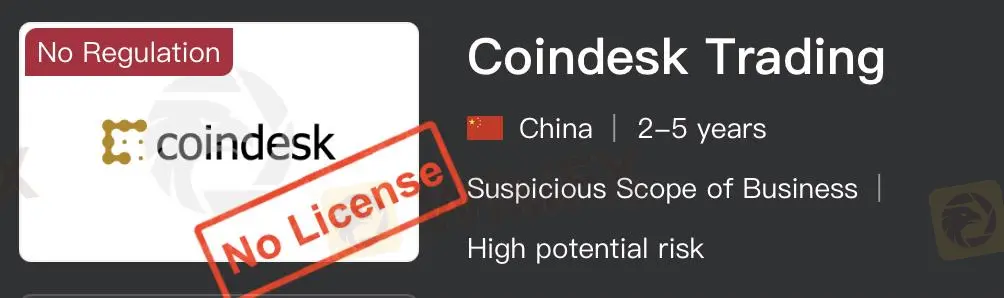

Coindesk Trading

Abstract:Coindesk Trading was registered on Sep 9,2023 at NameJolt.com LLC in Shakil Khan. Coindesk Trading is currently unregulated.

Note: Coindesk Trading's official website: https://coindesktrading.net is currently inaccessible normally.

Coindesk Trading Information

Coindesk Trading was registered on Sep 9,2023 at NameJolt.com LLC in Shakil Khan. Coindesk Trading is currently unregulated.

Is Coindesk Trading. Legit?

Coindesk Trading operates without regulation, and all information is limited. This means that the company is not subject to oversight or enforcement by any financial regulator. This creates inherent risks for investors, including potential issues with transparency, investor protection, and more.Therefore, people should be rational and cautious.

Downsides of Coindesk Trading

- Lack of Transparency

Coindesk Trading needs more transparency, which would help evaluate their operating conditions and risk levels.

- Limited information

Coindesk Trading's information is entirely restricted, which results in customers being unaware of potential costs, leading to financial loss.

- Service Quality Issues

Coindesk Trading do not offer customer support, which makes it challenging to ensure service quality and provide a satisfactory experience for investors.

Negative Coindesk Trading Reviews on WikiFX

On WikiFX, “exposure” is information users pass on by word of mouth.

Clients must review the information and assess the risk before trading, especially for unregulated platforms. You can consult our platform for details. The client can find trader-related comments in our “Exposure” section, where our team will try our best to resolve any issues.

Conclusion

Coindesk Trading has many risks and problems. First of all, it is not regulated, which will bring legal risks to investors. In addition, it does not provide any contacts, which does not ensure the service quality. Lastly, the lack of transparency can lead to investors losing their money. Therefore, clients should choose a transparent and regulated platform.

Read more

Behind the Licences: Is Pepperstone Really Safe for Malaysians?

Pepperstone has built a global reputation as a forex and CFD broker, and it frequently highlights its network of international licences. Yet, when examined through WikiFX, the picture becomes more complex.

IBKR Jumps on September DARTs, Equity Growth

Interactive Brokers' stock climbs after strong September metrics, with DARTs and client equity surging while Citigroup lifts its price target.

Hirose Halts UK Retail Trading Amid Market Shift

Hirose Financial UK suspends retail forex services, citing a shift toward institutional trading despite strong revenue growth.

FINRA Fines United Capital Markets $25,000

FINRA fined and censured United Capital Markets $25,000 for supervisory gaps and unapproved, exaggerated retail communications in 2018–2019.

WikiFX Broker

Latest News

He Clicked, He Transferred, and He Lost RM1.86 Million!

Behind the Licences: Is Pepperstone Really Safe for Malaysians?

Promised Recession... So Where Is It?

Treasury Secretary Bessent says U.S. GDP could take a hit from the government shutdown

Hirose Halts UK Retail Trading Amid Market Shift

Here is why cargo pilots are furious with the FedEx CEO

China’s Myanmar Scam Crackdown Intensifies with Death Sentences

CONSOB Blocks EurotradeCFD’s Solve Smart, 4X News

FINRA Fines United Capital Markets $25,000

PU Prime Halloween Lucky Draw 2025

Rate Calc