FB Investment Scam Cost Malaysian Housewife RM80K

Abstract:A 50-year-old Malaysian housewife recently lost RM82,175 to a fraudulent investment scheme promoted on Facebook in July. The victim, a former secretary in a private company, was initially attracted to the enticing investment opportunity and followed a link from the advertisement that directed her to WhatsApp to connect with the scheme's operator.

A 50-year-old Malaysian housewife recently lost RM82,175 to a fraudulent investment scheme promoted on Facebook in July. The victim, a former secretary in a private company, was initially attracted to the enticing investment opportunity and followed a link from the advertisement that directed her to WhatsApp to connect with the scheme's operator.

According to Jasin district police chief DSP Ahmad Jamil Radzi, the victim received an overview of the investment packages and was asked to pay an RM1,235 registration fee to participate. Upon registration, the fraudsters informed her that she had reportedly earned RM8,000 in returns, an assertion that prompted her to invest additional funds with hopes of securing even higher profits. This early success story appeared convincing enough to lead the victim to commit more resources to the scheme.

In her pursuit of greater returns, the victim went as far as withdrawing her Employee Provident Fund (EPF) savings accumulated over two decades. Over the course of several weeks, she made multiple transfers to five different bank accounts belonging to various individuals, amounting to a total of RM82,175. However, her trust in the scheme began to wane when she encountered difficulties in retrieving the promised returns. The operators of the scheme instead demanded an additional RM20,000, citing it as a required “withdrawal tax,” a condition that raised her suspicions about the legitimacy of the entire operation.

Upon realizing that she had been deceived, the victim lodged a formal complaint at the Jasin Police Station. Authorities have since launched an investigation under Section 420 of the Penal Code, which addresses offenses related to cheating and dishonesty. Police Chief Ahmad Jamil Radzi has urged the public to remain cautious and vigilant against similar scams that continue to target unsuspecting individuals through social media channels.

The incident underscores the ongoing threat posed by fraudulent investment schemes, often disguised as legitimate opportunities, which prey on individuals seeking to increase their financial security. Authorities advise potential investors to conduct thorough background checks and seek guidance from trusted financial advisors before committing to unfamiliar investment programs. This case serves as a stark reminder of the risks involved in online financial schemes and the importance of safeguarding personal savings against fraudulent promises.

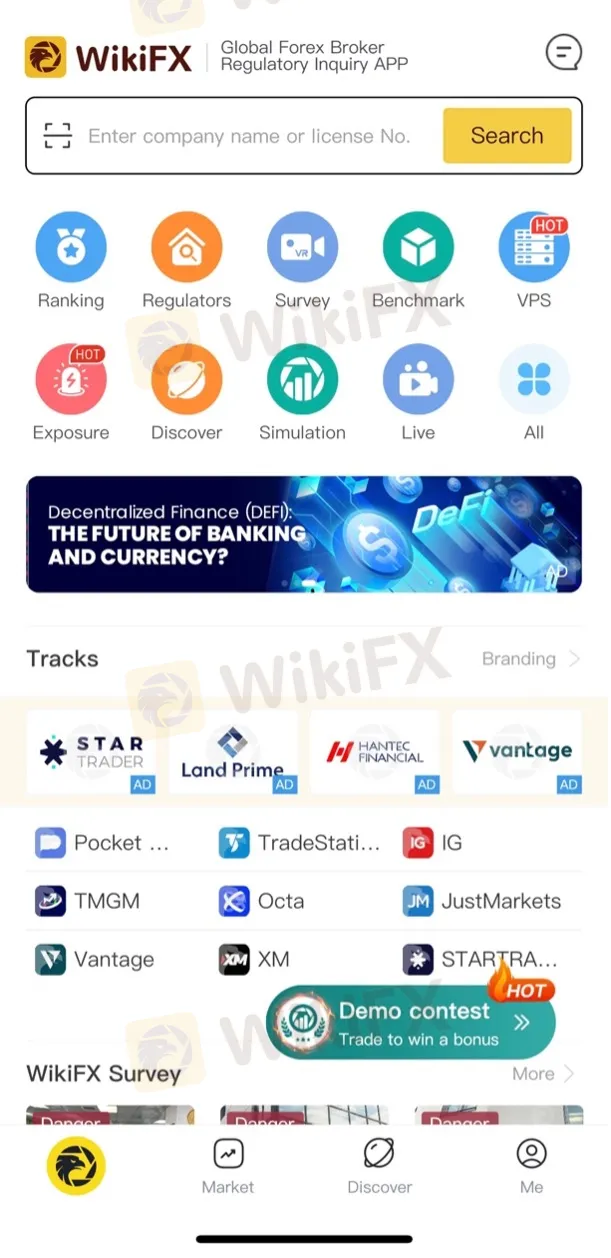

To prevent falling victim to fraudulent schemes like this one, using tools like WikiFX can be a game-changer. WikiFX provides detailed information on brokers, including regulatory status, customer reviews, and safety ratings, allowing users to verify the legitimacy of any investment platform before committing their money. With access to in-depth insights and risk alerts, WikiFX equips potential investors with the resources to make informed decisions and avoid unauthorised or unlicensed entities. By checking with WikiFX, users can confidently protect their savings and avoid the costly traps set by unscrupulous investment syndicates.

Read more

VOLNEX Exposure: Withdrawal Denials, Fund Loss & Platform Glitches

Did you witness wrong price movements on the VOLNEX terminal, which led to your forex trading account being blown away? Did you face massive capital losses on the platform? Does the broker constantly deny your fund withdrawal applications? Do you feel like taking legal assistance to recover your funds? You may just have to go legal in light of these trading complaints that are on review platforms. We have shared some of these complaints while drafting this VOLNEX review guide. Read on as we share them out.

Modmount Review: Examining Allegations of Fund Withdrawals & Capital Scams

Did you find the Modmount withdrawal support team incompetent to handle your requests? Did your constant follow-ups with it only result in generic responses? Did the lack of a stop-loss arrangement make you lose all your capital? Have you witnessed the liquidation of forex positions due to the broker’s negligence? Many traders have reported these on broker review platforms such as WikiFX. This Modmount review article highlights some of the complaints against the broker. Keep reading!

UPFOREX Regulatory Status: A 2026 Deep Dive into Its Licenses and Risks

Before trusting any forex broker, checking if it's legitimate isn't just a good idea – it's the most important step to protect yourself. The excitement of financial markets can make people forget about safety, but a broker's regulatory status is the foundation that keeps traders safe. This article gives you a thorough, fact-based investigation into the UPFOREX Regulation status for 2026. Our research uses publicly available information, mainly from WikiFX (a global broker checking platform), to give you an objective and honest view.

Is UPFOREX a Real Company? Checking If This Trading Platform Can be Trusted

The question "Is UPFOREX legit?" isn't just something people ask casually - it's about finding safety and security. For anyone who trades online, the biggest fear is exposing capital to a fake company. You've probably heard about UPFOREX, looked at what it offers, and felt unsure about it. This feeling makes sense and shows you're smart. In this detailed investigation, we'll look past fancy marketing and personal opinions. We'll do a careful, fact-based study using public information about regulations to give you a clear answer. Our goal is to give you the facts you need to make a safe choice. To save your time and answer your main question right away, our conclusion is clear from the start: Our research shows that UPFOREX works without any proper financial rules for forex trading and shows many warning signs that are typical of risky, untrustworthy brokers. The evidence shows an unacceptably high level of risk for any trader thinking about using this platform.

WikiFX Broker

Latest News

Spotware Refines cTrader Infrastructure as Broker Ecosystem Expands

CME Group Moves to 24/7 Trading for Digital Asset Derivatives

Is The US Dollar About to Crash?

Is AssetsFX Safe or Scam: Looking at Real User Feedback and Complaints

Trump Defies Supreme Court with 15% Global Tariff; Record Retail Flows Buffer Market Impact

Retail FX Insight: Volatility Squeeze and Regulatory Risks Persist as iFOREX Eyes IPO

$128M Crypto Scam: Chinese Suspect Nabbed in Thailand

Is Cabana Capital Safe or Scam: Looking at Real User Reviews and Common Problems

The Trading Pit Launches Regulated Brokerage Unit 'TTP Markets' in Strategic Pivot

Prop Trading Industry Pivots to Futures to Secure US Market Access

Rate Calc