AGA TRADERS GROUP

Abstract:AGA TRADERS GROUP was founded in the United States on 2020-12-16. It is an unregulated trading platform offering leverage of up to 1:200 and 24-hour one-on-one customer service. Clients can trade on MT5.

Note: AGA TRADERS GROUP's official website: https://www.aga-markets.com/index.php/En is currently inaccessible normally.

AGA TRADERS GROUP Information

AGA TRADERS GROUP was founded in the United States on 2020-12-16. It is an unregulated trading platform offering leverage of up to 1:200 and 24-hour one-on-one customer service. Clients can trade on MT5.

Is AGA TRADERS GROUP. Legit?

AGA TRADERS GROUP operates without regulation, meaning client funds and transactions are not secure and transparent. While they offer one-on-one customer service, the quality of the service is uncertain. Additionally, customer information could be leaked, potentially leading to financial losses. Clients should be cautious when trading.

Downsides of AGA TRADERS GROUP

- Lack of Transparency

AGA TRADERS GROUP needs more transparency, which would help evaluate their operating conditions and risk levels.

- Legal Risks:

AGA TRADERS GROUP cannot offer legal protection, leaving investors with limited recourse in a disagreement.

- Leakage Risks

Inadequate information security measures at the broker make the client's personal and financial information vulnerable to leakage or attack.

Negative AGA TRADERS GROUP Reviews on WikiFX

On WikiFX, “exposure” is information users pass on by word of mouth.

Clients must review the information and assess the risk before trading, especially for unregulated platforms. You can consult our platform for details. The client can find trader-related comments in our “Exposure” section, where our team will try our best to resolve any issues.

There were 4 pieces of AGA TRADERS GROUP exposure in total. I will introduce 2 of them.

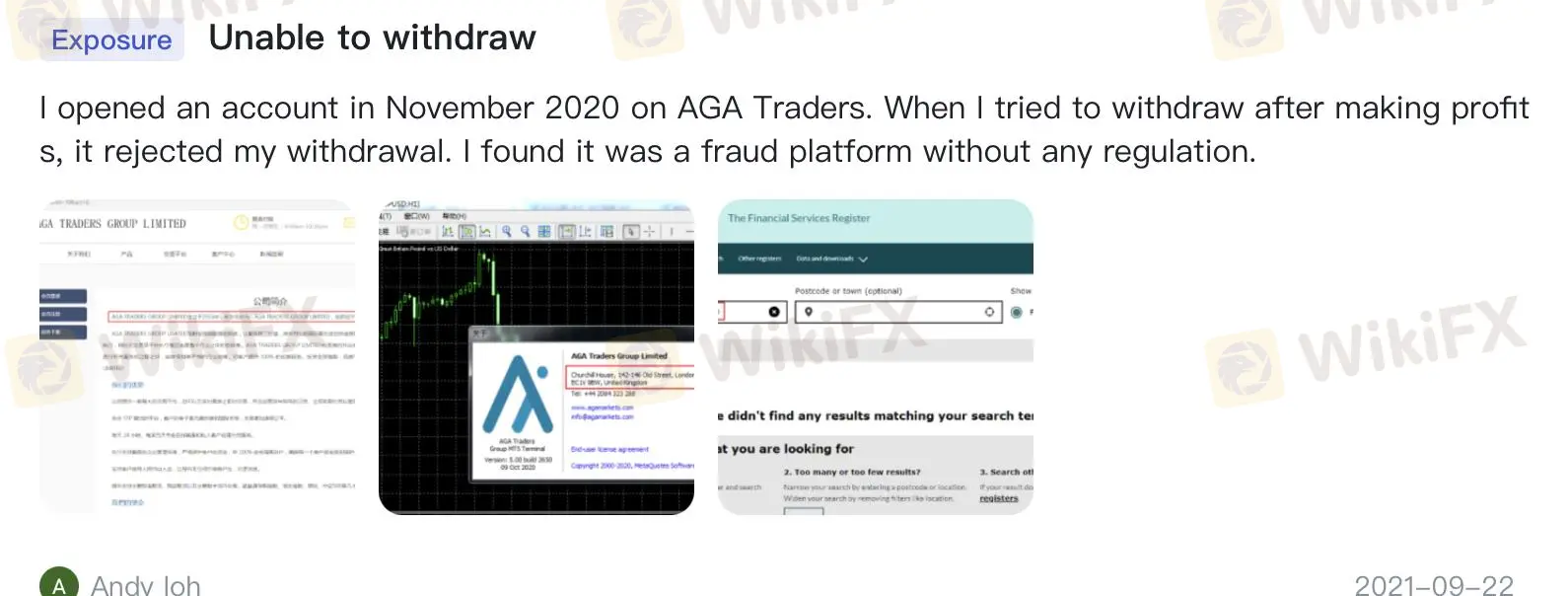

Exposure. Cannot withdraw

| Classification | Unable to Withdraw |

| Date | 2021-09-22 |

| Post Country | Malaysia |

The user said that he was unable to withdraw his money and the website is not regulated. You may visit:

https://www.wikifx.com/en/comments/detail/202109225672630252.html

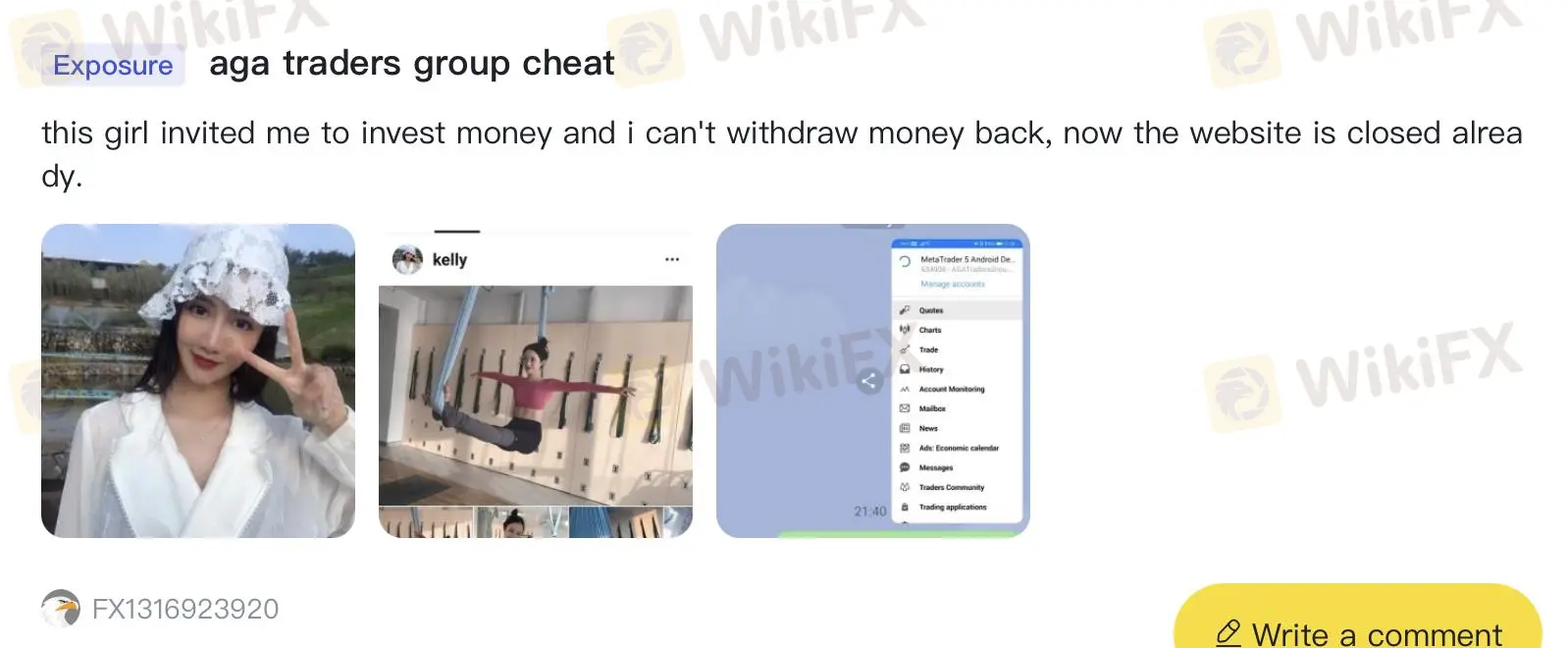

Exposure. Cheat

| Classification | The website cannot open |

| Date | 2021-06-09 |

| Post Country | Thailand |

The user said that he was cheated by someone to invest. You may visit: https://www.wikifx.com/en/comments/detail/202106095032999801.html

Conclusion

AGA TRADERS GROUP has many risks. It is not regulated, posing a security threat to the platform and increasing the potential for abrupt closure. The platform lacks transparency in information and transactions, potentially leading to financial losses for clients. Additionally, there is a risk of clients' private information being leaked. Clients should select a trader that offers transparent information and operates within regulations.

Read more

Oanda Shines As Frop Trading Firm After Being Acquired By FTMO

FTMO enhances prop trading with the OANDA Prop Trader Community and loyalty program, integrating CRM automation and rewards post-acquisition.

Webull: A Comprehensive Review from Accounts to Withdrawal 2025

Webull Financial stands as a digital trading platform founded in 2017, offering commission-free trading across multiple asset classes including stocks, options, ETFs, cryptocurrencies, and forex. The platform targets primarily intermediate traders seeking a balance of analytical tools and straightforward execution capabilities. While Webull provides robust charting tools and an intuitive mobile experience, its forex offering remains at industry average levels with certain limitations in currency pair selection compared to some other forex brokers.

Quotex Review 2025:Live & Demo Accounts, Withdrawal to Explore

Quotex is an online trading platform specializing in digital options, offering access to various assets, including currencies, commodities, and cryptocurrencies. It operates with a proprietary web-based platform. The platform's user interface, while basic, is generally functional, and the availability of numerous short-term trading options may appeal to those seeking rapid trading opportunities. While it presents a user-friendly interface and a low minimum deposit, it's important to note that the regulatory landscape surrounding Quotex involves offshore registration, which may present different levels of investor protection compared to more strictly regulated financial jurisdictions.

ASIC Banned the Director of JB Markets

The Australian Securities and Investments Commission (ASIC) has banned Peter Aardoom, the director of JB Markets, for eight years from associating with any financial services firm. This ban follows a series of regulatory actions against JB Markets, which included the cancellation of its Australian Financial Services (AFS) license less than a year ago.

WikiFX Broker

Latest News

Brazilian Man Charged in $290 Million Crypto Ponzi Scheme Affecting 126,000 Investors

Become a Full-Time FX Trader in 6 Simple Steps

ATFX Enhances Trading Platform with BlackArrow Integration

Decade-Long FX Scheme Unravels: Victims Lose Over RM48 Mil

The Top 5 Hidden Dangers of AI in Forex and Crypto Trading

5 Steps to Empower Investors' Trading

How to Find the Perfect Broker for Your Trading Journey?

The Most Effective Technical Indicators for Forex Trading

What Can Expert Advisors Offer and Risk in Forex Trading?

Indian National Scams Rs. 600 Crore with Fake Crypto Website

Rate Calc