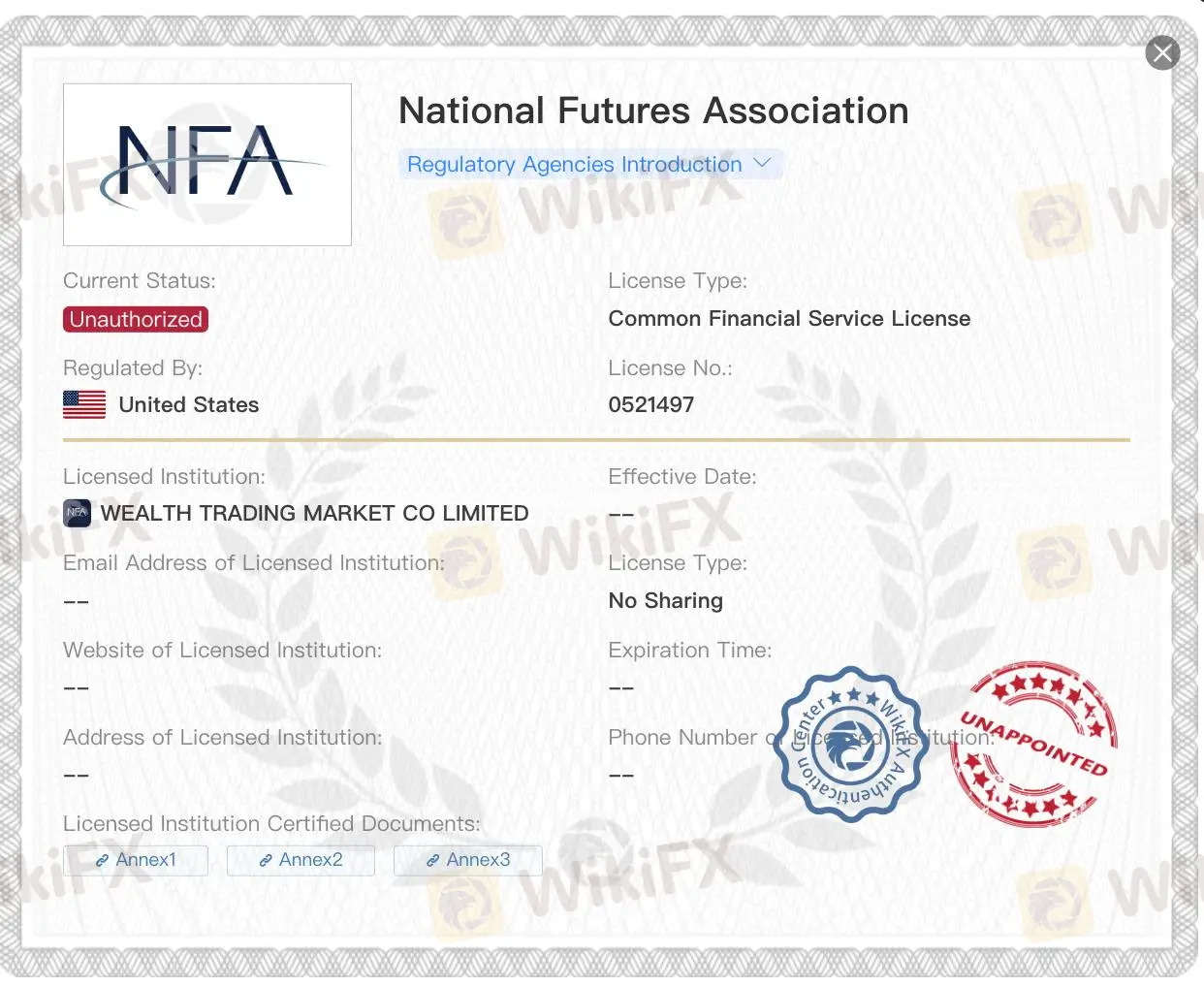

| National Futures Association (NFA) |

| Current Status | Unauthorized |

| Regulated by | United States |

| License Type | Common Financial Service License |

| License No. | 0521497 |

| Licensed Institution | WEALTH TRADING MARKET CO LIMITED |

WTM's regulatory status is “not authorized by the NFA,” meaning it is not regulated by any authority. The lack of regulation significantly increases the risk of trading on this platform, as it means there are no official or government safeguards and protections in place.

Downsides of WTM

- Unavailable Website:The official website of WTM is currently inaccessible, which severely reduces the platform's transparency and reliability.

- Lack of Transparency:There is a significant lack of information about WTM online, making it difficult for investors to make informed decisions compared to other brokers. The inaccessible website means there is no trustworthy official information available regarding fees, security measures, or trading software.

- Regulatory Issues:WTM is not authorized by the NFA, meaning it is unregulated. This lack of regulation poses a high risk for trading activities.

- Investment Scam Reports:There have been reports of investment scams associated with WTM, including false promises of returns and subsequent demands for large payments, leading to financial losses.

Negative WTM Reviews on WikiFX

On WikiFX, “Exposure” refers to user reviews and feedback.

Users are advised to review other users' experiences on the WikiFX website before choosing a trading platform. The WikiFX link for WTM is: https://www.wikifx.com/en/dealer/8621893256.html

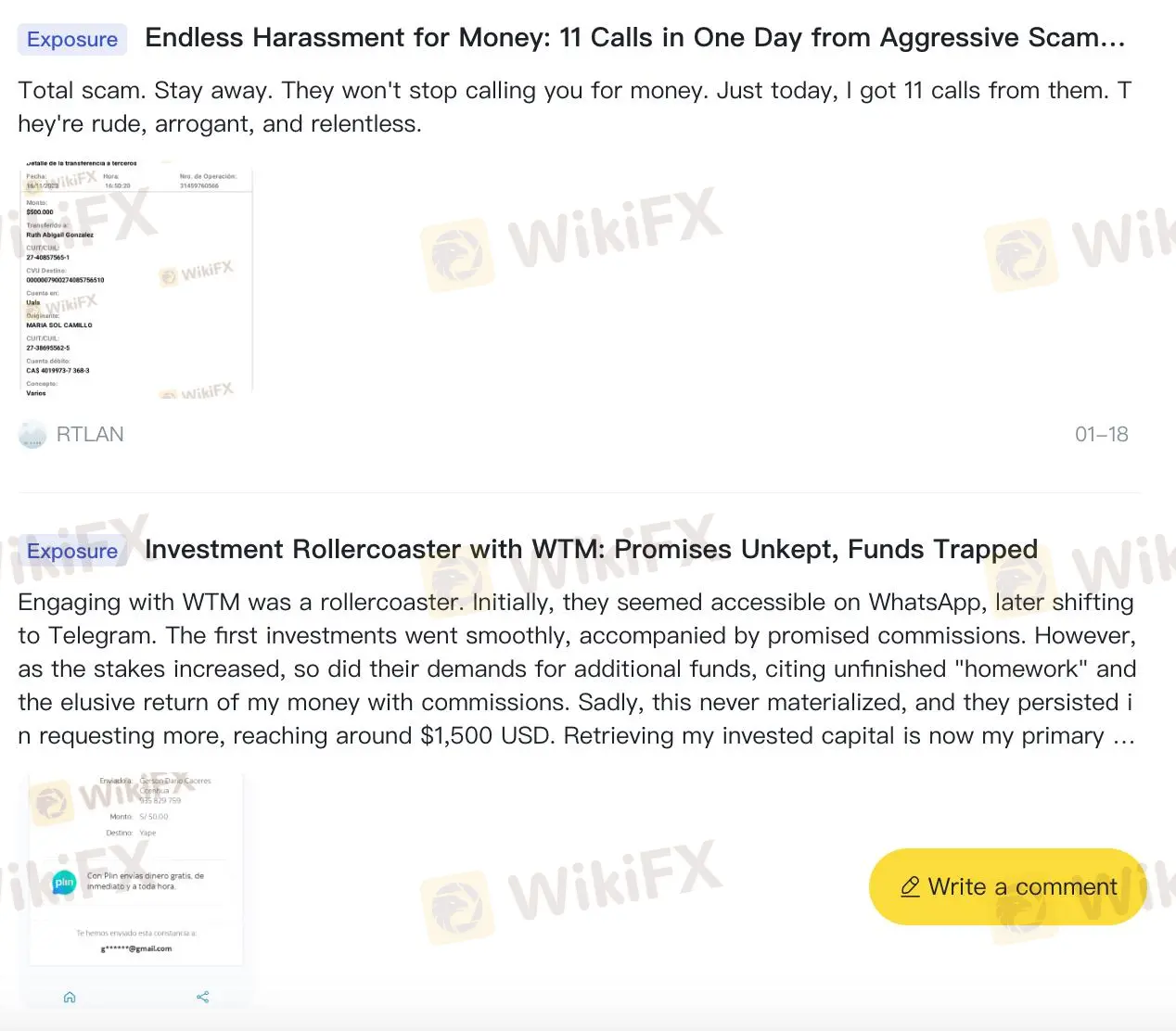

Currently, there are four exposure reports on WTM. Here are details on two of them:

Exposure 1. False promises of returns

| Classification | False promises of returns |

| Date | 2023-12-01 |

| Post Country | Argentina |

A user reported that WTM promised investment returns. Initially, the user did receive some profits. However, the platform began demanding increasingly higher investment amounts, resulting in a loss of approximately $1,500.

Visit https://www.wikifx.com/en/comments/detail/202311303752885580.html for more details.

Exposure 2. Subsequent demands for high payments

| Classification | Subsequent demands for high payments |

| Date | 2023-11-04 |

| Post Country | Peru |

A user reported being contacted by WTM representatives via WhatsApp and then Telegram to start investing. Similar to the first user, initial trades were successful, but the platform increasingly demanded higher investment amounts, leading to a loss of 1,150 soles.

For more details, visit: https://www.wikifx.com/en/comments/detail/202311045172801076.html

Conclusion

WTM is an unregulated trading platform with several significant drawbacks. Its lack of regulation means there is no oversight or protection for investors. Additionally, the inaccessible website further reduces transparency, and numerous negative feedbacks highlight issues such as increasing investment demands and potential fraud.

Overall, WTM is not recommended for investment trading.

Read more

ASIC Banned the Director of JB Markets

The Australian Securities and Investments Commission (ASIC) has banned Peter Aardoom, the director of JB Markets, for eight years from associating with any financial services firm. This ban follows a series of regulatory actions against JB Markets, which included the cancellation of its Australian Financial Services (AFS) license less than a year ago.

X Charter Review: Is It a Safe Broker for Your Investments?

Choosing a reliable broker that offers competitive conditions and robust security is essential. X Charter, a Belize-registered brokerage, claims to offer a comprehensive trading platform for Forex, CFDs on Shares, Futures, Indices, Metals, and Energy. However, with its unregulated status and some concerning features, potential traders must carefully assess the risks before opening an account.

Plus500 Review 2025: Trading Accounts, Demo Accounts, Withdrawal to Explore

When it comes to online trading and investment, Plus500 has established itself as a prominent global fintech company, offering trading on over 2,800 CFD-based financial instruments, covering forex, commodities, indices, global stocks, ETFs and cryptocurrencies. Whether you're new to trading or an experienced investor looking for a reliable platform, understanding how to open, use, and manage your Plus500 account is essential. This guide will walk you through the key aspects of Plus500 accounts, from opening a demo account to making withdrawals.

Pepperstone Adds 79 Stocks to 24-Hour US Share CFDs

Pepperstone expands 24-hour US share CFDs, adding 79 stocks like Tesla and Nvidia, meeting demand for after-hours trading opportunities.

WikiFX Broker

Latest News

Brazilian Man Charged in $290 Million Crypto Ponzi Scheme Affecting 126,000 Investors

Become a Full-Time FX Trader in 6 Simple Steps

ATFX Enhances Trading Platform with BlackArrow Integration

Decade-Long FX Scheme Unravels: Victims Lose Over RM48 Mil

What Can Expert Advisors Offer and Risk in Forex Trading?

5 Steps to Empower Investors' Trading

How to Find the Perfect Broker for Your Trading Journey?

The Top 5 Hidden Dangers of AI in Forex and Crypto Trading

The Most Effective Technical Indicators for Forex Trading

Indian National Scams Rs. 600 Crore with Fake Crypto Website

Rate Calc